Energy-guzzling data centres a boon for Tenaga

This article first appeared in Capital, The Edge Malaysia Weekly on June 24, 2024 - June 30, 2024

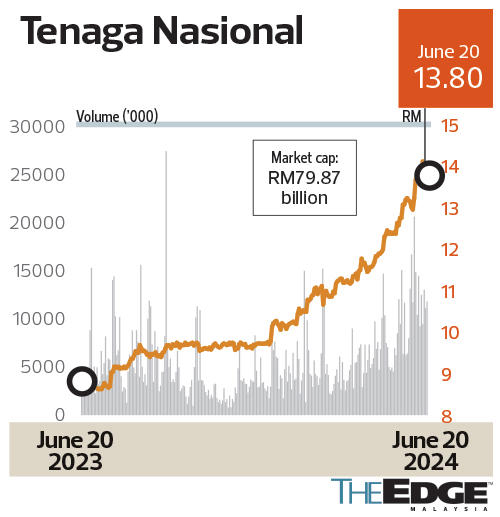

TENAGA Nasional Bhd’s (KL:TENAGA) share price has leapt 25% since February, hitting an all-time high of RM14.28 on June 13. Over the past year, the heavy-weight blue chip has jumped close to 50%, closing at RM13.80 last Thursday.

The share price rally was driven by a combination of factors. The fact that more energy-guzzling data centres will be sprouting up in Malaysia has fuelled the strong buying interest, apart from the export of renewable energy.

In short, electricity demand will not just follow the economic growth pattern in the coming years.

The utility giant has already benefited from the increase in power consumption driven by data centres. In the first quarter ended March 31, 2024 (1QFY2024), electricity demand increased by 9.6% year on year (y-o-y) to 31,899GWh. Power consumption in the domestic segment went up 16.8% while the commercial segment saw an 11.2% rise. The months of hot weather no doubt had contributed to the increased electricity consumption.

During the quarter, two data centre projects with a total energy demand of 535mw had been commissioned under the Green Lane Pathway, an exclusive pathway for data centres with strategic offerings, according to Tenaga.

The company’s presentation slide for its quarterly results shows that as at June 2024, it had signed 10 electricity supply agreements (ESA) with data centre operators, for a total energy demand of 2,000mw. It expects two data centre projects with a total energy demand of 484mw to be commissioned in the financial year ending Dec 31, 2025 (FY2025).

Kenanga Research, which has an “outperform” call on Tenaga with a target price of RM14.50, expects the higher demand growth assumption to be pencilled in during RP4 (Regulatory Period 4) compared with the 1.7% seen in RP3 (Regulatory Period 3).

RP4 will cover the three-year period between 2025 and 2027.

“I think the thematic play is the country’s energy transition. The T&D (transmission and distribution) upgrades and all that will actually anchor your regulatory-based earnings. So that is one,” says Sean Lim, an RHB Research analyst, in explaining the share price’s upward trend.

He sees that the upcoming data centres’ high electricity consumption will justify Tenaga’s large capex moving forward, which will include the upgrading of the national grid. Furthermore, Lim foresees that more gas-fired power plants will be built to cope with the rising demand for electricity.

Gas-fired power plants are the most reliable option in the absence of a stable supply of renewable energy and battery energy storage system (BESS) methods, he says, adding that gas is considered a cleaner fuel than coal.

“The low hanging fruit that they can pluck is to build more gas plants, and I think Tenaga will benefit from this because it is one of the major players in the country,” Lim says. He pegs his target price for the stock at RM16.10.

For FY2024, Tenaga has allocated capex of RM13.8 billion, of which between RM6.4 billion and RM7.7 billion will be regulated capex. In 1QFY2024, Tenaga’s capex on distribution network and retail was RM1.23 billion, compared with RM976.2 million a year ago. Meanwhile, it spent RM393.2 million on the national grid during the quarter, up from RM268.2 million a year back.

HLIB Research writes in a June 5 note that Tenaga is finalising RP4 details with the Energy Commission. The details are likely to be announced by December this year.

Tenaga had previously said that it would invest RM90 billion over the 2025-2030 period.

“We believe Tenaga’s allowable capex spending and allowable returns under RP4 will be heavily subject to the potential increase in power demand by the booming data centre set-ups in Malaysia and the expected increase in renewable energy exports to neighbouring countries (regulated by ENERGEM), HLIB Research says. “To date, Tenaga has completed infrastructure set-ups for 535mw data centres, and management [has] guided actual power demand to be stepped up in phases. In 1QFY2024, the actual power demand from data centres was 150mw.”

“Management guided that there are more data centres under development stages as 2GW of ESAs is expected to be finalised in 2024. Hence, we expect a stronger regulated earnings growth from 2025 onwards (driven by the higher regulatory asset base),” it adds.

Out of the 19 analysts that cover the stock, 13 have a “buy” call, while six have a “hold”.

The highest target price is Morgan Stanley’s RM17.21 while the lowest is MIDF Research’s RM11.52. Most of the analysts’ target prices are between RM13 and RM15.

After the rally, Tenaga is trading at a price-earnings ratio (PER) of 32.26 times at RM13.80, based on its historical trailing 12-month earnings.

Some analysts think the good news has already been priced in at the current price level. Indeed, the utility giant has exceeded some of their target prices.

“We still like Tenaga as a beneficiary of the energy transition but we believe valuations have run ahead of fundamentals at this juncture,” says MIDF Research in a June 4 report. “The stock is now trading at 16 times FY25F PER, close to 1SD (standard deviation) above the historical mean of 13.9 times, reflecting an already high expectation of future earnings.”

The research firm pegs Tenaga’s fair value at RM11.52, saying that its projections already assume a step-up in regulated asset base growth to a compound annual growth rate (CAGR) of 7.7% in RP4, compared with 4.2% in RP3. “Any weaker-than-expected capex in the upcoming RP4 determination is a valuation de-rating risk, in our opinion.”

Public Investment Bank Research also ascribes a “neutral” call to Tenaga with a 12-month target price of RM13. However, it notes that RP4 poses an upside risk to its call, judging by the current electricity demand that far exceeds forecasted RP3 base sales.

“Our earnings forecast includes the estimated step-up in the forecast base sales set for FY2025F but remains conservative at low single-digit annual growth for FY2026F based on previous RP cycles,” it says.

The research outfit notes that the Energy Commission needs to be convinced that a higher forecast base sales annual growth assumption should be more reflective of the robust demand outlook for RP4.

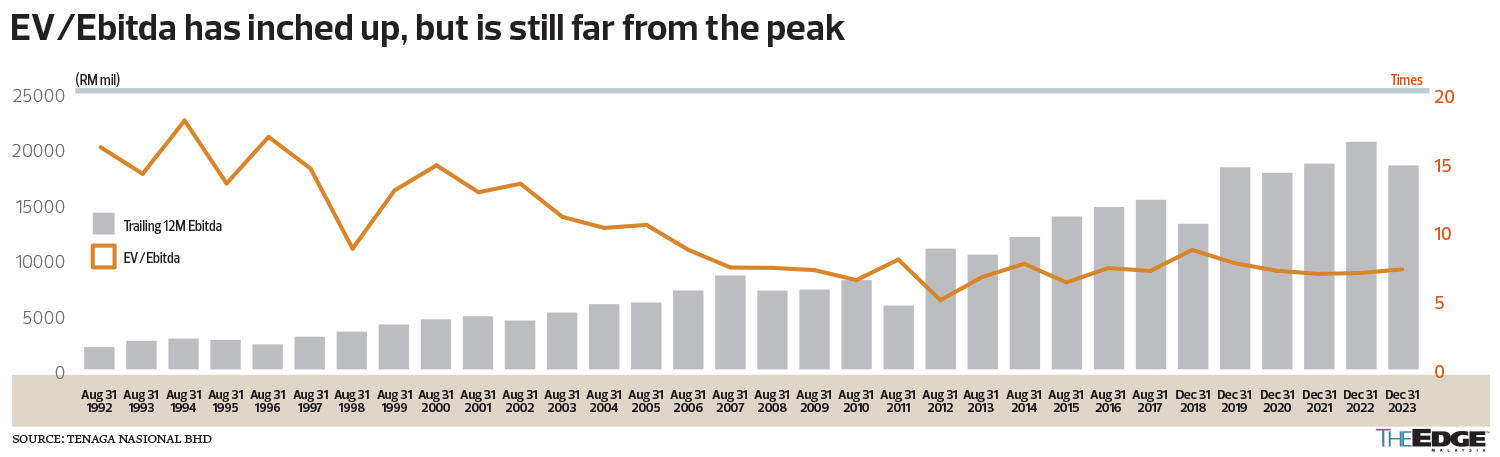

Tenaga’s enterprise value to its earnings before interest, taxes, depreciation and amortisation (EV/Ebitda) multiple was 7.18 times as at Dec 31, 2023. This is much lower than the peak of 18.02 times as at Aug 31, 1994. Notably, Tenaga’s gearing ratio then was at about 0.6 times.

Having said that, the 1990s were the go-go years for the Malaysian stock market, with gross domestic product (GDP) growing at an annual rate of more than 8%.

