Extinction Rebellion protesters made it inside London insurance buildings, including the Walkie Talkie – Guy Bell/Alamy Live News

Extinction Rebellion protesters have been arrested after gaining access to a series of London office buildings including the Walkie Talkie as they held demonstrations against insurance companies that cover the fossil fuel industry.

City of London Police said that nine people have been arrested, one for breach of bail and eight on suspicion of conspiracy to commit criminal damage. The police service added: “The majority of the group have dispersed. Officers will remain in the area.”

About 20 activists gained entry to each of five buildings, also including sites in Leadenhall Street, Threadneedle Street, Creechurch Place and Mark Street.

They held up signs calling on companies to “insure our future not fossil fuels” and “don’t insure Eacop” (the East Afrcian Crude Oil Pipeline).

The offices are home to insurers Tokio Marine Kiln, Probitas, Talbot, Travellers and Zurich. City of London Police said there have been a number of arrests.

It comes after Rishi Sunak approved 27 new drilling licenses in the North Sea last year.

The Prime Minister has argued that the Government’s policy of “maxing out” developments in the North Sea was compatible with net zero.

Read the latest updates below.

06:11 PM GMT

Signing off

Thanks for joining us today. Chris Price will be back in the morning, but I’ll leave you with news that Dubai is in talks to fund the development of Orient Express superyachts.

The superyachts are intended to be ‘reminiscent of the golden age of mythical cruises” – Maxime d’Angeac & Martin Darzacq

05:58 PM GMT

The dash for electric cars risks further industrial destruction in Britain and Europe

Far from breathing new life into the economy, the energy transition’s benefits are already passing us by, says Jeremy Warner:

There is so much wrong with climate change policy as it stands that it is hard to know where to start.

Yet bans and deadlines are as good a place as any, for the way things are going we’ll end up with the worst of both worlds – significantly higher costs but with much of the intended industrial upside of the transition going not to the local economy but to overseas producers.

I’m not going to get into the rights and wrongs of the presiding cross-party commitment to net zero by 2050. Suffice it to say that the cost argument often advanced to support it has always somewhat missed the point.

The relatively modest investment costs of meeting the target – generally judged by economic modelling to be around 0.5pc of GDP a year in today’s money – are nothing, it is said, against the potentially catastrophic costs of doing nothing at all. Money well spent, in other words.

Unfortunately, the comparison only holds good in a perfect world where everyone strives for the same thing, which is very definitely not where we are.

At just 1pc of global emissions, it matters not a jot what privations Britain imposes on itself unless others do the same. If they don’t, then we’d still be faced with the costs of doing nothing.

Read the full article…

Rishi Sunak and Jeremy Hunt during a visit to the Nissan production plant in Sunderland in November – Ian Forsyth/AFP/Getty

05:46 PM GMT

‘Rip-roaring gains’ in house prices are ‘unlikely’, say economists

House prices could rise by 5pc in the final three quarters of the year, economists have said, but “rip-roaring” increases are unlikely.

A top economics consultancy, Pantheon Macroeconomics, has warned that the recovery in buyer demand looks “fitful”. In a briefing paper out this afternoon it said:

House prices have turned the corner, but it’s unlikely we will see rip-roaring growth this year, unless government policies change substantially.

We still look for a 5pc rise in the official measure of house prices over the final three quarters of 2024, which – after past data are revised – would probably mean the index only just returns to its November 2022 peak by the very end of this year …

The outlook for a very gradual decline in mortgage rates over the remainder of 2024 suggests demand won’t soar.

Our calculations suggest the average dual-earner household buying an average-priced property in quarter four will have to commit to monthly mortgage payments equal to 25.2pc of their income if prices hold steady, and 26.0pc if prices rise by 5pc, in line with our forecast. Both shares are down from an average of 27.7pc in 2023 but still well above the 20.1pc average in the 2010s.

Properties on offer in an estate agent’s window – Yui Mok/PA

05:32 PM GMT

Jeremy Hunt met Shein boss to encourage London listing

Jeremy Hunt met the chairman of Chinese fast fashion retailer Shein, Donald Tang, earlier this month in an attempt to encourage the company to float in London, Sky News has reported.

Insiders reportedly said that the two men had engaged in “productive” discussions.

Earlier we reported that the retailer is considering switching its plans for a New York listing to London as it grapples with regulatory hurdles in the US.

