Time to Pounce: 2 Ultra-High-Yield Dividend Stocks That Are Begging to Be Bought for the Second Half of 2024 (and Beyond)

There are a lot of ways for investors to grow their wealth. They can buy Treasury bonds, a commodity like oil or gold, or purchase a home and let it increase in value over time. But when compared to other asset classes, stocks have delivered the highest average annual return over the last century.

One of the best aspects of putting your money to work on Wall Street is that, with thousands of stocks and exchange-traded funds (ETFs) to choose from, there's a very high probability of one or more securities matching your risk tolerance and investment goals.

Although growth stocks have driven all three major indexes to record levels in 2024, it's dividend stocks that have handily outperformed on Wall Street over the last half-century.

A businessperson counting a stack of one-hundred-dollar bills in their hands.

In 2023, the investment advisors at Hartford Funds, in collaboration with Ned Davis Research, released a comprehensive report on the advantages dividend stocks bring to the table for investors. In particular, researchers compared the performance of dividend-paying companies to non-payers over the prior 50 years (1973-2023).

Based on their findings, dividend stocks averaged a 9.17% annual return over a half-century, and did so while being 6% less volatile than the broad-based S&P 500. This compares to a more modest 4.27% average annual return for non-payers, which were 18% more volatile than the benchmark index.

The biggest challenge for income seekers is avoiding a yield trap -- i.e., a company with a broken operating model whose falling share price has artificially pumped up its dividend yield. Thankfully, safe, ultra-high-yield dividend stocks do exist.

What follows are two ultra-high-yield dividend stocks -- companies with yields that are at least four times higher than the current yield (1.33%) of the S&P 500 -- that can be confidently pounced on by opportunistic income seekers in the second half of 2024.

Realty Income: 5.98% yield

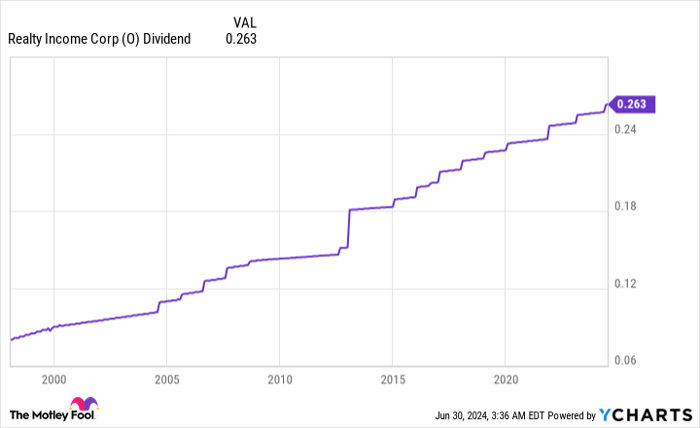

The first high-octane dividend stock that investors can pile into for the second half of the year is premier retail real estate investment trust (REIT) Realty Income (NYSE: O). Realty Income doles out its dividend on a monthly basis, and has increased its payout for a jaw-dropping 107 consecutive quarters.

O Dividend

As you're liable to note from Realty Income's stock chart, it hasn't participated in the current bull market rally. The reason for its poor performance over the last two years is primarily the result of monetary policy changes from the Federal Reserve.

Beginning in March 2022, the nation's central bank began undertaking its most aggressive rate-hiking cycle since the early 1980s. During this process, yields on short-term U.S. Treasury bills soared. Instead of buying various REITs, investors have opted to generate similar yields from purchasing Treasury bills, which have almost nonexistent risk to invested principal.

However, this dynamic is unlikely to continue for much longer. Even though core inflation has remained stubbornly high, the Fed is more likely to reduce interest rates than increase them, as evidenced by the recent movement we've witnessed in Treasury bond yields. With Realty Income's yield rising to 6%, this absolutely puts this monthly dividend icon back on the radar.

What makes Realty Income the company that other retail REITs envy is its massive, but exceptionally resilient, commercial real estate (CRE) portfolio. As of the end of March, the company owned nearly 15,500 CRE properties. But here's the kicker: Approximately 90% of its total rent "is resilient to economic downturns and/or isolated from e-commerce pressures," according to the company.

