The State of the Nation: No pressure for Malaysia to follow suit after Indonesia’s surprise rate hike, economists say

This article first appeared in The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

ALTHOUGH Indonesia’s central bank last Wednesday surprised with a rate hike of 25 basis points to 6.25% — the nation’s highest — to shore up the rupiah, Malaysia does not face any pressure to do the same, as economic growth remains a priority of Bank Negara Malaysia, economists say.

Furthermore, the Department of Statistics Malaysia’s (DOSM) Consumer Price Index data for March released last Thursday, which showed lower-than-expected consumer inflation of 1.8% year on year (y-o-y) amid slower increases in the price of food and healthcare, had the majority of economists expecting Bank Negara to keep the overnight policy rate (OPR) unchanged this year.

The 1.8% headline figure was slightly lower than the median 2% rise predicted in a Bloomberg survey of economists, and unchanged since February’s 1.8% gain.

Interest rates are rising in Southeast Asia, with central banks in Indonesia and the Philippines raising their key policy rates. Singapore and Vietnam also have higher rates than Malaysia but the economists whom The Edge spoke to last week do not expect Bank Negara to follow suit.

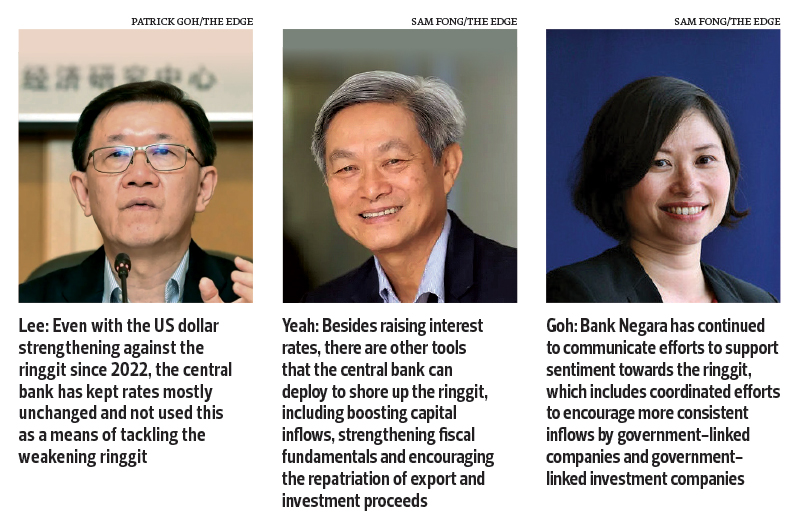

“Looking at the headline inflation figure, it shows that Malaysia’s inflation has come off its peak. Even with the US dollar strengthening against the ringgit since 2022, the central bank has kept rates mostly unchanged and not used this as a means of tackling the weakening ringgit,” Lee Heng Guie, executive director of the Associated Chinese Chambers of Commerce and Industry of Malaysia’s Socio-Economic Research Centre (SERC), tells The Edge.

Economists say that unlike Bank Indonesia — which has a policy to stabilise the rupiah, which includes raising interest rates — Bank Negara has never had such a policy.

“Instead, Bank Negara has continued to communicate efforts to support sentiment towards the ringgit, which includes coordinated efforts to encourage more consistent inflows by government-linked companies and government-linked investment companies, alongside greater engagements with Malaysia’s corporates and exporters to further promote conversion activities,” UOB senior economist Julia Goh tells The Edge.

In fact, Malaysia’s inflation and growth in the first quarter of this year have been moderate, with most economists considering the current interest rate level to be appropriate under the existing and projected inflation level and growth conditions for the year. After all, the strengthening of the greenback buoyed by expectations of higher-for-longer US interest rates is a common factor affecting most currencies.

“Besides raising interest rates, there are other tools that the central bank can deploy to shore up the ringgit, including boosting capital inflows, strengthening fiscal fundamentals and encouraging the repatriation of export and investment proceeds,” says Sunway University Business School professor of economics Dr Yeah Kim Leng, who projects headline inflation to remain unchanged at 1.8% in March and edge up to its long-term trend of 2% to 3%.

Meanwhile, the flash estimate of a 3.9% GDP growth in the first quarter indicates that the economy is at or near its potential output. “Barring a global downturn, the pace is expected to pick up in the coming quarters to hit the 4% to 5% for the full year,” says Yeah.

As for how rate hikes or cuts affect growth, he explains that central banks typically aim for a neutral interest rate that enables the economy to expand in line with its potential growth while achieving full employment and stable inflation as reflected by the present state of the Malaysian economy.

“A stronger-than-expected upward revision of growth and inflation trajectories in the coming quarters [may] necessitate an upward adjustment of interest rates to temper strong growth and excess demand from stoking inflation,” Yeah cautions.

He believes that an interest rate hike is warranted if the higher inflation is caused predominantly by strong demand or wage increases. “Rising oil prices are more likely to affect the fuel subsidy than to cause a rate hike,” he notes.

