Where Will Alphabet Stock Be in 5 Years?

Technology stocks are off to a strong start in 2024, with the Nasdaq-100 Technology Sector index clocking 9.8% gains as of this writing. The same cannot be said about Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), as shares of the technology giant are flat so far in 2024.

Alphabet delivered solid results at the beginning of the year, but its ad revenue wasn’t up to the market’s expectations. Additionally, concerns were raised by investors about Alphabet’s ability to compete in the generative artificial intelligence (AI) market after its chatbot Gemini ran into controversy.

Can the company turn around negative investor perceptions and deliver solid returns to investors over the next five years? Let’s find out.

Alphabet needs to grow at a faster pace

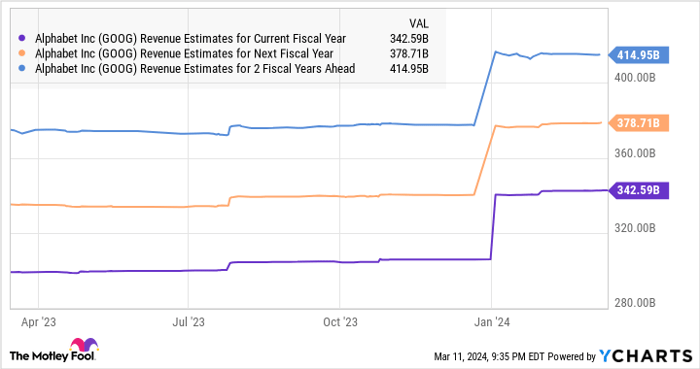

In 2023, Alphabet reported total revenue of $307.4 billion, a 10% jump over the previous year in constant currency terms. That was a drop in growth from the 14% jump the company clocked in 2022. Analysts expect Alphabet’s revenue growth to improve slightly in 2024, rising at an 11.4% rate to total $342.6 billion.

However, as the following chart indicates, Alphabet’s pace of growth is expected to decelerate slightly over the next couple of years.

GOOG Revenue Estimates for Current Fiscal Year

There are a couple of reasons why that may be the case.

First, the company’s ad business is under threat from Meta Platforms (NASDAQ: META). Alphabet’s Google Advertising revenue was up just 6% in 2023 to $237.8 billion. Meta Platforms, on the other hand, delivered a 16% jump in advertising revenue last year to $132 billion. It is worth noting that the digital ad market recorded 10.7% growth in 2023, according to eMarketer. So Meta’s faster growth than the digital advertising market means that it is gaining share in this lucrative niche from Alphabet.

Moreover, Alphabet’s estimated revenue growth for 2024 means that it could keep losing share to Meta. That’s because the digital ad market is forecast to grow 13.2% this year, and analysts predict a 17% increase in Meta’s revenue in 2024.

Alphabet’s growth is also expected to stay mediocre because of the competition in its cloud computing business. Though Google Cloud revenue increased an impressive 26% year over year in the fourth quarter of 2023 to $9.2 billion, competitor Microsoft’s Azure cloud increased 30% year over year in its corresponding quarter thanks to the growing adoption of its AI-focused cloud services.

All this indicates why investors seem to prefer other “Magnificent Seven” stocks this year instead of Alphabet. There is no doubt that Alphabet is trying to get its foot in the door of the generative AI market, with management explaining the company’s AI-related efforts at length on the January earnings conference call, but the numbers indicate that its peers are using this technology in a better way to boost their financial performance.

However, there is one reason why investors might still want to consider taking a chance on Alphabet and buying the stock right now for the long haul.

The valuation suggests that investors are getting a good deal on the stock

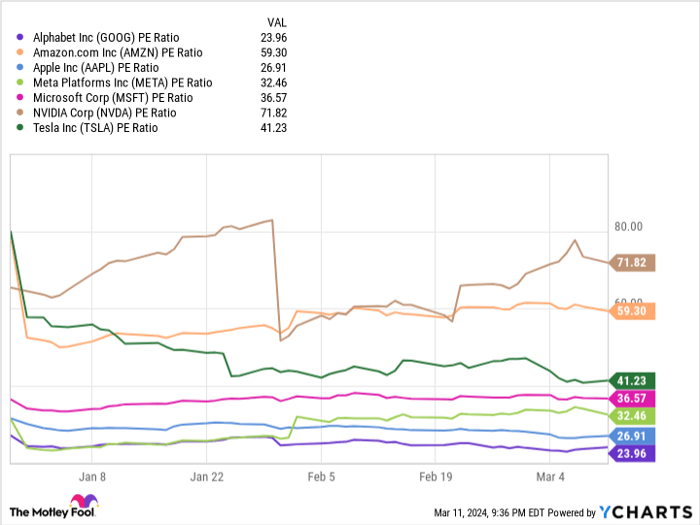

The rapid rise in the stock prices of Alphabet’s Magnificent Seven peers means they trade at expensive valuations (see chart below).

GOOG PE Ratio

Buying Alphabet at this valuation could turn out to be a smart long-term move. We have seen that its cloud business is already growing at a healthy pace, and certain analysts believe that it could gain ground in the generative AI market as well. JPMorgan’s Doug Anmuth, who has an overweight rating on Alphabet stock, predicts that the company could make a comeback in the generative AI space.

That wouldn’t be surprising, as the company is aggressively adding generative AI tools into its advertising tools to drive greater returns for advertisers. So with the stock trading at 23 times trailing earnings and 20 times forward earnings — a discount to the Nasdaq-100’s earnings multiple of 32 (using the index as a proxy for tech stocks) — investors are getting a good entry point.

Analysts predict Alphabet’s earnings will increase at an annual rate of 19% for the next five years. Based on its 2023 earnings of $6.79 per share, the company’s bottom line could increase to $13.84 per share in five years. If Alphabet’s growth picks up by that time and the market rewards it with a higher earnings multiple, this tech stock could deliver impressive gains.

Even if Alphabet is trading at 24 times forward earnings after five years, which is equivalent to its five-year average forward price-to-earnings ratio, its stock price could jump to $332 in five years. That would be a 138% increase from current levels, which is why it may be a good idea to buy Alphabet while it is still cheap.

SPONSORED:

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 11, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, JPMorgan Chase, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.