Is This Spectacular Vanguard ETF a Millionaire Maker?

Most people would like to be a millionaire. But what is the best way to get your hands on a million bucks? In my opinion, the answer is simple: investing. One of the best ways to invest -- and almost certainly the easiest -- is with an exchange-traded fund (ETF). Let's examine one of my favorites, the Vanguard Growth ETF (NYSEMKT: VUG).

A lightbulb taking off like a rocket against an orange background.

What is the Vanguard Growth ETF?

The Vanguard Growth ETF tracks an index of large-cap, growth-oriented stocks, roughly 400 in total, spanning several sectors.

Technology (35%), electronics (27%), and retail (10%) make up the bulk of the fund's holdings. Meanwhile, financials, industrials, and energy stocks comprise less than 5%. From a geographic standpoint, most of the Vanguard fund's holdings are American-based (98%), with a small fraction from Ireland and the U.K.

The fund's top holdings are dominated by the "Magnificent Seven" megacaps, a term used to describe the largest and most influential companies in the market. These companies, including Nvidia, Microsoft, Apple, and Amazon, have consistently shown strong growth and profitability, making them key contributors to the Vanguard Growth ETF's performance.

| Company Name | Symbol | Percentage of Assets |

|---|---|---|

| Microsoft | MSFT | 12.6% |

| Apple | AAPL | 11.5% |

| Nvidia | NVDA | 10.6% |

| Alphabet | GOOG, GOOGL | 7.5% |

| Amazon | AMZN | 6.7% |

How has the Vanguard Growth ETF performed?

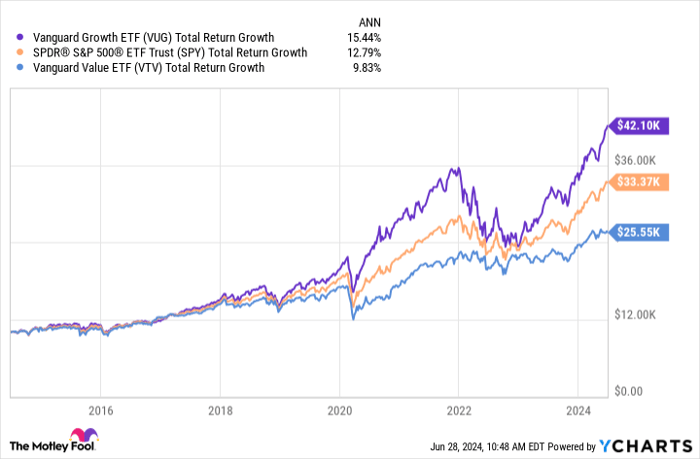

Simply put, the Vanguard Growth ETF has been one of the best broad-based ETFs to own over the last decade. A $10,000 investment in the fund made in 2014 would now be worth $42,000, representing a compound annual growth rate (CAGR) of 15.4%. This means that, on average, the fund's value has grown by 15.4% each year over this 10-year period.

That easily outpaces the performance of the SPDR S&P 500 ETF Trust, an ETF that tracks the performance of the S&P 500 index. In fact, the Vanguard Growth ETF has consistently outperformed many other broad-based ETFs in its category over the past decade, such as the Vanguard Value ETF, a fund that tracks an index of value stocks.

VUG Total Return Level

What's more, investors in the Vanguard ETF pay a minuscule expense ratio of 0.04%. This means that for every $10,000 invested in the fund, only $4 per year is charged in fees. That's one of the lowest fee structures available for an ETF and is great news for investors. Large fees can stunt investment growth by siphoning off money and slowing the accruing gains of compounding.

Is the Vanguard Growth ETF a buy now?

So, the question remains: Is now the right time to invest in the Vanguard Growth ETF? In short, consistent investments in broad-based index funds are one of the best ways to accumulate wealth. What's more, by avoiding the pitfall of trying to time the market, long-term buy-and-hold investors improve their investments' rate of return.

Finally, with its low-fee structure, the Vanguard fund ensures that investors -- rather than the fund's administrators -- reap the most benefit from the investment returns.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $761,658!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, and Vanguard Index Funds-Vanguard Value ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.