Banks’ solid NOII growth seen slowing

This article first appeared in The Edge Malaysia Weekly on June 24, 2024 - June 30, 2024

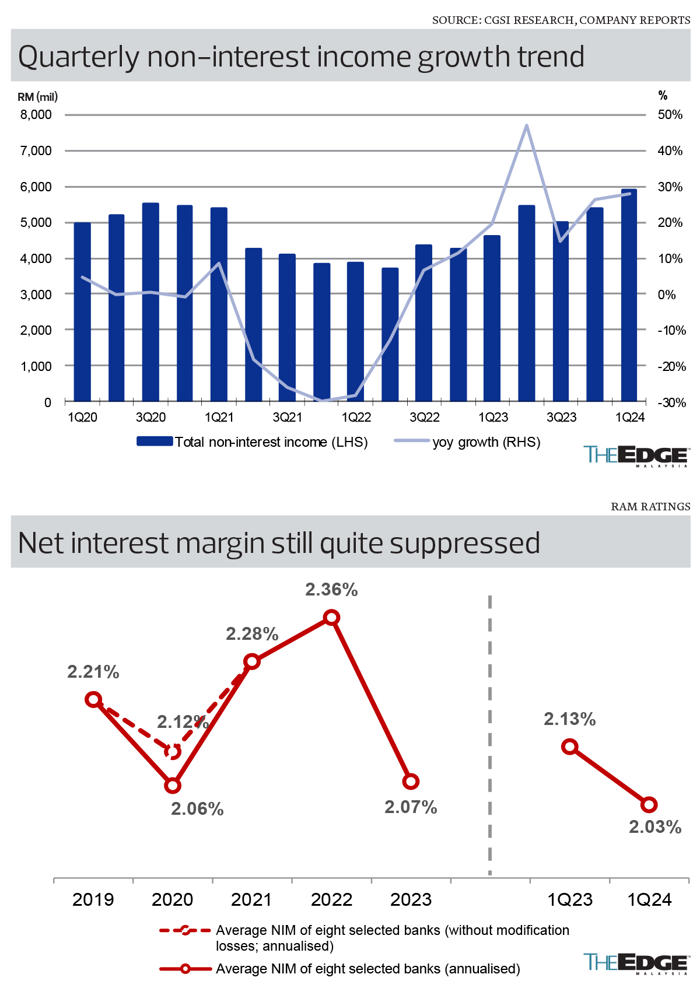

BANKS’ non-interest income (NOII) growth — the key driver of the sector’s commendable first-quarter earnings — is expected to slow in the remaining quarters of this year, contributing to analysts’ expectations of slower earnings growth for banks in 2024.

In the recent January-March quarter, banks’ NOII jumped 34% year on year (y-o-y) and 11% quarter on quarter to RM5.7 billion — the highest quarterly NOII in five years, according to Hong Leong Investment Bank (HLIB) Research, which collated data from eight lenders (excluding Hong Leong Bank Bhd).

Banks derive NOII from treasury or investment trading as well as fees from investment banking and insurance, among others.

“We saw stronger treasury-related revenue fuelling 1Q2024 NOII growth, although there was no external aid from low-hanging benchmark rate reductions. However, we are sceptical that this tempo can be sustained, given [the] historical volatility of treasury gains. Also, there are no signs of Bank Negara Malaysia lowering the overnight policy rate (OPR) in the near term and, thus, the Malaysian Government Securities (MGS) [bond] market is not seen to make any major positive moves,” HLIB Research banking analyst Chan Jit Hoong tells The Edge.

“In addition, the view is for the US Federal Reserve interest rate to stay higher for longer — with possibly just one cut in December — following months of stickier-than-expected inflation and continued strength in the US jobs market. As such, we anticipate the 10-year US treasury yield to hover above the 4% mark, making it more attractive than the 3.9% 10-year MGS yield. With this, investors may shy away from MGS in favour of the higher-yielding US treasuries,” he adds.

Chan expects NOII to moderate in the remaining quarters of this year, at a run-rate of around RM4.9 billion each compared with the first quarter’s RM5.7 billion.

