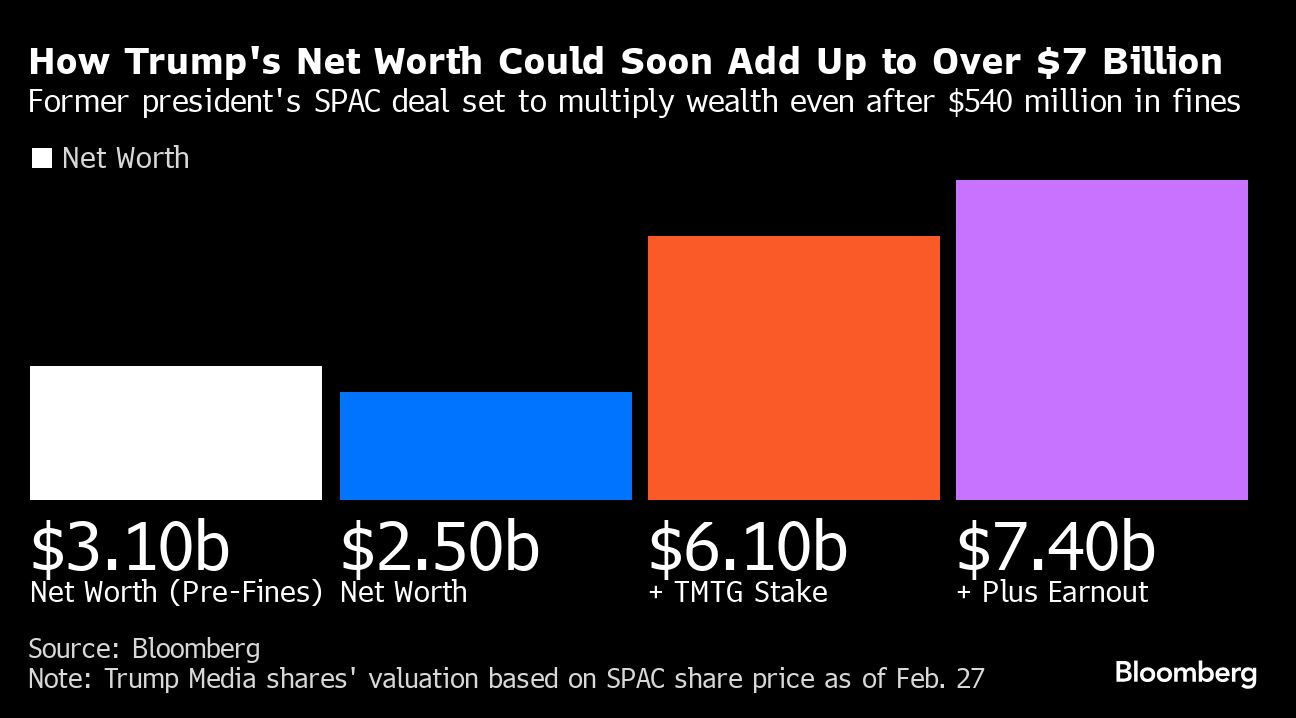

(Bloomberg) — On the financial front, the news has appeared dire for former president Donald Trump this year. Within a span of just a month, two judges in two separate cases ordered him to pay about $540 million in total — a sum so great that pundits have speculated it could erode his campaign finances.

What’s gotten far less attention, though, is this: A frenetic rally in a stock tied to Trump Media & Technology Group — which operates the Truth Social platform he posts on daily — has minted a nearly $4 billion windfall for him.

There are any number of caveats to this figure, including how it’s only a paper profit for now that he’ll have to wait months to monetize, and yet the stock’s surge is a potentially huge financial boost for a billionaire candidate suddenly short on cash.

The type of transaction — known as a de-SPAC or blank-check deal — that would hand Trump this new-found wealth is a complex one that briefly became popular on Wall Street during the stock mania unleashed by pandemic-era stimulus. In this particular deal, Truth Social’s owner would enter the stock market by merging with a publicly traded company called Digital World Acquisition Corp.

