The Supreme Court decides not to trigger a second Great Depression

Justice Clarence Thomas takes an unexpected face turn in CFPB v. Community Financial Services Association.

The Supreme Court delivered a firm and unambiguous rebuke to some of America’s most reckless judges on Thursday, ruling those judges were wrong to declare an entire federal agency unconstitutional in a decision that threatened to trigger a second Great Depression.

In a sensible world, no judge would have taken the plaintiffs arguments in CFPB v. Community Financial Services Association seriously. Briefly, they claimed that the Constitution limits Congress’s ability to enact “perpetual funding,” meaning that the legislation funding a particular federal program does not sunset after a certain period of time.

The implications of this entirely made-up theory of the Constitution are breathtaking. As Justice Elena Kagan points out in a concurring opinion in the CFPB case, “spending that does not require periodic appropriations (whether annual or longer) accounted for nearly two-thirds of the federal budget” — and that includes popular programs like Social Security, Medicare, and Medicaid.

Nevertheless, a panel of three Trump judges on the United States Court of Appeals for the Fifth Circuit — a court dominated by reactionaries who often hand down decisions that offend even the current, very conservative Supreme Court — bought the CFPB plaintiffs’ novel theory and used it to declare the entire Consumer Financial Protection Bureau unconstitutional.

In fairness, the Fifth Circuit’s decision would not have invalidated Social Security or Medicare, but that’s because the Fifth Circuit made up some novel limits to contain its unprecedented interpretation of the Constitution. And the Fifth Circuit’s attack on the CFPB still would have had catastrophic consequences for the global economy had it actually been affirmed by the justices.

That’s because the CFPB doesn’t just regulate the banking industry. It also instructs banks on how they can comply with federal lending laws without risking legal sanction — establishing “safe harbor” practices that allow banks to avoid liability so long as they comply with them.

As a brief filed by the banking industry explains, without these safe harbors, the industry would not know how to lawfully issue loans — and if banks don’t know how to issue loans, the mortgage market could dry up overnight. Moreover, because home building, home sales, and other industries that depend on the mortgage market make up about 17 percent of the US economy, a decision invalidating the CFPB could trigger economic devastation unheard of since the Great Depression.

Thankfully, that won’t happen. Seven justices joined a majority opinion in CFPB which rejects the Fifth Circuit’s attack on the United States economy, and restates the longstanding rule governing congressional appropriations. Congress may enact any law funding a federal institution or program, so long as that law “authorizes expenditures from a specified source of public money for designated purposes.”

The law funding the CFPB clears this very low bar and is therefore constitutional.

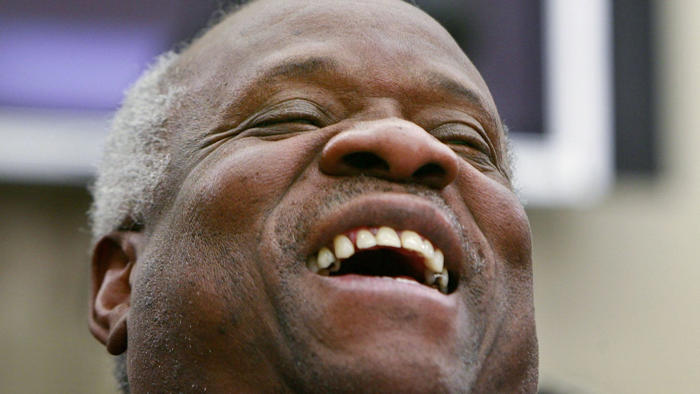

Notably, the Supreme Court’s CFPB decision was authored by Justice Clarence Thomas, who is ordinarily the Court’s most conservative member. The fact that even Thomas delivered such an unambiguous rebuke to the Fifth Circuit is a sign of just how far the lower court went off the rails in its decision.

Two justices did dissent: Justice Samuel Alito, the Court’s most reliable GOP partisan, and Justice Neil Gorsuch, who also dissented in a similar case that could have triggered an economic depression if Gorsuch’s view had prevailed. Alito’s dissenting opinion is difficult to parse, but it largely argues that the CFPB is unconstitutional because Congress used an unusual mechanism to fund it.

Among other things, the CFPB’s funds first pass through a different federal agency, the Federal Reserve, before it lands in the CFPB’s banking account.

But, as seven justices correctly conclude, the fact that CFPB’s funding mechanism is unusual does not make it unconstitutional, and judges are not supposed to simply make up new constitutional restrictions on Congress because they think that Congress acted in a way that is novel or unwise.