China Trade and Investment in BRICS – Scope for an Alternative Payment System?

Jaya Josie, Advisor China Africa Center, Zhejiang University International Business School (ZIBS); Adjunct Professor University of the Western Cape and University of Venda

The recently published (2024) Government Work Report (GWR) in China presented several economic targets for the country. The key indicator target of the GDP remained unchanged from 2023 at 5%. The GWR noted that the GDP is in a recovery mode and therefore the target was not changed.

China is already encountering pressure from the USA to curb its production capacity and exports to Russia by Chinese companies. These sentiments were articulated during the recent visit by the USA Treasury Secretary, Janet Yellen on 8 April 2024.

China’s response to these statements from its Foreign Ministry Spokesperson Mao Ning was quick to defend China’s sovereign right to defend its companies and, trade with its long standing partners. Russia, in fact has been diversifying its foreign trade to the Asia-Pacific market where China is fast becoming a key trading partner.

In 2023, according to customs data from China, Russia-China trade increased to a record level of US$240 billion, far exceeding the amount of US$ 240 billion set by the trading partners. Mao Ning’s remarks only further emphasised China’s position of continuity in China’s foreign policy decisions taken at the recent Two Sessions of the National People’s Congress (NPC).

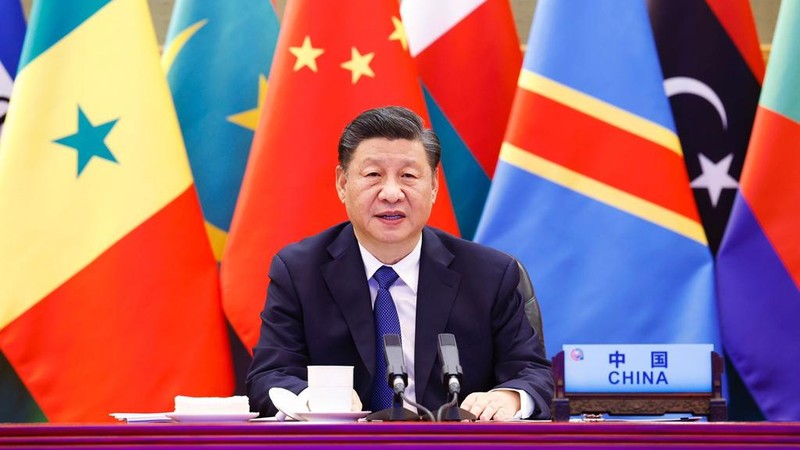

China’s foreign policy position was recently demonstrated in the relationship with its BRICS partners and, was further underlined by a visit to Beijing by the Russian foreign Minister Sergei Lavrov on 9 April 2024 to meet with the Chinese foreign minister Wang Yi. The visit, immediately after the visit by USA Treasury Secretary, Janet Yellan, underscored the growing economic and trade ties between China and Russia.

At the meeting the Russian and Chinese foreign ministers agreed to initiate talks with respect to the Eurasian security issues, sanctions concerns within BRICS and the Shanghai Cooperation Organization (SCO). The BRICS + group of countries is perceived globally as an emerging centre of economic cooperation and a viable alternative to the current global economic framework.

In anticipation of further threats of sanctions the foreign ministers discussed a proposal by Minister Wang Yi to use multilateral formats such as BRICS + and the SCO as a mechanisms to overcome sanctions. The foreign ministers meeting noted that none of the BRICS + members have joined the sanctions and, in fact, many of the BRICS + countries have increased trade with Russia.

Almost a year ago the media in South Africa was awash with articles in preparation of South Africa hosting the much anticipated BRICS Summit in August 2023. Articles speculated intensely about the possible launching of a BRICS currency that would facilitate intra-BRICS trade and move away from dependency on the US Dollar.

Despite all the hype around a BRICS currency the BRICS Summit did not launch a currency for intra-BRICS trade payments. Instead the BRICS group resolved to promote the use of own currencies for mutual trade in the bloc. With the expansion of the BRICS group to include five more countries from the global South into its ambit and the need for a trade payment system less dependent on the US dollar is becoming more and more imperative.

In addition to South Africa two more African countries, Egypt and Ethiopia, have now joined the group. From the middle east Saudi Arabia, Iran and the United Arab Emirates have also now formally joined the group in January 2024.

Foreign Minister Wang Yi’s proposal for providing a mechanism for the BRICS multilateral group to overcome to develop mechanisms to overcome sanctions is slowly developing.

Currently, although old and new members are making efforts to trade and invest in their own currencies, they still use the US dollar for transactions. The reason for this is that the US dollar is an established reserve currency that is accepted globally. Amongst the BRICS nations only the Chinese Renminbi has achieved the status of an international reserve currency. South Africa, Brazil and some new BRICS countries have currencies that are internationally convertible but are not accepted as reserve currencies.

China’s Renminbi (RMB) accession to the status of reserve currency by the International Monetary Fund (IMF) was confirmed in October 2016 when the IMF decided that RMB met the criteria for inclusion into its Special Drawing Rights (SDR) basket. The Chinese three month yield Treasury Bonds was added to the basket and also used to set SDR interest rates.

As significant as this may have been for China at the time, recent developments however suggest that China is addressing internal monetary policy issues that will facilitate the wholesale use of the RMB as a reserve currency for trade and investment amongst the BRICS nations.

China, South Africa, Brazil and Russia have all signed mutually beneficial swap agreements whereby each country keeps a certain amount of the RMB and China retains a certain amount of the currency of the other country. These amounts are then used for mutually beneficial trade using own currencies. The post-pandemic economic growth was subdued for most of the BRICS countries. Notwithstanding, the Covid-19 challenges China’s economy has rebounded.

