Capital Allowances

Working for yourself may give you more freedom and flexibility, but it also means you are responsible for funding everything from your own office equipment to company cars.

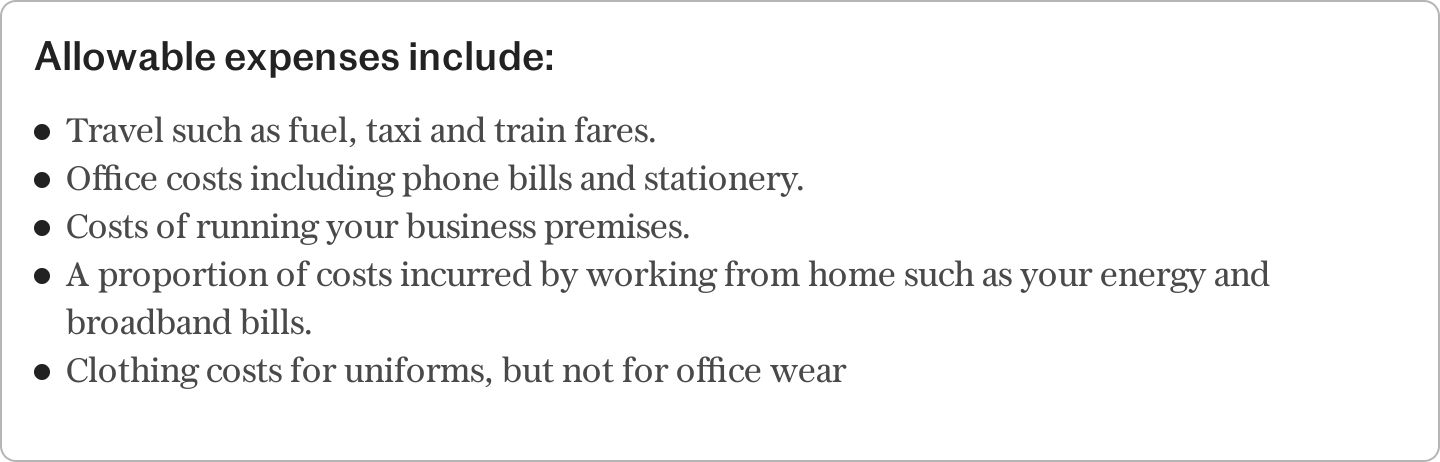

Some smaller costs may be classed as business expenses that help reduce your taxable profit, but it is also possible to get tax relief on larger spending and the value of certain items.

These are known as capital allowances and let you purchase items to specifically use for your business, such as tools and machinery, as well as deducting a percentage of the value of certain assets from your profits each year.

Capital allowances can assist the self-employed with cash flow management, ultimately helping your business grow and allowing you to better manage profits so more money goes into your business rather than to HMC.

Here is what you need to know.

What are capital allowances?

Running your own business can be expensive.

There is no department that will sort your stationery, change light bulbs or make sure your computer or phone works, it is all up to you.

Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment.

It typically applies to high-cost assets such as equipment, machinery, vehicles, and buildings. Unlike low-cost business expenses such as pens or printer ink, rather than the total cost of these assets being offset against your taxable income in one go, capital allowances can be spread across several years.

Ian Dickinson, tax director at accountancy UHY Hacker Young, said: “By providing relief to capital expenditure, the allowances are designed to encourage investment and level the playing field across the country with equal entitlement to the same rateable relief.”

What can be claimed as capital allowances?

Capital allowances are reliefs you get on investments you make in your business, known as “plant and machinery”.

Mr Dickinson added: “Capital allowances are a tax relief for businesses in which any expenditure of a capital nature can be claimed. This primarily includes the purchase of plant and machinery such as office equipment, machinery, and business vehicles.

“The capital allowances regime has expanded in scope to include nearly all capital expenditure. Buildings that are used for businesses can now also be claimed at a low level of rate relief, having previously only qualified when being sold.”

There are a few different types of capital allowance.

The annual investment allowance (AIA) lets you claim up to £1m on certain plant and machinery spending during the accounting period of your business.

The full value of the item can be deducted from your profits, therefore lowering your tax bill. You can only claim AIA during the period you purchased the item.

It can be claimed on most plant and machinery spending up to the AIA amount but not for business vehicles, items you owned before you started using them in your business or if something was given to you.

There are other capital allowances if your spending doesn’t qualify for the AIA though.

Certain assets will qualify for 100pc first year allowances after you have purchased them and HMRC lets you deduct the full cost from your profits before tax. This includes new electric cars, zero-emission goods vehicles and equipment for electric vehicle charging points.

This allowance can be used in addition to the AIA but not for the same expense. Once a purchase is made and something is owned for the business, you can also use writing down allowances to deduct a percentage of the value of certain items from your profits each year.

The percentage you can claim depends on the item but there is an 18pc tax relief rate for plant and machinery.

This includes items that you use in your business including equipment, machinery and cars. There is a special rate pool relief of 6pc for parts of a building considered integral – known as “integral features.” This includes parts of the building such as lifts and air conditioning systems.

You can only claim for plant and machinery on items you own, so it can’t be used if you lease or rent items or buildings.

Business owners may be able to claim an allowance of 3pc on money you spend on buying, constructing or renovating some non-residential buildings. When working out the value, it is based on what the asset is worth on the open market, not necessarily what you paid for it.

Does all capital expenditure qualify for capital allowances?

Capital allowances can’t be claimed on everything, only on “qualifying expenditure.”

This is broadly split into equipment, machinery and business vehicles.

An accountant can help identify what counts and ensure you don’t fall foul of HMRC but qualifying expenditure typically means plant and machinery such as computers, office furniture, business vehicles or machinery and on structures and buildings such as purchasing, building or renovating an office.

Steve Watts, tax partner at BDO, said: “It must be ‘qualifying expenditure’ for purposes of a qualifying activity.”

Structures and buildings allowances can be available in respect of the purchase, construction or renovation of a qualifying building or structure that is used for a non-residential purpose, subject to meeting certain conditions.

For example, capital expenditure incurred on land, planning permission, landscaping or land reclamation are specially excluded.”

What is the super deduction and what can I claim it on?

For two years, business owners also benefited from a super deduction.

This temporarily boosted the first-year capital allowance to 130pc instead of 100pc to encourage investment on new equipment after the pandemic.

However, it only lasted until March 2023 and has now been scrapped.

What is considered plant and machinery?

Plant and machinery are items that provide a functional use to help you conduct your trade.

There is not a definitive list of what can qualify as plant and machinery, said Mr Watts, so you need to look at the relevant legislation and case law.

He added: “Plant and machinery can include equipment such as computers and office furniture, machinery including a crane or mechanical excavator and business vehicles.

“It can also comprise certain integral features within a building such as a lift, heating system, electrical system or thermal insulation to an existing building.”

Make sure you claim for what you use though as some business owners may not realise what is allowed and could be missing out on valuable reliefs.

Mr Dickinson added: “Many self-employed people do not appreciate the scope of equipment they are able to claim relief on. Phones and computers are important for businesses to do their trade and therefore classify as equipment under plant and machinery.”

Working out capital allowances

The way you work out capital allowances will depend on the item and how you use it.

The AIA may cover most initial expenses although cars are excluded.

If using other capital allowances such as the writing down allowance, the rate of relief will depend on the item, ranging from 18pc per year for plant and machinery, known as the “main pool”, 6pc on parts of a business building considered “integral” and 3pc for structures and building allowances.

If there is an item you also use outside the business, such as a car, you will also need to work out what proportion of the time it will be used privately and how much it will be used for business purposes, and then only get relief on this latter portion.

Mr Dickinson said: “Some people do claim in excess with purchases that they seek to justify as being primarily for the business, so be mindful of the repercussions of aggressively claiming.”

How to claim

Sole traders can claim capital allowances through a self-assessment tax return while partnerships use their own tax forms.

If you run a limited company, then you can include a separate capital allowance calculation in your company tax return.

Mr Dickinson said: “It is best practice to keep records of all items and share these with your accountant who can review what rates of allowances you can claim based on your tax returns.

“The best rate incentives are more focused on new equipment, so the system does encourage businesses to be proactive with purchasing new and claiming allowance quickly.”

The amount you can claim is deducted from your profits, reducing your tax bill.

Rather than using capital allowances, a smaller self-employed business – for example, a sole trader or partnership with turnover of £150,000 or less a year – may instead be able to use “cash basis” accounting and claim for certain expenditure as expenses against their income.

Frequently asked questions

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report