This ETF Lets You Invest in 1 of 2024's Best-Performing Sectors. Can It Keep Winning?

After cooling off a little in April, the S&P 500 is up around 5% this year. That’s still a strong start for that broader market index.

However, other sectors have performed even better. Energy stocks listed in the S&P 500 have gained about 9% this year, making it one of the market’s best-performing sectors.

There are lots of ways to participate in the red-hot energy industry. The Energy Select Sector SPDR Fund (NYSEMKT: XLE) lets you easily invest in this top-performing sector. This exchange-traded fund (ETF) is up more than 10% this year. Here’s a closer look at the leading energy ETF and whether it can continue its winning ways.

Drilling down into the Energy Select Sector SPDR Fund

The Energy Select Sector SPDR Fund aims to provide investors with returns matching the energy sector of the S&P 500 index. It gives them passive exposure to oil and gas producers, oilfield service providers, refiners, and pipeline companies. The fund also allows investors to invest in the largest energy stocks for a relatively low cost (0.09% gross ETF expense ratio).

The ETF currently has 23 holdings. The 10 largest are:

- ConocoPhillips: 9% weighting to the independent oil and gas producer

- EOG Resources: 4.7% weighting to the independent oil and gas producer

- Schlumberger: 4.2% weighting to the oilfield services company

- Marathon Petroleum: 4.1% weighting to the refining company

- Pioneer Natural Resources: 3.9% weighting to the independent oil and gas producer

- Phillips 66: 3.7% weighting to the refining company

- Valero: 3.3% to the refining company

- Williams: 3.8% weighting to the midstream company

The ETF’s top 10 holdings comprise more than 75% of its value, with the two largest totaling over 40%. The Energy Select Sector SPDR Fund will likely become even more top-heavy later this year. Exxon is acquiring Pioneer Natural Resources in an all-stock deal, while Chevron has agreed to buy Hess (12th-largest at 2.7%) in another all-stock transaction.

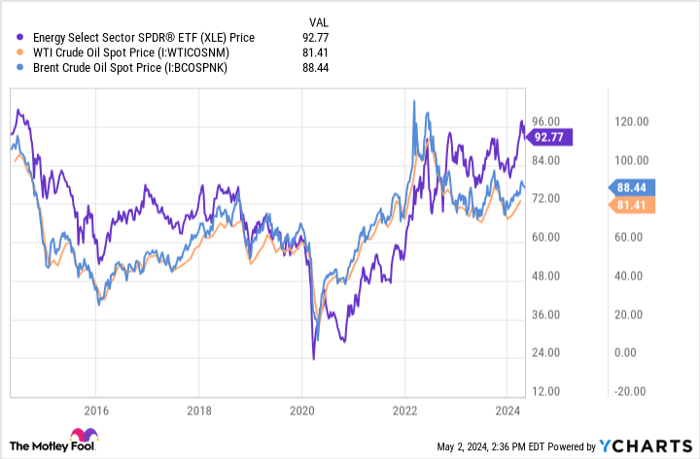

Half of the ETF’s top holdings and over 70% of its total weighting are companies that produce oil and gas. Because of that, the fund has meaningful exposure to commodity price volatility. Its value tends to rise and fall along with crude prices:

XLE

What has fueled the fund’s winning ways this year?

Oil prices have rallied sharply in 2024. WTI, the primary U.S. oil price benchmark, is up more than 10% on the year (and was up more than 20% at one point) to a little less than $80 per barrel. Meanwhile, Brent oil, the global price benchmark, has rallied a little less than 10% and recently sat just below $85 per barrel.

Several factors have driven up crude prices in 2024. OPEC has been holding back oil supplies by extending production curtailments through the first half of this year. On top of that, many U.S. producers have reduced their capital spending to limit new supply growth.

Meanwhile, geopolitical tensions in the Middle East have caused concerns about potential supply disruptions. Given its exposure to crude prices, it’s no surprise to see the Energy Select Sector SPDR ETF rally this year.

Does this ETF have the fuel to continue rallying?

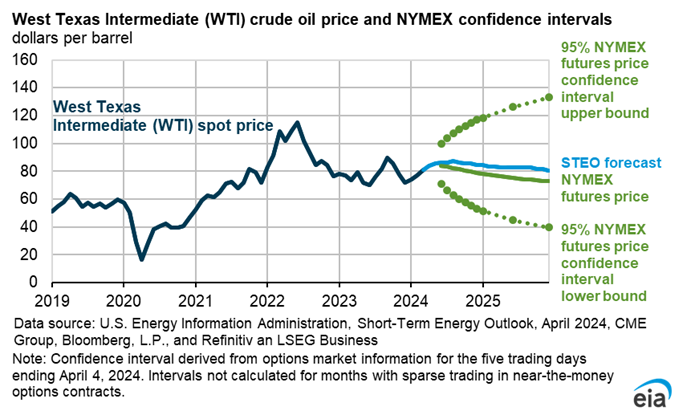

What happens next with oil is anyone’s guess. The latest short-term energy outlook by the U.S. Energy Information Administration (EIA) estimates that Brent oil will average $90 a barrel in the second quarter (up $2 a barrel from its last forecast) and be around $89 for the year. It sees similar near-term strength in WTI:

A graph showing the EIA’s latest forecast for WTI.

A big factor fueling this forecast is geopolitical risks, namely the potential of escalating tensions between Israel and Iran. Iran is a large oil producer and OPEC member. It also has the potential to cut off key global oil transit chokepoints (the Strait of Hormuz in the Persian Gulf and Bab el-Mandab leading into the Red Sea). If tensions between those countries flare up again, oil prices could surge.

On the other hand, there are growing concerns about a potential slowdown in the global economy. If the economy stalls or declines, it will likely impact oil demand. That could put downward pressure on prices, especially if geopolitical concerns also cool off.

This ETF needs oil to continue fueling its winning performance

The Energy Select Sector SPDR Fund is off to a strong start this year thanks to the impact higher oil prices have on its holdings. Given the current geopolitical situation, crude oil prices could remain strong this year. Because of that, the ETF could continue winning.

However, it’s a higher-risk ETF since softening crude prices could cause it to run out of fuel. Thus, investors need to have a bullish view of oil prices before buying this ETF.

SPONSORED:

Should you invest $1,000 in Select Sector SPDR Trust – The Energy Select Sector SPDR Fund right now?

Before you buy stock in Select Sector SPDR Trust – The Energy Select Sector SPDR Fund, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Select Sector SPDR Trust – The Energy Select Sector SPDR Fund wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 3, 2024

Matt DiLallo has positions in Chevron, ConocoPhillips, and Phillips 66. The Motley Fool has positions in and recommends Chevron and EOG Resources. The Motley Fool has a disclosure policy.