Pepsi Is a Rock-Solid Dividend King, but So Is This Blue Chip Stock That's Down 12% in the Past 3 Months

Dividend stocks can be excellent investments to generate passive income. The best dividend-paying companies have steady earnings growth, and in turn, they increase their payouts to shareholders. The elite among them eventually may earn entry into the category of Dividend Kings -- companies that have raised their payouts annually for at least 50 consecutive years.

In addition to being a Dividend King, PepsiCo (NASDAQ: PEP) has a yield of 3.3% at its current share price -- high relative to the average yield of 1.3% for the S&P 500. It also has a fairly recession-resistant business, which makes it exactly the kind of consistent company that many risk-averse income investors look for.

Pepsi is a top-tier dividend stock and a familiar name to most consumers, but the less widely known Illinois Tool Works (NYSE: ITW) may be an even better Dividend King to buy now.

A person smiles while working on the underside of a car.

Getting to know ITW

Illinois Tool Works, which also goes by ITW, is a global industrial conglomerate with a diversified product portfolio spanning several industries. The company mainly sells products to businesses, so it would be understandable if you were unfamiliar with many of its brands.

It doesn't make massive earth-moving equipment or highly complex machinery. Rather, many of its products act as role players in larger systems. Here's a breakdown of its segments and some product examples.

Data source: Illinois Tool Works.

One thing that separates ITW from other industrial conglomerates is that none of its seven segments dominate its revenue mix. And aside from automotive -- which has been struggling in North America but growing rapidly in China -- all of its segments have excellent operating margins. The overall business notched an operating margin of more than 25% in 2023.

Management is projectng for an even better 26% to 27% operating margin in 2024 and a 30% operating margin by 2030.

Growth concerns

ITW's main challenge has been sluggish organic growth. Its organic revenue actually declined 0.6% last quarter. ITW is forecasting for just 1% to 3% organic growth for the year and 2% to 4% revenue growth. Earnings per share (EPS) growth is expected to be a little better at 6% to 10% for a total of $10.30 to $10.70 in full-year EPS -- partially thanks to a one-off accounting change.

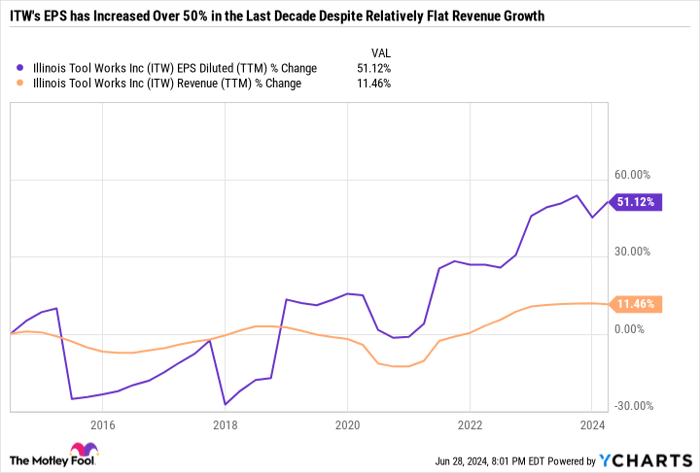

Zoom out a bit further, and you'll see that ITW's EPS only increased by 20.6% during the past three years. That's not a terrible growth rate for a stodgy dividend payer, but it's not exactly great, either. Revenue has grown even slower, at 14.7%. However, take a look at an even longer time frame, and you'll notice that its earnings have grown much faster than revenue -- which is a testament to ITW becoming a more efficient, higher-margin business.

ITW EPS Diluted (TTM)

A leaner business with widening margins is better than an overextended model that leans heavily on sales growth at the expense of margins. But eventually, ITW will need to chart a path toward both wider margins and higher revenue, especially because there's a limit to how many efficiency improvements a business can make.

If you tune in to a typical ITW earnings call, you'll find that most of the conversation centers around margins. It might seem trivial to go back and forth about a single percentage point in margins. But ITW generated $16.1 billion in trailing 12-month revenue and $4.2 billion in operating income -- so each percentage point change in margin equates to a $160 million difference in operating income.