Donald Tang of Shein – Heathcliff O’Malley

05:18 PM GMT

Don’t bet on a rate cut soon, says Bank of England policymaker

Interest rates must stay high until there is more evidence that inflation is under control, a senior Bank of England policymaker has warned. Tim Wallace reports:

Sir Dave Ramsden, deputy governor of the Bank, said the “persistence” of price rises is still worrying, despite the sharp fall in inflation over the past year.

“Although services inflation and wages growth have fallen by somewhat more in recent months than we had expected last autumn, key indicators of inflation persistence remain elevated,” Sir Dave said.

“In terms of my thinking about the future, I am looking for more evidence about how entrenched this persistence will be and therefore about how long the current level of Bank Rate will need to be maintained.”

So far inflation has fallen from a peak of 11.1pc in October 2022 to 4pc in January, which the deputy governor said was “undoubtedly encouraging”. But this remains twice the Bank’s 2pc target.

City economists increasingly expect inflation to fall below 2pc when the energy price cap is cut in April, but the Bank of England does not think it will meet its target until the end of 2026.

Officials raised the Bank’s interest rate from a pandemic-era low of 0.1pc to the current level of 5.25pc, which Sir Dave said “weighed on activity through 2023” to slow the economy.

However, hopes that the Monetary Policy Committee would be able to cut rates quickly have so far been dashed by stubborn inflation.

Inflation falls to date are ‘undoubtedly encouraging’ – Paul Grover

04:55 PM GMT

Footsie closes flat

The FTSE 100 closed virtually unchanged today, down 0.02pc. The biggest riser was Vodafone, up 3.51pc, following by PaddyPower owner Flutter, up 2.31pc. The biggest faller was tobacco company Imperial Brands, down 4.84pc, followed by chemicals business Croda International, down 3.16pc.

Meanwhile, the FTSE 250 closed up 0.19pc. Close Brothers was the biggest riser, up 7.78pc, followed by cruise operator Carnival, up 5.75pc. The biggest faller was Abrdn, down 3.28pc, followed by energy industry kit manufacturer Hunting, down 3.13pc.

04:40 PM GMT

Nine Extinction Rebellion protesters arrested as group disperses

City of London Police said that nine people have been arrested after protesters targeted insurance companies today in the City of London. According to a police statement, one arrest was for breach of bail and eight were arrested on suspicion of conspiracy to commit criminal damage.

The police service added: “The majority of the group have dispersed. Officers will remain in the area.”

Extinction Rebellion activists occupying the offices of major insurers in the City of London – Gareth Morris

04:30 PM GMT

Consumer confidence falls in America as voters worry about high-stakes election

US consumer confidence fell much more than expected in February, as Americans voiced concern about the political environment ahead of the high-stakes presidental election later this year.

