Young Caucasian woman with pink her studying from her laptop screen

Investing in shares that are down over 80% can seem daunting. After all, some companies’ share prices fall for good reason. Yet, I think this FTSE 250 business might be an opportunity.

Most people know Dr. Martens (LSE:DOCS) well. It’s become iconic in London, and the brand has spread around the world for its fashionable footwear.

The company has had rich cultural significance since the 1960s. It also initiated a successful turnaround culminating in 2010. But are the shares really worth me owning today?

Doc Martens in 2024

This year, the management is focusing on driving sustainable profitability and growth, focusing on shareholder value.

It currently has a strategy called DOCS, focused on direct-to-customer sales, operational excellence, customer connections, and supporting business-to-business partnerships.

The company now operates in three primary regions: Europe, Middle East, and Africa (EMEA); the Americas; and Asia Pacific (APAC).

It sells products from various segments, including Originals, Fusion, Kids, and Casual ranges.

A closer look at the financials

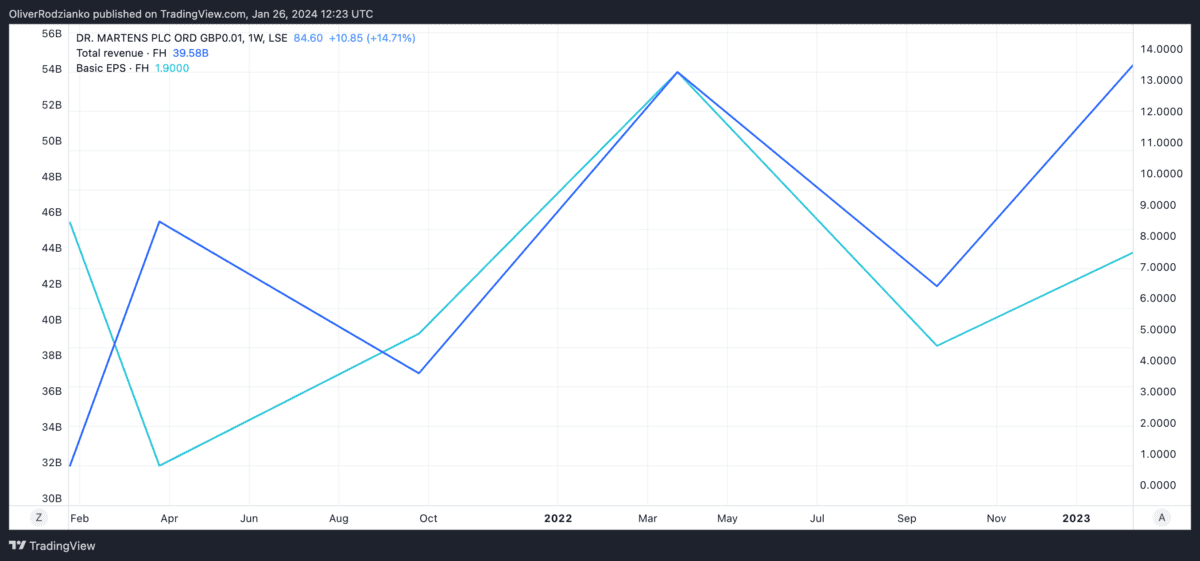

The firm has reported growing revenues and earnings since its initial public offering (IPO) in 2021. However, there’s been significant volatility in the results, particularly for its earnings per share:

Source: TradingView

While the above graph paints a turbulent financial picture for Dr. Martens in the last few years, generally the company’s growth is good.

After all, the firm’s three-year average annual revenue growth rate is over 14%.