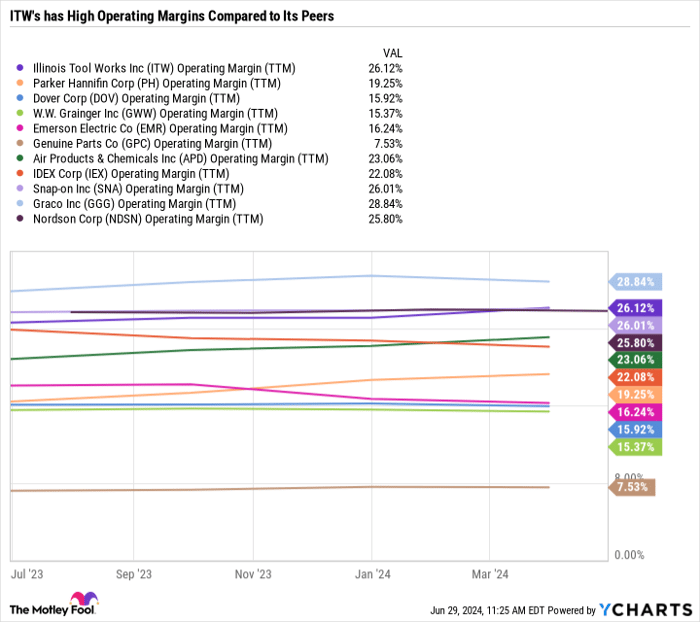

Since ITW is involved in so many different industries (and generates a significant amount of sales from outside North America), no company is an exact competitor. However, some companies compete with it in one or more segments. And ITW has significantly higher margins than many of these peers.

ITW Operating Margin (TTM)

Despite having lower revenue than Genuine Parts, Parker Hannifin, W.W. Grainger, and Emerson Electric, ITW has the highest operating income of any company on this list. What makes it such a special company is that it combines size with wide margins across many different product categories. Conglomerates can often be bulky and inefficient, but ITW is a good example of an effective conglomerate that is benefiting from diversification.

Expect a dividend raise soon

Last August, ITW announced a 7% dividend hike to $1.40 per share per quarter. ITW typically announces its annual payout raises in the summer, with the first affected payout coming in October. Given the consistency of its dividend program, investors should expect an announcement sometime in the next couple of months.

Not all Dividend Kings use stock buybacks as a primary way to return capital to shareholders, but ITW plans to repurchase $1.5 billion of its shares this year. By comparison, it distributed $418 million in dividends last quarter -- or roughly $1.7 billion during the past year. So on the surface, ITW's 2.4% yield may not look super attractive, but its capital return program is much stronger when one factors in the buyback program.

High margins help ITW squeeze more profit from every dollar in revenue. But buying back stock reduces its share count, leading to higher earnings per share. During the past five years, it has reduced its shares outstanding by 7.8%, which has boosted EPS by 36.1% even as net income rose by 24.2%.

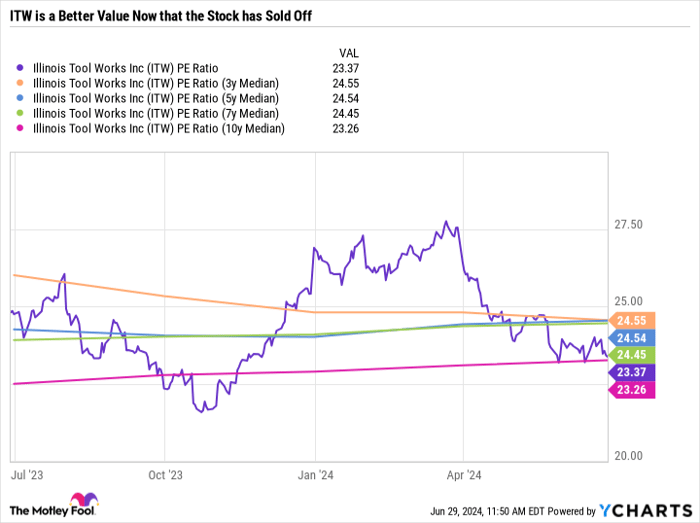

Buybacks have also helped keep a lid on ITW's valuation. The recent sell-off in the stock paired with steady earnings growth has dropped its price-to-earnings (P/E) ratio down to just 23.4 -- which is below its three-, five- and seven-year median P/E ratios. And ITW was trading above these key levels just a few months ago.

ITW PE Ratio

ITW is a well-rounded buy

ITW is a phenomenal business, but its valuation was pricey, and its revenue growth is weak. Now that the stock has sold off, the conglomerate's only bad quality is its low sales growth.

There are nearly perfect businesses, but there's no such thing as a perfect stock. The best companies are usually expensive relative to their trailing or projected earnings, while bad companies trade at cheap levels for good reasons.

However, ITW is close to a perfect blue chip dividend stock. It is an extremely efficient business with high margins, an over 50-year track record of raising dividends, a sizable buyback program, and a reasonable valuation. The conglomerate model works well for ITW and helps the company offset much of the cyclicality of its various end markets.

Add it all up, and there's a lot to like about ITW as a top-tier Dividend King to buy and hold for years to come.

Should you invest $1,000 in Illinois Tool Works right now?

Before you buy stock in Illinois Tool Works, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Illinois Tool Works wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Emerson Electric. The Motley Fool has a disclosure policy.