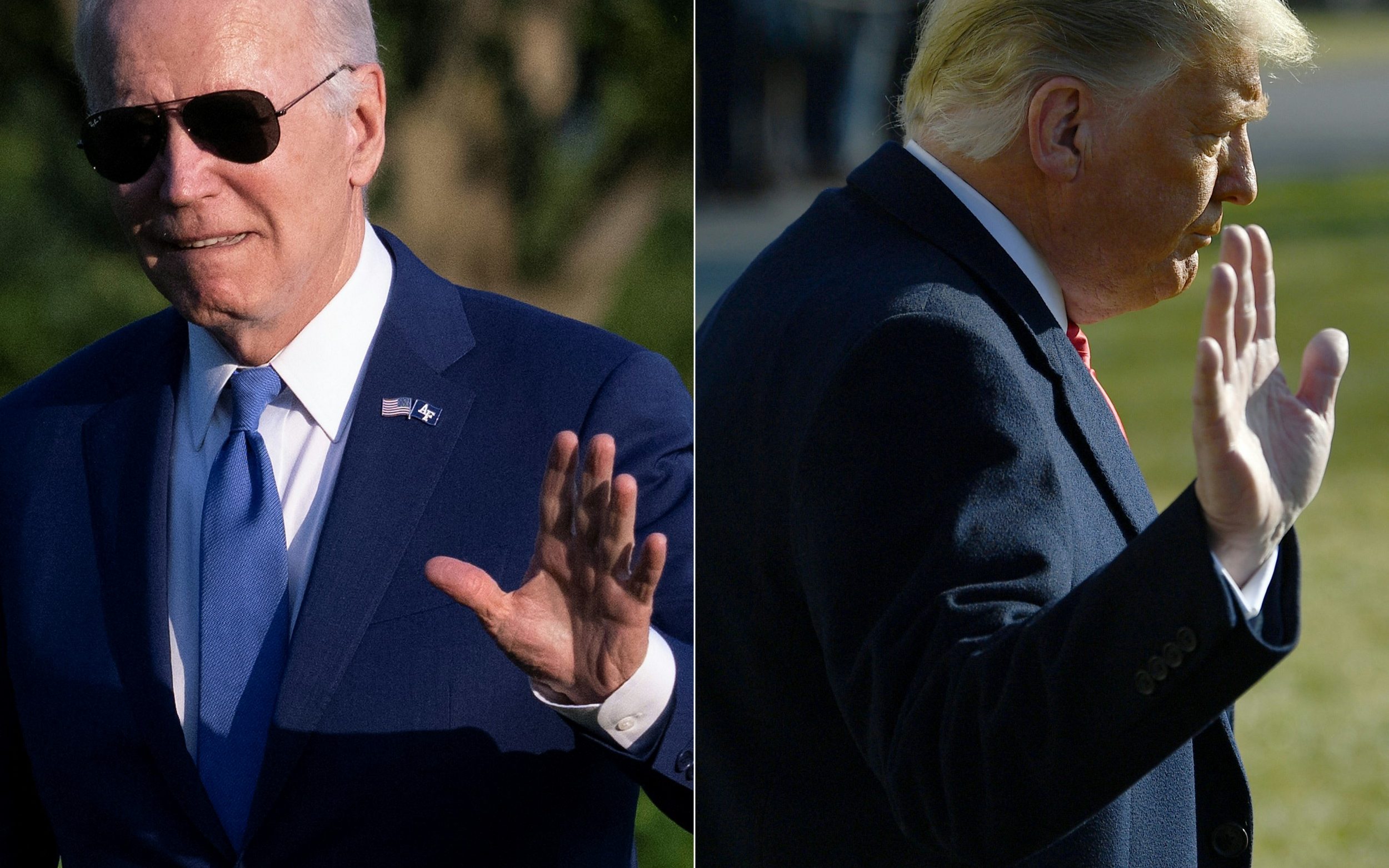

The fall in consumer confidence could cause concern for President Joe Biden’s administration, which has been looking to highlight US economic strength ahead of the Democrat’s likely rematch in November against Donald Trump.

Despite data showing falling inflation, strong growth and a surprisingly resilient jobs market, public perception on the economy has proven to be an ongoing challenge.

Consumer confidence slipped to 106.7 in February, the Conference Board said in a statement, while last month’s figure was reduced to 110.9. The figures show confidence benchmarked against confidence in 1985, which was set at 100.

The February data was well below market expectations of 114.6, according to Briefing.com.

The survey responses “revealed that while overall inflation remained the main preoccupation of consumers, they are now a bit less concerned about food and gas prices,” Dana Peterson, the Conference Board chief economist, said.

“But they are more concerned about the labour market situation and the US political environment,” she added.

The battle between Joe Biden and Donald Trump is said to be affecting confidence – Jim Watson and Brendan Smialowski/AFP

04:21 PM GMT

Booking.com to fund share buyback by issuing debt

The company behind travel website Booking.com is to issue bonds so it can issue a share buyback, according to a report.

Bloomberg says that Booking Holdings plans to raise €2.75bn (£2.35bn) through selling bonds, as the conflict in Gaza and currency fluctuations have affected earnings.

Shares in Booking Holdings plunged 10pc on Friday, after it issued results saying that profits for the final quarter of 2023 were $222m, a fall of 82pc from the year before.

Booking Holdings has been approached for comment.

03:56 PM GMT

Abrdn hits back at break-up plans as investors pull out £15bn

The Abrdn chief executive has denied that the struggling asset manager could be broken up after clients pulled £15bn from funds last year. Michael Bow reports:

Stephen Bird has led a shake-up at the FTSE 250 firm, buying investment platform Interactive Investor in an attempt to move away from its core asset management business.

Some have speculated that breaking up Abrdn, formed by a merger between Standard Life and Aberdeen Asset Management, is the only way to boost the company’s sluggish share price.

Mr Bird said: “We haven’t [discussed a break-up]. We haven’t had any approach and there are no activist shareholders. People like to whip up stories, but we do have very valuable parts in this business. We like the way they work together.”

City analysts have suggested there is no reason to buy Abrdn shares unless “radical” action is taken.

In a note to clients, Deutsche Numis analyst David McCann said: “We think the only clear investment case for owning the stock today, would be if one were to assume that the status quo could meaningfully change and more radical action, such as a breakup of the group, were to happen.”

