Malaysia govt bonds supply may slow in second half of 2024

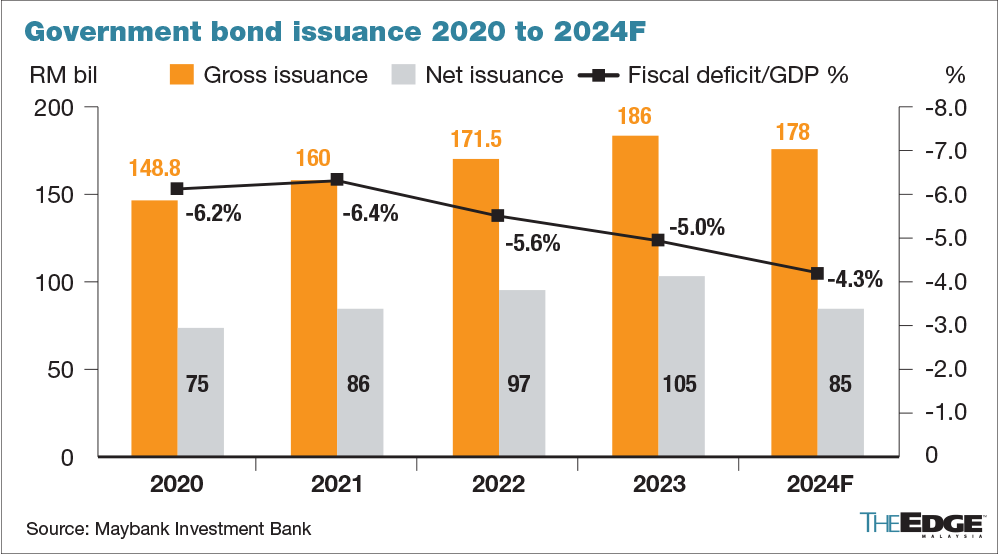

KUALA LUMPUR (July 2): Malaysia's government bond supply may slow in the second half and be on track to fall for the full year of 2024 amid smaller deficit financing requirements and strong investor demand, analysts said.

Gross issuance for July-December may come in the range of RM83.5 billion to RM85.5 billion, according to fixed income analysts contacted by The Edge. Malaysian government securities and government investment issues totaled RM94.5 billion in the first half of 2024, data compiled by The Edge showed.

“The pace of issuance so far this year has generally met expectations,” said Woon Khai Jhek, head of economic research at RAM Rating. “We should not expect the supply of government bonds to sway too far from the current trajectory.”

This year, the government is targeting to narrow its budget gap as a proportion of economic output to 4.3% from 5% last year. The government issued RM186 billion worth of MGS and GII in 2023.

Malaysia has been trying to shrink a long-running fiscal deficit that stretches back to the 1998 Asian Financial Crisis.

Malaysia govt bonds supply may slow in second half of 2024

The government has introduced a slew of measures ranging from trimming subsidies to imposing additional taxes in a bid to fix its weakened finances. The key is the withdrawal of subsidies for fuel and other non-essential items widely panned by economists for being wasteful.

Under Budget 2024, allocation for development spending will decline to RM90 billion from RM97 billion for 2023. However, rigid operating expenditures — emoluments, retirement charges, and debt service payments — are growing and are expected to take up two-thirds of federal government revenue.

Fiscal spending on track

Despite ongoing budget consolidation, “fiscal spending remains intact in Malaysia, with the continuation of infrastructure projects spurring the supply of both government and private sector bonds,” said Dr Ray Choy, chief economist at MARC Ratings.

However, there is a potential for “slightly higher issuance” in the second half, given the lower tax revenue collection in the first four months of 2024 based on the preliminary tax data, Choy flagged.

Demand, meanwhile, is expected to remain robust while yields may have peaked along with global and domestic policy rates.

Malaysia's relatively tame inflation environment compared to other select Asean economies suggests “investors look favourably at Malaysia's economic fundamentals,” Barnabas Gan, acting group chief economist at RHB Bank and senior fixed income strategist Chris Tan wrote in an email to The Edge.

“We expect fund inflows to likely outperform the Asean region, indicating that investor demand will be supported in the second half,” they said.

Bid-to-cover ratios, a measure of demand from investors, have ranged from 1.7 times to 4.4 times and averaged 2.6 times year-to-date. The last government bond issue that matures in August 2029 drew a bid-to-cover ratio of 2.5 times with an average yield of 4.241%.

Yields may stay elevated

So far this year, the yield on Malaysia’s benchmark 10-year government bonds maturing in November 2033 has risen by about 13 basis points, tracking the spike in yields at the US Treasury as strong growth and high inflation in the world’s largest economy pushed the Federal Reserve to delay rate cuts.

Bond yields and prices move inversely.

Despite the recent decline, yields are likely to stay elevated amid the prospects of fewer rate cuts by the Fed this year. Both RHB’s Gan and MARC’s Choy expect the yield on the 10-year MGS to end in 2024 at 3.80%.

The US Treasury remains the single most important driver of the direction of local bond yields, “though not significant on the beta,” said Winson Phoon, head of fixed income research at Maybank Investment Bank. He is forecasting the yield on 10-year MGS to range from 3.80% to 3.90% in the near term.

“We are conscious of upside risks to yields if US economic data remain strong and the timing of Fed rate cut is further delayed,” he said. Yields could shift lower by up to 25 basis points by end-2024 if Bank Negara Malaysia stands pat while the Fed cuts rates by 50 basis points this year, he flagged.

BNM has kept the benchmark rate unchanged since it was last raised in May 2023 by 25 basis points.