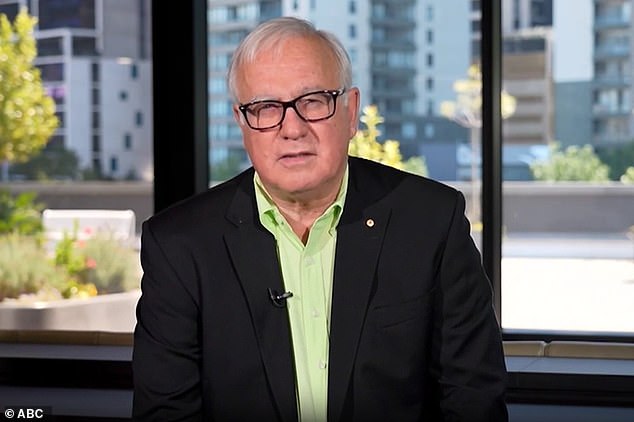

The ABC’s finance expert Alan Kohler has described the housing affordability crisis as Australia’s worst ever financial mistake

- ABC’s Alan Kohler said housing affordability crisis worse ever mistake

- Adelaide now Australia’s second least affordable compared with income

- READ MORE: Reserve Bank blames immigration for unaffordable homes

The ABC’s finance expert Alan Kohler has described the housing affordability crisis as Australia’s worst ever financial mistake.

The situation is now so bad that a median-priced house is unattainable for a single, average-income earner even in the traditionally more affordable capital cities.

Adelaide, he pointed out, is now Australia’s second least affordable capital city when the state’s average, full-time salary is compared to the city’s median property price.

In January, the median price for houses and units in Adelaide was $721,376, which is 7.9 times higher than South Australia’s average full-time salary of $91,026.

This was well above Australia’s national debt-to-income ratio of 7.5 – itself well above the banking regulator’s ‘6’ threshold for mortgage stress.

‘There are a couple of things that might surprise you: Adelaide became the second, least affordable Australian city last year,’ Mr Kohler explained.

‘Adelaide has just taken over from Hobart in second place.

‘What’s going on: put simply, incomes in Adelaide, Hobart and Brisbane are not keeping up with house prices, which are being pushed up by fast-rising population and by first-home buyers.’

Mr Kohler, a baby boomer, noted that when he and his wife bought their first home in Melbourne for $40,000 in 1980, he was earning $11,500 as a journalist. This meant his home cost just 3.5 times his income before a mortgage deposit.

‘When my wife and I bought our first house in 1980, the average house price was 3.5 times average income,’ he said. ‘Now, it’s 7.5 times and rising.

‘That didn’t have to happen: it’s Australia’s worst, economic mistake.’

The Reserve Bank in November raised interest rates for the 13th time in 18 months, taking the cash rate to a 12-year high of 4.35 per cent, which has also diluted what banks can lend.

Australians wanting to buy a property are now unlikely to be able to borrow more than five times their salary, locking younger, single buyers out of the market unless they have help from their parents or part of a double-income couple.

The Australian Prudential Regulation Authority is concerned when a borrower owes more than six times their salary after a mortgage deposit, with this situation occurring when the RBA cash rate was still at a record-low of 0.1 per cent.

First-home buyers made up a third of the housing market in December.

Mr Kohler said parents were increasingly propping up the mortgage deposits of first-home buyers, as first-home buyer subsidies from the federal government only pushed up property prices.

‘Despite rising prices and crushing interest rates, first-home buyers were the fastest-growing type of borrower,’ he said.

‘The Bank of Mum and Dad coughing up early inheritances and politicians showering them with grants and concessions, desperate to appear to be doing something about affordability while actually making it worse.’

Along with high interest rates – record-high immigration is pushing up houses prices and worsening rental availability.

The 518,000 net overseas migration level of 2022-23 was almost five times the level of two decades ago.

This meant skilled migrants with money ended up buying property so they weren’t competing with international students for scarce rental accommodation.

Australia’s median property price of $759,437 in January was 7.6 times the national, average full-time of $99,174, with bonuses and overtime included.

Sydney is the world’s most expensive property market, after Hong Kong, when property prices were compared with income.

The city’s median house and unit price of $1.122million in January was 11.3 times the average, full-time salary of $98,675 in NSW.

But Hobart is still relatively dear, having a debt-to-income ratio of 7.5 based on the median home price of $651,807 and a lower, average, full-time salary of $86,819.

This jumped to 7.7 based on the Tasmania’s average, full-time pay of $84,203 before bonuses.

Daily Mail Australia came to similar conclusions to Kohler, but found Brisbane instead of Adelaide to be the second most expensive capital city market.

The Queensland capital had a debt-to-income ratio of 8.2 based on a median dwelling price of $796,818 divided by the state’s average, full-time salary of $97,115.

Australia’s most unaffordable housing markets

SYDNEY: Debt-to-income ratio of 11.3 based on median house and unit price of $1,122,430 and NSW average, full-time salary of $98,675

BRISBANE: Debt-to-income ratio of 8.2 based on median house and unit price of $796,818 and Queensland average, full-time salary of $97,115

ADELAIDE: Debt-to-income ratio of 7.9 based on median house and unit price of $721,376 and South Australian average, full-time salary of $91,026

MELBOURNE: Debt-to-income ratio of 7.9 based on a median house and unit price of $777,250 and Victorian average, full-time salary of $98,358

CANBERRA: Debt-to-income ratio of 7.8 based on a median house and unit price of $842,971 and Australian Capital Territory average, full-time salary of $107,484

HOBART: Debt-to-income ratio of 7.5 based on median house and unit price of $651,807 and Tasmanian average, full-time salary of $86,819

PERTH: Debt-to-income ratio of 6.1 based on a median house and unit price of $676,823 and West Australian average, full-time salary of $110,282

DARWIN: Debt-to-income ratio of 5 based on a median house and unit price of $501,520 and Northern Territory average, full-time salary of $98,342

Source: CoreLogic median dwelling price for January (houses and units) and Australian Bureau of Statistics total average, weekly ordinary time earnings (seasonally adjusted) including overtime and bonuses for May 2023

Read more

News Related-

Window opens for Zahid to ride off into the sunset – but at Anwar's cost

-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport