Tax implications: Here's what you can do when transferring money to your spouse goes beyond basic expenses

Tax implications: Here’s what you can do when transferring money to your spouse goes beyond basic expenses

It was the end of the month. X (name withheld on request) received that all-important notification on his phone informing him that his salary had been credited. He immediately opened the banking app on his phone to transfer funds to various accounts to meet daily expenses, set aside savings and investments, etc. He also transferred some money to his wife, a homemaker, to cover her monthly expenses.

But then a doubt crept into his mind. Would the money transferred to his wife’s account be considered taxable income for her? Should he then file income tax returns for her?

Faced with this dilemma, he reached out to experts. They reassured him that, in most cases, transferring money between spouses for everyday expenses is not taxable. This is because a married couple is considered one economic unit for tax purposes.

But there is a catch here: the transfers are not taxable, provided the sums are not large. If, for instance, the transfers are large sums or are being done for reasons other than meeting shared expenses, then it’s possible that there could be some tax implications.

“Generally, an individual transfers a certain amount to their spouse, who is a homemaker and does not earn any income regularly, solely for meeting personal and household expenses; such transfers are not subject to tax in the spouse’s hands. This is known as ‘pin money’. Any amount can be termed ‘pin money’. It depends on the individual’s total income, total household expenditure, and justification for the quantum of savings,” explains Prabhakar K.S., Founder and CEO of Shree Tax Chambers.

However, if it is more than a reasonable quantum and is kept in the bank as a recurring or fixed deposit, or if invested in shares or mutual funds, then the income earned, like interest or capital gains, is clubbed with that individual’s income.

In other words, if the money is being transferred to gain some tax benefits, then beware; there may not be any benefit to be had.

Of course, the situation is different if the transfer is to another relative. Suresh Surana, Founder of tax consultancy RSM India, says, “Section 56(2)(x) of the Income Tax Act (I-T Act) provides that receipt of any sum of money or property without adequate consideration will be subject to tax in the hands of the recipient under the heading ‘income from other sources’.”

Nevertheless, transferring residential property to a spouse will trigger the clubbing provisions of rental income. “Section 27 of the I-T Act directs that an individual transferring any house property otherwise than for adequate consideration to his or her spouse (not in connection with an agreement to live apart) shall be deemed to be the owner of the house property so transferred. Accordingly, rental income accruing on such property shall be taxable to the deemed owner under the heading ‘Income from House Property’,” says Surana.

