This article first appeared in The Edge Malaysia Weekly on November 13, 2023 – November 19, 2023

JOHOR Corporation (JCorp) is understood to be going ahead with the initial public offering (IPO) of its plantation assets under Kulim (M) Bhd, despite the weaker crude palm oil (CPO) price environment that has resulted in a lower valuation of about RM2.5 billion for the business, according to sources.

Slightly over a year ago, it was widely speculated that JCorp was targeting US$1 billion, or over RM4.5 billion market capitalisation, upon listing but The Edge understands that the IPO would likely go ahead with a reduced valuation.

“The entity to go on IPO will not be Kulim; it will be Johor Plantations Bhd, the consolidated vehicle for all the plantation businesses under Kulim, so EA Technique (M) Bhd will not be part of the exercise,” says one of the people familiar with JCorp.

Johor Plantations is wholly owned by Kulim.

“The size of the portion of shares to be offered for sale will also be smaller. Previously, we were looking at 40% to 50% of the enlarged share capital upon listing; now we are talking about 30% to 40%,” he adds.

Assuming Kulim offers 35% of the enlarged share capital for sale, it could be raising over RM800 million proceeds from the Johor Plantations IPO, the largest on the local stock exchange since the listing of Farm Fresh Bhd in March 2022.

JCorp tipped to go ahead with plantation assets IPO at lower valuation of about RM2.5 bil

Both Kulim and Johor Plantations had yet to respond to requests for comment at press time.

The downsizing of the IPO came amid the normalisation of CPO prices, where the benchmark third-month contract traded above RM8,000 per tonne last year, following the Feb 24 Russian invasion of Ukraine, a major producer of edible oil globally.

Year to date, the benchmark CPO contract has fallen 9.5% to RM3,779 last Thursday (Nov 9). The commodity fell 41% from its peak to end at RM4,174 last year.

Kulim was previously listed on the Kuala Lumpur Stock Exchange in 1975 and JCorp became a major shareholder a year later. The state-owned firm took Kulim private in 2016.

Currently, Kulim is 96.33% owned by JCorp and 3.67% owned by JCorp Capital Solutions Sdn Bhd, according to data from the Companies Commission Malaysia (SSM).

Johor Plantations is currently headed by managing director Mohd Faris Adli Shukery, who has been tasked to spearhead its reorganisation and transformation agenda.

Tan Sri Dr Ismail Bakar, who was appointed as Kulim’s chairman in May 2022, is leading the Johor Plantations 10-member board of directors, comprising four non-independent directors and six independent directors.

Apart from Ismail and Mohd Faris, the other two non-independent directors are Datuk Sr Hisham Jafrey and Shamsul Anuar Abdul Majid.

The six independent directors are Abdullah Abu Samah, Fawzi Ahmad, Mohd Fazillah Kamaruddin, Ong Li Lee, Norita Ja’afar and Vinie Chong Pui Ling.

Kulim, meanwhile, owns a 2.43% stake in EA Technique and 50.05% shareholding in the oil and gas marine transport and offshore storage services provider through wholly-owned Sindora Bhd.

Kulim announced in March this year that it had consolidated all of its plantation businesses under Johor Plantations, as part of a business transformation to manage its land bank of more than 60,000ha, 23 estates, five mills, and trading and services activities in Malaysia, including its renewable energy initiatives comprising a biomethane plant and five biogas plants.

It is unclear whether the move to group all plantation assets under Johor Plantations is related to EA Technique, a PN17 company, which is widely seen as a sore point among Kulim’s range of assets.

Nonetheless, EA Technique announced last week that Voultier Sdn Bhd — 70% owned by Datuk Wira Mubarak Hussain Akhtar Husni and 30% by Kinergy Advancement Bhd managing director Datuk Lai Keng Onn — is stepping in to take up 51% shareholding as part of the group’s regularisation plan to lift its PN17 status.