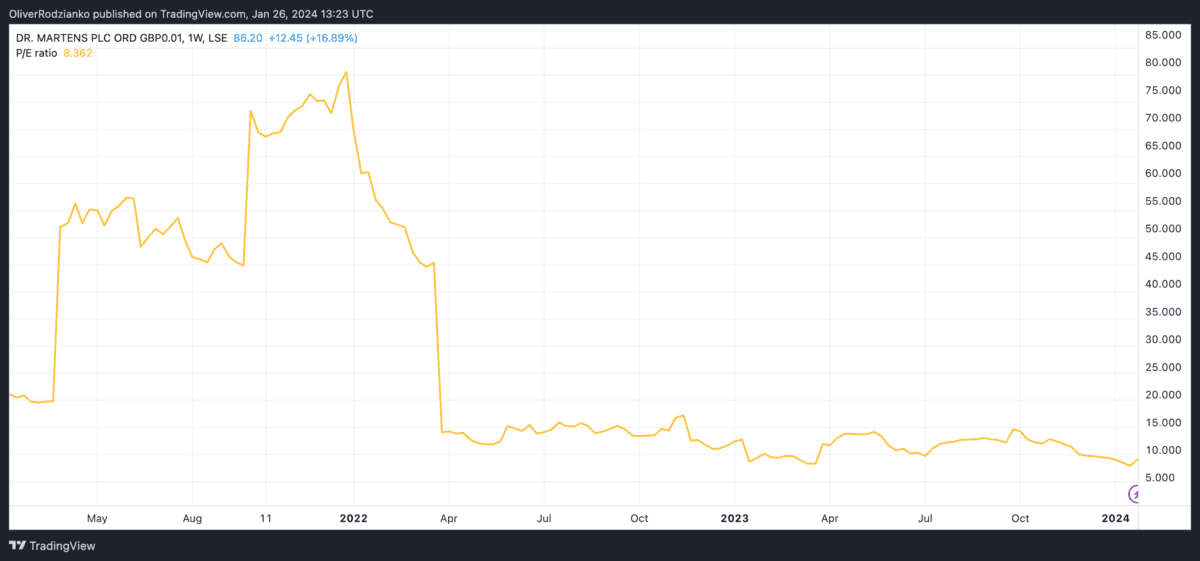

Also, the company’s price-to-earnings (P/E) ratio stands at around eight, particularly cheap compared to past prices. It’s also strong for its sector, considering an industry median of around 19.

Source: TradingView

While the above points look relatively promising to me, the organisation’s balance sheet does present some cause for concern.

As of its last annual report in March, it had £446m in debt and only £158m in cash on its books.

While that’s not terrible, it has gotten worse, and taking into account the trailing 12-month period, it has £530m in debt and £46m in cash. If the company faces economic hardships, it might need to raise more finances to pay its debts.

Other risks I’m considering

As of 26 January 2024, the Dr. Marten’s share price had dropped 39% in a year. While the company faced a significant drop in revenue during the period, it did maintain its trading expectations.

To me, that means such a steep decline in the share price was slightly unwarranted. However, it outlines a risk of volatility for Dr. Marten’s shareholders.

Also, while inflation and interest rates are expected to ease soon, there’s no guarantee of this, and any wider economic setbacks could contribute to reduced consumer spending over some time. Therefore, I think the shares might have slower or even negative growth in the near future.

It’s on my watchlist

I’m taking my time before adding these value shares to my portfolio.

As I’ve learned from Warren Buffett: I don’t need to pick many great investments in my lifetime to end up rich. It’s the quality of the ones I choose that really matters. Deciding on that often takes time.

If I do invest, I’ll be giving it at least five years to start seeing the investment returns I’d like. That’s not something I mind, as I like to buy investments with the intention of holding them for at least a decade.

Should you buy Dr Martens shares today?

Before you decide, please take a moment to review this first.

Because my colleague Mark Rogers – The Motley Fool UK’s Director of Investing – has released this special report.

It’s called ‘5 Stocks for Trying to Build Wealth After 50’.

And it’s yours, free.

Of course, the decade ahead looks hazardous. What with inflation recently hitting 40-year highs, a ‘cost of living crisis’ and threat of a new Cold War, knowing where to invest has never been trickier.

And yet, despite the UK stock market recently hitting a new all-time high, Mark and his team think many shares still trade at a substantial discount, offering savvy investors plenty of potential opportunities to strike.

That’s why now could be an ideal time to secure this valuable investment research.

Mark’s ‘Foolish’ analysts have scoured the markets low and high.

This special report reveals 5 of his favourite long-term ‘Buys’.

Please, don’t make any big decisions before seeing them.

Claim your free copy now

More reading

Oliver Rodzianko has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report