Hedge-Fund Whales Rocking Latin America Are Exposed in Mexico

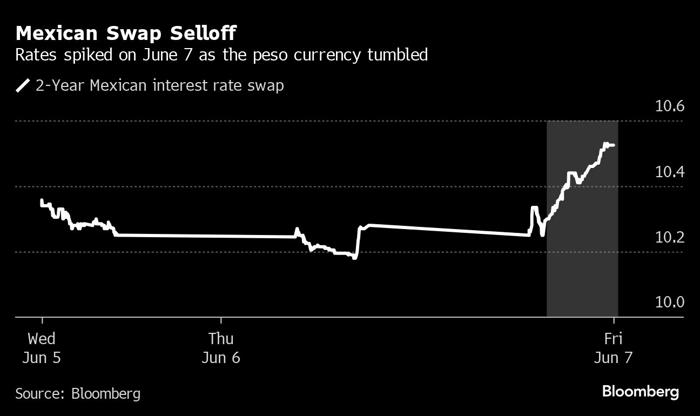

(Bloomberg) -- Early in the morning of June 7, interest-rate futures spiked wildly in Mexico. All week long, they had held steady even as the peso plunged in the wake of the ruling leftist party’s landslide election victory. But now, the selloff was suddenly spilling into the rates market.

As yields soared throughout that day — over a quarter percentage point on some contracts — word spread quickly across trading desks in Mexico City: “It’s the Brazilians.”

By the Brazilians, they meant Brazilian hedge funds. Some of the biggest and most powerful in Sao Paulo and Rio de Janeiro had snapped up Mexican assets in the months before the vote. Ill-fated bets on the peso were big. That part wasn’t all that unusual. The peso had become a popular trade, and investors from Japan to the US got stung when it crashed.

Brazil's Growth Surprise Boosts Economic Outlook Ahead Of Vote

Where the Brazilian hedge funds conspicuously stood out, Mexican traders say, was in the rate futures market. Firms including Genoa Capital, Kinea Investimentos, Vinland Capital and Ibiuna Investimentos had piled into wagers on a decline in rates, amassing, collectively, an outsize position in a market that’s just a fraction of the size of the peso market. So when several of them suddenly decided to unwind those bets, caving into the pressure that mounted as the peso rout squelched the prospect for rate cuts, they drove rate futures quickly higher.

The episode highlights the potent force that Brazil’s hedge funds are becoming across Latin America. From Bogota to Santiago, they move in and out of markets, pushing asset prices higher and lower and, in the process, attract the attention of local investors who grouse about how these vast sums of foreign money are fueling volatility.

This is in part a reflection of Brazil’s growing economic might. Flush from a decades-long export boom, wealthy Brazilians started handing over ever-greater sums of cash to hedge fund managers, swelling their assets under management three-fold over the past 10 years to 1.6 trillion reais ($290 billion) and fueling a hunt for opportunities abroad to deploy strategies they’d honed over years of navigating high inflation in Brazil. Frequently, those opportunities are easiest to find, the fund managers say, in neighboring countries with similar economic fundamentals.

“Brazilian hedge funds are definitely getting more noticed,” said Thierry Wizman, director of global currencies and an interest-rate strategist at Macquarie Futures in New York. “Many of them have accumulated a lot of assets and are making their presence known through their trading.”

Mexican Swap Selloff | Rates spiked on June 7 as the peso currency tumbled

In the rate futures market, Genoa, Kinea, Vinland and Ibiuna — the Sao Paulo-based shops which combined manage over $36 billion in assets — all had amassed receiver positions that would benefit if rates fell, according to investor notes seen by Bloomberg News and people familiar with the matter.

The bet was that policy makers would steadily bring down the benchmark rate from 11% as the peso rallied and inflation slowed. The elections weren’t supposed to change that outlook. But when President-elect Claudia Sheinbaum and her congressional allies rolled to such big victories that they started talking about enacting policies that could remove checks on the government’s power, it triggered a wave of panic selling across Mexican markets.

Genoa exited the trade entirely following the election while Vinland and Ibiuna trimmed their positions, said the people, who asked not to be identified discussing private decisions.

Of the 15 worst-performing large hedge funds in Brazil that week, at least seven of them had exposure to Mexico, according to data compiled by Bloomberg. Genoa, Vinland, Ibiuna and Kinea were all among that group.

Jose Oswaldo Monforte, a portfolio manager at Vinland, said the firm’s macro hedge fund had been betting that contracts maturing in around two years would decline at a faster clip than those maturing in a shorter period. The fund is now “fairly neutral” in Mexican rates, he said. Genoa, Kinea and Ibiuna declined to comment.

Fund Outflows

It’s been a rough past three years for the industry. With benchmark rates in Brazil high enough once again — 10.5% today — that some investors don’t feel they need a hedge fund manager to generate income for them, many funds have seen outflows. Returns have been poor, too. An index that tracks hedge-fund performance is flat for the year in its worst first half since 2020, dragged down in part by a slump in Brazilian stocks and bonds.

The industry’s push into foreign markets was in part an effort to cushion returns against the vagaries of the Brazilian market. Many funds have opened offices and built out international trading desks in North America, Europe and Asia.

They’ve put on some bold trades in those markets, including a big win they scored a couple years ago by predicting the surge in US yields, but it’s in Latin America where they have the heft to actually move markets. Like that time in Bogota in 2022, when several of them put on short wagers against the Colombian peso and, in the process, accelerated a monthlong selloff in which the currency sank 9%.

Back in Mexico, the Brazilian funds aren’t completely giving up on the rates trade. The rout last month may have forced them to scale back their bets but it didn’t dent their conviction that rates are coming down.

“Brazilian accounts,” says Jessica Roldan, chief economist at Casa de Bolsa Finamex in Mexico City, “play aggressively.”

--With assistance from Felipe Saturnino, Maria Elena Vizcaino and Davison Santana.

Most Read from Bloomberg

©2024 Bloomberg L.P.