He projects that NOII growth will slow to 5% this year and 3% in the next, compared with the robust 27% in 2023.

Similarly, CGS International (CGSI) Research anticipates NOII slowing down this year. By its calculation of the banks it covers, NOII grew a solid 27.8% y-o-y to RM5.9 billion in 1Q2024, making it the sixth consecutive quarter that NOII grew at a double-digit pace, with the rates in that period ranging from as low as 11% to as high as 47%.

It sees the pace easing from the second quarter onwards.

“We envisage NOII growth to narrow to single-digit rates in 2Q2024,” it says in a June 12 report on the sector. “This is premised on our view that robust investment income in 1Q2024 — which amounted to RM3.69 billion, representing y-o-y growth of 268.8% for the eight major banks — is not sustainable, and higher base of NOII of RM5.43 billion in 2Q2023 versus RM4.62 billion in 1Q2023.”

Nevertheless, it believes the fee income portion of NOII may stay steady. “We think that the high fee income in 1Q2024 would be sustainable in 2Q2024, given the robust equity market and positive economic growth. Based on this, we forecast banks’ fee income growth would be strong at around 10% y-o-y in 2Q2024,” it adds.

Of the banks, Malayan Banking Bhd (Maybank) (KL:MAYBANK), Affin Bank Bhd (KL:AFFIN) and CIMB Group Holdings Bhd (KL:CIMB) saw the strongest y-o-y NOII growth in 1QFY2024. Maybank’s NOII surged 78% to RM3.05 billion, Affin Bank’s rose 33.7% to RM142.56 million and CIMB’s climbed 24.5% to RM1.84 billion.

On the flip side, Alliance Bank Malaysia Bhd (KL:ABMB), AMMB Holdings Bhd (KL:AMBANK), Bank Islam Malaysia Bhd (KL:BIMB) and Hong Leong Bank (KL:HLBANK) saw their NOII decline in that quarter. The decline was the strongest, at 37.7%, for Hong Leong Bank.

Weaker net profit

The weaker prognosis for NOII, coupled with an expected improvement — though not strong — in banks’ net interest income (NII), has analysts predicting lower net profit growth for lenders this year. (It should be noted that last year’s net profit was partly lifted by the non-recurrence of the Cukai Makmur taxation.)

“We still expect the sector to post 5% to 6% y-o-y net profit growth in FY2024 and FY2025 (compared with 15% in FY2023) on the back of a NII rebound from stabilising net interest margin (NIM) and continued loan growth. We assume credit cost stays broadly stable but, despite the strong start to NOII, also expect a moderation in growth to 6% y-o-y (2023: +30%),” RHB Research says in a June 6 report on the sector.

NIMs were significantly compressed last year owing to elevated cost of funds from the upward repricing of deposits following multiple rate hikes and heightened deposit competition. RAM Ratings notes that NIMs have started to stabilise in 1QFY2024 as competition for deposits has eased, but on the whole, it expects margins in 2024 to remain suppressed — similar to the year before.

A casual survey of six research houses shows that three (CGSI Research, Maybank Investment Bank Research and Kenanga Research) have a positive investment stance on the banking sector, while the others (HLIB Research, RHB Research and AmInvestment Bank Research) have a “neutral” stance.

CIMB Group, AMMB and Alliance Bank were among the most frequently cited as the analysts’ top picks.

“Post [1Q2024] results, we believe investors may continue to see opportunities in the sector as its earnings resilience remains highly supported. Concerns appear to be more muted as compared to past years, albeit with some smaller banks still appearing to be navigating through challenges,” Kenanga Research says in a June 4 report.

It adds: “We subscribe to flattish OPR at 3% until end-2024, which could be viewed as providing more stability for the industry as well as banks in the near term. Apart from that, dividend yields of 6% to 7% could still be offered by certain names with sustainable return on equity to boot,” says Kenanga Research.

As at June 21, the Bursa Malaysia Financial Services Index had gained 6.82% year to date compared with the benchmark FBM KLCI’s 9.33% gain to 1,590.37 points.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.