The HUF Route

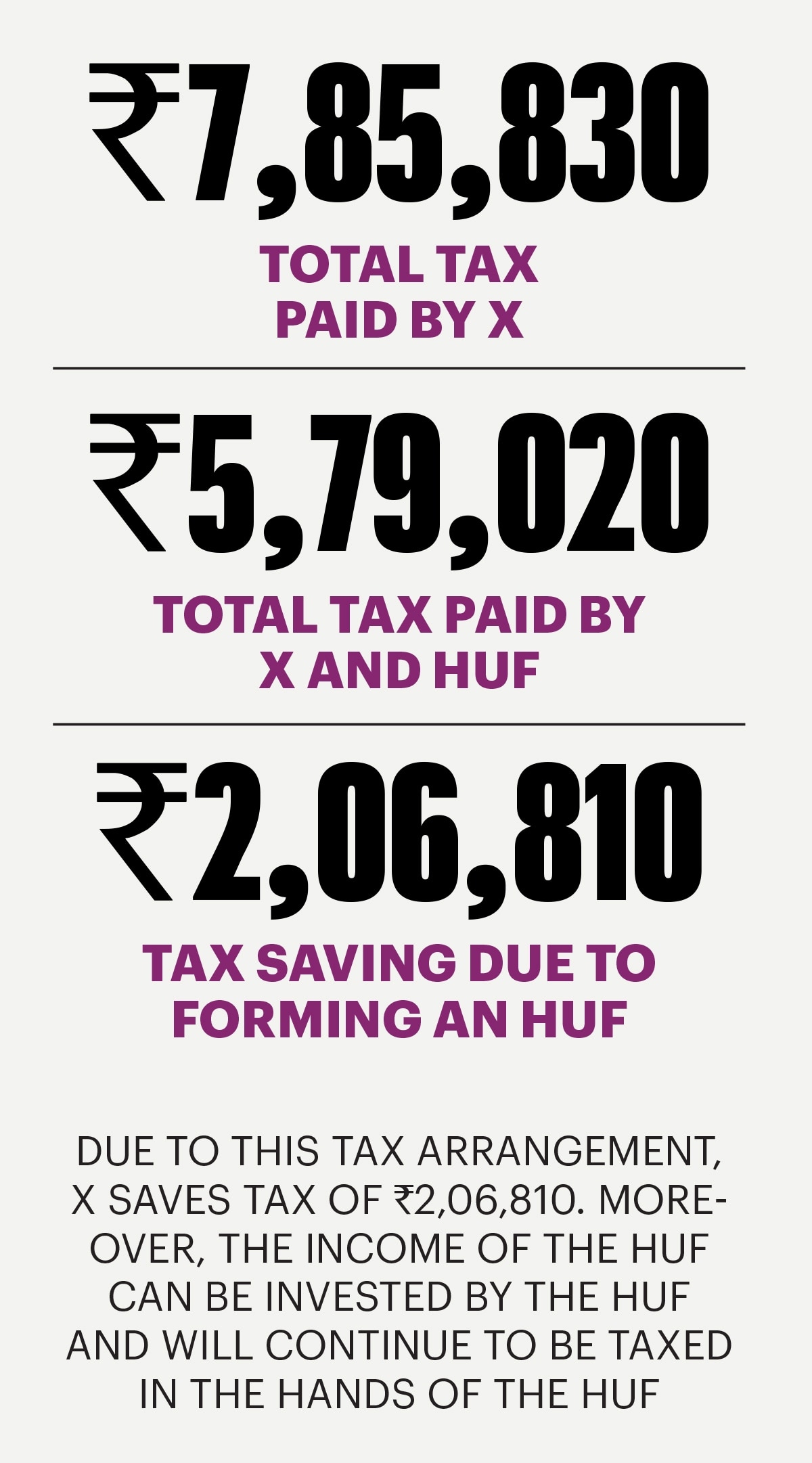

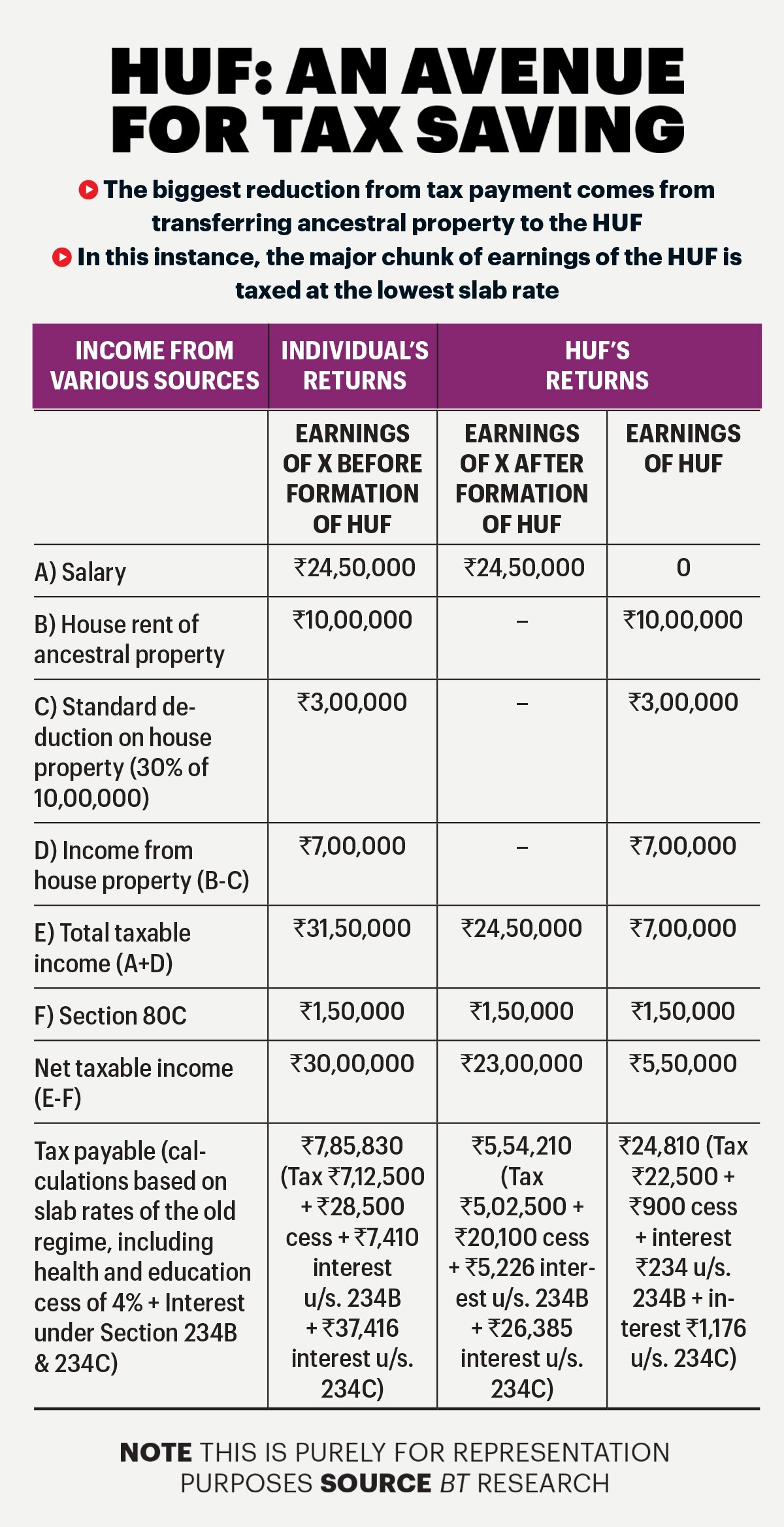

There are, however, some other legal means beyond transfers that a married couple can use to reduce taxes. One such method is forming a Hindu Undivided Family, or HUF. This is a creature of the law akin to trusts. But where it differs from a trust is that it consists of all males lineally descended from a common ancestor, their wives and daughters. From the income tax point of view, an HUF is a separate legal entity with an independent set of tax liabilities and exemptions. For instance, you can receive rental income from a property on behalf of an HUF. The tax authorities levy taxes on profits generated from the family business under the HUF, with exemptions that provide greater leverage for tax savings. This way, an HUF can help reduce tax outgo.

This entity can also run a business, generate income, and invest its funds in shares, stocks, mutual funds, real estate, and other asset types. Its asset pool may include gifts, assets received through inheritance, and those pooled by its members. However, individuals who are part of the HUF will not be eligible for any tax relief on additional income from pooling the assets, like interest earned from them.

Additionally, an HUF enjoys basic exemptions like individual tax deductions under provisions like sections 80, 80D, and 80DDB of the I-T Act. Further, a member of an HUF can avail of a 100% exemption on any income received from business done by their HUF, which is taxable in the hands of the HUF.

HUFs can also obtain bank loans to purchase residential property and give loans to their members on mutually agreed-upon terms.

But transferring property to an HUF imposes certain restrictions. For instance, the property can be transferred only with the consent of all the claimants or by the eldest member of the family, who alone can dispose of it. However, a coparcener, or an HUF member who holds inheritance rights to the property, can challenge this. Besides, if a minor is involved, then a court’s permission is required for disposing of the property.

