This is the 'sweet spot' for Roth individual retirement account conversions, expert says

- If you’re eyeing a Roth individual retirement account conversion, you could save on taxes by leveraging a “sweet spot,” according to experts.

- Converting early in retirement while your income is lower could lower your upfront tax bill.

- But you need to be mindful of income-related monthly adjustment amounts, or IRMAA, for Medicare Part B and Part D premiums.

This is the ‘sweet spot’ for Roth individual retirement account conversions, expert says

If you’re weighing a Roth individual retirement account conversion, you could save on taxes by leveraging a limited window of time, experts say.

Roth conversions transfer pretax or nondeductible IRA money to a Roth IRA, which kickstarts future tax-free growth. The trade-off is upfront taxes due on the converted balance.

The decision to convert a pretax balance hinges on several factors. But converting early in retirement — while your income is lower — could reduce your upfront tax bill.

After you stop working, but before you start required withdrawals from retirement accounts, is “the sweet spot” for Roth conversions, according to JoAnn May, a Berwyn, Illinois-based certified financial planner at Forest Asset Management. She is also a certified public accountant.

More from Personal Finance:

More home sellers are paying capital gains taxes — how to reduce your bill

How to avoid getting ‘hammered’ on inherited individual retirement account taxes

IRS waives mandatory withdrawals from certain inherited IRAs — again

If your income drops after retiring, “there are some nice years in there for conversions,” May said.

Plus, many investors want to leverage lower income tax brackets through 2025 before provisions could sunset from former President Donald Trump’s signature tax overhaul, she said.

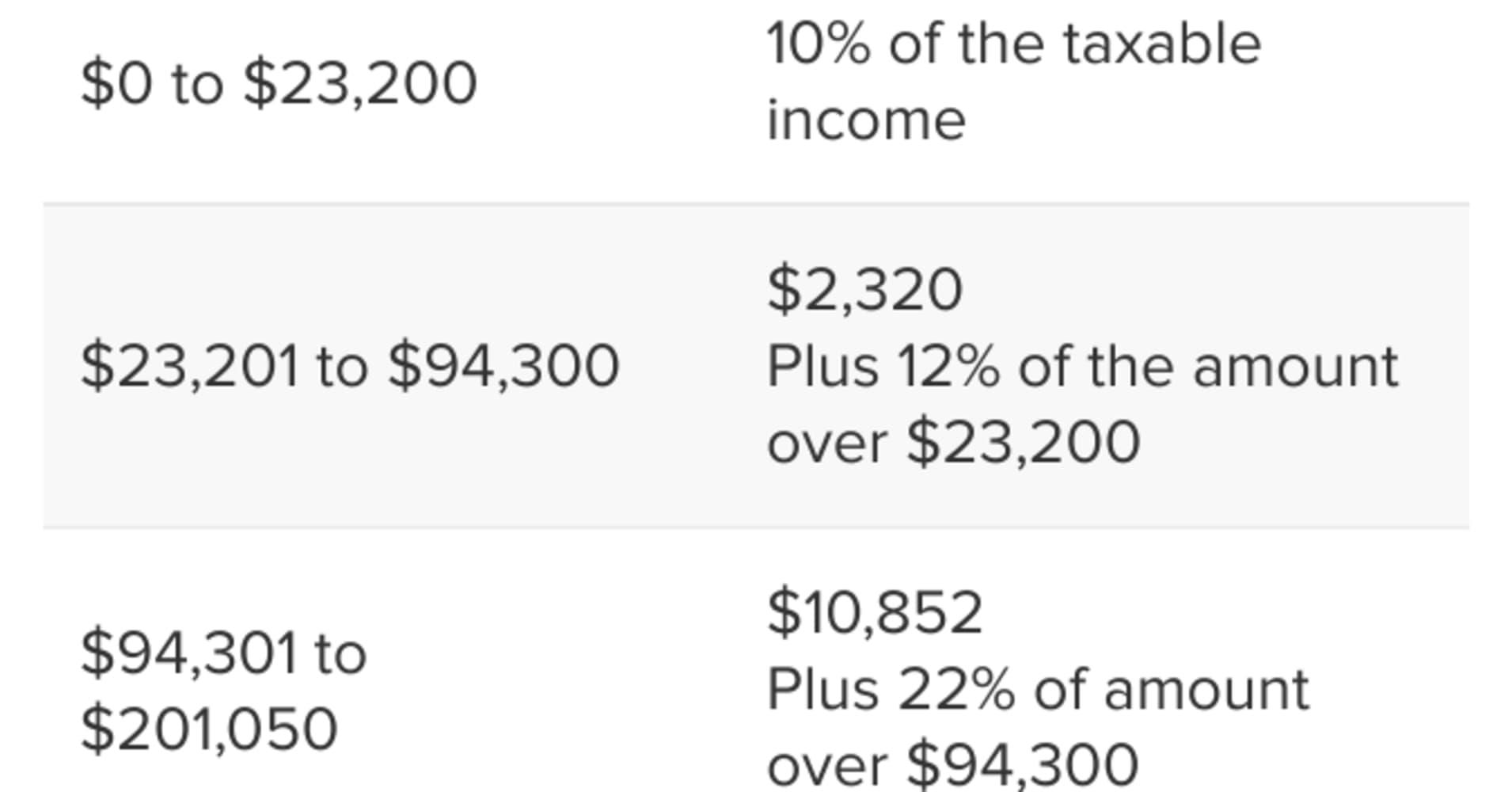

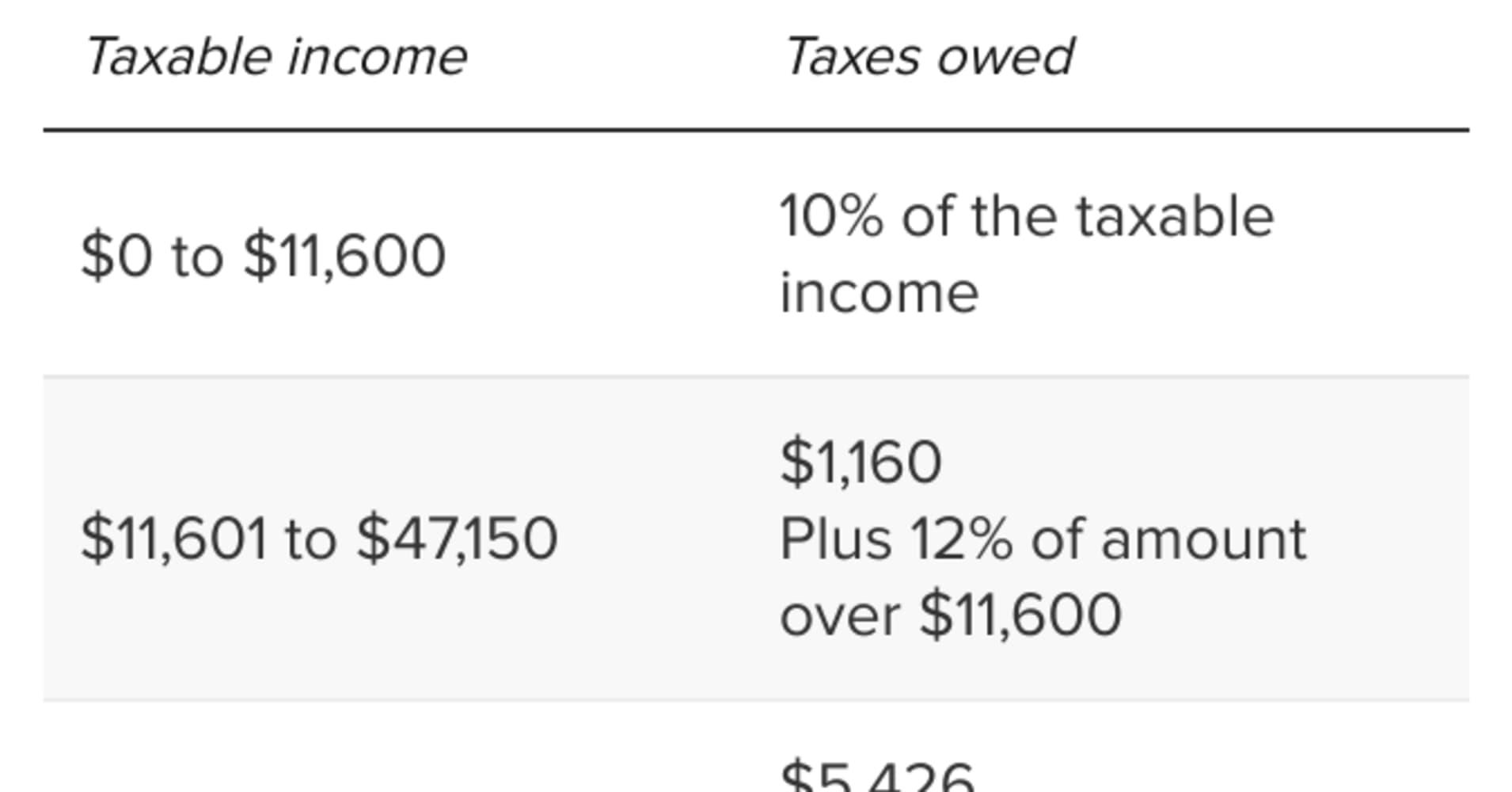

After a Roth conversion, you’ll owe regular income taxes on the converted amount. But your bracket depends on that year’s taxable income.

Roth conversions can reduce your taxable retirement balance subject to future required minimum distributions. Roth accounts are not subject to RMDs.

A Roth conversion could also eliminate taxes for heirs who later inherit the account. Since 2020, most adult children must deplete inherited accounts within 10 years, known as the “10-year rule,” which can trigger tax issues during peak earning years.

How Roth conversions affect Medicare premiums

Since Roth conversions can boost income, it can also affect income-related monthly adjustment amounts, or IRMAA, for Medicare Part B and Part D premiums, May said.

Your IRMAA is based on so-called “modified adjusted gross income,” or MAGI, which is your adjusted gross income plus tax-exempt interest — and there’s a two-year lookback.

“That’s a big piece,” said Ashton Lawrence, CFP and director at Mariner Wealth Advisors in Greenville, South Carolina. “No one likes paying excess premiums.”

The standard monthly Medicare Part B premium is $174.70 in 2024. But that could be higher with a 2022 MAGI above $103,000 for individuals or $206,000 for married couples filing jointly.

MAGI limits are a cliff, and income from a Roth conversion could easily bump you into the next bracket, Lawrence warned.

“The last thing you want is to peak right over that bracket by $1,” he said. “Now your Medicare premiums have just jumped up substantially.”