Fed Officials Latch Onto ‘Scenarios’ as New Way to Communicate

(Bloomberg) -- There’s a new buzzword in central banking: scenarios.

A growing chorus of Federal Reserve officials is discussing the advantages of communicating how they would respond to various economic outcomes different from their baseline forecast.

The post-pandemic recovery has repeatedly surprised economists on Wall Street and at the Fed, leading to abrupt changes in market expectations for interest rates.

Fed's Quarterly Forecasts Over Time | Policymakers' projections for 2024 have evolved with the economy

That has prompted fresh discussion about how central bankers can better explain the risks and uncertainty around the outlook for policy moves.

“The path of the economy is so uncertain — which means that our response to it, a change in monetary policy, may also be uncertain — so why not entertain various scenarios?” Fed Governor Lisa Cook said last week. “That could be a very useful tool.”

The concept of employing scenarios in policy making caught fresh momentum after former Fed Chair Ben Bernanke recommended the Bank of England make greater use of them in his independent review of the central bank’s forecasting approach in April.

The word “scenario” has peppered Fed officials’ speeches and other public comments since, with a number of officials — like Atlanta’s Raphael Bostic and San Francisco’s Mary Daly — using scenarios to sketch out different ways the economy could evolve, influencing the path for borrowing costs.

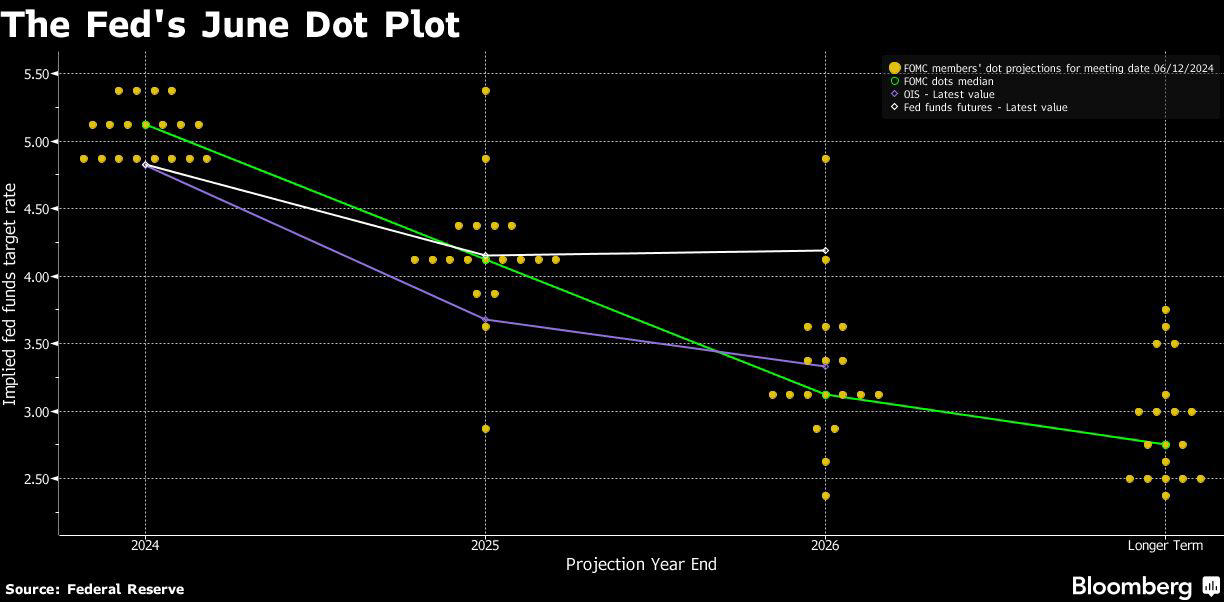

The Fed’s main tool for messaging its outlook is a quarterly summary of officials’ individual forecasts for unemployment, gross domestic product, inflation and the policy rate. The median projections in this document, known as the Summary of Economic Projections, aren’t meant to be official baseline estimates but are often viewed as so.

The Fed's June Dot Plot

Some officials, like Chicago Fed chief Austan Goolsbee and former Cleveland Fed President Loretta Mester, have suggested adding more detail to the SEP to better communicate with the public about potential policy paths.

Both have proposed publishing an anonymized matrix connecting officials’ forecasts for interest rates – often referred to as the “dot plot” — with Federal Open Market Committee participants’ projections for growth, unemployment and inflation. They have also suggested complementing the SEP with risk scenarios.

Officials like Cook and St. Louis Fed President Alberto Musalem have stopped short of calling for a reworking of the SEP, but both seem to favor scenarios as a regular tool to explain how policy would respond to a plausible risk to the outlook.

“It is critical to communicate both about the most likely scenario and about less likely scenarios that could be consequential if they materialize,” Musalem said in June. “Communicating about a range of scenarios, rather than only the most likely, is an important component of robust policymaking.”

At the start of 2024, when the SEP had signaled three rate cuts for the year, investors were betting on roughly six reductions, according to futures markets. After a string of disappointing inflation figures, markets were pricing in just over one in late April, though they’ve since moved closer to two cuts.

Longer-Term Changes

Ellen Meade, a research professor at Duke University and former Fed Board senior adviser on monetary policy and communication, said recent remarks by Fed officials point to ongoing thinking about communication policy.

While the Fed typically approaches big changes to policy documents like the statement or the SEP slowly, Chair Jerome Powell said in June that communications would be “within scope” of the central bank’s long-run strategy review that kicks off later this year.

“Once you get up into the neighborhood of about six people — with Chair Powell leaning into scenarios himself at the May press conference — you really can’t ignore that,” Meade said.

Scenarios “would help the Fed,” she said. “FOMC communication has been a little fraught since late last fall.”

Most Read from Bloomberg

©2024 Bloomberg L.P.