Shares of Nvidia rallied in after-hours trading on Wednesday after the company reported a nearly 769 per cent surge in its last-quarter net profit and issued a bullish guidance, as demand for its graphics processing units, which are central to the surge in artificial intelligence boom, has soared.

The company’s net profit in the 2024 fiscal fourth quarter ending January 28 jumped to about $12.3 billion, from $1.4 billion in the same period a year earlier, Nvidia said in a statement. It was up 33 per cent on a quarterly basis.

Earnings per share jumped to $4.93, from 57 cents in the same period last year, while revenue soared more than 265 per cent annually to $22.1 billion, exceeding LSEG, formerly known as Refinitiv, expectations of more than $20.6 billion.

It was the company’s third consecutive quarter with more than $10 billion in revenue.

Nvidia’s stock jumped over 7.6 per cent in after-hours trading to almost $726 a share after closing 2.9 per cent down at market close on Wednesday.

The Nasdaq-listed company’s share price is up more than 40 per cent year-to-date. Nvidia’s market value reached $1.67 trillion at the close of trading on Wednesday, positioning it firmly with Apple, Microsoft, Amazon and Alphabet – all of which have a 13-figure market cap.

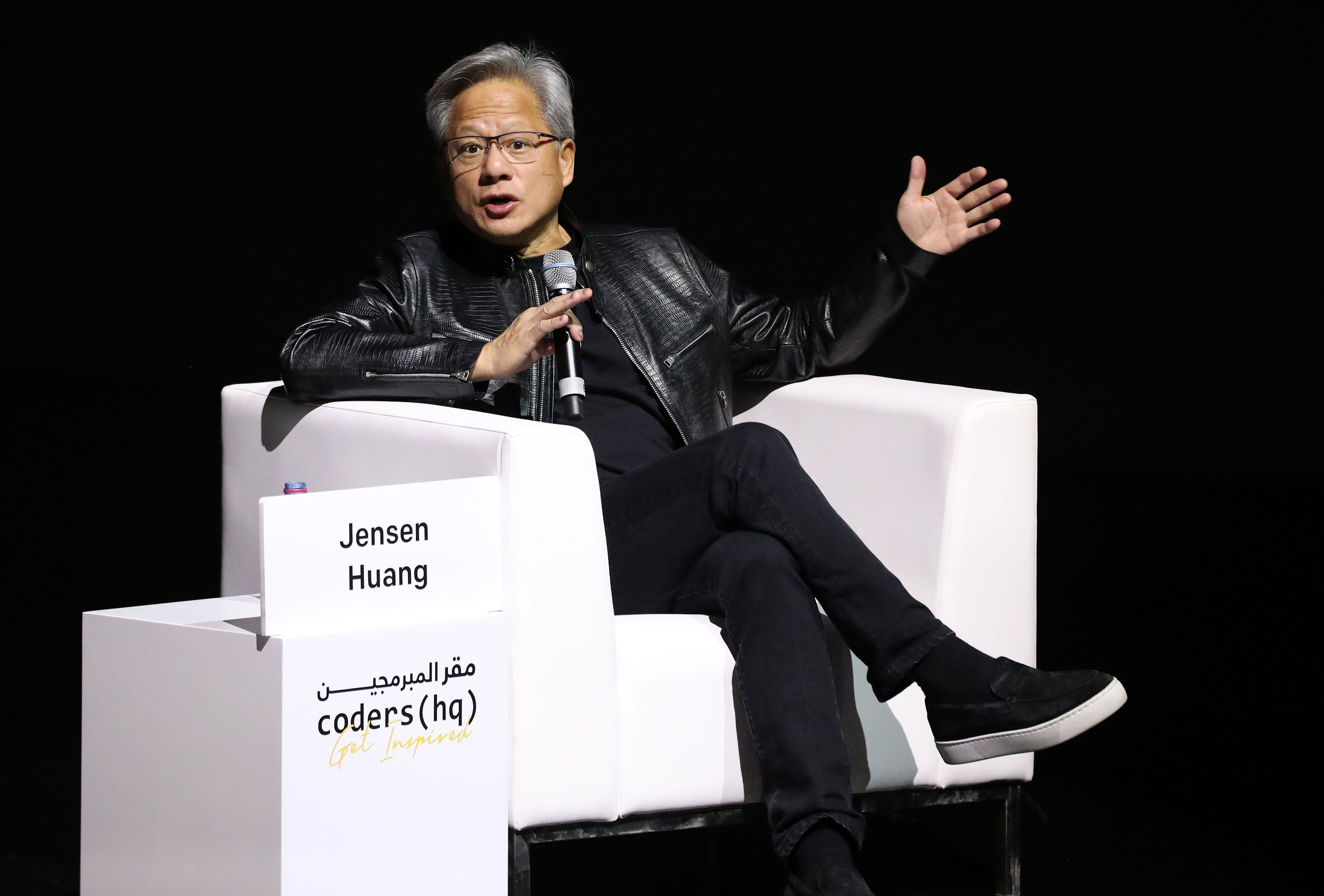

Jensen Huang, founder and chief executive of Nvidia. Chris Whiteoak / The National

The company’s market cap reached nearly $1.8 trillion last week, surpassing Alphabet and Amazon. It is currently behind only Microsoft and Apple.

“Nvidia is certainly not trading at bubble levels,” Thomas Monteiro, senior analyst at Investing.com, told The National.

The conditions are excellent for continued growth

Jensen Huang, Nvidia’s founder and chief executive

“Despite the impressive bull run from the last two years, profitability and margins have followed even faster than we would have expected.

“If there is, in fact, overexcitement from the market, it is in the companies that are receiving funds to buy Nvidia chips, and not in Nvidia itself … not only did Nvidia surpass expectations, but it also did so by posting positive numbers on all key aspects.”

Nvidia’s 2024 full fiscal year net profit surged 581 per cent to $29.8 billion while its revenue increased 126 per cent to more than $60.9 billion during the period.

“Fundamentally the conditions are excellent for continued growth [in 2025 and beyond],” Nvidia’s founder and chief executive Jensen Huang said during the investors’ call.

“Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations … vertical industries – led by auto, financial services and health care – are now at a multibillion-dollar level.”

The California-based company is now forecasting first-quarter revenue of about $24 billion, compared to the $22.17 billion forecast by LSEG analysts.

“The year ahead will bring major new product cycles with exceptional innovations to help propel our industry forward,” Mr Huang said.

Nvidia’s strong performance in the last quarter was primarily driven by its data centre business that manufactures A100 and H100 AI chips, used to build and run generative AI technologies such as ChatGPT.

The division’s fourth-quarter revenue stood at record $18.4 billion, up 27 per cent on a quarterly basis and 409 per cent from a year ago period. Full-year revenue rose 217 per cent to a record $47.5 billion.

Nvidia said it will pay its next quarterly cash dividend of $0.04 per share on March 27. Reuters

Nvidia designs and manufactures AI hardware and software GPUs for various industries. GPUs can process various tasks simultaneously, making them useful for machine learning, video editing and gaming applications.

The company’s gaming unit added nearly $2.9 billion, up 56 per cent from the same quarter a year ago, in the November-January period. Full-year revenue jumped 15 per cent to $10.4 billion.

Before its AI chips gained momentum, Nvidia primarily focused on gaming graphics cards. However, some of its graphics cards are now used for AI purposes.

Nvidia’s professional visualisation and automotive units added $463 million (up 11 per cent) and $281 million (up 8 per cent), respectively, in the previous quarter.

The company said it would pay its next quarterly cash dividend of $0.04 per share on March 27 to all shareholders of record on March 6.

Why market analysts are optimistic on Nvidia

The market was poised to “sell the news” following Nvidia’s earnings, given the sky-high expectations and deteriorating macro conditions, Mr Monteiro said.

“However, once again, the company left no doubt that the AI boom is much more than just a stock market narrative, but rather the most significant bet from corporations worldwide at this moment,” he added.

Despite the impressive bull run from the last two years, Nvidia’s profitability and margins have followed even faster than we would have expected

Thomas Monteiro, senior analyst at Investing.com

Nvidia, which went public in 1999, has established itself as a “trailblazer in the AI hardware domain”, Hong Kong-based Counterpoint Research wrote in a note on Wednesday.

“The researcher predicts Nvidia’s AI product revenue to surge by 78 per cent yearly to reach $49.8 billion in 2024.

“This growth trajectory will be bolstered not just by the sustained reliance of cloud providers on Nvidia for their internal AI training and services but also by the expanding interest from the enterprise sector.

“The demand from enterprises is anticipated to escalate significantly, driven by their endeavours to integrate AI technologies into their core business strategies.”

News Related-

AWS and Clarity AI to use generative AI to boost sustainable investments

-

Ref Watch: 'Enough' of a foul to disallow Man City goal vs Liverpool

-

Day in the Life: Ex-England rugby star on organising this year's Emirates Dubai Sevens

-

Pandya returns to MI, Green goes to RCB

-

Snowstorm kills eight in Ukraine and Moldova, hundreds of towns lose power

-

‘This is why fewer Sikhs visiting gurdwaras abroad’: BJP after Indian envoy heckled in Long Island

-

Inside a Dubai home with upcycled furniture and zero waste

-

Captain Turner aims for Pitch 1 return as JESS bid to retain Dubai Sevens U19 crown

-

No Antoine Dupont but Dubai still set to launch new era for sevens

-

Why ESG investors are concerned about AI

-

Your campsite can harm the environment

-

Mubadala, Saudi Fund deals on US radar for potential China angle

-

Abu Dhabi T10 season seven to kick off with thrilling double-header

-

Eight climate fiction, or cli-fi, books to consider before Cop28