Back then, ESG-compliance issues had yet to pop up and Tenaga was then one of the must-have stocks in institutional investors’ portfolios.

Nevertheless, looking at the 20-year period between 2003 and 2023, Tenaga was trading at an EV/Ebitda multiple of 11 times as at Aug 31, 2003. The group was valued at 8.6 times its Ebitda as at Dec 31, 2018.

In comparison, YTL Power International Bhd (KL:YTLPOWR) is trading at an EV/Ebitda multiple of 8.45 times, while Malakoff Corporation Bhd (KL:MALAKOF) is trading at 7.82 times. Mega First Corporation Bhd (KL:MFCB) is trading at 8.82 times.

“In 1QFY2024, Tenaga’s net profits came in below Bloomberg estimates. If it can report earnings above market expectations in the coming quarters, then the share price can still go further up,” says an analyst with an international research firm.

In 1QFY2024, Tenaga reported net profits of RM715.7 million, which was 28.6% lower than the previous corresponding quarter’s RM1 billion. This was due to forex transaction losses of RM196.7 million as well as increased tax expenses of RM180.1 million.

The market consensus estimate, according to Bloomberg, was a quarterly net profit of RM1.2 billion.

According to Tenaga, its normalised profit after tax (PAT) in 1QFY2024 was RM1.034 billion, compared with RM1.084 billion in the previous corresponding quarter.

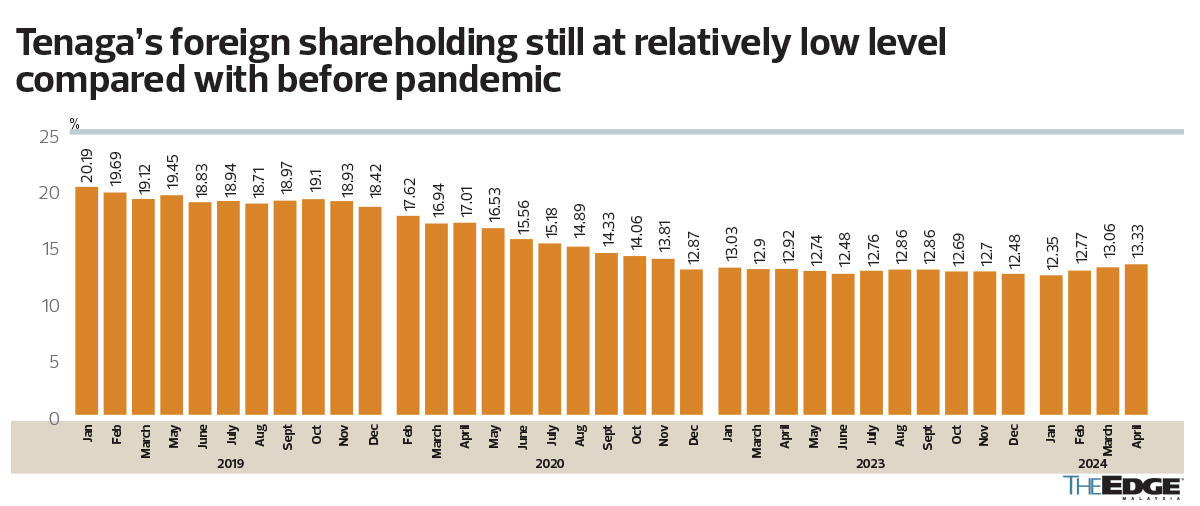

Another factor that would move Tenaga’s share price is foreign shareholdings, says the analyst. Malaysia’s profile as an investment destination has improved in recent years due to the relatively stable political situation as well as the focus on data centres, semiconductors and renewable energy.

In the two weeks ended June 14, foreign funds were net buyers of Malaysian equities with net inflows of US$156.9 million (RM739.8 million). This is in contrast with the net outflow of foreign funds from the Indonesian, Thailand, Philippines and Vietnamese markets.

Tenaga’s foreign shareholding level has been inching up this year, from an average of 12.35% in January to 13.33% in April. However, this is still low compared with the 18% to 20% levels seen in 2019 and the above-28% levels seen in September and October of 2016.

Tenaga was, indeed, the stock that had the highest net foreign inflow — RM337.3 million — during the week ended June 14, as local institutions pared down their shares in the utility group.

“Foreign interest in Malaysian markets will also play a role as to whether the share price of Tenaga can be further supported or not. However, Tenaga is one of the most liquid stocks that is also shariah-compliant, making it a favourite of the local funds.

“In contrast, YTL is not shariah-compliant, therefore the local funds who need to be shariah-compliant would not be holding the stock, which allows the foreign funds to be more active,” says the analyst.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.