One company that is quickly emerging as a front-runner in the artificial intelligence (AI) revolution is Palantir Technologies (NYSE: PLTR), which has a suite of data analytics software platforms that it sells to the U.S. government, its Western allies, and the private sector.

Last year, Palantir released its Artificial Intelligence Platform (AIP), and it has been a game changer for Palantir, helping draw over 100 new customers in 2023. The company ended 2023 with 497 customers. Given that some of Palantir’s enterprise deals are in excess of $10 million, the rapid customer adoption of AIP appears to be setting the company up for long-term sustained and robust growth.

Make no mistake about it — as the bull narrative becomes clearer for Palantir, investors are taking note. The stock is up 200% over the last year, handily topping the return of the S&P 500 index. With such a dramatic shift in the stock, investors may be wondering if they’ve missed out.

Let’s dig into Palantir and assess what the future could hold and whether now is a good time to scoop up shares, or if investors missed the boat and should look for growth elsewhere.

How is Palantir performing?

For years, one of the biggest bear arguments surrounding Palantir was that the company relied too heavily on government business. While a lot of money can be made in the public sector, investors typically do not apply as much of a premium to government contractors given the lumpy and less predictable nature of these types of deals.

However, Palantir has spent the past few years rounding out its host of platforms: Foundry, Apollo, and Gotham. Moreover, with the addition of AIP, Palantir now has an artificial intelligence (AI) product that is looking to disrupt competing platforms such as Microsoft Fabric, Databricks, and others.

In 2023, Palantir increased it total customer count by 35% year over year. More impressively, the company grew its nongovernment customers by 44%. In the fourth quarter, the company’s revenue from U.S. private sector customers grew by a jaw-dropping 70% year over year.

Clearly, Palantir’s software is in high demand outside of the government, and its adoption by these new customers is helping drive significant top-line acceleration. Total revenue grew 17% in 2023. What’s even better is that Palantir’s overall business is financially strong. The company has been profitable on a generally accepted accounting principles (GAAP) basis for five straight quarters, and its balance sheet ended the year with $3.7 billion of cash and equivalents, with no debt.

Given these results, it’s no surprise to learn that Palantir stock has rocketed over 40% since the company reported fourth-quarter earnings on Feb. 5. Given such a dramatic move in a short time frame, investors should zoom out and look at what Palantir’s future could hold.

A person coding on a computer at work.

What the future could look like for Palantir

Getting a sense of how Palantir drove such strong growth last year should help shed light on the company’s prospects.

With demand for artificial intelligence services rising, it can be challenging for companies to differentiate their products from the competition’s. Palantir employed a unique strategy following the commercial release of AIP.

The company started hosting immersive seminars that it calls “boot camps.” During these sessions, Palantir allows prospective customers to test out its various products and identify a specific use case revolving around AI. The idea behind this lead generation strategy is to help foster potential customers for Palantir’s pipeline.

This system allows Palantir to get more prospects through the door at a faster rate. In theory, should these boot camps convert to actual paying customers at a high rate, Palantir now has a unique opportunity to upsell and cross-sell additional products to these new customers.

Management has been speaking about the success of boot camps for the last several quarters. However, during the fourth-quarter earnings call, investors received some much-needed detail. Since the release of AIP in April 2023, Palantir has completed over 500 boot camps. To put this into perspective, the company held 92 demos for prospective clients during all of 2022.

I am encouraged by the results of the boot camps so far and see this as an approach to customer acquisition that can work well in the long run. 2023 was just a preview of what’s to come. As Palantir continues to add customers at double-digit growth rates, the company’s top and bottom lines should accelerate exponentially for years.

Is it too late to buy Palantir stock?

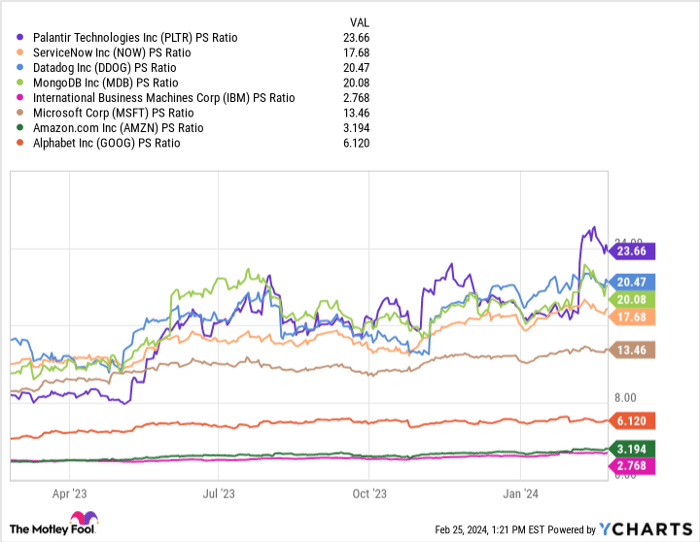

The chart below illustrates the price-to-sales (P/S) ratio for Palantir stock benchmarked against a number of high-growth software-as-a-service (SaaS) names, as well as some of the megacap leaders in AI

PLTR PS Ratio

While Palantir’s P/S around 24 is the highest among this cohort, investors can clearly see the multiple expansion following the company’s blowout earnings report in early February. Although this might suggest that Palantir stock needs a breather, acclaimed Wall Street analyst Dan Ives of Wedbush Securities sees significant upside in Palantir stock — even from its current levels.

My personal take is that Palantir’s premium valuation is warranted. The company is well positioned from a capital perspective to continue investing in relentless product innovation, and the demand trends for its boot camps could result in much further growth in the long run. While the stock is enjoying some momentum right now, a prudent approach could be to use dollar-cost averaging to build around a long-term position.

SPONSORED:

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Datadog, Microsoft, MongoDB, Palantir Technologies, and ServiceNow. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

News Related-

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

Namwater Dam Bulletin on Monday 27 November 2023

-

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

Victory over Nigeria puts Uganda on the brink

-

BoG holds policy rate at 30%, tightens liquidity measures

-

When sea levels rise, so does your rent

-

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Sierra Leone prison breaks co-ordinated - minister

-

Address the rise of single parenthood

-

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Unmarried People Under 35 Outnumber Married Ones

-

European interior ministers in Hungary to discuss migration

-

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone