Few money managers command the attention of professional and retail investors quite like the CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), Warren Buffett.

Since becoming Berkshire’s chief in the mid-1960s, he’s overseen a jaw-dropping 5,080,168% aggregate return in his company’s Class A shares (BRK.A), as of the closing bell on Feb. 23. For context, we’re talking about a nearly 20% annualized return spanning six decades, which is roughly double the annualized total return, including dividends, of the benchmark S&P 500 over the same period.

Berkshire Hathaway CEO Warren Buffett.

Even though the Oracle of Omaha and his team of investors aren’t perfect, their track record undeniably points to a history of recognizing plain-as-day values hiding in plain sight. This is why investors pay such close attention to Berkshire Hathaway’s quarterly Form 13F filings with the Securities and Exchange Commission (SEC).

A 13F offers a snapshot of what Wall Street’s brightest minds purchased and sold in the latest quarter (in this instance, the December-ended quarter). However, Berkshire’s 13F doesn’t tell the complete story of Berkshire Hathaway’s equity holdings.

Warren Buffett has a “secret” portfolio that contains two prominent Magnificent Seven stocks

In 1998, Buffett’s company completed a $22 billion acquisition of General Re. While the reinsurance segment was the catalyst behind the deal, General Re also owned a specialty investment firm known as New England Asset Management (NEAM). When Berkshire purchased General Re, it became the new parent of NEAM.

Because New England Asset Management continues to oversee more than $100 million in assets under management, it’s required to file a 13F with the SEC every quarter. Although Warren Buffett isn’t involved with the investing activity at NEAM in the same way he is with Berkshire Hathaway’s $371 billion portfolio, the $621 million NEAM had invested as of Dec. 31, 2023 is, nevertheless, part of Berkshire Hathaway’s aggregate holdings. In other words, New England Asset Management is Warren Buffett’s “secret” portfolio.

As of the end of 2023, this $621 million portfolio held positions in 115 securities, which includes common stock, exchange-traded funds (ETFs), and preferred stock. But what really stands out is this portfolio’s stake in two of the Magnificent Seven stocks.

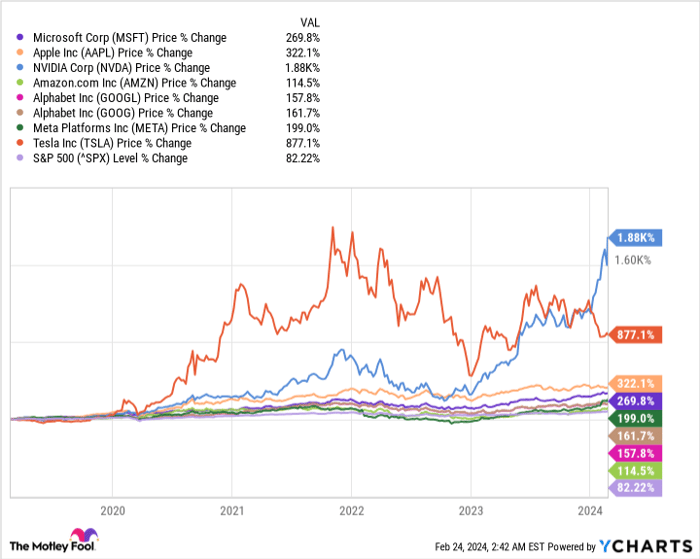

They are seven of the largest and most-influential publicly traded companies in the United States. I’m referring to:

- Microsoft (NASDAQ: MSFT)

- Apple (NASDAQ: AAPL)

- Nvidia (NASDAQ: NVDA)

- Amazon (NASDAQ: AMZN)

- Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

MSFT

The Magnificent Seven stocks have two lures. First, as you can see in the chart above, they have handily outperformed the broad-based S&P 500.

More importantly, the Magnificent Seven provide sustained competitive advantages and/or virtually impenetrate moats.

- Microsoft’s Windows is the leading global operating system, while its Azure has quickly become the world’s No. 2 provider of cloud infrastructure services.

- Apple’s iPhone is the clear leader in smartphone market share in the United States. Furthermore, Apple’s share-repurchase program is unrivaled, with more than $600 billion worth of its common stock bought back since the start of 2013.

- Nvidia’s A100 and H100 graphics processing units (GPUs) could account for up to a 90% share of GPUs deployed in artificial intelligence (AI) accelerated data centers in 2024.

- Amazon’s marketplace captured a nearly 38% share of online spending in the U.S. in 2023. Meanwhile, Amazon Web Services (AWS) is the world’s leading provider of cloud infrastructure services.

- Alphabet’s Google accounted for more than 91% of global internet search in January. It also owns Google Cloud, the world’s No. 3 cloud infrastructure service provider, and YouTube, the second-most-visited social site on the planet.

- Meta Platforms’ social media real estate is unmatched. Facebook is the most-visited site globally, and its family of apps attracted just shy of 4 billion monthly active users in the fourth quarter.

- Tesla is North America’s leading electric-vehicle (EV) maker and the only EV pure play that’s generating a recurring profit, based on generally accepted accounting principles (GAAP).

Warren Buffett’s secret portfolio holds stakes in two of these seven companies.

A stock trader using a stylus to interact with a rapidly rising stock chart displayed on a tablet.

Alphabet

The first Magnificent Seven stock you’ll find in Warren Buffett’s hidden portfolio is Alphabet, the parent of internet search engine Google, streaming platform YouTube, cloud infrastructure service platform Google Cloud, and autonomous vehicle company Waymo, among other ventures. NEAM closed out December with 18,200 shares of Alphabet’s Class A shares (GOOGL), which were worth more than $2.5 million at the time.

The longtime draw for investors to Alphabet has been its foundational search engine. It’s been nearly nine years since Google last accounted for less than a 90% share of worldwide internet search in a given month. As a virtual monopoly, it is able to command exceptionally strong ad-pricing power and take advantage of disproportionately long periods of economic expansion. Internet search should continue to be a healthy cash-flow driver.

However, the company’s most-exciting cash flow growth is liable to come from its smaller but substantially faster-growing segments. For instance, Google Cloud delivered four consecutive quarters of operating income in 2023 after years of steady operating losses. Businesses are still very early in the cloud spending cycle, which suggests the high margins associated with cloud infrastructure services can really lift Alphabet’s cash flow.

Similarly, YouTube’s monthly active user count is marching higher. Daily views for Shorts (short-form videos that usually last less than 60 seconds) have climbed from 6.5 billion in early 2021 to north of 50 billion in early 2023. This represents an excellent monetization opportunity for YouTube, as well as another catalyst to spark an increase in high-margin subscriptions.

Alphabet remains cheap, as well. Despite a sizable bounce from their 2022 bear market low, shares of the company can be picked up for less than 13 times estimated cash flow per share in 2025. That’s a marked discount to the average multiple to cash flow of 17.9 that Alphabet has traded at over the trailing-five-year period.

Microsoft

At one time, Warren Buffett’s “secret” portfolio had a sizable position in Apple and owned shares of GPU giant Nvidia. But as of Dec. 31, 2023, neither company remained in New England Asset Management’s $621 million portfolio. The only Magnificent Seven stock represented in that portfolio, other than Alphabet, is tech stock Microsoft. NEAM held 30,845 shares of the company as of Dec. 31, which equated to roughly $11.6 million in market value.

The reason asset managers are attracted to Microsoft is its exceptional cash flow, which is a function of its seemingly flawless operating model and pristine balance sheet.

As I’ve pointed out previously, Microsoft’s success is a reflection of its blending the old with the new. Although its legacy Windows and Office segments are no longer growing much, if at all, they still generate exceptionally juicy margins that provide abundant cash flow. The company is able to use this cash to reinvest in high-growth initiatives or make acquisitions.

On the other side of the coin, Microsoft is betting its future on cloud services (including Azure), as well as the rise of AI. It has invested billions in OpenAI, the company behind popular chatbot ChatGPT, and is expecting longtail growth from the AI revolution.

And Microsoft is one of only two publicly traded companies with the highest possible credit rating (AAA) from Standard & Poor’s, a division of S&P Global. The company closed out 2023 with $81 billion in cash, cash equivalents, and short-term investments, and it’s on pace for almost $99 billion in net cash generated from operations in fiscal 2024, based on the $49.4 billion of net cash it has generated through the first six months of its current fiscal year.

SPONSORED:

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, S&P Global, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

News Related-

The best Walmart Cyber Monday deals 2023

-

Jordan Poole took time to showboat and got his shot blocked into the stratosphere

-

The Top Canadian REITs to Buy in November 2023

-

OpenAI’s board might have been dysfunctional–but they made the right choice. Their defeat shows that in the battle between AI profits and ethics, it’s no contest

-

Russia-Ukraine Drone Warfare Rages With Dozens Headed for Moscow, Amid Deadly Winter Storm

-

Trump tells appeals court that threats to judge and clerk in NY civil fraud trial do not justify gag order

-

Can Anyone Take Paxlovid for Covid? Doctors Explain.

-

Google this week will begin deleting inactive accounts. Here's how to save yours.

-

How John Tortorella's Culture Extends from the Philadelphia Flyers to the AHL Phantoms

-

Tri-Cities' hatcheries report best Coho return in years

-

Wild release Dean Evason of head coaching duties

-

Air New Zealand’s Cyber Monday Sale Has the 'Lowest Fares of 2023' to Auckland, Sydney, and More

-

NDP tells Liberals to sweeten the deal if pharmacare legislation is delayed

-

'1,000 contacts with a club': Tiger Woods breaks down his typical tournament prep to college kids in fascinating video