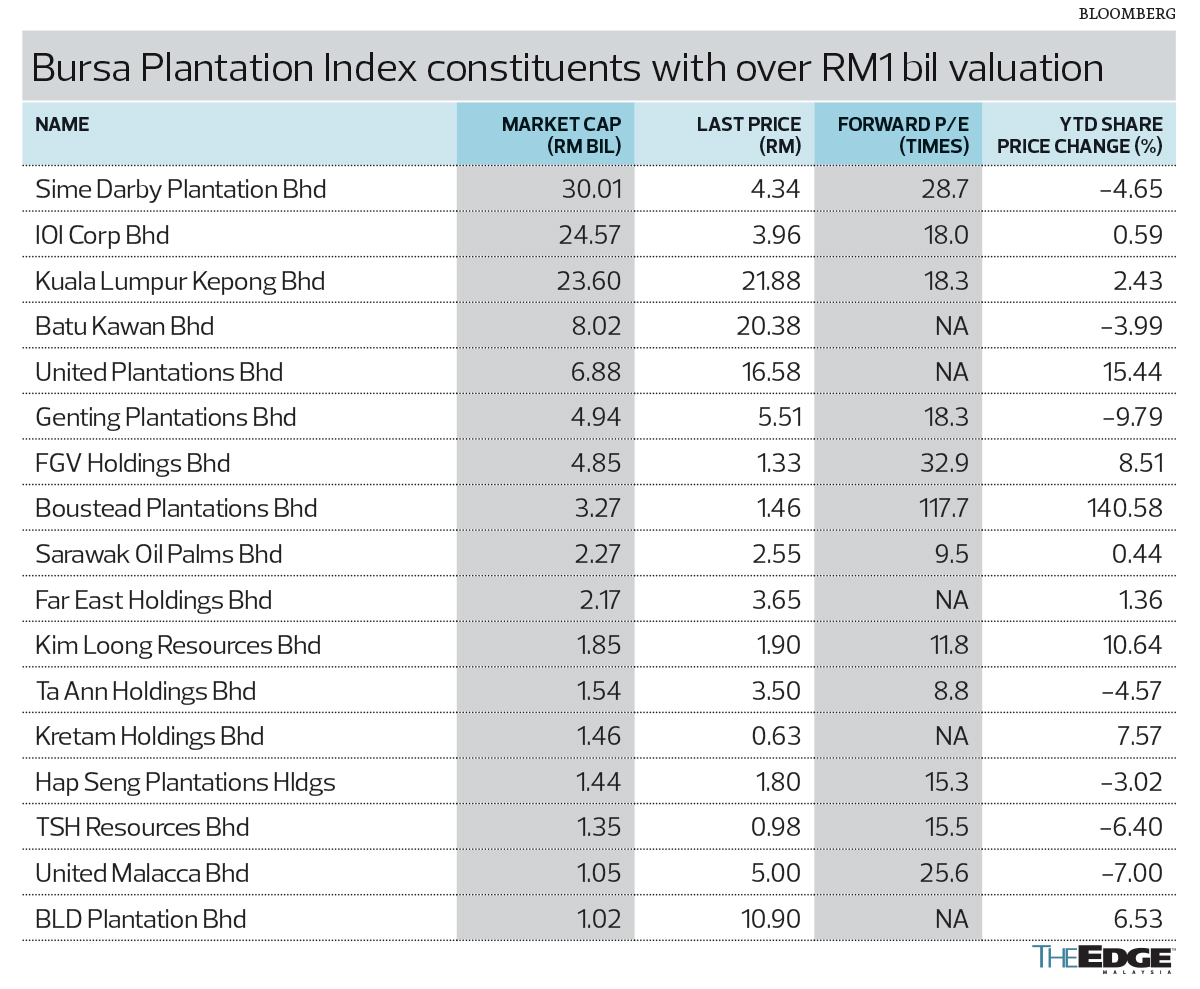

While weaker CPO prices have dampened investors’ appetite for palm oil producers, the lacklustre performances of certain industry players, such as Boustead Plantations Bhd and FGV Holdings Bhd, coupled with allegations of deforestation and poor treatment of labour, also weighed on their attractiveness, especially amid the rising adoption of environmental, social and governance (ESG) standards.

If the IPO of Johor Plantations materialises, which sources say could be sometime in the middle of next year, it would be the first oil palm grower’s listing since that of Matang Bhd in December 2016, Boustead Plantations in June 2014 and FGV in June 2012. FGV’s IPO raised RM4.5 billion, making it the world’s third largest public listing globally that year, after Meta Platforms Inc and Japan Airlines Co Ltd’s re-listing.

Matang, which is 17.7% controlled by the Malaysian Chinese Association (MCA), is a relatively smaller player, with a land bank of 1,076.33ha as at June 30 this year, of which 100.94ha are planted with durian while the remaining are planted with oil palm.

Boustead Plantations, which has a land bank of 97,400ha, is undergoing a privatisation exercise by the Armed Forces Fund Board (LTAT) after years of underperformance compared with industry peers, in terms of profitability and yields.

For FGV, one of the largest among the listed plantation players, with a land bank of 439,051ha across Malaysia and Indonesia, there had also been an attempt by its largest shareholder, the Federal Land Development Authority (FELDA), to take it private at RM1.30 a share in late 2020. However, the privatisation exercise failed as FELDA only managed to acquire 80.99% of FGV, short of the minimum 90% to privatise and delist from the stock exchange.

It is worth noting that Johor Plantations has been a member of the Roundtable on Sustainable Palm Oil (RSPO) since 2009. Its mills and Malaysian estates are RSPO-certified, which market observers say could give the IPO a leg-up on the ESG front.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport