Silhouette of a bull standing on top of a landscape with the sun setting behind it

I think this company looks like an exceptional opportunity to invest in at the moment for passive income. Not only is the dividend yield good, but the valuation looks incredibly attractive to me.

Here are the main reasons I’m buying it for my portfolio.

Impax

Impax Asset Management (LSE:IPX) is a UK-based investment firm that focuses on environmental markets, particularly in resource efficiency.

It manages funds and accounts that invest in companies that work in renewable energy, water management, waste technology, and sustainable agriculture.

The firm chooses its investments by analysing long-term changes in global trends, and it caters to a range of regions across the world.

Convincing financials

First of all, I think Impax has a lot of stability at the moment, considering its balance sheet has 71% of its assets balanced by equity. This matters to me because the future is often uncertain, and having minimal debts means the firm is well-protected from unexpected challenges.

Also, its revenues have been growing fast. Over the past 10 years, it’s been growing its top-line income by 29% on average every year.

It looks cheap to me, at 68% below its high and selling at a price-to-earnings ratio of 14. Particularly, its valuation, based on my discounted cash flow analysis, shows that it could be 60% undervalued.

I estimated this by projecting earnings per share growth of 20% per year over the next 10 years. That’s conservative, considering it grew its earnings at 37.4% each year on average over the last decade.

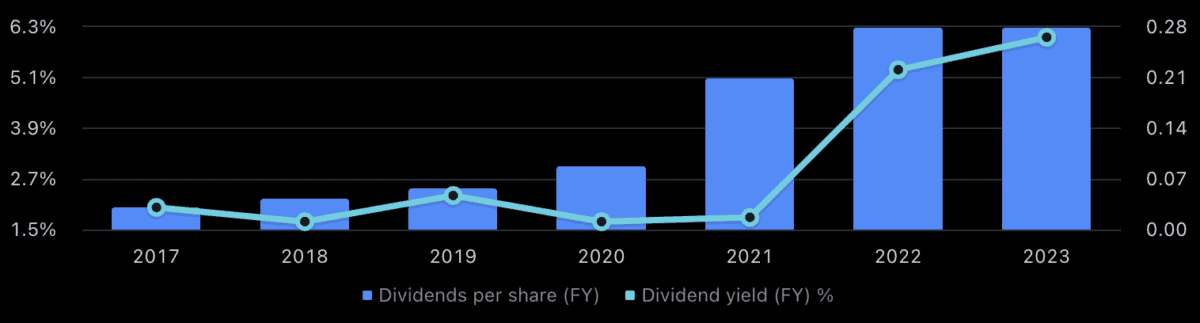

Of course, as I was looking for dividends when I found this company, its higher-than-usual yield means I could pocket some nice cash over the next few years if I buy the shares now:

In £ – Source: TradingView

Risks I’ve noticed

However, Impax pays out 78% of its earnings as dividends at the moment. While that’s nice and contributes to its high 5% dividend yield, it means it isn’t reinvesting much of its net income into its funds at this time.

Even if the company decides to maintain this, it’s arguably not sustainable. That’s why I think the yield will go back down to 1%-2% soon, which is the level it was at prior to 2022.

Also, while I noted its excellent revenue growth above, this has slowed down in the past 12 months. That further emphasises that there’s no guarantee the great financial results will continue.

Why I’m buying it

Although there’s a lot I love about this company, I reckon the high dividends are temporary. That means I need other reasons to make an investment in the firm, as the residual income might not last.

Because I want exposure to environmental, social, and governance (ESG) investing, I’ll buy it next time I have some spare cash to invest. It especially seems good to me because the price is so low right now.

The thing is, if I take the dividends out of the equation, it’s still something I’d buy. Why? Because over the past 10 years its grown in price 773%. While past returns are no guarantee of future success, that does give me confidence in a winning track record.

Next time I make more investments, Impax is one company I’m buying a stake in.

5 Shares for the Future of Energy

Investors who don’t own energy shares need to see this now.

Because Mark Rogers — The Motley Fool UK’s Director of Investing — sees 2 key reasons why energy is set to soar.

While sanctions slam Russian supplies, nations are also racing to achieve net zero emissions,

he says. Mark believes 5 companies in particular are poised for spectacular profits.

Open this new report — 5 Shares for the Future of Energy

— and discover:

- Britain’s Energy Fort Knox, now controlling 30% of UK energy storage

- How to potentially get paid by the weather

- Electric Vehicles’ secret

backdoor

opportunity - One dead simple stock for the new nuclear boom

Click the button below to find out how you can get your hands on the full report now, and as a thank you for your interest, we’ll send you one of the five picks — absolutely free!

Grab your FREE Energy recommendation now

More reading

Oliver Rodzianko has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report