Brokers Digest: Local Equities - OCK Group Bhd, Dialog Group Bhd, Mah Sing Group Bhd, Perak Transit Bhd

This article first appeared in Capital, The Edge Malaysia Weekly on June 24, 2024 - June 30, 2024

OCK Group Bhd

Target price: 85 sen BUY

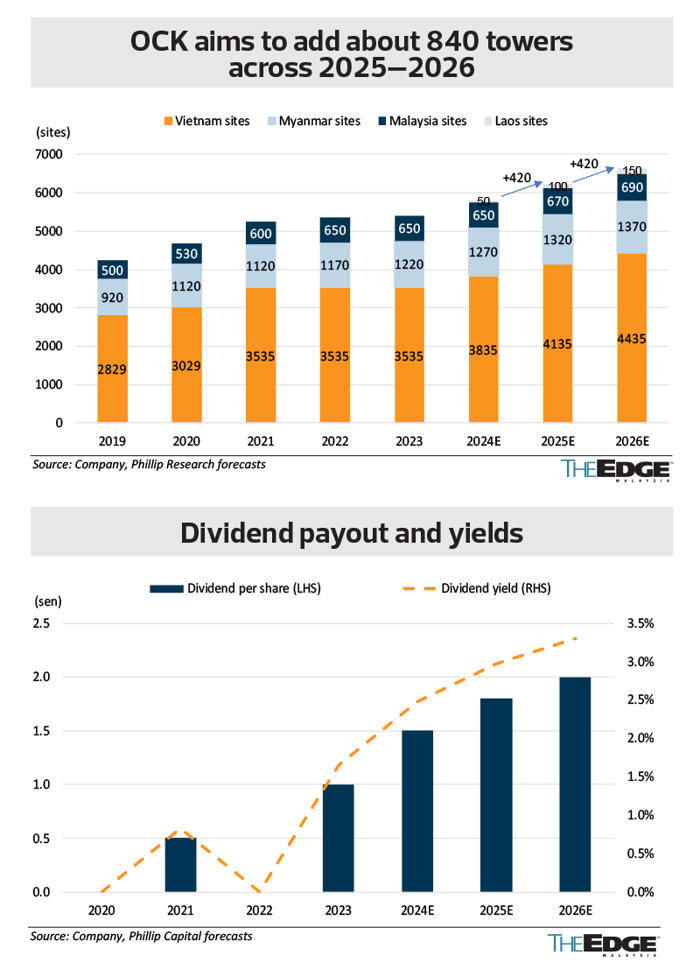

PHILIP CAPITAL (JUNE 18): OCK (KL:OCK) is a leading provider of comprehensive end-to-end telecommunications network services in Malaysia, specialising in the ownership and leasing of towers to telco operators. Regionally, OCK is Indonesia’s largest tower-managed service provider and the leading independent tower company in Vietnam. OCK stands to benefit strongly from 5G deployment in Malaysia, given its solid execution track record in rolling out 3G/4G sites under projects initiated by the Malaysian Communications and Multimedia Commission and Jendela. With over 5,500 towers spanning Malaysia, Vietnam and Myanmar, OCK generates steady and long-term recurring revenue, accounting for circa 60% of its total group revenue.

The green energy and power solution business is set to gain stronger traction, driven by strategic initiatives under the National Energy Transition Roadmap (NETR), including the expansion of more solar farms. OCK is well-positioned to capitalise on the growing data centre opportunities, having secured a RM25 million order book and robust RM50 million tender pipeline. Additionally, OCK’s new digital business prospects are bolstered by its recent collaboration with SenseTime, a leading artificial intelligence (AI) software company, aimed at innovating AI-driven solutions for its customers.

We project a three-year revenue and profit CAGR of 7% and 20% respectively over 2023-2026, fuelled by recurring regional site expansion and the ongoing 5G deployment. Potential opportunities from Malaysia’s NETR initiative and growing data centre prospects are also expected to fuel further momentum in the green energy and power solution segment. We expect OCK to maintain its strong Ebitda margin, which has averaged 29% over the past three years. We forecast the Ebitda margin to range between 30% and 32% over 2024-2026, supported by continuous cost optimisation and finance cost savings. This improvement is anticipated to drive higher core net profit margin of 6% to 8%, compared to the historical three-year average of 6%.