Since Mr Bird took over as chief executive in 2020 shares have fallen by 30pc. He said Abrdn needed to become “more profitable”.

Net outflows at the group hit £15.3bn for the year ending 2023 as higher interest rates prompted its customers to shift money away from active funds into cash.

Stephen Bird acknowledges that Abrdn needs to become “more profitable” – Hollie Adams/Bloomberg

03:52 PM GMT

Barclays to sell £870m of credit card debt to Wall Street giant

Barclays is selling $1.1bn (£870m) of credit card lending to American investment manager Blackstone as it clears the decks for more lending.

Bloomberg reported that Barclays plans to continue billing and servicing the customers whose borrowings have been sold, taking a fee from Blackstone.

Barclays plans to continue servicing the customers whose borrowings have been sold – Barclaycard/PA

03:40 PM GMT

FCA to speed up investigations amid criticism it is too slow

The City watchdog has promised to speed up investigations after being criticised for delays. Adam Mawardi reports:

The Financial Conduct Authority said that acting faster will bolster the deterrence effect of enforcement actions.

It now plans to streamline its caseload, prioritising investigations focused on protecting consumers’ interests, taking action against market abuse and tackling financial crime.

Steve Smart, the FCA’s joint executive director enforcement and market oversight, said: “Reducing and preventing serious harm is a cornerstone of our strategy.

“By delivering faster, targeted and transparent enforcement, we will reduce harm and deter others. We will also make greater use of our intervention powers to stop harm in real time.”

The FCA oversees about 50,000 banks, insurers, asset managers and other financial firms across the UK.

The changes come after the UK’s public spending watchdog in December rebuked the FCA for taking too long between identifying an issue and taking regulatory action.

The National Audit Office warned of delays caused by high staff turnover in recent years, especially in specialist areas such as cryptocurrency.

The FCA said: “The proposals are designed to boost public confidence, encourage whistleblowers to step forward and increase accountability on the enforcement agency.”

The Financial Conduct Authority’s head offices in London – Toby Melville/Reuters

03:39 PM GMT

Handing over

That’s all from me today. Alex Singleton will make sure you are furnished with all the latest updates until the end of the day.

Hopefully Alex will be a bit more cheerful about it than these two, pictured below, as Home Secretary James Cleverly held a Q&A with the LinkedIn co-founder Reid Hoffman at the Microsoft offices in San Francisco during a visit to California.

Home Secretary James Cleverly, right, held a Q&A with American internet entrepreneur and venture capitalist Reid Hoffman – Stefan Rousseau/PA Wire

03:17 PM GMT

Aldi loses appeal over copying M&S gin bottles

Aldi has lost an appeal against a High Court ruling which found it had copied the design of Marks & Spencer’s light-up Christmas gin bottles.

A judge ruled in January last year that the German supermarket chain had infringed the design of its rival’s product.

Judge Richard Hacon said there were “striking” similarities which would be “significant” to shoppers, stating that the differences pointed out by Aldi were “relatively minor”.

Aldi took the case to the Court of Appeal but in a ruling on Tuesday, Lord Justice Arnold, Lord Justice Moylan and Lord Justice Lewison dismissed the appeal, unanimously agreeing that Judge Hacon was “fully entitled” to make his decision.

Lord Justice Arnold said: “He made no error of principle in comparing the overall impressions of the Aldi products with those of the registered designs, and his conclusion was one that he was fully entitled to reach.”

M&S introduced a new line of Christmas gin products in 2020, with Aldi launching its own product line the following year.

But M&S took legal action after claiming that Aldi’s gold flake clementine and blackberry gin products were “strikingly similar” to its own.

Aldi had denied the allegations but Judge Hacon found that their products were similar to that of M&S in five ways, including the “identical” bottle shape, the background “winter scene” and the light integrated into the bottles.

A lawyer for M&S said that its own-brand light-up gin bottle (left) had its protected design infringed upon by Aldi’s product (right) – Stobbs IP Limited

02:56 PM GMT

Currys rejects second takeover bid from US hedge fund Elliott

Electricals chain Currys confirmed it has rejected a higher takeover approach from US suitor Elliott Advisors, valuing the retailer at close to £750m.

Currys said Elliott returned with a second proposed offer worth 67p a share, up from its initial 62p a share approach on February 19, which was rejected by Currys as being too low.

The retailer said its board had also rebuffed the second proposal, claiming it “significantly undervalued the company and its future prospects”.