With the ever present threat of sanctions and hanging over member countries of the expanded BRICS the group is looking for alternative payment mechanisms. Among the options being considered is the use of own currencies. To date Russia and China trade with each other using the Yuan (CNY).

In 2022 the Rand Merchant Bank in South Africa reported that South African importers of goods from China prefer being invoiced in Yuan as importers and suppliers derive benefits from such transactions. Suppliers in China potentially pay a lower price for goods and are likely to pass these lower prices as discounts to South African importers. The forward cover for most Chinese suppliers is lower in CNY/South African Rand (ZAR) than in US$/ZAR as interest rates are currently higher in China than in the USA.

Another advantage is a lower currency risk for importers and suppliers as the South African Rand is considered a volatile currency in relation to the US$, but less so in relation to the CNY and, lower volatility means lower risk as the weakening of the Rand against the Yuan will limit currency losses in the transactions.

There are also tangible benefits for Chinese suppliers invoicing in Yuan as the currency risk resulting from using the US$ is eliminated.

Chinese exporters receive 6% to 16% tax rebates much quicker for invoicing in Yuan than they would if they invoiced in US$.

Other trade payment mechanisms are also being considered globally. In 2021 it was reported that the Bank of International Settlements (BIS) was going to test the use of central bank digital currencies (CBDC) in a pilot scheme called “Project Dunbar” that involved Australia, Malaysia, Singapore and South Africa.

The aim of the project was to consider if using a CBDC payment mechanism could lead to a more efficient global payment platform that will enable international settlement in digital fiat currencies issued by national central banks. The BIS averred that such a system will allow direct transactions in CBDCs between institutions, while reducing time and costs.

Today China leads in using CBDC for payments domestically and internationally central banks are considering such payment technologies that were initiated by tech firms such as China’s Ant Group.

The possibilities of a new payment mechanism for international trade will be strengthened by the expansion of the BRICS group in January 2024 to include Saudi Arabia, the United Arab Emirates (UAE), Egypt, Iran and Ethiopia. In an article in the Review of the International Monetary Institute (IMI) published (2024.03.12) by Renmin University in Beijing, Herbert Poenisch (Senior Fellow at Zhejiang University and former senior economist at the BIS) suggested that five new currencies will be included for payments and mutual holdings in the BRICS group.

However, he argued that the BRICS lack a vehicle currency such as the Euro in the European Union. In the same way that the German Mark (D-Mark) was used as a transition vehicle currency before the European Central Bank established the Euro, China’s Renminbi will possibly become the new prime holding currency for trade in the BRICS group.

Added to South Africa, Brazil and Russia, Saudi Arabia and the UAE have begun trading using the Renminbi independent of a denominator currency and serve to promote the Renminbi as an international reserve currency. In the event of the Renminbi impacted by currency limitations the UAE Dirham has full capital account convertibility for residents and foreigners and is open to trading in all the other BRICS currencies.

Both the Renminbi and UAE Dirham may be able to serve the role of a vehicle currency in the short term for the BRICS group. The UAE’s well developed financial centre can offer BRICS partners Dirham instruments, deposits and convertibility options with minimum risks.

Poenisch argues that the UAE could play a significant role as the Economic Policy Uncertainty (EPU) mechanism, by accepting weaker currencies for remittances or Renminbi for imports from Chin, and later disposing of them or augmenting Dirham reserves.

The international media reported that Janet Yellan’s statement during her recent visit to China amounted to a threat with respect to China’s trade with Russia and the export of goods to the USA and other western countries. The statements by the US treasury secretary that cheap goods from China is flooding the USA markets and poses a risk to manufacturing in the USA and other countries.

This statement goes against the economic principles of comparative advantage in trade and the World Trade Organisation (WTO) policy against protectionism. The argument that China has over capacity due to unfair subsidies does not take account of China’s planned economic policy to achieve net zero carbon emissions by 2030 that focus on clean technologies and high firm level robust competition in China.

If these goods are produced cheaply the world should be grateful to China that we are moving towards a greener economy and mitigating the effects of climate change. If the expanded BRICS group institutes a new payment mechanism for international trade within the group that manages to overcome the risk of sanctions then the threat of sanctions may be less significant in the long term.

The mechanism options discussed above should be considered by the BRICS central banks if the BRICS countries wish to avoid falling into the sanctions trap and monetary policy economic uncertainty.

News Related-

Antoine Dupont still hurt by 'injustice' of World Cup loss to Springboks

-

China's New Aircraft Carrier Begins Catapult Testing

-

Aircraft Downed Inside Russia By Patriot System: Ukrainian Air Force

-

“Am I Prog’s Taylor Swift? That’s a debate that could run and run”: why Peter Hammill re-recorded his Enigma-era albums

-

Car With Pro-Russian Fighters Blown Up by Resistance: Exiled Mayor

-

Europe and African nations must find effective common ground in dealing with migration influx

-

Springbok lock opts not to renew contract with URC team

-

Pravin Gordhan’s deathly legacy: A threat to SA’s economic future

-

Antoine Dupont STILL hurt by ‘injustice’ of Rugby World Cup loss to Springboks

-

Rubber stamping NHI Bill will have damaging consequences for SA for generations

-

Inside horrific conditions Hamas hostages suffered including losing 15lbs in 50 days

-

After the Bell: SA’s NHI healthcare disaster starts right here

-

Gupta-linked development land for sale

-

Gary Neville begrudgingly claims brilliant Man Utd midfielder ‘looked like a Man City player’ in Everton mauling