OCK has historically paid out 18% to 36% of its net profit. In February 2024, OCK formally announced a dividend payout policy of paying out a minimum of 20% of its earnings. We are projecting a 28% to 30% payout ratio over 2024–2026, which translates to a yield of 2.5% to 3.4%. We initiate coverage on OCK with a “buy” and sum-of-parts-derived target price of 85 sen, which implies an 11 times forward PE multiple on 2025 EPS.

Dialog Group Bhd

Target price: RM3.00 BUY

HONG LEONG INVESTMENT BANK RESEARCH (JUNE 18): Dialog’s (KL:DIALOG) management guided that the 24,000-cubic metre (cbm) renewable fuel tanks at Langsat Phase 3 is slated for completion by end-2024 and will be running at full capacity in 2025. In our view, the 200,000 cbm additional capacity to be developed in Langsat, which will cater for renewable fuel storage, is undergoing feasibility studies and will likely reach final investment decision in 2025. We understand that the rate of renewable terminals is 30% to 50%, higher than its conventional counterparts although the internal rate of return is similar at low teens due to higher capex requirements.

For downstream, the plant maintenance master service agreement with Petronas is running at renewed rates, though its contribution is only slightly positive to its plant maintenance profitability. We believe Pengerang Phase 3 will finally secure leases from customers in 2025. Dialog will likely earmark most of its engineering, procurement, construction and commissioning resources to internal jobs in the coming years as it embarks on terminals expansion in Langsat and Pengerang.

We maintain our forecasts and raise our target price from RM2.75 as we revisit assumptions for its midstream terminals and Pengerang Phase 3 expansion.

Mah Sing Group Bhd

Target price: RM2.27 BUY

UOB KAY HIAN RESEARCH (JUNE 18): We are positive on Mah Sing’s (KL:MAHSING) data centre venture with Bridge Data Centres, a subsidiary of Chindata Group, as we believe the venture will provide immediate value unlocking for idle land in Southville City, thus bolstering recurring income. We raise our target price from RM2.11. Our blue-sky target price could range from RM2.47 to RM4.84 if the entire 500MW data centre investment is fully realised and completed.

Apart from contributing land valued at RM160 psf, Mah Sing will also be involved in constructing buildings/infrastructure, and hold a stake in the joint venture, initially estimated at 20% or more. This stake will allow Mah Sing to generate recurring income from offtakers such as hyperscalers and AI data centres. Typically, data centre operators do not disclose their clients, but our channel check indicates that Chindata primarily serves major technology companies across China, India and Southeast Asia, including ByteDance. Our pro forma calculation suggests that a 100MW data centre could generate RM650 million in revenue, based on financial data from Chindata.

We have learnt that several other data centre operators have shown interest in Southville City.

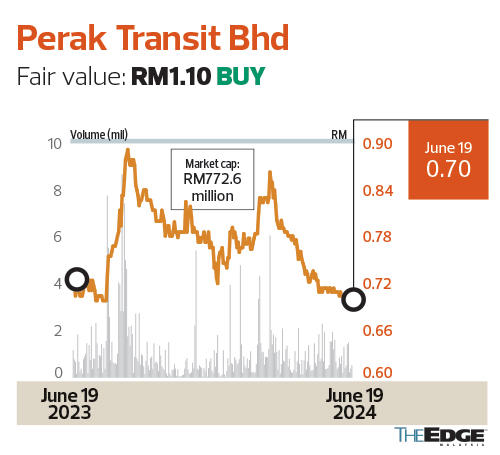

Perak Transit Bhd

Fair value: RM1.10 BUY

AMINVESTMENT BANK RESEARCH (JUNE 19): We maintain a “buy” on Perak Transit (KL:PTRANS) with a slightly lower fair value of RM1.10 (from RM1.12), pegged to FY2025 PER of 16 times, or -2 standard deviation above its three-year average of 11 times. We tweak FY2024-FY2026 earnings forecast downwards by 2% to 5% after taking into account the net impact from a higher decline rate in project facilitation fee (PFF) and improved contribution from Terminal Bidor Sentral, premised on stronger-than-expected occupancy rates.

We expect to see a decline in PFF revenue in the near term after experiencing a peak performance in FY2023 following completion of associated projects with higher gross development costs. Management reported an order book of RM25 million for the subsegment, with visibility for up to a year.

The construction of Terminal Bidor Sentral has been completed and operations are expected to commence by 2HFY2024. We gather that the group has secured an occupancy rate of 54% based on total net lettable area. We believe the group’s strongest catalyst will be the planned Terminal Tronoh Sentral. It has secured development approvals for the project and expects to commence construction in 2HFY2024 with completion by end-2026.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.