Plus, managing an HUF can be a complex affair, involving legal formalities, separate accounts, and compliance with tax laws. Surana says, “While HUFs offer some level of asset protection, they are not immune to partition risks. Disputes among coparceners or changes in family dynamics can lead to partition, resulting in the division of assets. Though it is notable that there shall not be any income tax implication in the case of full partition under the I-T Act.”

Other Ways and Means

There are other provisions in the I-T Act that help married taxpayers maximise their tax savings.

Gifts received under some circumstances are also tax-free. For instance, gifts received from a spouse, those that are valued at or below Rs 50,000, or as the result of a bequest excluding rental or other income earned from them, are free of tax. Additionally, gifts received in contemplation of the death of the donor, from a registered trust, or any money or property received at the time of the partition of HUF are also tax-free.

“Section 56(2)(x) of the I-T Act provides tax implications on any sum of money or property received by an individual or HUF without consideration or in cases that involve the transfer of property for inadequate consideration. However, the aforementioned provisions shall not apply in specified circumstances, one of them being a monetary gift received by an individual on the occasion of marriage,” says Surana of RSM India.

But gifts received on occasions other than marriage or wedding anniversaries are taxable if received from people who are not close relatives as defined under the I-T Act.

“In a scenario where the transfer of funds is in connection with an agreement to live apart, then the income earned from such transferred money is taxable in the hands of the transferor,” says Sudhakar Sethuraman, Partner at consultancy Deloitte India.

Apart from gifts, transferring money to a spouse’s account to support their financial needs can also help save taxes. But there should be a proper loan agreement between the spouses.

For instance, money given to start a business venture could be treated as a loan if it’s expected to be repaid with interest.

Prabhakar of Shree Tax Chambers says, “If the husband loans money to his wife to start a small or medium business, the income earned from that business does not get clubbed with the husband’s income for tax purposes.” However, if the husband waives the interest component while giving the loan, the income will get clubbed with his income.

Another money saver is a joint home loan. A couple can avail of deductions up to Rs 4 lakh on interest paid on a home loan (Rs 2 lakh each). In addition to that, they can avail deductions of up to Rs 3 lakh on the repayment of the loan’s principal (Rs 1.5 lakh each under Section 80C). However, this option works only in cases where both the husband and wife are taxpayers.

An education loan for a spouse is also eligible for tax deduction under Section 80E of the I-T Act. The interest paid in a financial year will be allowed as a deduction. There is no limit on the deduction as such. In other words, this can be availed of even if one exhausts the Section 80C limit of Rs 1.5 lakh. The benefit can be availed of for a maximum of eight years, or until the last interest is paid. It also applies in the case of joint education loans available for children’s education.

A couple can also opt for medical and family health insurance and claim a deduction of up to Rs 50,000 under Section 80D for premiums paid (Rs 25,000 each).

“The limit is provided based on the category of persons covered in the policy and the type of payment (insurance premium, preventive health check, etc.). Married couples could each claim this benefit to the limit specified by going in for higher coverage and also by including their respective (dependent) parents in their health insurance policy,” says Sethuraman of Deloitte.

Under both the old and new tax regimes, deductions can be availed of on contributions to the National Pension System (NPS) up to Rs 50,000 per person. Married couples can contribute Rs 50,000 each to the NPS, making it Rs 1 lakh per annum. It is important to note that this deduction is over and above the limit of Rs 1.5 lakh per individual per annum under Section 80C of the Income Tax Act.

And when it comes to children, there are also exemptions associated with education expenses. Sethuraman says, “The tuition fee paid for children’s education is allowed as a deduction under Section 80C, capped at Rs 1.5 lakh per annum. If a couple is spending this amount every year on each of their two children, then each parent can claim Rs 1.5 lakh as a deduction under Section 80C.”

It’s apparent that there are many legal ways of blunting the hit from taxes. But all such decisions must be taken in consultation with a tax professional.

@imNavneetDubey

Watch Live TV in English

Watch Live TV in Hindi