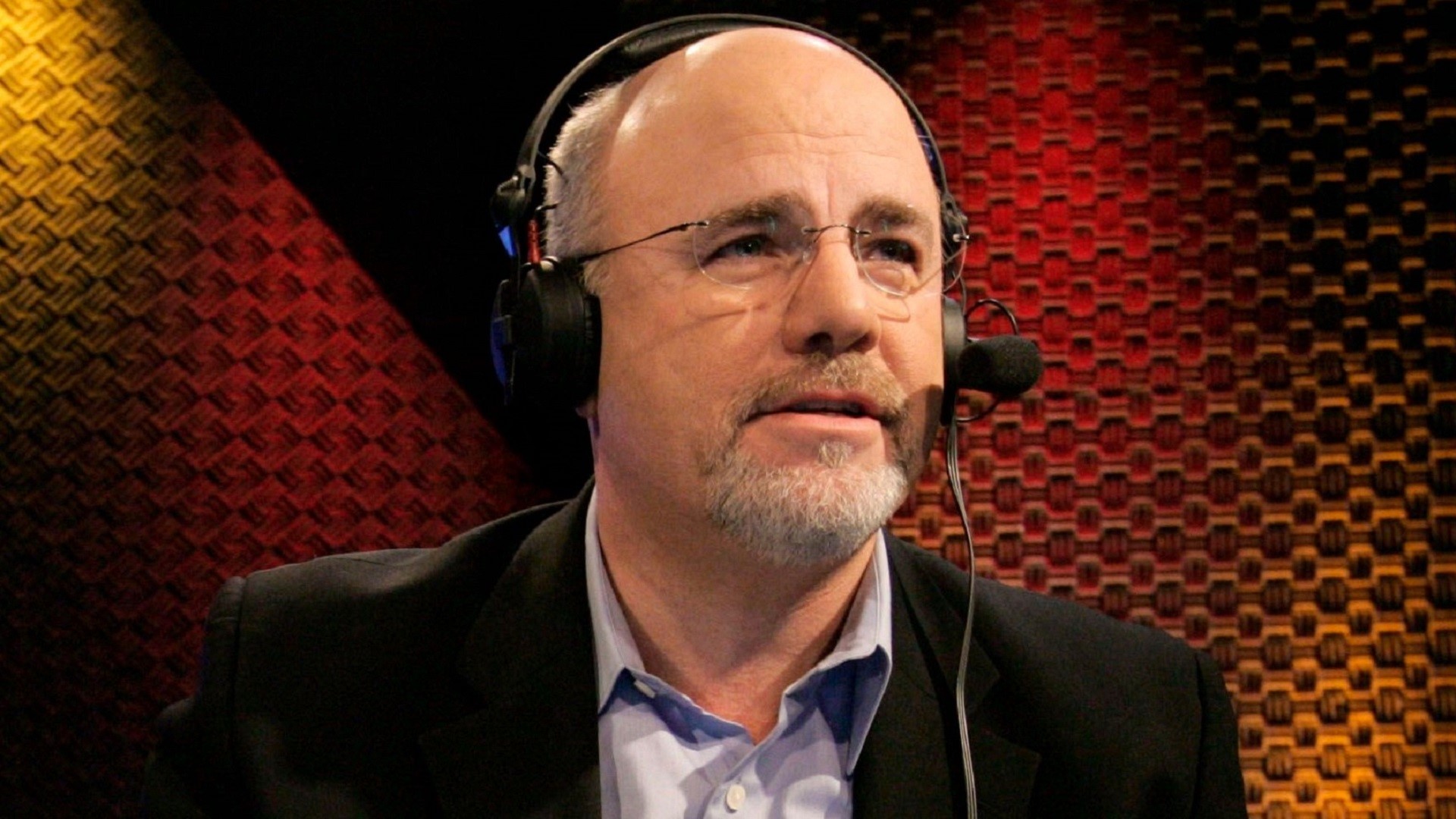

dave ramsey talk show tennessee brentwood_shutterstock_editorial_6378435b

Personal finance expert and host Dave Ramsey typically recommends that households invest 15% of their household income in retirement to save money and build wealth — and as part of his Dave Ramsey’s 7 Baby Steps financial plan.

Learn More: 401(k) Growth Potential: Ways to Double Your Savings in 10 Years

For You: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

“When it comes to saving for retirement, you’re the CEO of You, Incorporated — it’s up to you to take charge! And if you practice what we preach, taking charge means you’re investing 15% of your income in tax-favored retirement accounts — like 401(k)s and IRAs,” according to a Ramsey Solutions article.

Now, when it comes to high-income earners, however, Ramsey said that if you make a lot of money, “maxing out those tax-favored accounts won’t come close to hitting that 15% mark.”

So, what are the options for this cohort?

Sponsored: Protect Your Wealth With A Gold IRA. Take advantage of the timeless appeal of gold in a Gold IRA recommended by Sean Hannity.

Backdoor Roth IRA

According to Ramsey, as there’s an income restriction on Roth IRAs, typically, high-income earners can’t open one.

“But there’s a way around the rule book — and it’s perfectly legal,” he said. “The federal government says you can convert a traditional IRA into a Roth IRA regardless of your income.”

Ramsey also added that some pros of investing in a backdoor Roth IRA include the fact that when you convert your traditional IRA to a Roth IRA, you pay the taxes upfront and enjoy tax-free growth and withdrawals — that is, once you reach age 59 ½.

Health Savings Account (HSA)

An HSA is both a savings and investment account that can give you three tax breaks, according to Ramsey, who deemed them “a hidden gem of investing.”

