Budget 2024: Will government offer capital gains tax relief to investors?

With the Narendra Modi-led National Democratic Alliance (NDA) government getting down to work on the first full Budget of its third term, investors are hoping for some relief on the capital gains taxes front.

Under the Income Tax Act, gains from sale of capital assets, both movable and immovable, invite "capital gains tax".

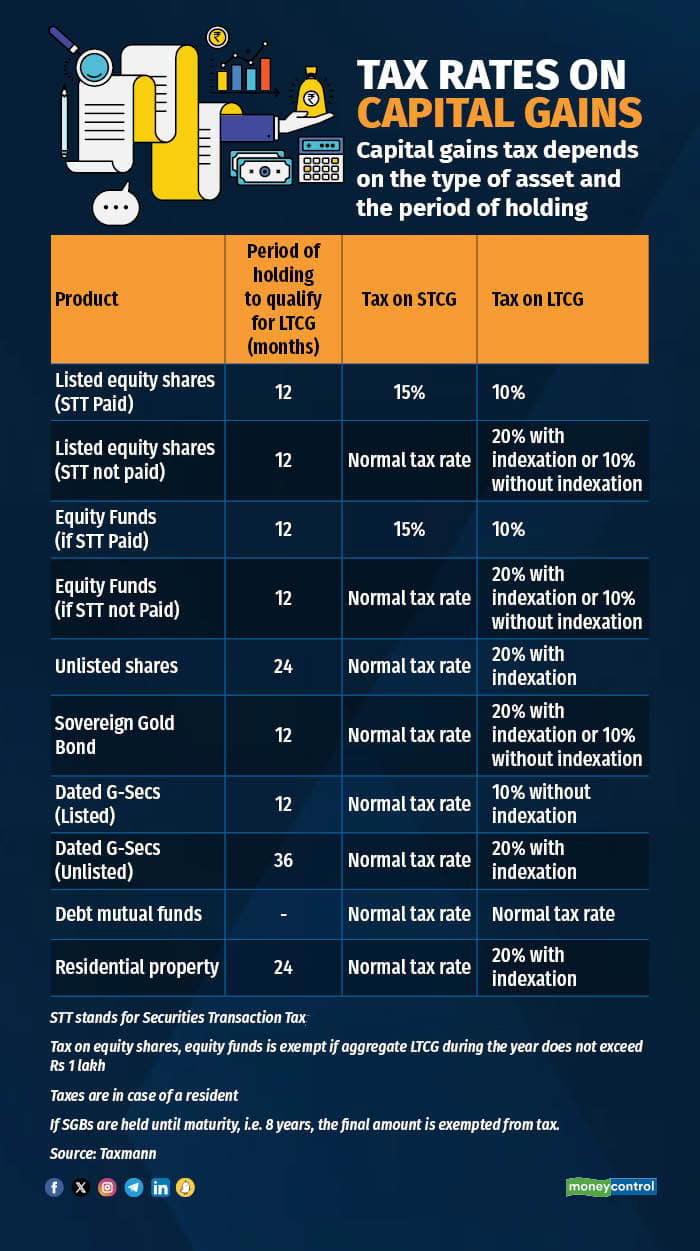

Different sets of assets — such as equity, debt and real estate — are taxed at different rates and periods that determine whether the gains are short or long term.

Budget expectations

Capital gains range from 10 percent to the highest nominal tax rate of 30 percent, depending on the holding period, which varies from one to three years.

Experts say rationalising and standardising the capital gains regime to streamline the holding period, uniformity in long-term/short-term rates across asset classes, and a change in the base year for indexation for long-term capital gains would benefit the investor community.

There are hopes that the capital gains tax structure will be simplified by introducing a uniform holding period across domestic equities and mutual funds. Uniformity in tax treatment will likely encourage higher compliance.

Jimmy Patel, Managing Director and Chief Executive Officer, Quantum Mutual, is hopeful of parity in tax treatment for direct investment in listed debt securities and indirect investment in the same instruments through debt-oriented mutual funds.

At present, direct investment in listed debt securities and zero-coupon bonds (listed or unlisted) for more than 12 months is treated as a long-term investment.

On the other hand, if the investment is through a debt-oriented mutual fund scheme, the holding period goes up to 36 months for it to be a long-term investment.

“If the long-term holding period for debt mutual fund investment is brought down to 12 months, it will make the category attractive to investors by simplifying the long-term capital gain tax structure,” Patel said.

"Post April 2023, we have seen investors allocation tilting in favour of equities. We see merit in investors having debt: equity mix in their portfolio based on the advice of their investment counsellor. Hence we expect some tax concession for debt mutual funds. We expect status quo on capital gains tax for equities," said Deepak Agrawal, Chief Investment Officer-Debt, Kotak Mahindra AMC.

Tax rates on capital gains R

What experts say?

With markets trading at record highs, sentiment remains buoyant and the budget might follow the cue, experts say.

“Any kneejerk reactions owing to any new taxes being introduced remain low, for now,” said Siddharth Alok, assistant vice president (investments), Multi Ark Wealth-Epsilon Money Group.

Vivek Iyer, a partner at Grant Thornton Bharat, expects the budget to focus on creating access to new asset classes from a mutual funds perspective in real estate and infrastructure.

“It would be good to see some announcements on the capital gains side but we expect it to be in the next budget rather than this year’s budget, given the need to stay the course on the fiscal consolidation path,” Iyer said.

Surprises unlikely

In the run-up to the recently concluded general elections, there were reports the government could look at uniform treatment for all asset classes. Many experts, including Christopher Wood, global head of equity strategy at Jefferies, said such a move would be negative for Indian equities.

The finance ministry had dismissed the reports as speculative.

Mutual fund industry experts think that given the lack of a clear mandate for the BJP, the budget would not want to upset the investor mood.

“The probability of that happening has dropped significantly, especially against the backdrop under which the current government has come back to power,” said Nirav Karkera, Head of Research at Fisdom. “Further, given the state elections coming up and the participation of capital market investors rising in the voting pool, the probability of capital gains being negatively tweaked has significantly dropped.”

Karkera expects the budget to be fiscally prudent rather than populist.

Capital gains' structure

At present, selling listed securities such as shares and units of equity-oriented mutual funds (where equity exposure is above 65 percent of the assets) within a year invites a short-term capital gains (STCG) tax at 15 percent.

The long-term capital gains (LTCG) tax kicks in if the listed securities are sold after a year, attracting a tax of 10 percent on gains of over Rs 1 lakh in a year.

According to the amendments to the Finance Bill in March 2023, in the case of debt fund investments, gains from funds with less than 35 percent of their assets in equities do not offer LTCG and indexation benefits. Irrespective of when you sell these units, they are added to your income and taxed at income-tax rates.

Earlier, gains from investments in debt funds — if units were held for more than three years — were subject to the LTCG tax rate of 20 percent after indexation.