Shares of DWAC, as the company is known, have soared 161% this year in anticipation of the merger, which has been green-lit by the Securities and Exchange Commission and is now slated to go to a shareholder vote next month. If it’s approved, Trump will hold a greater than 58% stake. At DWAC’s current price — it closed Tuesday at $45.63 per share — that stake is worth $3.6 billion. Trump could get even more — close to an additional $1.3 billion worth, if the shares meet certain performance targets.

How Trump’s Net Worth Could Soon Add Up to Over $7 Billion | Former president’s SPAC deal set to multiply wealth even after $540 million in fines

It seems improbable to many analysts that a stake in a money-losing social media company with little revenue and a fraction of its rivals’ user bases could potentially more than double Trump’s net worth. But as Trump began to steamroll his Republican rivals in January, setting up a likely rematch with President Joe Biden in November, retail investors frantically bid DWAC shares up. And when a group on Wall Street known as momentum traders joined the buying frenzy, the conditions for an epic rally were in place. In just six days, the stock jumped 200%.

“This is a meme stock, it’s not the type of thing where you bust out P/E ratios — you can throw that out the window,” said Matthew Tuttle, the chief executive and chief investment officer at Tuttle Capital Management. “DWAC has now become the de facto way to bet on or against Trump,” he added.

But if Trump’s rebound carries him back to the White House — and many polls currently make him the favorite to win — there could be value, in theory, at least, in owning a cut of the mouthpiece that will carry his message.

“The fundamental bull case is that he confines his tweets to the Truth Social platform, which means if you want to see them or interact with them, you need to sign up as well, making advertising all the more profitable,” Tuttle said.

Penalties and Fees

While Trump’s windfall would more than cover the penalties and legal fees he faces — he is appealing New York state’s $454 million civil fraud verdict — he would need to wait at least five months before cashing in shares, unless the company files to expedite that timing.

“He needs the money but he can’t sell too much at once without risking tanking the stock,” said Usha Rodrigues, a professor at the University of Georgia School of Law. “Once the lockup is expired, he could use the shares as collateral for loans in order to access cash without selling the shares.”

And it’s unlikely a bank would lend him a large sum of money against the locked-up shares, according to industry watchers like University of Florida finance professor Jay Ritter.

Representatives for DWAC, Trump Media and the Trump Organization didn’t immediately respond to requests for comment.

Even the so-called earnout would more than cover it. After the deal closes, if the stock trades above $17.50 for 20 of 30 days, Trump Media holders would be entitled to receive as many as an additional 40 million shares filings show — with the majority earmarked for Trump.

A more troubling question for Trump is whether shareholders will keep the faith for more than five months after the merger is complete. As recently as April, Trump assigned the company a $5 million to $25 million value in a financial disclosure filed with the Federal Election Commission, a fraction of its valuation in the SPAC deal terms as well as in the market.

The business has struggled, with Trump Media losing $49 million in the nine months through September while generating just $3.4 million in revenue, according to regulatory filings. As such, the company has warned that it may run out of cash without the merger, filings show.

Trump Media “hasn’t been able to turn the corner and it’s not clear how the company is going to succeed in monetizing its business,” said Ritter.

Read More on Trump’s Financial Worries

| Trump Owes $112,000 for Every Day He Doesn’t Pay NY Fraud Fine |

| Trump Asks to Delay His Bond in ‘Excessive’ Carroll Verdict |

| Trump Already Owes $99 Million of Interest in Fraud Verdict |

The deal’s anticipated completion is a feat in itself after more than two years of starts and stops. Skeptics questioned whether Trump Media’s merger could clear a litany of shareholder votes, as well as investigations from the Justice Department and the SEC.

After the completion and during the lockup, the share price – and Trump’s potential windfall – will hinge on how successful he is politically, industry watchers agree. Trump Media has been aiming to “rival the liberal media consortium” and fight against big tech companies like Meta Platforms Inc., Netflix Inc., and Elon Musk’s X.

Shareholders may even choose to hold onto their shares in the hope that because of Trump Media’s alignment with his campaign message, Trump would have a strong incentive not to add Truth Social to the long list of ventures he’s endorsed, then exited from.

“The majority of people who are buying and holding this thing are Trump supporters, “ Tuttle said. “I don’t think it’d be smart for him to entirely blow out of his position and leave them holding the bag.”

–With assistance from Tom Maloney.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB