Personal Savings

Putting money aside is an effective way to save for special occasions or to build a rainy day fund in case of emergencies, but earn too much and the taxman may come calling.

Depending on how much you earn and your personal tax band, there are a few allowances on savings that mean you can earn interest without having to worry about HMRC.

But some allowances may also be out of reach for higher earners. Here is what you need to know about tax on savings and how to avoid it.

How tax on personal savings works

Income tax on savings depends on a few allowances.

First there is the personal allowance, which is the threshold before you pay income tax, currently set at £12,570.

The allowance may be higher depending on a few factors. If your spouse is lower-earning you can claim marriage allowance raising it to £13,830 or blind person’s allowance increases it to £15,440.

If you had no other income and earned savings interest below the £12,570 threshold, there would be no tax to pay.

Additionally, if your total earnings are below £17,570 you can make up to £5,000 of interest tax free.

Many will earn more than this overall, especially if you are paid more than the minimum wage.

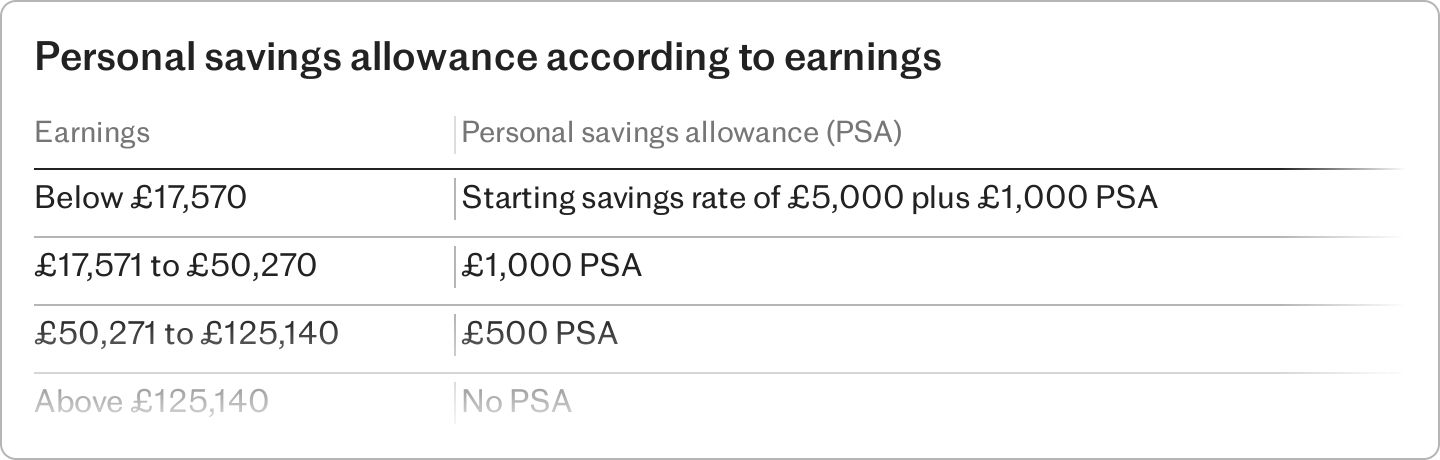

This is where the personal savings allowance (PSA) comes in. The PSA lets savers earn a set amount from savings before having to pay tax on the income.

It is worth £1,000 for basic rate taxpayers, but drops to £500 for those on the higher rate, and there is no such perk for those on the additional rate.

The interest you earn from savings is paid gross by your provider, and any tax owed is usually collected through your salary by changing your tax code or by completing a self-assessment tax return.

What types of savings are taxable?

Money in your current account doesn’t usually earn interest so you don’t have to worry about tax. But once your excess cash is in a savings account, those allowances start to become relevant.

This includes savings accounts such as a bank or building society fixed rate, regular saver or easy access product, peer-to-peer lending, government bonds and investment trusts as well as money with a savings or credit union.

Interest received in an Isa is not taxed.

Personal savings allowance

The PSA was launched in April 2016 by the then-chancellor George Osborne to help encourage the nation to save. Previously, tax was automatically taken from your savings interest.

But now, you are not taxed until you have earned above the PSA threshold depending on your marginal rate.

The idea is that rather than leaving excess cash dwindling in your current account, where you are unlikely to earn interest, it can be put to work in a savings product.

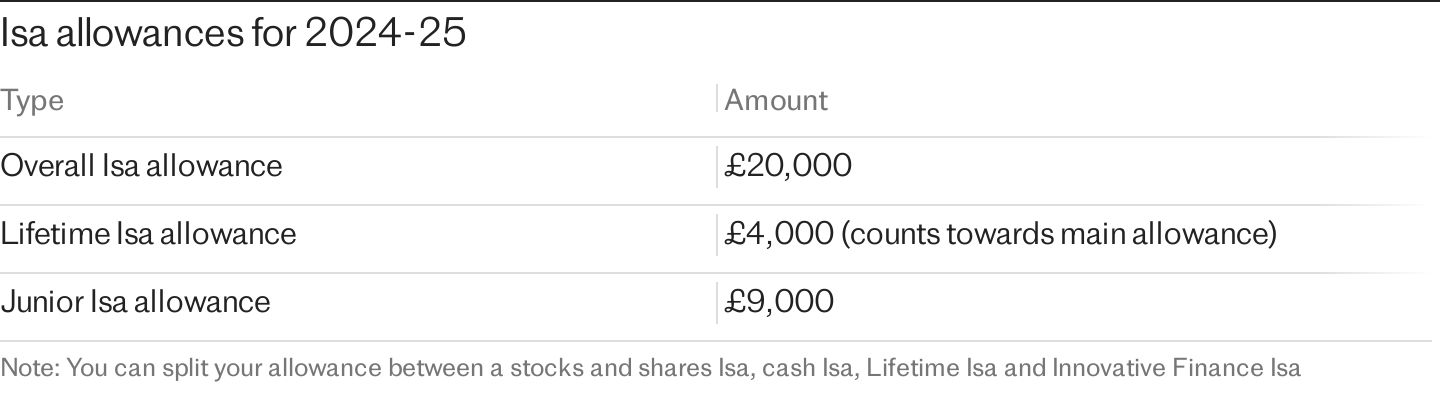

The PSA is separate to the ISA allowance, which lets you put £20,000 into a tax-free wrapper and see your money grow without having to worry about HMRC.

UK tax on savings may not have seemed important when interest rates were low a few years ago, as returns were pretty paltry. But with many easy access rates now at around 5pc, even a £10,000 emergency fund can quite easily breach the £500 PSA allowance for high earners.

Personal savings tax for basic rate taxpayers

If you earn below the £12,570 personal allowance, you get a starting rate for savings that lets you earn the first £5,000 of interest tax free plus the PSA on top, so £6,000 in total.

However, for every £1 of non-savings income over your personal allowance, you lose £1 of your starting savings allowance, so if you earn £17,570 you lose all of that allowance.

Basic rate taxpayers still get a PSA of £1,000, so if your total income is worth between £17,570 and £50,270, anything earned from savings above £1,000 will be charged at 20pc.

This means a basic rate taxpayer in this earnings threshold can have just under £20,000 in a savings account paying 5pc before having to pay tax on the interest.

Personal savings tax for higher rate taxpayers

The PSA for higher rate taxpayers drops to £500 and is applied on earnings between £50,271 to £125,140.

That means you can earn just under £10,000 in a savings account paying 5pc interest before breaching the PSA. Any interest earned above £500 would be charged at 40pc.

There is no PSA for additional rate taxpayers.

Depending on your total income, tax band and how much you are putting into a savings account and the rate of interest you are earning, there may be tax to pay on your money.

As long as you keep your savings and earnings from interest below the PSA threshold based on your tax rate, and make use of your Isa allowance, it may be possible to reduce or perhaps even not pay any tax on savings.

Sarah Coles, senior personal finance analyst for Hargreaves Lansdown, said: “For most people, the key is the personal savings allowance.”

Taxes on children’s savings

Income tax on savings is different when it comes to children’s accounts.

There’s usually no tax to pay on children’s accounts, particularly as they are unlikely to be earning above the personal allowance. But that doesn’t mean you can just pile loads of cash into a child’s savings account to reduce your own tax bill.

There are usually limits on contributions, plus you have to tell HMRC if a child gets more than £100 in interest from money given by their parents. In this case, it will form part of the parent’s PSA.

There are no limits for grandparents, relatives and friends, but they need to be careful about the other tax implications of gifting rules.

Tax on personal investments

Investment income may also be taxable if it pushes you above the personal allowance and it may even move you into higher tax brackets.

There are some allowances though.

Similar to the tax allowance on savings, you can put up to £20,000 into a stocks and shares Isa each financial year, and benefit from growth without having to share a penny of capital growth or dividends with HMRC.

Outside of an ISA, you can earn up to £3,000 in capital gains tax free when making a profit from selling assets, and can earn up to £500 from dividends tax free.

Do I pay tax on savings from abroad?

If you have savings income from overseas, are resident in the UK and domiciled here, you will have to pay UK tax on the interest through a tax return.

Depending on where the account is based, you might also have to pay overseas tax.

Coles added: “If there’s a double tax agreement with the country where your savings are held, you may then be able to claim UK tax relief, so check where you stand.”

Do you pay tax on savings if retired?

Pensioners and older savers still face paying tax on savings when retired.

Income tax will be owed on anything earned above the personal allowance.

With the new state pension now worth £11,502 per year, many people in retirement could hit the threshold.

You only need a bit more savings interest or income from other assets such as a buy-to-let portfolio or annuity income to push you into HMRC’s tax net.

How much can I have in savings without paying tax?

Your tax allowance on savings will depend on your annual earnings as well as where you are putting your money.

Basic rate taxpayers benefit from the £1,000 PSA allowance. This drops to £500 for higher rate taxpayers.

The amount you can save will depend on the rate of interest, but currently if you are earning around 5pc on £10,000 of savings, you could come close to breaching the £500 PSA.

The PSA is just one allowance though. There is also a £20,000 Isa allowance that lets you earn returns from a cash or stocks and shares Isa tax free.

You can also put up to £60,000 into a pension each tax year, where you will get tax relief on savings – plus any growth is tax free. Income tax is only payable once you start accessing your pension pot from age 55, either through an annuity or drawdown.

Do I have to notify HMRC of savings interest?

HMRC collects data from banks and building societies on interest paid to account holders.

It is then up to the taxman to match this with taxpayers and adjust tax codes if necessary to reclaim any tax owed for going above the PSA through your monthly salary.

It is also possible to just inform HMRC yourself if you breach the allowance and don’t want to wait for HMRC’s calculations.

If your savings interest is above £10,000 you need to tell HMRC by filing a self-assessment tax return. Many, such as the self-employed, will already report savings interest when completing these forms.

You can also claim a refund if you think you have been taxed too much on savings interest by completing an R40 form.

How can I avoid paying tax on my savings?

Planning is key to limiting how much tax you pay on your savings. Keep an eye on the interest being earned so it doesn’t push you above the PSA while rates remain high.

It is also worth making use of tax allowances. For example, you can earn tax-free interest on up to £20,000 of savings through an Isa each tax year, so it could be prudent to save into an Isa instead of a regular savings account if you think you will exceed the limit.

Returns on money invested in a pension are tax free, plus you also get tax relief at your marginal rate to boost your contributions.

Rachel Springall, financial expert at Moneyfacts, said: “It is imperative savers take time to check the interest they earn on their pots to ensure it does not breach their own allowance, which may be more likely now compared to previous years due to higher interest rates.

“Those looking to avoid paying tax on their savings would be wise to utilise their Isa allowance each year.

“Investing in cash Isas protects money from tax and it does not impact the PSA. These can be very useful for savers both over the short and long term. However, using a stocks & shares Isa could reap more returns over the longer term, but these also come with risks.”

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report