Is UPI making you overspend or helping you save money?

A small UPI code peeks out of the green coconuts heaped on Yuvraj Yadav’s handcart outside a park in Delhi’s GK-1. “I get 90% of my money through it,” says the 18-year-old, pointing to the QR code.Â

This is nothing unusual for Indians now, for they have been witness to a payments’ revolution. From paying for tender coconuts to cutting chai, from giving alms to settling the bill at a fine-dining restaurant, people are simply whipping out their phones and using the indigenous United Payments Interface (UPI) platform.Â

The seamless transaction system, however, has fuelled a silent epidemic. The epidemic of overspending.

Around 74% of the 276 people surveyed by IIIT Delhi, in what it claims to be the first study on spending behaviour of people using the government’s UPI, said they were spending more after adopting the e-payments system.

This is interesting because human beings have been trading in currencies for centuries and their spending and saving behaviour has evolved around cash.

One might argue that plastic money in the form of credit cards has been there for decades now, but come to think of it, UPI is different from credit cards as no interest is charged. Also, the penetration of UPI is much more than that of credit cards. The mobile-to-bank transfers have done away with the need for a point-of-sale (PoS) machine, which is needed for credit or debit cards.

So, on the payment band, UPI is somewhere between cash and credit cards. Â

However, there are two sides to the UPI coin. If some people are spending more, anecdotal evidence suggests there is a segment of people who are now saving money because of UPI.

Yuvraj Yadav, who sells tender coconuts in Delhi’s GK-1, bears testimony to that. But before we look at his side of the coin, let us find out how and why people believe they are overspending because of UPI.

WE ARE SPENDING MORE BECAUSE OF UPI, SAYS SURVEY

“Does the convenience of UPI push us to spend more? I feel the tangibility of cash makes us conscious about how much we spend. Paying 5×500 notes in cash is more painful than paying 2500 on UPI. What has been your experience with UPI and spending?” asked Bengaluru-based Dharmesh Ba on X in 2022.

Dozens of people responded to his question and most agreed that they were now spending more because of UPI.

Dhruv Kumar, Assistant Professor at IIIT Delhi, and two of his students, Harshal Dev and Raj Gupta, conducted a survey to find out if UPI had indeed changed people’s spending habits.

They used Google Forms and surveyed 276 individuals aged 18 and above. The participants were from diverse backgrounds, age groups and occupations.Â

“A significant majority, 74.2% of the respondents, admitted to experiencing increased spending after adopting UPI,” Dhruv Kumar, Assistant Professor of IIIT Delhi, tells IndiaToday.In.Â

He says the study is pivotal and reveals how India’s push for a digital economy is potentially reshaping consumer habits and economic dynamics in the country.

The survey found 91.5% of the respondents were satisfied with their overall UPI experience and 95.2% finding UPI convenient for making payments.Â

“Users reported using UPI for essentials like rent, groceries, and bills, as well as for work-related expenses and leisure activities like dining out and entertainment, education, online shopping, and even small everyday indulgences like street food and auto-rickshaw fares,” says Dhruv Kumar.Â

What is worth noting here is the entire range of UPI transactions — essential to indulgent and big to small, for which people wouldn’t use a credit or a debit card.

