Why the Fed Is Right to Bide Its Time on Rate Moves

Why the Fed Is Right to Bide Its Time on Rate Moves

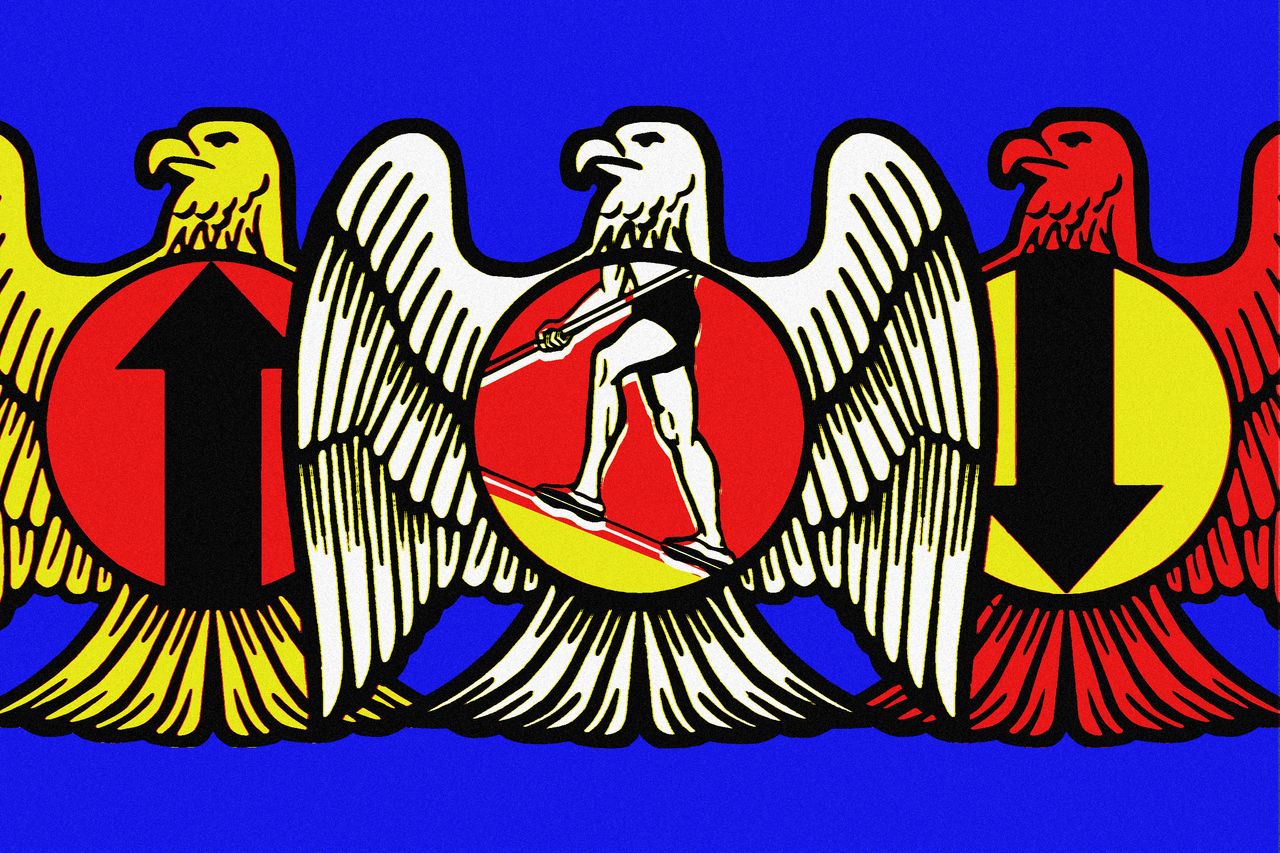

If you want to know the trouble with a balanced outlook, ask a tightrope walker.

The Federal Reserve has finally reached the stage of being balanced between whether interest rates are too high or too low. Unfortunately, it’s a precarious balance, with exceptionally weak evidence that rates are in the right place. They might be too low or too high, but it will be hard to stay balanced for long.

