One of the defining characteristics of the bull market is that some sectors lead and some lag. The sectors and themes that do well in one bull market seldom do as well in the next.

Similarly, there is a very high probability that sectors that have not done well in the previous cycle have a great chance of reviving and leading in the next cycle.

These cycles are repeated over time as investors, both individual and institutional, tend to flock to sectors with strong fundamentals and perpetuate a virtuous cycle of strong returns. Initially, these sectors lead to re-ratings and eventually tend to move to a zone of bubble valuations, until a crisis and a subsequent bear market changes the pecking order again.

However, whenever there is a strong drawdown or correction in the markets, given our natural hindsight bias, the first reflexive action is to buy these leaders, as investors see this as a great buying opportunity. Usually, new sectors that lead emerge a couple of quarters into the new bull market.

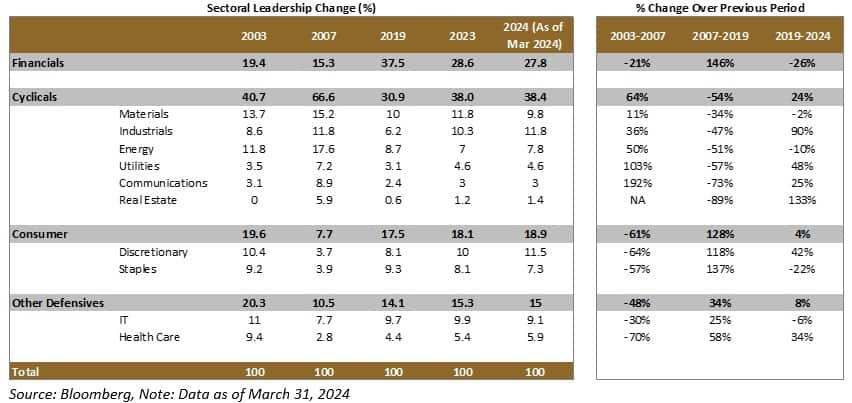

In the Indian context, these cycles have typically lasted 6-8 years. What we are witnessing currently is very similar. To illustrate this trend, let’s look at the data in the table below:

Image112042024

To understand the shifting leadership across various bull cycles, we took data for the top 800 companies comprising almost 95 percent of the total market cap.

We divided the sectors as:

1. Financials (including public, private and NBFCs)

2. Cyclicals (including materials, industrials, energy, utilities, communications and real estate)

3. Consumer (discretionary and staples)

4. Defensives (IT and healthcare)

And, we divided the cycles as:

1. 2003-2007 – the post-TMT (technology, media, and telecom) bust bull market

2. 2007-2019 – the post GFC (global financial crisis) bull market

3. 2019-24 – the post Covid-19 bull market

What we observed was that in the bull market of 2003-07, the domestic cyclicals were the leaders. Their cumulative weight in the total market went up from about 41 percent to a staggering 67 percent. They went up six times during that period – the Nifty 50 at the start of CY2003 was 1,100 and 6,139 by the end of 2007.

This was when growth in the economy and the market was led by capex-heavy domestic cyclical sectors with investments going into sectors such as power, telecom, infrastructure, metals and real estate.

During this period, the weights of financials fell from 19 percent to 15 percent, consumers from 20 percent to 8 percent and defensives like IT and healthcare fell from 20 percent to 10 percent.

However, after the global financial crisis, the cyclicals fell out of favour as their debt-fuelled growth model sputtered. Several companies made global acquisitions using leverage.

Many scams subsequently led to judicial intervention – 2G, and the coal and mining sectors took a huge toll on the profitability and cash flows for the companies in these sectors. Many went bankrupt and with them took down the banking system which had lent to them, especially state-owned banks and non-bank infrastructure financiers.

However, during that period, private banks and NBFCs that were focussed on consumer lending did very well. That was the era of consumption. The weight of these consumer-focussed banks and NBFCs went up from 15 percent in 2007 to a peak of 38 percent by the end of 2019, while simultaneously the weight of cyclical sectors more than halved from 67 percent to 31 percent.

Such was the destruction of wealth. And along with financials, the consumers and defensives bounced back with their respective weights increasing by 10 percent and 4 percent from their previous troughs.

The dominance of these sectors ended with the onset of Covid-19 in 2020. However, given the long years of leadership, most investors lapped up these consumer stocks and private banks during the Covid-19 correction as they saw the drawdown in these stocks as a great opportunity, a very typical reflexive action.

But the tide had already changed. It was time for the cyclicals to strike back. And that is exactly what we are witnessing in the current cycle.

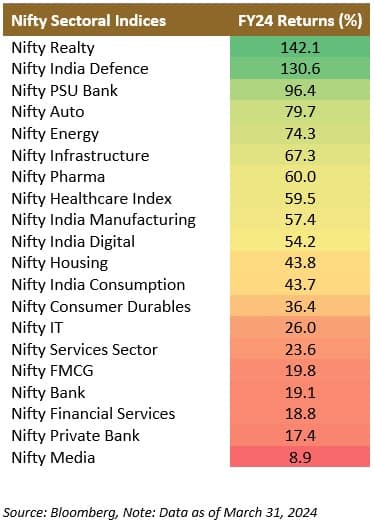

Below is the table of sectors that have delivered returns in descending order.

Image116042024

What is very interesting is that among the top 10 sectors and sub-sectors that outperformed the market, none was a leader in the previous cycle. Most leaders of the previous cycle – private banks and consumers – underperformed massively in relative terms. And almost all the laggards of the pre-Covid cycle are now leading.

This sector leadership is very apparent, and we seem to be in the early to mid-point of this new bull market cycle. This also broadly coincides with the government’s focus on infrastructure – defence, railways, renewable and thermal energy, and electric vehicles coupled with Make in India and import substitution that are driving manufacturing across sectors.

We believe that the leadership of cyclicals and public sector units including PSU banks may be reinforced and accelerate, especially if this government comes back to power, which is a very high probability.

The initial bout of outperformance was shrugged off by some investors and especially professional money managers on the pretext that these sectors were very cyclical and unpredictable. The comfort of sticking with what had worked in the previous cycle was still strong.

However, as this new leadership reinforces itself, as it usually does, investors who had not participated will join the bandwagon, leading to an even further rerating of these sectors. Well, until the next cycle brings about a change in the set of leaders.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

News Related-

Anurag Kashyap unveils teaser of ‘Kastoori’

-

Shehar Lakhot: Meet The Intriguing Characters Of The Upcoming Noir Crime Drama

-

Watch: 'My name is VVS Laxman...': When Ishan Kishan gave wrong answers to right questions

-

Tennis-Sabalenka, Rybakina to open new season in Brisbane

-

Sikandar Raza Makes History For Zimbabwe With Hattrick A Day After Punjab Kings Retain Him- WATCH

-

Delayed Barapullah work yet to begin despite land transfer

-

Army called in to help in tunnel rescue operation

-

FIR against Redbird aviation school for non-cooperation, obstructing DGCA officials in probe

-

IPL 2024 Auction: Why Gujarat Titans allowed Hardik Pandya to join Mumbai Indians? GT explain

-

From puff sleeves to sustainable designs: Top 5 bridal fashion trends redefining elegance and style for brides-to-be

-

The Judge behind China's financial reckoning

-

Arshdeep Singh & Axar Patel Out, Avesh Khan & Washington Sundar IN? India's Likely Playing XI For 3rd T20I

-

Horoscope Today, November 28, 2023: Check here Astrological prediction for all zodiac signs

-

'Gurdwaras are...': US Sikh body on Indian envoy's heckling by Khalistani backers