Savers who rushed to lock away money before the end of the financial year in 2023 into short term Isa fixes will be seeing accounts mature now in the run up to the end of the current financial year.

But they are being warned they could find the interest on their tax-free savings plummet to just 0.1 per cent in the worst case.

On £20,000, in the best one-year fix today, savers could get £1,027 interest over a year versus just £20 if they allow their Isa to rollover into a dreadful rate – the startling difference of £1,007.

>> Check the This is Money independent best buy savings tables for the top one-year fixed-rate cash Isas

Locked away: Savers who locked their savings away in a one-year fix this time last year could get a 4% rate. But if they are not careful this could plummet to just 0.1%

At the end of February 2023, the top one-year fixed Isa available to new customers came from Barclays at 4 per cent, according to rate scrutineers Moneyfacts Compare.

This was followed by UBL UK offering 3.91 per cent and Castle Trust Bank at 3.9 per cent.

Savers need to take action if they don’t want to end up with a low rate by giving their Isa provider instructions about what to do with the cash at the end of the term.

Contact your provider – DON’T do nothing…

If you do not provide instructions to Castle Trust Bank about what to do with your money, the one-year fixed Isa converts into something called a maturity holding account.

This has a variable interest rate of a beyond shoddy 0.1 per cent.

Rates compared

If you had £20,000 saved, here is the interest garnered over the year.

Barclays 4% one-year fix opened last March: £815

Barclays 1.65% and 1.2% rate it converts to: £287

Castle Trust 3.9% one-year fix opened last March: £794

Castle Trust 0.1% variable rate it converts to: £20

–

OakNorth 5.02% best buy one-year fix available now: £1,027

Difference vs Barclays: £740

Difference vs Castle Trust: £1,007

If a saver put £20,000 in Castle Trust Bank’s one-year Isa this time last year, they would have earnt around £794 of interest by the end of the term.

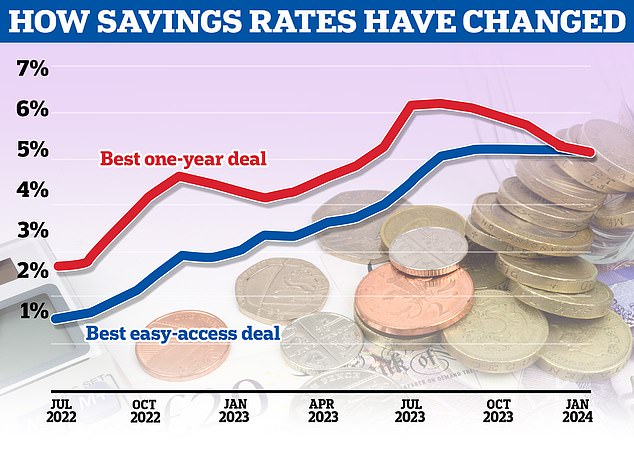

Savings rates have been gently falling in recent months, but the top deals are still better than a year ago.

The top one-year fix now comes from OakNorth offering 5.02 per cent. This would garner £1,027 interest on £20,000 – use our savings interest calculator to work out what different rates mean for your money.

But if the money is left to languish in Castle Trust Bank’s maturity holding account, after a year savers would have earnt a pitiful £20 on £20,000.

Castle Trust Bank will contact customers roughly a fortnight before an account matures.

Savers can provide maturity instructions online via its self service portal.

The rate on Castle Trust’s one-year Isa now is 5 per cent – savers can also choose to move money into this account.

This would mean £1,023 in interest and it is one of the best deals on offer.

At the end of the term for Barclays’ 4 per cent one-year fixed Isa, the account converts into an easy-access cash Isa with a variable rate.

That account pays 1.65 per cent today on balances up to £10,000 – a dip of 2.35 percentage points on the original.

For balances over £10,000, the rate is an even worse 1.2 per cent – a 2.8 percentage point dip.

If you had tucked away £20,000 in Barclays’ fixed-rate Isa, at the end of the term you would have garnered £815 interest.

By leaving money in the one-year account when it matures, you could be missing out on £740 worth of interest by not moving your money to the best one-year fixed Isa.

Barclays also offers a 4.65 per cent one-year fixed-rate Isa, and savers can choose to reinvest in this – but must contact the bank to do this, rather than allowing it to rollover.

Don’t rollover

Even if you contact Barclays and Castle Trust to reinvest in another year, you’ll do far better than not acting at all…

On £20,000, the Barclays variable rate in coverts to offers just £287 interest.

If you opt for its one-year Isa again, you’ll get £940 interest.

For Castle Trust, you’ll get just £20 interest if it rolls over.

Whereas, if you opt for its decent 5 per cent one-year fix, you’ll get £1,023 interest.

Like Castle Trust Bank, you must also provide UBL UK with instructions about what you want to do with your Isa money.

If you want to withdraw and re-invest your money in another best buy account, you must write to the bank instructing them that you want to withdraw your money at least one business day before the maturity date.

If you do not, UBL will automatically roll your cash Isa into a cash Isa which is either identical or reasonably similar to your matured account.

The interest rate will be whatever interest rates offered by UBL UK at that time. The rate on UBL’s one-year fixed Isa is now 4.56 per cent.

With the best one-year fixed Isa rate now 5.02 per cent and the best easy-access Isa at 5.08 per cent, you would be missing out on a better interest rate if you left your money sitting in UBL’s one-year fixed Isa.

UBL UK will write to you at least fourteen days before your cash Isa matures to ask what you would like to do with your cash Isa money at maturity.

Savings rates peaked above 6 per cent but have come down sharply since autumn

What are your options when your fixed-rate Isa is maturing

If you want to lock in your money again for a year, the best one-year fixed-rate is from OakNorth and pays 5.02 per cent. Crucially it allows transfers in from other providers.

Fixed-rate accounts have been falling across the board but one-year fixed Isas have crept up to above 5 per cent in recent weeks from 4.7 per cent.

READ MORE: Five best cash Isas 2024: Find top fixed-rate and easy-access tax-free deals

The best-two year fixed Isa pays less than the top one-year fixed Isa. Savers can get a 4.65 per cent two-year fix from Close Brothers Savings.

For those who need ready access to their cash, easy-access Isas are also paying more than 5 per cent.

The best of the rest is Zopa’s easy-access Isa, which pays 5.06 per cent. This is a variable rate so it could fall.

The message here is that when locking away your money for a fixed period, it is vital that you are fully aware of what will happen to the rate on your savings when the term ends.

Rachel Springall, finance expert at Moneyfacts Compare said: ‘It is vital savers are conscious of any conditions and make sure they give their instructions on how they want to access their cash on maturity if it’s a fixed account.

‘Some accounts can automatically move money into an instant access alternative which may pay a poor return.

‘Those with a fixed rate Isa could set a diary reminder to review their account a month or so before the end of its fixed term, to give them some time to explore new options.

‘Savers would do well to review any older existing pots and switch their Isa to a better deal to maximise the interest they earn, and not cash them to keep their tax-free status.’

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report