Last week, Federal Reserve Chair Jerome Powell said a rate increase was “unlikely,” giving markets what they wanted to hear. He also retreated a bit from his previous pivot toward rate cuts, saying the Fed would first need to be confident that inflation was heading back to target—which it hasn’t been recently.

Powell thinks interest rates are restrictive, that they are slowing the economy and thus should be contributing to reducing inflation. The problem is there is also lots of evidence that they are not. Start with the signs in the Fed’s favor, that monetary policy is indeed putting a squeeze on growth.

Labor: Jobs are far less plentiful than they were. While there are still more vacancies being advertised than before the pandemic, workers are much less likely to quit their jobs. Consumers report jobs are harder to find, and small employers have slashed hiring plans.

Friday’s payrolls figures showed the second-lowest monthly number of new jobs since October, and the rise in hourly earnings was small.

Credit: More consumers and companies are struggling to cope with the interest burden on their debts. More than 3% of borrowers failed to pay their credit-card bills on time in the fourth quarter of last year, the highest delinquency rate since 2011, and double the low reached three years ago. Young and poor borrowers who took out loans to buy a car or truck are also getting into trouble more often than before the pandemic.

Something similar is going on with companies: Those closest to the edge are at much greater risk of tipping into bankruptcy than normal—even as profit margins for the biggest companies remain high.

This shows up as a higher proportion of the worst-rated junk bonds trading at prices more deeply distressed than at any time outside of a recession, according to Viktor Hjort at BNP Paribas. The deep distress of the worst-hit contrasts with a lack of stress in the wider junk-bond market.

Money: The Fed’s tightening has coincided with a collapse in the money supply, something the monetarist school of economics thinks should lead to lower inflation. The broadest measure of the money supply, known as M2, has fallen year-over-year for 16 months. This is something it had never before done in data back to 1960.

The trouble is that, if monetary policy is so tight, why isn’t it showing up in broader financial measures?

An economy beset with problems shouldn’t have the S&P 500 stock index trading at just 2.4% below its all-time high. It shouldn’t have implied volatility, as measured by the Cboe Volatility Index, or VIX, at boom-time levels of 14. And it shouldn’t have junk bonds paying around the smallest amount of extra yield above safe Treasurys of the past 30 years.

If the Fed is right that financial conditions are tight, the markets are wrong.

How could that be? On jobs, maybe employers weren’t put off from hiring by high rates. Maybe it was the massive immigration of the past three years combined with people coming back into the workforce that allowed jobs to be filled and wage pressures to be reduced.

Economist Dario Perkins at TS Lombard points out that postpandemic normalization also helped. The biggest drops in vacancy rates occurred in sectors such as transport and health that had the biggest postpandemic recruitment problems.

Credit trouble is obviously being caused by the Fed’s rate rises, but it is far from obvious that it is widespread enough—yet—to slow the economy. Companies with low-income customers have suffered, but consumer spending as a whole is strong. In fact, personal-consumption spending rose in March at the fastest pace since January last year.

Rate increases are meant to crimp demand, but haven’t. Similarly, corporate capital spending is elevated. While planned spending has dropped back sharply from peak levels, it is picking up again.

The money supply isn’t obviously holding back the economy, either.

Monetarists think the shrinking of the money supply shows a slowdown to come, and it might. But mainstream economics gave up tracking the money supply decades ago because it was such a poor predictor.

Even true believers ought to be concerned that perhaps year-over-year change is less relevant after the huge spike in deposits caused by pandemic-era handouts. On top of that, broad money has been rising again since October.

The problem is that both sides have a good case, which is why I keep writing about the two-speed economy. If enough people or companies struggle with higher rates—or see that they might—it would bring down consumer demand and slow inflation, and perhaps cause a recession.

But, for now, enough consumers and big businesses are thriving, and demand could stay robust and perhaps push inflation higher. I can see why the Fed wants to wait and see how these conflicting pressures play out before deciding if it needs to raise or cut rates.

Write to James Mackintosh at [email protected]