Elliott has until March 16 at 5pm to make a firm offer for Currys or walk away under City Takeover Panel rules.

02:51 PM GMT

US department store giant Macy’s to close a third of its stores

Macy’s will close 150 stores over the next three years and 50 by the end of 2024 after posting a fourth quarter loss and declining sales.

The department store signalled it would also switch to a luxury focus as part of turnaround plans that will see it open 15 of its higher end Bloomingdale’s stores and 30 of its luxury Blue Mercury cosmetics locations.

While adjusted net income and revenue topped Wall Street expectations, Macy’s offered a muted outlook for the year.

Nevertheless, its shares were up 5.6pc as it faces a proxy fight from Arkhouse Management, which nominated a slate of nine director for election to Macy’s board last week.

Last month, Macy’s rejected a $5.8bn takeover offer from the hedge fund and Brigade Capital Management, an investment manager.

Macy’s flagship store in the Herald Square neighborhood of New York – Yuki Iwamura/Bloomberg

02:38 PM GMT

Video: Extinction Rebellion protesters inside Talbot offices

02:37 PM GMT

US markets mixed ahead of inflation figures

Wall Street lacked direction at the opening bell as investors wait to see what US inflation data will look like on Thursday.

The Dow Jones Industrial Average was down 0.3pc to 38,960.42, while the benchmark S&P 500 was flat at 5,070.79.

The tech-focused Nasdaq Composite gained 0.3pc to 16,019.38.

02:20 PM GMT

Sony to close London PlayStation studio as it cuts 900 jobs

Sony is cutting around 900 jobs at its PlayStation division, including closing its London studio in its entirety.

The gaming giant’s chief executive Jim Ryan said it had made the “extremely hard decision” because the “industry has changed immensely” and the company needed to “future ready ourselves to set the business up for what lies ahead”.

The cuts represent around 8pc of PlayStation’s total global workforce and follow many other technology and gaming firms, who have made job cuts in recent months in response to ongoing global economic uncertainty.

In an email sent to PlayStation staff, Mr Ryan confirmed the proposed cuts would see the company’s London Studio close “in its entirety”, with staff reductions also occurring at its British-based Firesprite Studio.

He said there will be “reductions in various functions across Sony Interactive Entertainment (SIE) in the UK”. He said:

The PlayStation community means everything to us, so I felt it was important to update you on a difficult day at our company.

We have made the extremely hard decision to announce our plan to commence a reduction of our overall headcount globally by about 8pc or about 900 people, subject to local law and consultation processes. Employees across the globe, including our studios, are impacted.

Sony will shut its London studio as it cuts 900 jobs from its PlayStation division – CHARLY TRIBALLEAU/AFP via Getty Images

02:13 PM GMT

Inflation risks remain ‘elevated,’ warns Bank of England deputy

A Bank of England deputy governor has raised concerns about key warning indicators on inflation, which he says remain “elevated”.

Sir Dave Ramsden said the “sharp fall-back” in the headline inflation reading “is undoubtedly encouraging,” after the consumer prices index fell to 4pc from its highs of 11.1pc in October 2022.

However he said he is “looking for more evidence” about the persistence of inflation when it comes to his next decision on the Monetary Policy Committee (MPC) about whether to cut interest rates.

He told the Association for Financial Markets at Europe’s Bond Trading, Innovation and Evolution Forum:

Although services inflation and wages growth have fallen by somewhat more in recent months than we had expected last autumn, key indicators of inflation persistence remain elevated.

I support the more balanced outlook on risks to inflation set out in the MPC’s latest forecasts.

In terms of my thinking about the future, I am looking for more evidence about how entrenched this persistence will be and therefore about how long the current level of Bank Rate will need to be maintained.

01:59 PM GMT

Currys suitor Elliott returns with £750m takeover bid

Currys has received a second takeover offer from US activist investor Elliott as a bidding war for the electronics chain heats up.

Our retail editor Hannah Boland has the details:

Elliott Advisors, the owner of Waterstones, is understood to have raised its offer for Currys, having been rebuffed by management earlier this month.

The latest bid is said to be between 65p and 70p a share, according to Sky News which first reported the fresh approach.

It would value Currys at around £750m, up from Elliott’s previous £700m bid priced at 62p a share.

This chart shows the history of Currys.