Realty Income's not-so-subtle secret is that it tends to lease stand-alone stores to time-tested, brand-name businesses that provide basic need goods and services. For instance, grocery stores, convenience stores, dollar stores, home improvement, drugstores, and automotive service lessees collectively account for 42% of annualized contractual rent. Consumers will need food, beverages, prescription medicines, and vehicle maintenance/repairs, regardless of how well or poorly the U.S. economy is performing.

What's more, Realty Income has a superior track record relative to other S&P 500 REITs when it comes to tenant occupancy. Since the start of this century, its median occupancy rate of 98.2% is 400 basis points higher than the median occupancy rate for S&P 500 REITs.

Another positive for current and prospective investors is that Realty Income has been fortifying its existing CRE portfolio and expanding into new channels. For instance, its January 2024 acquisition of Spirit Realty Capital was complementary to its existing CRE portfolio, but also opened doors in new industries.

Last but not least, Realty Income's stock is trading at a historically cheap valuation, relative to its future cash flow. Whereas shares have averaged a multiple of 17.3 times cash flow over the trailing-five-year period, opportunistic income seekers can buy into the Realty Income growth story right now for 11.8 times forecast cash flow in 2025.

Two lab technicians viewing an enhanced image on a computer monitor from a digital microscope.

Pfizer: 6% yield

The second ultra-high-yield dividend stock that's begging to be bought for the second half of 2024 (if not well beyond) is pharmaceutical titan Pfizer (NYSE: PFE). Although Pfizer isn't guaranteed to raise its payout on an annual basis, its current yield of 6% is safe.

Pfizer, like Realty Income, has been left in the dust by the current bull market rally. As I've pointed out previously, Pfizer's underperformance is a reflection of it being a victim of its own success.

Pfizer is one of a handful of drugmakers that successfully developed therapies for COVID-19. In 2022, the company's COVID-19 vaccine (Comirnaty) and oral therapy (Paxlovid) brought in north of $56 billion in combined revenue. This year, combined sales for these blockbuster treatments will total around $8 billion. For those of you keeping score at home, this is a $48 billion sales decline that Wall Street and investors have had to come to terms with.

However, perspective changes everything. Though COVID-19 sales aren't close to what they once were, Pfizer wasn't generating a cent in COVID-19 revenue prior to the pandemic. This estimated $8 billion in sales in 2024, coupled with organic growth from existing product lines and newly launched therapeutics, has lifted annual sales from $41.9 billion in 2020 to a mid-range estimate from $60 billion this year.

Digging a bit deeper, Pfizer's March-ended quarter saw sales, excluding COVID-19 therapies, jump by 11% on a constant-currency basis. Continued double-digit operational growth from blockbuster blood-thinning drug Eliquis suggests Pfizer's total portfolio is considerably stronger now than it was four years ago.

Another reason for current and prospective investors to be excited about the future is Pfizer's $43 billion acquisition of cancer-drug developer Seagen, which closed in December. Despite buyout-related costs weighing on Pfizer's 2024 earnings per share (EPS), this combination should result in meaningful cost savings and improved EPS in 2025 and beyond. Moreover, this deal vastly expands Pfizer's oncology pipeline and provides a greater-than $3 billion boost to annual sales right off the bat.

Like Realty Income, Pfizer has macro factors in its corner. Since we have no control over when we become ill or what ailment(s) we develop, demand for everything from prescription medicines to devices tends to remain constant in any economic climate. The point is that Pfizer is highly resistant to economic downturns.

The final piece of the puzzle is that Pfizer's stock is cheaper than it's been in a very long time. Shares of the company recently hit their lowest level in a decade. Further, shares are valued at roughly 10 times forward-year earnings, which is modestly lower than the average multiple of 11 times forward-year EPS that Pfizer's stock has traded at over the prior five years.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer and Realty Income. The Motley Fool has a disclosure policy.