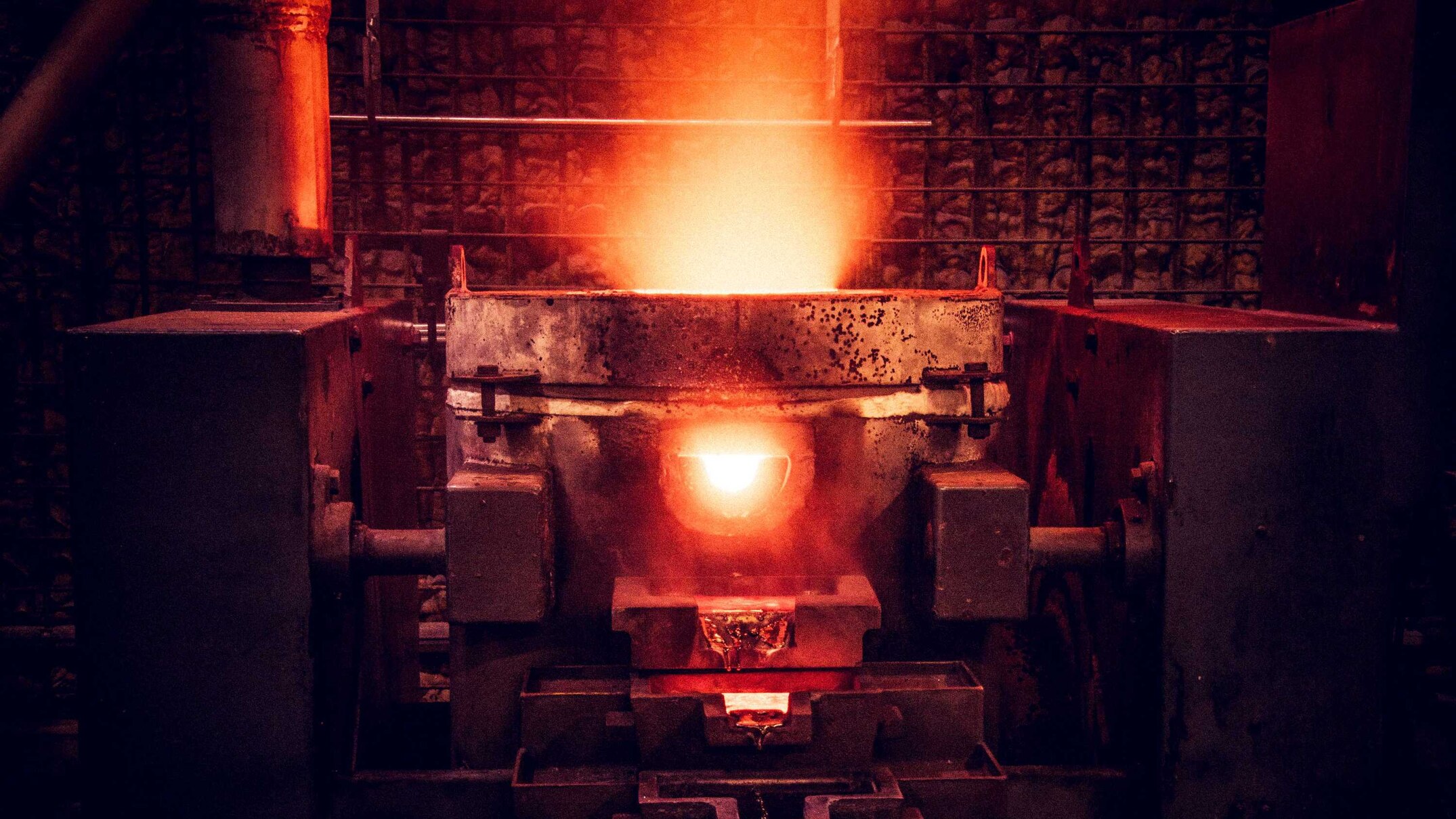

The gold price continues to heat up, like this furnace which burns at close to 1,000 degrees Celsius for a gold pour. (ABC Goldfields: Jarrod Lucas)

In recent months, gold’s market value has surged to record highs.

In Australian dollar terms, the price of the precious metal has soared more than 20 per cent this year, sitting above $3,700 an ounce.

According to some of the world’s most famous gold bulls, that price will continue to rise significantly by the end of the year.

Canadian billionaires Pierre Lassonde and Eric Sprott had top billing on an investment podcast hosted by Arlington Group Asset Management last week, where predictions for gold over the next 12 months ranged from $US3,500 to $US8,000 an ounce.

“Am I being bullish on gold for the next few years? One hundred per cent,” Mr Lassonde said.

If those predictions come to pass, it could have a transformative impact on the Australian gold sector, which for years has enjoyed a healthy buffer against the US dollar exchange rate.

Gold is touted as the ultimate store of value and in periods of global turmoil, prices have typically gone up.

Amid rising interest rates, an upcoming US presidential election and wars in Ukraine and the Middle East — all of which have come hot on the heels of a global pandemic — and it is fair to say there is no shortage of global uncertainty.

“Gold is a safe haven that investors will gravitate to during times of uncertainty,” private wealth investor Phil George told ABC Perth.

“When investors might be concerned about what’s happening with equity prices, or they might be concerned about what the share market’s doing, or property markets, and obviously geopolitical risks.”

Why is the price going up?

Put simply, demand is driving up prices.

John O’Donoghue, depository general manager at the Perth Mint, which is Australia’s biggest refiner of precious metals, said an increasing number of people wanted to open an account and trade with the mint.

“With gold in the media spotlight, it definitely gets people more interested in purchasing gold,” he said.