Elliott has made a 65p to 70p-a-share offer for Currys, up from its previous bid of 62p – Jason Alden/Bloomberg

01:28 PM GMT

Pictured: Protesters storm London insurance buildings

Protesters occupied the offices of Probitas on 88 Leadenhall Street – Joao Pereira / Story Picture Agency

Protesters also unfurled banners inside 20 Fenchurch Street, known as the Walkie-Talkie building, which is home to insurer Tokio Marine Kiln – Joao Pereira / Story Picture Agency

01:22 PM GMT

Insurers can ‘make a real difference’ by refusing to back fossil fuel projects

Protesters say 70pc of all fossil fuel projects are insured by the City of London and that the industry “has a unique opportunity to make a real difference to the future of this planet” by refusing to insure new schemes.

01:04 PM GMT

Protesters arrested after storming London office buildings

A number of protesters have been arrested after storming the offices of major London insurers.

City of London Police said one person has been arrested on suspicion of breach of bail conditions.

It said it would provide details of further arrests later.

12:41 PM GMT

Extinction Rebellion protesters occupy London insurance buildings

Extinction Rebellion protesters have gained access to a series of office buildings owned by insurers as they hold demonstrations against funding of the fossil fuel industry.

About 20 activists have gained entry to each of five buildings, including the Walkie Talkie and sites in Leadenhall Street, Threadneedle Street, Creechurch Place and Mark Street.

They are holding up signs calling on companies to “insure our future not fossil fuels” and “don’t insure Eacop” (the East Afrcian Crude Oil Pipeline).

The offices are home to insurers Tokio Marine Kiln, Probitas, Talbot, Travellers and Zurich.

Extinction Rebellion activists have occupied the London offices of insurance companies – Gareth Morris

The activists dressed in business attire as they entered major office buildings

The activists are protesting against the issuing of insurance to fossil fuel companies – including inside the Walkie Talkie building – Gareth Morris

12:33 PM GMT

Hinkley Point C delays will leave Britain facing blackouts, report warns

Delays to French-built nuclear power stations will leave the UK struggling to keep the lights on by 2028, new research has warned.

Our energy editor Jonathan Leake has the details:

A “perfect storm” of increased demand because of net zero, the closure of existing nuclear power stations and delays to the delivery of Hinkley Point C, which is being built by French state-owned power company EDF, will leave the country facing a “crunch point” that risks blackouts.

Analysis by Public First predicts that the UK’s demand for power will exceed baseload capacity by 7.5GW at peak times by 2028 – a shortfall equivalent to the power used by more than 7 million homes.

The warning comes amid a political row between Westminster and Paris over who will pay for cost overruns on the long-delayed Hinkley Point C nuclear reactor, which was scheduled to open in 2025 at the time of approval but will now not come online until at least 2031.

See a timeline of Hinkley Point C’s delays.

Hinkley Point C costs have surged to £46bn, significantly more than the £18bn proposed when contracts were signed in 2016 – EDF ENERGY/AFP via Getty Images

12:00 PM GMT

Wall Street poised to edge upwards ahead of US inflation data

US stock indexes are poised to inch higher when trading begins later ahead of key figures on US inflation.

The S&P 500 and Dow Jones Industrial Average hit record highs after an AI-fuelled rally last week but investors are focused this week on the release of January’s personal consumption expenditures price index (PCE) on Thursday.

The figures are the US Federal Reserve’s preferred measure of inflation and could impact the path of interest rates this year.

Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, said: “Favourable data – meaning resilient but not abnormally strong growth, coupled with softening inflation – would allow the market bulls to surf on the ‘goldilocks’ wave.”

In premarket trading, the Dow Jones Industrial Average was flat, while the S&P 500 was up 0.1pc. The Nasdaq 100 was up 0.2pc.

Tesla outperformed megacap peers, rising 1.5pc ahead of the opening bell, while Micron Technology, a beneficiary of the AI rally, climbed 2.6pc after a 4pc advance on Monday.

11:46 AM GMT

HS2’s longest tunnel completed after nearly three years

The machine digging HS2’s longest tunnel has completed its 10-mile journey under the Chiltern Hills.

Florence, named after nurse Florence Nightingale, was greeted with cheers from hundreds of HS2 workers who gathered to witness the moment near South Heath, Buckinghamshire, on Tuesday.

It was launched in May 2021 near Rickmansworth, Hertfordshire.

The machine dug one of a pair of tunnels with a depth of up to 80 metres which will be used for HS2 trains travelling between London and Birmingham.

A second identical machine will break through in the coming weeks.

Rail minister Huw Merriman said: “This ground-breaking moment for HS2 demonstrates significant progress on the country’s largest infrastructure project, with Florence paving the way for faster, greener journeys between London and Birmingham while supporting hundreds of jobs and apprenticeships along the way.”

Workers cheer as digging machine Florence completes HS2’s longest tunnel – Aaron Chown/PA Wire

11:28 AM GMT

Campari shares surge as drinks industry defies downturn

Drinks maker Campari has seen its share price surge after it revealed booming demand for its cocktail staples despite it putting up prices.

Shares in the Milan-listed distiller rose as much as 7.6pc as it announced a third consecutive year of double-digit organic growth.

Adjusted underlying profits rose by 21.2pc to €618.7m (£529.3m), while bosses remained upbeat about the outlook for the drinks industry amid a “normalising macro environment”.

Chief executive Bob Kunze-Concewitz said:

In 2023 we delivered another year of best-in-class organic topline growth thanks to very healthy brand momentum, in particular from aperitifs, tequila and bourbon, and industry outperformance despite macroeconomic challenges and the expected consumption normalisation after exceptional growth post-pandemic.

We achieved a third consecutive year of double-digit organic growth across all operating profit indicators, underpinned by pricing across the portfolio, which enabled to more than offset input costs inflation and sustained reinvestment into brand building and strengthening of distribution infrastructure for the next phase of growth.

Campari is a key ingredient in negroni cocktails – Getty Images

11:00 AM GMT

On The Beach shares jump as it strikes peace deal with Ryanair

On The Beach shares have risen as much as 14pc after it agreed a truce with Ryanair that will allow it to feature the low-cost carrier’s flights.

Our senior business reporter Daniel Woolfson has the details:

Ryanair has struck a peace deal with the online travel agent On The Beach weeks after it was branded a “pirate” by the carrier’s chief executive Michael O’Leary.

On The Beach said on Tuesday it had agreed a deal with the low cost airline to sell its flights with “full cost transparency”, bringing a close to hostilities between the two that had even spilled into the courts.

Mr O’Leary had previously accused On The Beach and other online travel agents of ripping off customers.

Earlier this month his company lashed out at On The Beach for charging £125 for a flight change fee, which dwarfs the £45 fee levied by Ryanair.

Read the guarantees offered by On The Beach.

Ryanair boss Michael O’Leary has previously labelled online travel agents as ‘pirates’ – Horacio Villalobos-Corbis/Corbis via Getty Images

10:48 AM GMT

Building materials supplier plunges amid housing market woes

Building materials supplier Brickability Group has seen shares tumble after it warned profits will be at the lower end of forecasts as sales continue to slump amid woes in the housing market.

The group’s shares plunged by as much as 15pc after it said sales will remain under pressure for longer than first feared, affecting earnings.

It said sales by volume for bricks have been “significantly” lower in the past year across the wider market, with UK dispatches down around 30pc last year and imports into the UK falling by 42pc.

The company said its own sales reflect market trends, with pricing also becoming increasingly competitive due to lower demand.

It warned that demand for bricks and building materials is set to remain lower until the end of its financial year in March, with the market recovery set to take longer than expected.

This is set to leave full-year underlying earnings “towards the lower end” of market forecasts for £46.2m.

10:28 AM GMT

France threatens £6,400 fine for vegan food makers using term ‘steak’

The French government has issued a decree banning the term “steak” on the label of vegetarian products, saying it is reserved for meat alone.

Companies flouting the new labelling laws face a €7,500 (£6,400) fine if they use the term on meat free products, with other banned words including “escalope”, “ham”, “filet” and “prime rib”, according to the official order.

The ruling is a response to a long-standing complaint by the meat industry that terms like “vegetarian ham” or “vegan sausage” were confusing for consumers.

It is based on a 2020 law whose application was temporarily suspended by the State Council in June 2022 after a complaint from Proteines France, a consortium of French companies selling plant-based food.

According to the revised decree published today, some products containing a small amount of plant-based content can continue to use meaty names, such as merguez sausage, bacon or cordon bleu.

Producers elsewhere in the European Union can continue to sell vegetarian food with meat names in France.

Proteines France has been arguing that the French law is at odds with EU food rules.

Producers have one year to sell their existing stock before any penalties are applied.

Vegan imitations of meat products can no longer carry words like ‘steak’ on their labelling in France – John Nguyen/JNVisuals

10:15 AM GMT

Manufacturers at conference think Sunak will not be PM after next election

Alastair Campbell is holding a fireside chat with former Tory leadership contender Rory Stewart at the Make UK conference at the QE2 Centre in Westminster.

