(Bloomberg) — Chinese stocks climbed as onshore markets reopened after the Lunar New Year holidays, with traders weighing buoyant travel and spending data against broader caution toward the economy.

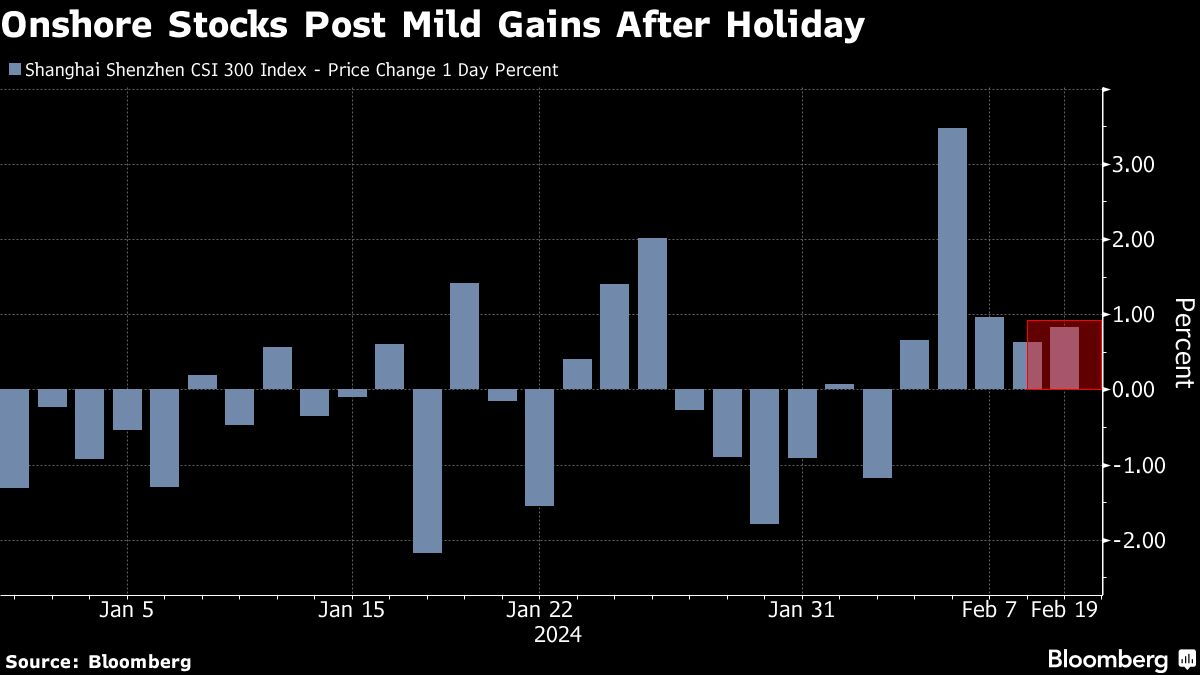

The benchmark CSI 300 Index advanced 0.8% as of 2:30 p.m. local time on Monday, its first trading session following the Feb. 9-16 break. A gauge of stocks in Hong Kong had gained nearly 5% in three sessions since it reopened on Wednesday while the Nasdaq Golden Dragon China Index jumped 4.3% last week.

Monday’s modest gains show that doubts run deep over the China market’s longer-term prospects as the economy struggles with deflation and a property crisis. Investors were expecting a rally onshore after state media reported that about 474 million domestic tourist trips were made during the eight-day holiday, up 19% from the same period in 2019 before the pandemic.

“Onshore markets may be reopening with some positive momentum after holiday spending data was better than expected, but given the strong rebound entering the holidays it will take more measures to be sustained,” said Marvin Chen, strategist at Bloomberg Intelligence.

Onshore Stocks Post Mild Gains After Holiday

Mainland stocks had rallied ahead of the holidays as authorities sought to revive investor confidence, with state funds ratcheting up purchases, a slew of regulatory tweaks to reduce selling pressure and a surprise replacement of the securities regulator chief. The benchmark CSI 300 Index rebounded from a five-year low and climbed 5.8% in the week before the break.

At a meeting of the State Council on Sunday, Premier Li Qiang called for “pragmatic and forceful” action to boost confidence in the economy, underscoring the government’s concern with a struggling recovery and stocks rout.

“It’s worth noting that this year’s Lunar New Year holiday spanned eight days, compared to the seven days in 2019,” said Redmond Wong, market strategist at Saxo Capital Markets. “Additionally, the average tourism spending per trip declined from the levels in 2019 as well.”

The CSI 300 Index — which erased all its gains early in Monday’s session — rose in late trading, with the rebound coinciding with a jump in trading volumes of a number of exchange-traded funds tracking mainland shares.

Meanwhile, foreign investors offloaded more than 5 billion yuan ($694 million) of mainland shares as of mid-Monday. Global funds have been opting out of Chinese stocks and seeking alternatives in other markets such as India and Japan.

Traders want to see further policy support across the monetary and fiscal space, in addition to a cut in the reserve requirement ratio already undertaken. China refrained from lowering a key policy interest rate on Sunday as its central bank sought to shield the yuan from volatility. Some economists expect commercial lenders to reduce their loan prime rates on Tuesday.

Read more on China markets

| Xi Can’t Use 2015 Playbook to Calm China Markets, Investors SayMSCI Cuts Swath of China Stocks From Indexes as Markets Sink China Stock Rebound Shows Cracks, Spoiling Traders’ Holiday Mood |

Tech stocks on the CSI 300 Index stood out on Monday. Cambricon Technologies Corp. and Zhongji Innolight Co. jumped more than 10% as Chinese names related to artificial intelligence responded to OpenAI’s unveiling of its new system, called Sora, that can create realistic-looking videos. Healthcare shares fell the most.

In Hong Kong, the Hang Seng China Enterprises Index slid more than 1% to snap a three-day advance.

“There is some profit taking in Hong Kong market today such as with the Macau casino operators after strong data prints of the Chinese New Year holiday,” said Dickie Wong, executive director of research at Kingston Securities Ltd. The next thing to watch is a potential lowering of the five-year loan prime rate, Wong added.

The latest Bank of America Corp. survey of money managers showed that going short Chinese stocks, which has been the second-most crowded trade for months, is becoming more popular. A third of the respondents said they will increase their allocation if they see more aggressive fiscal policy to boost the real estate sector.

Any stimulus signs emerging ahead of the key annual meetings in March, where the leadership announces the economic growth target and development goals, will thus be closely watched.

Coming soon: Sign up for Hong Kong Edition to get an insider’s guide to the money and people shaking up the Asian finance hub.

“In terms of tourist consumption numbers, most of the beat comes from the traffic numbers and if you look at average spending, austerity still exists,” said Willer Chen, an analyst at Forsyth Barr Asia Ltd.

–With assistance from Charlotte Yang.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

AWS and Clarity AI to use generative AI to boost sustainable investments

-

Ref Watch: 'Enough' of a foul to disallow Man City goal vs Liverpool

-

Day in the Life: Ex-England rugby star on organising this year's Emirates Dubai Sevens

-

Pandya returns to MI, Green goes to RCB

-

Snowstorm kills eight in Ukraine and Moldova, hundreds of towns lose power

-

‘This is why fewer Sikhs visiting gurdwaras abroad’: BJP after Indian envoy heckled in Long Island

-

Inside a Dubai home with upcycled furniture and zero waste

-

Captain Turner aims for Pitch 1 return as JESS bid to retain Dubai Sevens U19 crown

-

No Antoine Dupont but Dubai still set to launch new era for sevens

-

Why ESG investors are concerned about AI

-

Your campsite can harm the environment

-

Mubadala, Saudi Fund deals on US radar for potential China angle

-

Abu Dhabi T10 season seven to kick off with thrilling double-header

-

Eight climate fiction, or cli-fi, books to consider before Cop28