Your W-4 form determines the amount of money withheld from your paycheck for income taxes. Maks_Lab/Getty Images

After two weeks of filing, IRS statistics show tax refunds are trending lower this year. The average tax refund so far is $1,741 — a 13% drop from the average at this time last year, and a 46% drop from the $3,252 average for the total 2023 tax season.

It’s always nice to receive a hefty check from the government, but a bigger tax refund might not be as great as it seems. After all, that tax refund check represents the money you overpaid the government throughout the previous year, and you could have gotten that money much earlier in larger paychecks.

Luckily, it’s fairly simple to make your tax refund bigger or smaller each year: It takes just a few minutes, once you have the paperwork in hand. The IRS even bakes the process into one simple step on its tax forms.

Learn how to adjust your IRS W-4 tax form to change the size of your tax refund, and all of the factors you should consider before doing so. For more, learn whether your income from Social Security is taxable and our picks for the best tax software.

What is a W-4 form?

A W-4 form is a federal tax form from the IRS that lets your employer know how much money should be withheld from your paycheck for federal taxes. The IRS website says that taxpayers should “consider completing a new Form W-4 each year and when your personal or financial situation changes.”

The W-4 form was revised for the 2020 tax season to “reduce the form’s complexity and increase the transparency and accuracy of the withholding system.” Withholding allowances — or exemptions that reduced the amount withheld — were eliminated and replaced by calculations of additional untaxed income and expected tax deductions.

How do I change my W-4 to get a bigger tax refund?

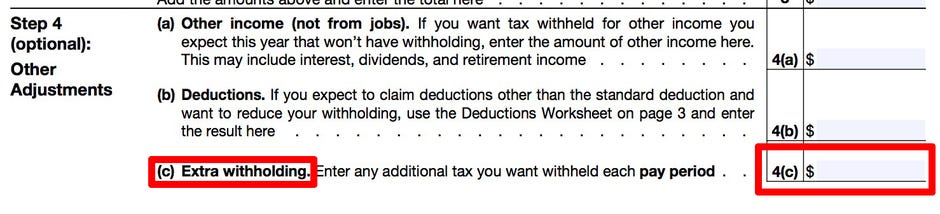

If you want to get more money back in your tax refund each year, you can designate that a larger amount of your paycheck is withheld. It’s simple — just enter the extra amount you want withheld from each paycheck on line 4(c) of your W-4 form. The line is marked “Extra withholding.”

To request more money be withheld from your paycheck, enter the amount into line 4(c) of the W-4 form. IRS/Screenshot by Peter Butler/CNET

Likewise, if you find yourself owing taxes to the IRS each year, adding the right amount of extra withholding via line 4(c) of your W-4 can reduce your tax burden to zero each year. Just divide the amount you usually pay in federal taxes by the number of paychecks you receive in a year to find out how much extra should be withheld each pay period.

While lending the IRS your money for 12 months or more at no interest might seem nuts to the financially disciplined, it’s an undeniably bulletproof method of saving money. You might not be earning interest, but you’re not spending it.

Why shouldn’t I increase my withholding to get a bigger tax refund?

Quite simply, it’s your money, and the IRS is holding onto it for up to a year with no interest. You could be spending that money, investing it to keep up with inflation or doing whatever the heck it is you want to do with that money … because it’s yours!

While it’s nice to get a big tax refund check in the spring, inflation is hovering around 3.9% right now. That means that your $1,000 from February 2023 will get you about $961 worth of stuff now, in February 2024. If you had put that money into a money-market fund or a high-yield savings account instead of letting the IRS hold it, you could be getting 5% interest and have $1,050 now instead.

How do I adjust my W-4 to get more money back in my paycheck?

As mentioned, the IRS eliminated withholding allowances in 2020, so withholding less money is no longer as simple as increasing the number of allowances on your W-4 form.

Also note that the US is a “pay as you go” tax system. You’re not allowed to eliminate withholding completely and pay your tax burden each April — there’s a penalty for underpayment of taxes.

However, if you’re getting a big tax refund every year and you’d rather have that money back sooner in your regular paycheck, you have some options, the biggest being deductions.

Take a look at your existing W-4 and your deductions from your last federal tax return. Increase the deductions amount on your W-4 form to meet the amount on your income tax returns. Make sure to look at student loan interest and IRA contributions, which are included in addition to your deductions estimation.

If you had no tax liability for the previous year, it’s possible you might not have to pay any taxes at all in the current year. To declare yourself exempt from withholding, according to the IRS, you “must have had no tax liability for the previous year and must expect to have no tax liability for the current year.”

If both conditions are true, per the IRS, write “Exempt” on Form W-4 in the space below Step 4(c). Complete steps 1(a), 1(b) and 5, then stop.

Also important, according to the IRS, the “Form W-4 claiming exemption from withholding is valid for only the calendar year in which it’s furnished to the employer. To continue to be exempt from withholding in the next year, an employee must give you a new Form W-4 claiming exempt status by February 15 of that year.”

On its website, the IRS provides a tax withholding estimator tool that can help you figure out how to adjust your W-4 form in order to pay more or less taxes during the year from your paycheck.

When can I adjust my W-4?

You can adjust your W-4 form any time that you would like. The IRS recommends checking your W-4 form once a year, but you should also update it upon certain events:

- Birth of a child, or new dependent

- Marriage or divorce

- New job for you or your spouse

- Purchase of a house or other major tax change

Your employer must implement your new W-4 info by the start of the first payroll period that ends on or after the 30th day after you submit an updated W-4.

Note: Talk to a tax expert to discuss your personal tax situation before adjusting your W-4 form. IRS local offices provide expert advice at various times via appointment.

For more, learn how to set up an IRS account.

News Related-

Fix water crisis, or else, City warned

-

Giving Tuesday: How to donate to a charity with purpose and intention

-

Visiting South Korea? Get your culture fix in this artsy street in Seoul

-

Traffic advisory issued ahead of PM Modi's Hyderabad roadshow today

-

How to improve teaching of English in primary schools

-

How to deep clean a small bedroom according to experts

-

Now you know how tough being in govt is, Puad tells PKR

-

How to make a Hummer even flashier: strap a Rolls-Royce on top

-

How to crack the zodiac code: Use your birth date to understand yourself better

-

Ravens vs. Chargers Sunday Night Football live updates: Odds, predictions, how to watch

-

How To Watch The 2023 BET Soul Train Awards

-

Stimulus Check for Senior Citizens: How to qualify for a $2000 payment?

-

How to watch Faraway Downs: stream the Baz Luhrmann miniseries

-

How to Watch Today's Cleveland Browns vs. Denver Broncos Game: Start Time, Livestream Options