To be clear, the economists are not ruling out inflationary pressures stemming from expectations of escalating oil prices on account of geopolitical tensions. Naturally, there are concerns that this could affect the fuel subsidy that the population is enjoying.

OCBC senior Asean economist Lavanya Venkateswaran tells The Edge that as long as the fuel subsidy remains in place, the impact of higher oil prices will reflect on the fiscal rather than inflationary front. Note that fuel accounts for the largest portion of the total subsidy bill of RM58 billion under Budget 2024, which was based on a Brent crude oil price assumption of US$85 per barrel.

For context, Minister of Economy Rafizi Ramli intends to implement the targeted RON95 subsidy programme — facilitated by the government’s central database hub or Padu — in the second half of this year to optimise its resources for those who need it the most as the blanket subsidy on RON95, which is the most widely used and affordable fuel, took up most of the RM81 billion in subsidies handed out in 2023.

For now, the retail price of RON97 and RON95 petrol, as well as diesel, will remain unchanged at RM3.47, RM2.05 and RM2.15 per litre respectively from April 25 to May 1.

“[In fact], higher oil prices should, in our view, motivate the government to adopt targeted fiscal subsidies sooner rather than later,” says Lavanya, who expects Bank

Negara to maintain the OPR at 3% for the rest of this year and 2025.

She does not deny that the removal of the petrol subsidy would present the possibility of triggering interest rate hikes, particularly if inflation becomes more persistent and pervasive following the introduction of the targeted fuel subsidy.

All things considered, it would be the collective effect of subsidy cuts alongside targeted cash assistance and the progressive wage mechanism that will dictate the extent of demand-driven price pressures and direction of interest rates, says UOB’s Goh.

Put another way, oil shocks may not necessarily be all bad, says M Niaz Asadullah, professor of development economics at Monash University Malaysia.

“[Oil shocks] may affect directly through shipping costs and indirectly through production cost, that is, imports. For example, an important source of Malaysia’s agricultural products is India which, in turn, imports 85% of Malaysia’s crude oil. Higher energy prices may increase the cost of food production and India’s export price. Having said that, I consider the risk of high inflation to be, at best, modest. As an exporter of oil and gas, Malaysia also stands to gain from energy price hikes and can use the extra revenue to deal with cost-of-living concerns,” he explains.

“Yes, there is a risk that the removal of the subsidy may lead to an increase in fuel prices and that, in turn, may push the central bank to respond by raising interest rates to stabilise prices. [But bear in mind that] Bank Negara Malaysia forecasts a low headline inflation,” says Niaz, maintaining the narrative that so long as subsidy rationalisation is implemented in stages, it would help manage the inflationary risks associated with fuel subsidy cuts as well as the likelihood of interest rate hikes.

SERC’s Lee says the petrol price increase would be monitored closely since it would heighten the people’s cost of living. Therefore, it would be counter-productive for the authorities to “use interest rates to cool down inflation, which will slow down the economy further”.

Recall that Indonesia in September 2022 also made “the difficult and last-resort option” to raise subsidised fuel prices by about 30% to rein in its ballooning subsidy bill, failing which the largest economy in Southeast Asia risked having its budget swell to IDR698 trillion after its 2022 energy subsidy had tripled to IDR502 trillion from the original budget. As a net importer of crude oil, Indonesia faced rising global oil prices and a depreciating local currency.

The controversial move resulted in a widening price disparity between subsidised and non-subsidised fuel, prompting consumers to switch to cheaper fuels.

Some economists said then that raising fuel prices that year would reduce the risk of spending overruns in 2023 when the government must lower its fiscal deficit to below 3% of gross domestic product.

Indonesia’s CPI data show that inflation peaked at 5.95% in September 2022, which was the month its government removed the fuel subsidy. However, inflation began ebbing until it reached the 3.05% level in the first quarter of 2024.

UOB noted in an April 22 report that Malaysia’s advance 1Q2024 GDP estimate of 3.9% y-o-y was in line with market consensus but lower than the bank’s preliminary estimate of 4.3%.

“The advance estimate and sector performance signal that the overall growth momentum is recovering after a lull of 3.0% in 4Q2023. All key sectors recorded positive growth, led by services (4.4%), manufacturing (1.9%) and construction (9.8%),” it said, guiding that it would revisit its GDP forecast of 4.6% for the full year of 2024 when the 1Q2024 GDP is released on May 17.

UOB says even though the ringgit nears its weakest level against the US dollar since the Asian financial crisis (AFC), Bank Negara has reiterated that Malaysia’s economic fundamentals remain solid and that it is not considering capital controls or restrictions like those introduced in 1998.

“It would be a balancing act on the government’s part to stimulate growth through interest rate cuts amid rising inflation. But because inflation is moderate in Malaysia, Putrajaya, thankfully, can afford to support growth through stable [though not so high] interest rates [keeping modest the cost of] borrowing. Otherwise, further rate cuts would simply add to inflationary pressures,” says Niaz.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.