Why mortgage rates are going up, not down

Why mortgage rates are going up, not down

Anyone thinking of buying a first home or moving to a new one will have watched recent increases in mortgage rates with concern.

The last two weeks have seen a string of lenders raise the interest rates on new fixed mortgage deals. The rises have made borrowing more expensive and potentially will mean some people having to postpone their plans.

More than 1.5 million existing homeowners are remortgaging this year, and they too may have expected rates to be falling, not heading back up again.

So why are rates heading upwards? The answer can be complex, and varied – but here are three reasons:

1. Borrowing is more expensive

Mortgage rates often pre-empt moves by the Bank of England with benchmark interest rates, also known as the base rate. Remember, higher rates make it more expensive to borrow money.

Markets move as they try to predict what the Bank’s Monetary Policy Committee will do. In turn, that affects mortgage lenders’ funding costs.

“Swap rates are when two parties exchange (or swap) interest rates to secure funding over a set period of time. Swap rates influence the price of fixed-rate mortgage deals,” explains Jo Jingree, from the broker Mortgage Confidence.

“Right now, fixed-rate mortgages have risen because the cost of borrowing has increased for lenders – and we have a number of factors, like numerous rises in the base rate, to thank for that.”

The Bank’s Monetary Policy Committee makes its next decision on Thursday. Crucially, It is now not expected to cut the rate as early or as often as previously thought.

So, the impact of those expectations eventually feeds through to mortgage rates, which have been creeping back up.

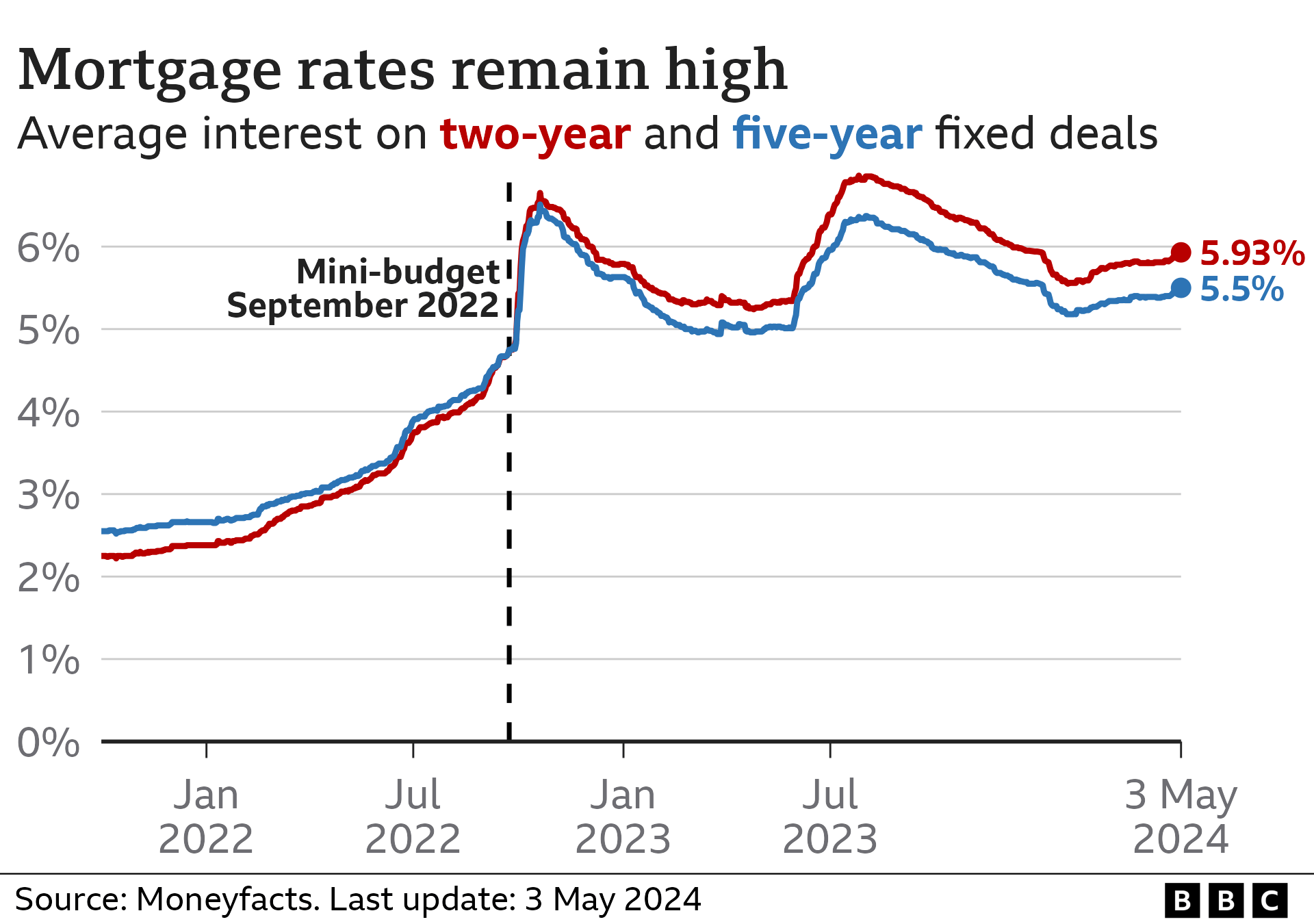

Lenders had engaged in a mini price war at the start of the year. The average interest rate on a two-year fixed deal dropped to 5.55% near the end of January, according to the financial information service Moneyfacts.

But that is as good as its been for mortgage-seekers. It has moved up since, and a flurry of activity in the last fortnight has pushed the average rate up to 5.93%.

That has worried Gary Rees, whose mortgage is up for renewal in October.

The 51-year-old, from Berkshire, pays about £350 a month with a mortgage interest rate of 2.4%. He is worried the rate could close to triple by the time he renews.

“I’ll have to cut back, and not go out as much,” said Mr Rees, who is registered blind.

Gary is braced for a large rise in his mortgage repayments

He is also considering the prospect of having to use savings to offset some of the mortgage interest, or pay down some of the capital.

It will affect his standard of living, and was not quite what he was expecting.

“The mortgage is a worry and a stress that feels a bit unfair,” he said. “I was hoping the rates would drop.”

2. Lenders don’t want too many customers

Mortgage brokers are keen to stress that the moves of recent days are not another cycle of rapidly rising rates, the likes of which were seen in the last two years.

The graph above shows that mortgage rates are still below last summer’s peak, and not accelerating as alarmingly as they did after the mini-budget of 2022.

However, some borrowers had banked on rates going down consistently throughout the year.

Two more key factors have created the current bump in the road.

- Firstly, the global economic outlook has not been as positive as many would have hoped. On Wednesday, the US central bank again said it would keep interest rates unchanged, because the rate of rising prices (inflation) had proved more persistent than expected.

- Secondly, lenders tend to move in a pack. A mortgage provider wants to set its rates to be competitive, but not too low to be suddenly inundated with custom and unable to cope with the demand.

The reality for home buyers and owners in pounds and pence is that, compared to someone getting a mortgage a year ago, it is a little more expensive.

Property portal Rightmove estimates that the average mortgage payment on a typical first-time buyer type property when taking out an average five-year fixed, 85% loan-to-value mortgage, is now £1,117 a month, up from £1,056 a year ago.

However, for those remortgaging as a two-year, or particularly a five-year, current deal expires, the monthly cost could be hundreds of pounds higher because the rate could have even been below 2% when they got their last deal.

3. What the Bank of England says has a big impact

The outlook for the coming months among commentators is still broadly more positive, but will create some food for thought for borrowers.

“This is not one-way traffic and could change again soon,” said David Hollingworth of L&C Mortgages.

Any suggestion from the Bank that it could move soon on benchmark interest rates – even if it holds at the current level on Thursday – could bring mortgage rates down again.

Matt Smith, from Rightmove, said: “The Bank of England meeting will be quite key for setting the tone for mortgage rates leading into summer.”

The markets still expect base rate cuts as the year goes on, but quite how far and how often the Bank goes with them is open to question.

Anyone remortgaging may have three or six months prior to the deadline to lock in a deal, and may be able to change to a better rate during that time if the situation improves.

Doing nothing during a time of uncertainty can be expensive, if borrowers are moved on to a default variable rate when their fixed deal expires.

“There are still plenty of good deals available,” said Mrs Jingree.

“It’s a good reminder not to wait for a better deal to become available, as rates don’t always follow predictions and expectations.”

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Read more here