“When the price is running hot, as it is at the moment, that sees existing customers looking to maybe top up their allocation and brings new customers to the table.

“Additionally, we will see some people looking to sell out and realise some gains.”

However, he said most of the demand for the Perth Mint’s products was from overseas, from institutions.

Veteran resources commentator Tim Treadgold said that was happening across the board.

“It’s coming from a number of directions, particularly from the world’s central banks, which are getting a bit edgy about owning too many US dollars or the currency of other countries,” he said.

“It’s coming from private investors, particularly in China, who are worried about the state of their country’s economy.

“And it’s just building up pressure in gold. And it’s finally breaking up.”

Mr George said it was gold’s ability to hold value that attracted buyers.

“It’s a very attractive hedge against inflation, which is another way of saying, protecting the buying power that your wealth gives you today,” he said.

“A fall in the confidence that consumers have in the value of the dollars that they hold, because they’ve been diluted, essentially … they start selling dollars and they buy gold, which is the ultimate store of value.”

He said post-COVID inflation had boosted gold’s allure.

Throw in some geopolitical uncertainty and central banks wanting to ensure their reserves were solid and you have a perfect storm.

According to Melbourne-based mining consultancy Surbiton, Australian gold miners produced a combined 304 tonnes of gold last year.

The result, worth about $32 billion at current metal prices, was down from 313 tonnes in 2022.

Surbiton director Sandra Close said while gold production was off nearly 3 per cent, it was due to miners blending in lower grade ore amid higher prices.

“It’s really nothing to worry about with this decline on an annual basis, because gold prices have been going up and up,” she said.

“When they rise, a lot of operators reduce their head grades. But what they’re doing is maximising their gold output over the life of their mine.”

Billionaire bullish on gold

During the 1980s, when gold prices boomed in Australia, Mr Lassonde founded the world’s biggest gold royalty company, the New York Stock Exchange-listed Franco-Nevado Corporation.

In Western Australia, it collects royalties from various operating mines, including South Kalgoorlie and the Duketon, Bronzewing and Wiluna mines in Western Australia’s northern Goldfields.

Mr Lassonde said demand was being driven from investors of all sizes.

“Who’s buying gold? It’s the family offices, it’s the people who are buying physical gold and putting it in the vault and that is their insurance against the deterioration of the US dollar,” he said.

“For sure there is a premium in the gold price because of the Middle East situation. How much of a premium? Maybe 10 per cent.”

He said central banks bought more than 1,200 tonnes of gold, equivalent to one-third of global production.

“The first two months of this year, gold imports through Hong Kong were 372 tonnes,” he said.

“If you annualise that, that’s two-thirds of all the gold produced this year is going into Hong Kong. That’s absolutely incredible.”

He said the Chinese appetite for gold was stemming from the inability to invest in real estate and cryptocurrency and he expected the demand to continue for several years.

Aussie miners finally benefit

Almost 70 per cent of Australia’s total gold production comes from WA, which has seen significant flooding in recent months.

Despite that, and miners cashing in on higher prices by processing lower grade ore, Mr O’Donoghue said refining figures had so far remained the same.

“We haven’t seen a drop in the amount of gold we’re receiving from our customers. What we’ve received so far is in line with our expectations.” he said.

The Perth Mint turned over $23 billion last year, and Mr Donoghue believed that number was likely to be significantly higher this financial year.

“We would expect that to be the case, but we’ll have to wait until the end of the financial year to get the final numbers,” he said.

Mr Lassonde said for miners, the galloping spot price for the shiny precious metal had surprisingly not equated to higher share prices.

“The margin that these companies are going to provide is enormous and yet the stocks are barely moving,” he said.

In recent weeks, that has started to change and Kelly Carter, chair of WA’s independent Gold Industry Group, said that allowed miners to plan for their future.

“There’s obviously significant investment in exploration at the moment,” she said.

“This not only allows for the extension of mine life of existing mines in the state … and brownfields exploration, but I think more excitingly, it really does support that investment in greenfields exploration, which is obviously a significant part of the future of mining.

“Every producer at the moment will be looking at how they can best capitalise on the higher prices.”

Ms Carter said that may mean mining additional material that would have otherwise not been economic, skills and training development, and investments in the communities that surrounded their operations.

“But what we need to do is make sure that we’re positioned in order to continue to sustain those activities when current prices come off, which inevitably, they will,” she said.

But for the moment, gold is having another moment in the sun.

“I think, in a balanced portfolio, 8 to 10 per cent gold feels about right, and maybe that’s a combination of bullion and gold equities,” Mr George said.

“It’s a good 21st present too. If you really want to chip in for it, you can buy little mini bars.”

News Related-

High court unanimously ruled indefinite detention was unlawful while backing preventive regime

-

Cheika set for contract extension as another Wallabies head coaching candidate slips by

-

Analysis-West's de-risking starts to bite China's prospects

-

'Beyond a joke' Labor won't ensure PTSD protections: MP

-

Formula One season driver ratings: Lando Norris shines as Max Verstappen nears perfection

-

Catalina golfer Tony Riches scores Guinness World Record four holes in one on same hole

-

Florida coach Billy Napier fires assistants Sean Spencer, Corey Raymond with expected staff shakeup ahead

-

Rohingyan refugee NZYQ accidentally named in documents published by high court

-

Colorado loses commitments of 2 more high school recruits

-

Queensland Health issues urgent patient safety alert over national bacteria outbreak

-

Townsville Community Pantry 'distressed' by fruit, vegetable waste at Aldi supermarket

-

What Is The Beaver Moon And What Does It Mean For You?

-

Labor senator Pat Dodson to resign from politics due to health issues

-

Hamas releases 11 more hostages, as Israel agrees to extend ceasefire