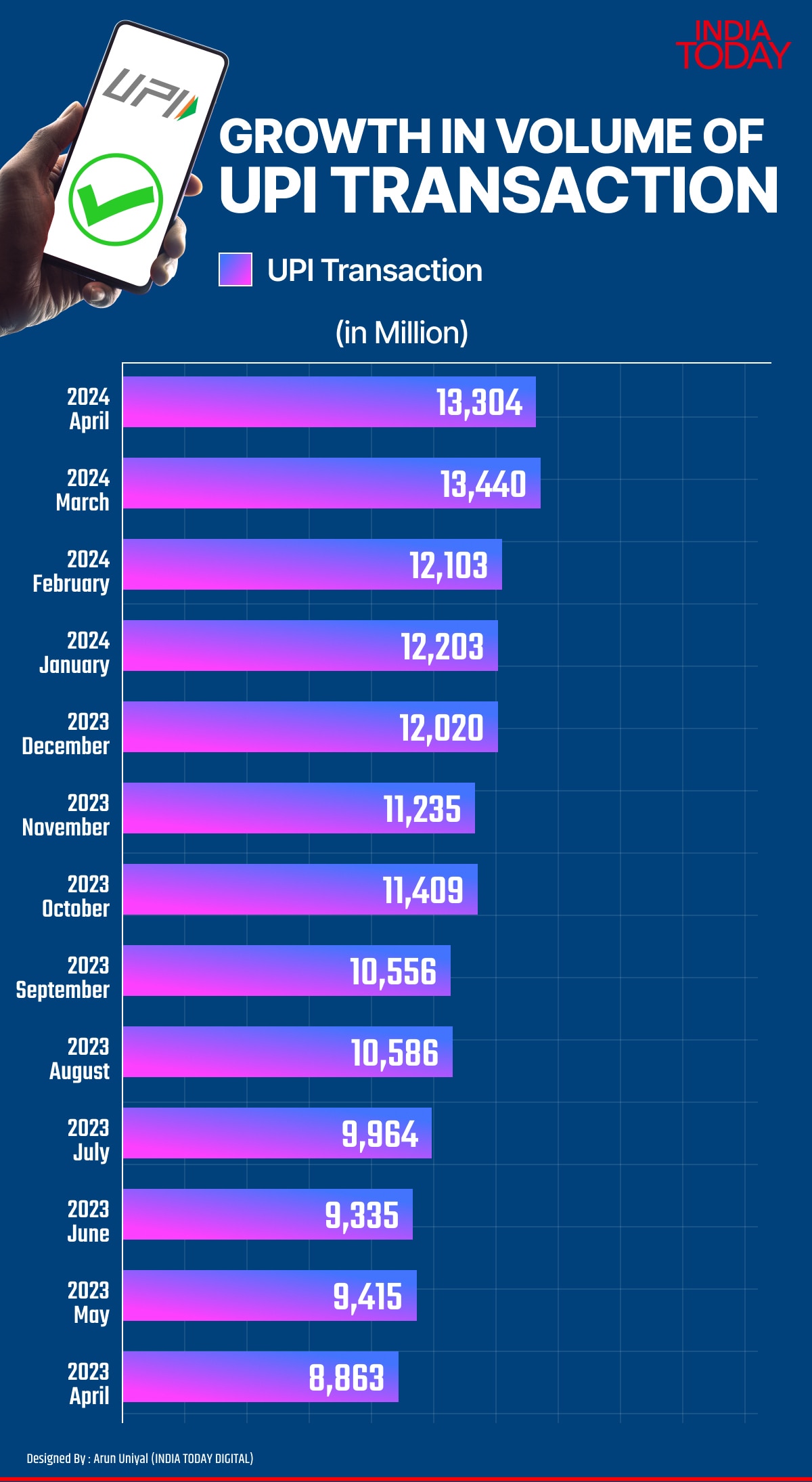

How the number of UPI transactions have grown per month from April 2023 to April 2024. (Source: NPCI)

WHY WE SPLURGE WHILE USING DIGITAL PAYMENT SYSTEMS

Launched in 2016, UPI got a big shot in the arm during the Covid pandemic when people began shunning cash.Â

People who have been recording their daily expenses are seeing a jump in their expenditure and credit that to UPI. Â

“I have been logging my expenses on an Excel sheet since 2018. My expenditure pattern shows that since then, my expenses have increased from 20â25% of my disposable income in 2018 to 60â65% in 2024,” Nihal Makwana, a Gurugram-based marketing professional, tells IndiaToday.In.

We are not talking about overspending because of inflation or consumerism, but due the medium we are choosing for our transactions.

“With cash in hand, it was a constant reminder of how cautious I should be. Earlier, a loaded wallet was a comfort. Now, the wallet is your bank account, and you are always stocked. So, the comfort is never-ending now,” says the 28-year-old Makwana, who has been running a blog on stock markets since 2021.Â

IIIT Delhi’s Kumar emphasised that despite their overall satisfaction with UPI, a significant portion of the respondents in their survey acknowledged the challenges it poses to budget adherence and control over their spending.Â

Obviously, there is ease with UPI. One just needs to scan the merchant or vendor’s QR code, type in the amount, punch in the password and tap enter. Payment’s done!

India sees the highest digital transactions in the world, accounting for nearly 46% of global transactions in 2022, according to the Press Information Bureau. Â

Overspending due to digital transactions, however, is a universal phenomenon.

“Academic research suggests that paying with cash makes people spend more consciously than using digital payments due to its tangible nature, budgeting effect (i.e., helping track expenses), and the psychological pain of giving away cash,” Jose Manuel Linares-Zegarra, Senior Lecturer in Finance at Essex Business School (UK), tells IndiaToday.In.Â

“Paying with cash is more painful. Therefore, e-payments could potentially reduce the pain of paying, making it easier to overspend without realising it,” explains Linares-Zegarra.

OUR SPENDING-SAVING BEHAVIOUR EVOLVED WITH CASH

For centuries, human beings depended on barter for things they didn’t produce. The barter system was based on mutual need and desire.Â

Currency, an abstract concept, took out the need for desires to be matched to conduct trade. Now, you can buy a bucket of fried chicken even if the guy at the store doesn’t need your shirt. Â

The first use of currency is recorded around 3,000 BC in Babylonian civilisation, where people used chunks of silver for trade. Other civilisations began using precious metals for trade around 1,000 BC.

The concept of paper money originated in China during the Tang Dynasty (618â907 AD).

So, for thousands of years, human beings have been spending and saving money in physical form. Remember the piggy bank?Â

Our lives and behaviours have evolved around physical currency notes. Digital payments, of which UPI has become a major part, is a disruptor.

