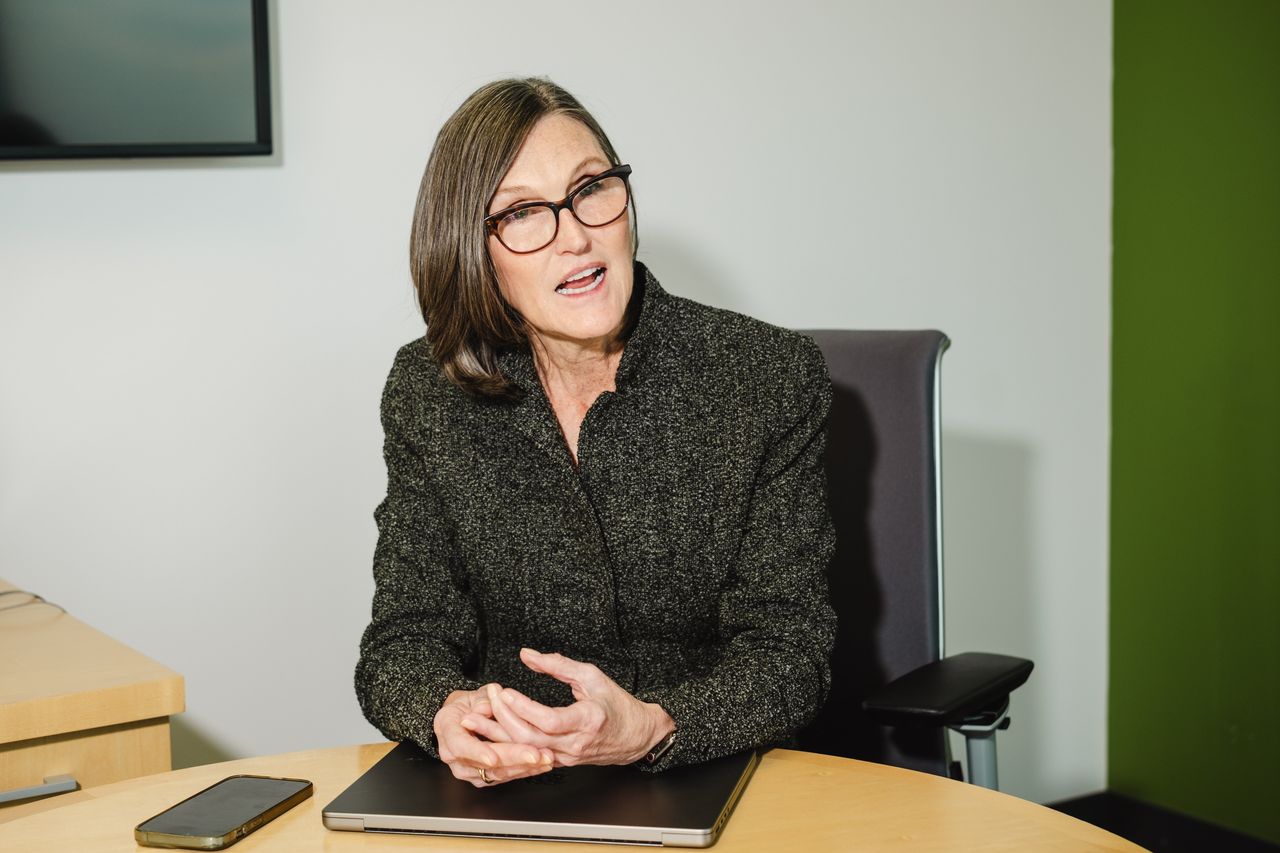

Cathie Wood’s investors are jumping ship.

They rushed into her funds and won big during the pandemic, when the star fund manager became a social-media sensation by making bold bets on disruptive technology stocks such as Tesla, Zoom Video Communications and Roku. They largely stuck with her when the funds’ fortunes reversed after the Federal Reserve raised interest rates. Now, after years of bruising losses, many of them have had enough.

Investors have pulled a net $2.2 billion from the six actively managed exchange-traded funds at her ARK Investment Management this year, a withdrawal that dwarfs the outflows in all of 2023. Total assets in those funds have dropped 30% in less than four months to $11.1 billion—after peaking at $59 billion in early 2021, when ARK was the world’s largest active ETF manager.

“The loyal shareholders have become frustrated,” said Todd Rosenbluth, head of research at data provider VettaFi. “This should be a better year for the ARK style of investing in growth and disruptive technology, but they are concentrated in companies that have underperformed.”

Hopes that the Fed will eventually pivot to cutting interest rates, along with excitement over generative artificial-intelligence technology, have pushed the S&P 500 up 5% in 2024. Those bets should benefit the ARK funds, too. Instead, shares of the flagship ARK Innovation fund have slumped 19%.

