‘I lost my home – over a £1,500 car loan’

Brian Flynn of Blackley, Greater Manchester, who was taken to the bankruptcy court, and thus racking up a bill of £65,000 for a £1,500 loan - Lorne Campbell/Guzelian

When Brian Flynn took out a £1,500 loan to buy his friend’s car four years ago, he had no idea it would one day cost him his family home.

The loan, which ballooned to £65,000 as a result of interest charges and insolvency fees, left him in council accommodation and with no house to one day pass on to his children.

Mr Flynn, a building maintenance surveyor for a housing association in Manchester, took out a £1,500 loan in July 2020 with a lender called Everyday Loans.

But after paying the first instalment, Mr Flynn lost his job and had to sign up for Universal Credit. He says he rang up the loan provider to ask for an alternative payment plan, as he could no longer afford the instalments – but claims they declined to help.

Mr Flynn's home was repossessed in April to pay off the debt, which included a £6,000 Government Insolvency Service charge - Lorne Campbell/Guzelian

He had two lodgers in his home generating £800 in monthly income, but the majority of this was going towards his mortgage.

Mr Flynn, who turns 62 next month, said: “I tried to live off my lodgers and Universal Credit during the pandemic. Then I’d planned to take an early retirement. I gave up on the loan because they were asking for so much interest – I never knew it would come to this.”

Everyday Loans, which markets itself as “the friendly UK lender”, advertises a 99.9pc representative annual percentage rate – the maximum amount of interest lenders can charge.

Mr Flynn’s loan grew and grew, until – in January 2023 – Everyday Loans issued a bankruptcy order against him. Any debt over £5,000 can trigger one.

But despite the loan snowballing further to around £9,000, Mr Flynn said, once other fees were applied – including for the court, insolvency service and trustee – he owed an eye-watering £65,000. This included a £6,000 charge by the Government’s Insolvency Service.

The debt – 4,200pc more than what he initially borrowed – triggered the repossession of Mr Flynn’s home in April, forcing both his lodgers, one of whom he is a carer for, out too. The house sold for £117,000, with a £22,000 mortgage on it.

Mr Flynn is currently living in council accommodation, and has now received £25,000 back from the forced sale of his home.

He said: “On Google, it told me I could oppose it. So I contacted the court to do this. But I got a letter through the door saying they’d gone to court without me. I was judged bankrupt and taken to the Insolvency Service.

“All I had was my house. I had no money to get the order annulled. So I was appointed a trustee. I didn’t think it would come to this in my wildest dreams. Some people don’t believe me when I tell them.”

The dad-of-three had intended to leave his house to his children, who have children of their own.

Mr Flynn says he does not want compensation, he just wants his house of 25 years back.

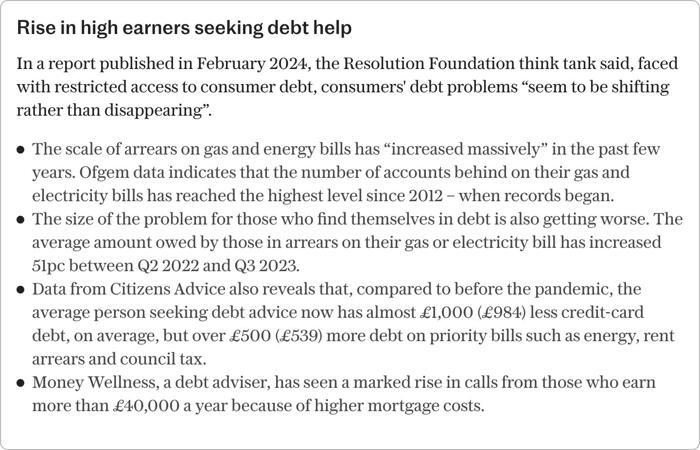

Household debt levels in Britain are at their lowest since records began in 1999 because lenders began tightening their risk appetites after the pandemic. As a result, those in need of unsecured credit are far more likely to be denied personal loans by mainstream lenders.

Money Wellness, a debt adviser, told the Telegraph it had seen a marked rise in calls from high earners seeking debt support in the past year. Many own their own homes and have stable, full-time jobs, it said.

Richard Harrison, a repossession expert at Homeowner Management Services, said property owners who get bankruptcy notices for small amounts of money often don’t realise “it’s going to turn into an astronomical sum”.

He added: “Owners leave it and bury their heads in the sand. They don’t understand it and they’re not taught it, so why would they? They don’t realise the seriousness of it because the trustees often sit on it and work in the background.

“Bankruptcies can be annulled, and there are ways to raise funds to pay bankruptcy off – especially if you have a property. But lots of people don’t know this.”

Everyday Lending was approached for comment.

In June 2023, the FOS announced a court-approved redress scheme for customers of Everyday Lending – which trades as Everyday Loans – who have outstanding complaints about unaffordable loans pre-March 2021.

Jamie Daley, of research foundation Fairer Finance, said if borrowers are struggling then lenders should be letting them access forbearance options – whether that’s a pause in interest or a reduction.

He added: “To let someone accrue interest at a level which allows the loan to grow to six-times the size of what was borrowed – on no planet would a regulator be happy with that.”

Earlier this year, the Telegraph revealed that Halifax had wrongfully repossessed a customers’ home and had to give it back following involvement from the Financial Ombudsman Service.

Recommended

The middle-class homeowners being forced to call a debtline

Read more

Play The Telegraph’s brilliant range of Puzzles - and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.