“In the short term, an HSA acts as a tax-advantaged emergency fund for health care expenses. You can use the money you save in your HSA to pay for doctor visits, prescriptions and a whole bunch of other medical bills,” he said.

Now, in the long term, he said, you can use your HSA as a “health IRA.”

“Because not only can you save money in your HSA, you can also invest the money in your HSA. Once you’ve contributed a certain amount (usually between $1,000-2,000), you can start investing that money into mutual funds inside the HSA,” he said.

After-Tax 401(k) Contributions

In 2024, the maximum amount you can contribute to a traditional 401(k) with pretax dollars is $23,000 and $30,500 for those age 50 and older.

“But some employers also allow you to make after-tax contributions once you’ve reached the pretax limit,” he said, adding that if that’s what you want to do, in 2024, you can contribute a maximum of $69,000 of both pretax and after-tax dollars -or $76,500 if you’re 50 or older.

In turn, when you retire, you can take after-tax 401(k) money and put it in a Roth IRA where you can continue to grow wealth.

Brokerage Accounts

These are also called taxable investment accounts. According to him, while you won’t get a tax break, they are more beneficial than letting your money sit in a savings or checking account.

Additional advantages are that there are no contribution limits and they are flexible.

“This flexibility is important if you want to retire early and need an income stream,” he said.

Real Estate

While real estate investments can be very profitable, Ramsey noted that you should first pay off your home before investing.

He also added that it’s the most time-consuming of your investing options.

“So don’t dive headfirst into real estate unless you have a real passion for it. Before you buy, do your homework. Talk to people who’ve done it. They’ll tell you what it’s really like,” he said. “Do the math to see how much money you’d actually make after expenses, including taxes, utilities and other costs. And never, ever borrow money to buy real estate. Only buy investment properties when you can pay cash for them.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: 5 Investment Options For High-Income Earners

News Related

-

Window opens for Zahid to ride off into the sunset – but at Anwar’s cost Sources within Umno have not ruled out strong speculation since last month about a so-called “exit plan” for Ahmad Zahid Hamidi, a move that could pave the way for his political retirement having survived more ...

See Details:

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Brianna Ghey died after she was found with fatal stab wounds in a park Two teenagers accused of murdering Brianna Ghey showed a “preoccupation” with “violence, torture and death”, a court has heard. The body of Brianna, 16, who was transgender, was discovered by dog walkers in a park in ...

See Details:

Murder-accused teens 'had preoccupation with torture'

-

ISLAMIC REVOLUTIONARY Guard Corps Commander-in-Cheif Major General Hossein Salami speaks at an anti-Israel protest in Tehran on Saturday. The IRGC trained Hezbollah to use human shields, say the writers. The conflict in Gaza has raised a deeply troubling issue: Reports suggest that Hamas is deliberately using civilians as shields, a ...

See Details:

A plea for Islamic voices against using human shields - opinion

-

Photo for illustration purposes only. – BERNAMA FILE PIX SHAH ALAM – The government needs to strengthen the Malaysia My Second Home (MM2H) programme, especially with the exemption of visas for Chinese and Indian citizens visiting the country starting Dec 1. Universiti Tun Abdul Razak economic expert Emeritus Professor Dr ...

See Details:

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill KUALA LUMPUR: The generational end-game (GEG) element has been removed from the revised Control of Smoking Products for Public Health 2023 Bill tabled for the first reading in the Dewan Rakyat on Tuesday (Nov 28). This is as the Health Ministry tries for the ...

See Details:

GEG element removed from anti-smoking Bill

-

-

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Malaysia Airlines launches year-end sale

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Dr M accuses govt of bribery over allocations

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Malaysia to check if the Netherlands still keen to send flood experts

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Appeals court to rule in Isa’s graft case on Jan 31

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Elephants Trample On Axia With Family Of Three Inside

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Sirul fitted with monitoring device

-

KUALA LUMPUR (Nov 28): National carrier Malaysia Airlines Bhd has launched its year-end sale with ticket prices starting from RM79 to domestic destinations and from RM229 to international destinations, for travellers who book flights between Nov 28 and Dec 11 this year. In a statement, Malaysia Airlines said all-in one-way Economy Class ...

See Details:

Nigerian airliner lands at wrong airport

OTHER NEWS

THOSE looking for fresh produce may find themselves spoilt for choice at the biggest wet market in Klang, but visitors to the place say the condition of the facilities and ...

Read more »

Olive Grove is the first-ever gated-and-guarded development in Bercham, Ipoh with 24-hour security. IPOH: YTL Land and Development Bhd announced that Phase 1 of Olive Grove is fully sold while ...

Read more »

Screenshots of a video showing a teenager pointing a knife at an elderly e-hailing driver. PETALING JAYA: Police have arrested a 13-year-old boy for holding an elderly e-hailing driver at ...

Read more »

Sprint Highway’s Semantan To KL Slip Road Fully Closed Until Dec 31 If you’re a regular user of the Sprint expressway, you’ll need to do some planning for your trips ...

Read more »

Genshin Impact Version 4.3 Leak Showcases Update to Domains New leaks reveals a quality-of-life update to Domains in Genshin Impact, making it easier for players to repeat and farm resources. ...

Read more »

CG Computers will host the Urban Republic (UR) Warehouse Clearance from 30 November to 3 December at the Atria Shopping Gallery in Petaling Jaya. During the event, visitor can get ...

Read more »

Photo for illustrative purposes only – 123RF KUALA LUMPUR – Hyperinflation has never happened in Malaysia and the government hopes it will never happen, according to the Economy Ministry. It ...

Read more »