That is largely because Wood’s funds are so heavily concentrated in a handful of stocks. Seven stocks, for instance, make up about half of the innovation fund. Shares of Tesla, the largest holding, are down almost 45% this year and trading around $142. Wood has been buying the dip and reiterated her moonshot five-year price target of $2,000 in a CNBC appearance earlier this month.

Other top holdings such as Roku, down 36%, and Unity Software, down 44%, have also dragged the fund lower.

Mark Hadden, a 63-year-old corporate accountant in Virginia Beach, Va., is one of the investors who recently sold out of two ARK funds at a steep loss.

Hadden bought 200 shares in summer 2021 after hearing about Wood from a friend. He says he primarily invests in cheap index funds but was intrigued by ARK and put some of his “speculative” money into a position representing a small fraction of his portfolio.

“It had a lot of promise, I thought. But the funds were just losing money. A lot of money. And I could get 5% on the cash in my Schwab account,” Hadden said. “I wish [Wood] well. But for me those funds don’t fit as part of an investment portfolio.”

ARK became a near-overnight sensation in 2020, when the innovation fund posted eye-catching returns and Wood made frequent TV appearances to offer bullish predictions about her top holdings. ARK’s active funds took in $20 billion of new investor money that year, a staggering sum for a small asset manager that made it a darling of the asset-management industry.

Investors closely watched ARK’s daily trade disclosures to mimic Wood’s bets. She won millions of followers on social media, some of whom nicknamed her “Mamma Cathie” or sold T-shirts with her picture in the style of the Barack Obama “Hope” poster.

Analysts say the funds were always risky for a variety of reasons. They soared with other speculative bets when interest rates were near zero—and then fell spectacularly when rates went up. Higher rates reduce the value that Wall Street attributes to companies that might not make money until far in the future, crushing the price of many of the unprofitable stocks Wood favors.

By the end of last year, ARK funds had destroyed more wealth than any other asset manager over the previous decade, losing investors a collective $14.3 billion, according to Morningstar. ARK’s biggest inflows came in the months surrounding the innovation fund’s February 2021 peak, unfortunate timing for many investors.

A spokeswoman said ARK’s value creation is evidenced by the flagship fund’s 109% return since its 2014 inception.

Investing forums on Reddit are littered with stories from individuals who invested in ARK during its heyday and are agonizing over whether to realize a huge loss or wait things out.

One entry from u/pigeon_playing_pong described moving his 401(k) and Roth IRA retirement accounts into ARK during the pandemic after seeing huge gains on his ARK funds in another account.

“I am now down about 50-60% in all my accounts,” he wrote. “I’m not sure how to move on three years later.”

Within the asset management industry, some critics say ARK funds are too reliant on Wood’s intuition. Now 68 years old, she founded ARK in 2014 in a bid to bring thematic, big-idea investing with a focus on emerging companies to everyday investors.

Nvidia’s absence in ARK’s flagship fund has been a particular pain point. The innovation fund sold off its position in January 2023, just before the stock’s monster run began. The graphics-chip maker’s shares have roughly quadrupled since.

Wood has repeatedly defended her decision to exit from the stock, despite widespread criticism for missing the AI frenzy that has taken Wall Street by storm. ARK’s exposure to Nvidia dated back 10 years and contributed significant gains, the spokeswoman said, adding that Nvidia’s extreme valuation and higher upside in other companies in the AI ecosystem led to the decision to exit.

Fund ratings firm Morningstar recently questioned ARK’s ability to successfully analyze early-stage companies given high personnel turnover after two of the firm’s veteran investment personnel left in 2023.

“Wood remains the firm’s key person. [Her] reliance on her instincts to construct the portfolio is a liability,” Morningstar analyst Robby Greengold wrote in April.

Wood, a longtime proponent of cryptocurrency, has done better standing by her bet on crypto exchange Coinbase Global, whose shares have quadrupled over the past year. The stock is still down 47% from its peak in 2021.

ARK has also had success attracting more than $2.5 billion of inflows to its new ETF that passively tracks bitcoin prices, for a much lower fee than its active stock funds.

And while Wood’s star power has dimmed, her funds still have believers.

Eric Lovgren, a 50-year-old consultant in the Milwaukee area, first invested in ARK funds about a year ago, enticed by the lower entry point. He says he has an interest in innovative companies and specifically genetic-based medicine, which led him to the ARK Genomic Revolution ETF.

Lovgren eventually bought shares of all six active ARK ETFs, a position that now makes up about half of his equity portfolio.

“Innovation especially benefits from low interest rates, and I plan to hold these long term,” he said.

Write to Jack Pitcher at [email protected]

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB