M40 families spending less

TALLYING the weekly or monthly grocery and utility bills for the M40 group can feel like a punch in the gut these days.

The middle-class folk, who receive limited government aid, are always walking a tightrope.

The M40 category consists of the middle 40% or 3.16 million Malaysian households with incomes ranging from RM5,251 to RM11,819.

There can be a subjective element to feeling “middle-class”.

Even within the income range, some may feel financially secure while others feel the strain.

To ensure subsidies and aid reach those who really need it, the Malaysian Central Database Hub (Padu) was launched by the government on Jan 2 to identify the socioeconomic status of citizens and improve policy planning and implementation.

While Padu takes into account household expenses and cost of living, some experts argue that it does not allow for other factors that weigh on M40 singles, such as supporting multiple households.

In addition, economic reforms, such as targeted subsidies and tax hikes like the increase in sales and service tax (SST), have also put more pressure on the M40 group.

The soon-to-be-launched Employees’ Provident Fund (EPF) Account 3 intends to ease the financial burden of contributors below age 55, but some fear that this will lead to inadequate savings for their retirement years.

To get an idea of the M40 group’s struggles, StarMetro spoke to four urban households for an insight into their monthly budgets.

Their stories paint a picture of how the middle-class dynamics have shifted over the years.

If fuel subsidies are removed, Gangeshwaran says he will cut back on using his diesel-fuelled four-wheel drive.

Cutting corners

For Gangeshwaran Sivagroonathan, 52, living within his means today involves reducing a lot of little luxuries, especially eating out and unnecessary spending.

The licensed mental health counsellor, who has an engineering background in Physics and Microelectronics, lives with his 80-year-old mother.

As Gangeshwaran’s mother receives her late husband’s pension, he does not need to spend a lot on his mother’s medical and living costs.

They live in an older single-storey home, well-ventilated with many windows and plants near Jalan Ipoh in Kuala Lumpur.

As such, they don’t need to use the air-conditioning much.

“We get by using just the fan. My electricity bill is about RM60 a month and water usage is low too,” he said.

But he revealed that he would need to cut back on using his diesel-fuelled four-wheel drive, which is under his own company, to deliver electronic and engineering products to clients.

Now, he said, using a courier service was cheaper.

“If the government removes the subsidies and the price for diesel goes up, I will need to think about getting a smaller car for city driving.

“Now, parking charges in Kuala Lumpur are very expensive, so I mostly use public transport to travel to the city,” he added.

Gangeshwaran also volunteers with a non-governmental organisation called Empire Project, which carries out charitable initiatives like food and educational aid for vulnerable communities.

“At least now, I don’t have to travel coast to coast to deliver goods; the team will manage as they have their own lorries.

“My diesel cost per month is RM400 and if the subsidy is removed, it will increase to between RM600 and RM700,” he said.Eating out a luxuryHotel general manager Rozaidi Md Ramli, 54, said while the SST increase from 6% to 8% may seem negligible in individual transactions, it accumulates into a substantial amount over a month for moderate-income families like his.

The father of three, who is based in Johor, said the rise in electricity tariffs affected M40 households to an extent, amplifying economic challenges amid a turbulent economic landscape that was increasingly resembling the struggles faced by the B40 segment.

“Essential services such as medication, which is crucial for societal health and economic productivity, are now subject to the higher SST,” he said.

Rozaidi said his family had to cut back significantly on eating out, opting for more home-cooked meals.

“We have also reduced our outings, necessitating careful planning for any recreational activity.

“Our lifestyle adjustments have been moderate yet deliberate, focusing on prudent spending and resourcefulness in managing our finances amid rising costs,” he added.

Saving up for a trip

Fatin and Shahiran managing their monthly bills with the rising cost of living. — AZMAN GHANI/The Star

In Cyberjaya, business development manager Fatin Farhana Mazlan, 33, and husband Megat Shahiran Megat Shahruddin, 32, a budget specialist, finally went on a week-long holiday to Japan after saving up for two years.

A trip to Japan can be expensive for many, especially with the costly public transport options there.

“We had our holiday in Tokyo only, so we did a lot of research on local bus routes and saved a lot of money on transport and hotel by planning things much earlier,” said Fatin, who also has two pet cats that were a source of entertainment for their son Raid Adam.

Their current rented condominium is relatively cheaper compared to properties in sought-after parts of Klang Valley.

But they already have plans to buy a house in Cybersouth with careful budgeting.

“Cybersouth suits our family’s needs and requirements.

“This location offers good accessibility to public amenities and commercial areas.

“Additionally, the housing prices are more affordable compared to other areas in the Klang Valley and Cyberjaya.

“We anticipate that Cybersouth will experience a rise in property value,” said Fatin.

Moreover, their apartment is closer to Fatin’s workplace in Cyberjaya.

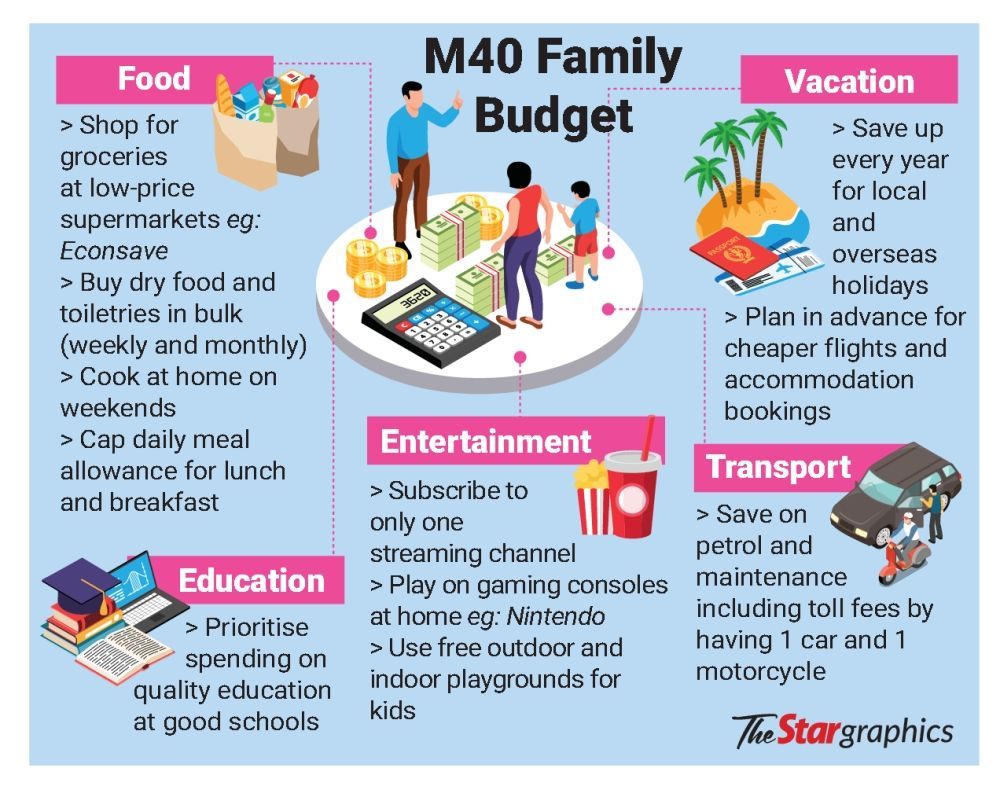

To save on petrol, Fatin uses the family’s only car while Shahiran rides his motorcycle to his office in Kuala Lumpur.

They revealed that the biggest chunk to come out of their budget is Adam’s pre-school fees.

“This is something that we will not compromise on as it’s a good pre-school in the area.

“We maintain quite a strict budget system for our utility bills and lifestyle expenditure.

“I’ll track our monthly expenses using budgeting apps, prioritising needs over wants and ensure we set aside some savings for the future,” said Shahiran.

He added that they only subscribed to one streaming channel for entertainment.

“The rest of the time, we spend quality time with Adam by playing on the gaming console as a family,” he said.

They also make use of the free amenities available such as playground and swimming pool at the condo to save money.

Mohan (right) and Richard repairing a motorcycle at his shop in Kota Damansara. — Kamarul Ariffin/The Star

Wearing many hatsWriter and business owner Mohan K., in his 50s and with a background in engineering, is a single father to two sons, aged 18 and 22.

He runs a motorcycle repair shop in Kota Damansara, Petaling Jaya, with a few employees, including oldest son, Richard.

For Mohan, his spending and lifestyle revolves around trimming costs.

“The key thing is budgeting and organising, but I tend to do a lot of things on the fly, and for many years, I’ve had to do a lot of ‘fire fighting’ – paying school fees and fixing things.

“I’m bad at sticking to budgets,” he said at his shop.

There was much pressure for the M40 group, said Mohan, as prices for everything had increased.

Rozaidi (right) and wife Zirwatul Amal Damin with sons Muhammad Adam and Muhammad Qayyum are eating out less often now.

“Being involved in the retail side of things too, the prices of things like imported tyres and components have gone up.

“Now, how do I make tyres last an additional three months?” he asked, as he shared the struggles of a client, who is an ehailing rider.

“The rider came to me with three punctures in his tyre and I quoted RM135 for a new tyre, but he couldn’t afford it.

“I ended up patching the tyre for RM60, which is all he could afford.

“The compromise here is fixing the tyre that will not last long – this shows what these people are going through,” he said.

Mohan said there was a big disparity between how much people earn and the actual purchasing power.

“Previously, I could walk into an upmarket grocery shop and spend about RM500 for a month.

“Now, it is RM400 a week for me and my sons, and it’s not even on imported goods, just necessities.

“Chicken is about RM20 now and even milk and coffee have gone up in price, between RM3 and RM5.

“People say cooking at home is cheaper, but with two young boys, one chicken is not enough.

“For every meal, I need to spend at least RM100 if I cook at home, so I might as well eat out at the same cost and no clean-up,” he said.

At home, Mohan said his sons were taught to be independent and responsible for their own spending although both get an allowance.

“For Richard, he gets some percentage of commission from specific projects he handles at the shop,” added Mohan.

Richard, who is also an engineering graduate, gets to see a different perspective of running a business from observing his father.

“I learned a lot of things studying engineering.

“Most of my work ethics come from working at automotive events including roadshows.

“Riding motorcycles also lets me learn how things work,” he said.

Richard said he observed the differences of getting things for free with paying for things out of his own pocket.

“I saw how my friends were like with the appreciation they showed their parents for buying them stuff and knowing the value of things when they buy it themselves.

“I got my car with the help of my parents, but I set aside money to maintain it,” he added.