“People have built budgeting practices around cash. There are also issues of financial literacy and trust. Digital payments are relatively new, and these institutions are in the process of adapting,” Professor Bernardo Batiz-Lazo of Northumbria University, Newcastle, tells IndiaToday.In.

“Therefore, you see a number of different behaviours between countries and within countries. So as a society is learning about these new forms, you have people at the extremes,” explains Batiz-Lazo.

EVEN SHOPKEEPERS ARE OVERSPENDING BECAUSE OF UPI

Basudev Chowdhury, who has been running a grocery store in Delhi’s CR Park for the last 30 years, is a witness to this changing behaviour. Â

“Customers are indulging themselves as their purchases aren’t constrained by the physical cash they are carrying. I see more people now giving in to their temptations,” says Chowdhury.

He reveals that even shopkeepers are overspending due to UPI. He says they are now overstocking, and losing money because the hoarded products are crossing their sale-by dates.

“The supplier knows that cash isn’t an issue as the shopkeeper can pay through UPI. I have been lured with better discounts on bulk purchases, and lost money when the products expired,” reveals Chowdhury.

Basudev Chowdhury, who has been running a grocery shop in Delhi for the last 30 years, reveals that even shopkeepers are overspending due to UPI.

The growing popularity of e-payments through UPI in India is evident from data shared by the National Payments Corporation of India (NPCI), which manages the retail payments and settlement systems in India.

According to NPCI, there were 13.3 billion transactions through UPI worth Rs 19.64 lakh crore in April 2024. The number of UPI transactions saw a 50% growth against April 2023 and the amount transferred rose by 40% year-on-year. Â

However, the transition to digital payments is influencing consumer behaviour in complex ways, says Jose Manuel Linares-Zegarra of Essex Business School (UK).Â

“For example, digital payments can increase spending, but it is also important to consider that there are several new tools available to consumers to manage their money,” he adds.

A distinction needs to be drawn here between credit cards and digital payment systems linked to savings bank accounts.

“From the consumer point of view, since one is able to check their account balance, they are spending from what they have. So, there is a reality check. Credit cards do allow you to spend what you don’t have,” Professor Gaurav Raina of IIT Madras tells IndiaToday.In.Â

Professor Raina was the chairman of the Mobile Payment Forum of India (MPFI), which played a key role in setting up the technology standards for mobile payments in India, from 2017 to 2021.Â

HOW INDIANS ARE SAVING MONEY BECAUSE OF UPI

A huge segment of Indians are actually saving money with UPI and that is because the money is landing in their bank accounts.

“I receive 90% of my payments through UPI, and it helps me save money. I use UPI to pay the wholesaler at Azadpur fruit market and use the cash for my expenses. The rest of the money remains as savings in my bank account,” says Yuvraj Yadav, the coconut seller in Delhi.

Professor Gaurav Raina says that since mobile payments enable customers to pay money directly into the bank, even small transactions add up in accounts, giving people from low-income groups the ability to make day-to-day, and long-term, decisions.

“One of the street vendors in ‘UPI â The Untold Story’ (www.upistory.com) states that accepting payments through UPI actually helps to pay the monthly rent,” adds Professor Raina. Â

Anju Devi, a domestic help who lives in Greater Noida mostly requests that people pay her salary by scanning the QR code on her cellphone. She says the money goes directly into her bank account, and only she has access to it.

Earlier, her husband, who is an alcoholic, used to snatch the cash from her to feed his addiction. “Now, he [her husband] has no access to my money and I can use it for my two daughters, and also save some,” says  Anju Devi, who is originally from Bihar.Â

The penetration of UPI and the financial inclusion it has brought has become one of the key achievements that Prime Minister Narendra Modi often talks about and flaunts.Â

In January this year, PM Modi and French President Emmanuel Macron had tea outside Hawa Mahal in Jaipur. Macron was pleasantly surprised when Modi used UPI to pay for the tea and the shopkeeper received confirmation of the transaction instantly.Â

For an inclusive digital economy, the Indian government has kept UPI transactions free and customers aren’t charged an interchange fee. Â

Yuvraj Yadav says UPI is a blessing because now he doesn’t need to turn away any customers because of lack of change. “Now, even sales on credit have come down as people seldom say that they don’t have the exact change and will pay later,” says Yadav.

PM Modi has lauded street vendors for adopting Digital India, calling them the “face of India’s digital revolution”.

For street vendors, UPI is a must-have, says Professor Raina of IIT Madras.

“From a ruralâurban divide perspective, there are still people in cities who might choose not to have UPI, but it is a matter of keeping the business alive for street vendors. So, it is not just good to have. It has almost become a must-have,” says Raina.Â

So, UPI might be making some people overspend because digital payments take away the pain associated with counting and paying in cash, but it is definitely helping people in the lower income bracket run their businesses better and save some money too.

Watch Live TV in English

Watch Live TV in Hindi