Our industry editor Matt Oliver is at the event, where the former Labour spin doctor has just conducted a poll of the room about who will be Prime Minister after the next general election.

No one put their hand up to say they thought Rishi Sunak would still be in the top job.

Mr Campbell declared: “Great!”

Former New Labour strategist Alastair Campbell – Jeff Gilbert

10:03 AM GMT

Abolish the Budget to give businesses stability, says manufacturing chief

Jeremy Hunt will stand up in the Commons next week and deliver what could be his final Budget as Chancellor – but the head of the manufacturing trade body want the fiscal events to be scrapped.

Delivering the opening speech of the Make UK conference in Westminster, its chief executive Stephen Phipson called for the Budget and Autumn Statement to be abolished.

He said that instead, tax policies should be set out at the start of a Parliament and only changed in exceptional circumstances. He said:

We need to see a return to political and policy stability, as well as a debate about some very serious choices we need to make as a country.

But, five Prime Ministers in eight years and fifteen Business Secretaries in fifteen years is no recipe for this.

Nor is the fact we have had six plans for growth in little over a decade, while the department responsible for industry has been re-organised five times in the same period. Any of you running businesses this way would have gone bankrupt.

The fact we have two statements a year has been responsible for twenty six changes in corporation tax since 2019. Those of you who are finance directors must be baffled by the ticker tape of announcements.

Instead, I would urge any Government of whatever colour to announce their tax policies for the lifetime of a Parliament, which would only be changed if exceptional circumstances merit it. No changes to investment allowances, corporation tax or green targets for five years would really help.

09:54 AM GMT

UK bonds rally as inflation eases

The price of UK bonds jumped as food price inflation fell to its lowest level in two years in a boost to hopes that the Bank of England will cut interest rates more steeply later this year.

The yield on 10-year UK gilts – which moves inversely to prices – has dropped by three basis points today to 4.13pc, leading major European economies.

Cuts in interest rates increase the price of bonds on the debt market as their fixed returns become more attractive.

Meanwhile, the pound is flat against the dollar at $1.26.

09:47 AM GMT

Supermarket own-brand supplier surges as price conscious shoppers switch

Household cleaning products business McBride has said annual earnings are poised to beat its forecasts after returning to a half-year profit as cost-conscious shoppers switch to retailer own-brands.

The group, which is behind many supermarkets’ own-brand cleaning products, saw shares soar by as much as 21pc at one stage after upbeat results revealing it swung to a pre-tax profit of £17.4m for the six months to December 31 against losses of £20m a year earlier.

It saw revenues jump 9.8pc to £468m over the year as it said consumers continued to shift towards cheaper, private label products in the face of cost-of-living pressures.

McBride has been increasing prices to offset its own surging cost inflation, which helped bolster profit margins over the first half.

The Manchester-based company, which also makes its own label products such as Oven Pride, said it expects full-year profits to be between 10pc and 15pc ahead of its previous internal forecasts.

09:28 AM GMT

Brent crude prices fall amid hopes of Gaza ceasefire

Oil prices have edged downwards amid hopes of a temporary ceasefire in Gaza, which would ease concerns about supplies to the global market.

Brent crude, the international benchmark, has fallen 0.1pc but remains above $82 a barrel after rising by 1.1pc on Monday.

US-produced West Texas Intermediate was also down 0.1pc towards $77.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said:

Brent crude remains above $82 a barrel, as disruption to shipping in the Red Sea keeps supply concerns bubbling.

There are some hopes that a temporary ceasefire in Gaza could be reached soon, with President Joe Biden confirming that Israel has agreed to halt attacks during Ramadan, although Hamas is still assessing the draft proposals.

09:15 AM GMT

Putin’s petrol export ban follows Ukrainian attacks on refineries

Vladimir Putin’s ban on petrol exports comes as Russia and Ukraine have targeted each other’s energy infrastructure in a bid to disrupt supply lines and logistics.

Some Russian refineries have been hit by Ukrainian drone attacks in recent months, with the ban on exports allowing time for repairs.

Exports of oil, oil products and gas are by far Russia’s biggest export and provide a major source of foreign currency revenue for Russia’s £1.5 trillion economy.

The Kremlin has been working with Saudi Arabia, the world’s biggest oil exporter, to keep prices high as part of the broader Opec+ group, which includes the Opec cartel of oil producing nations and its key allies.

Russia is already voluntarily cutting its oil and fuel exports by 500,000 barrels per day in the first quarter as part of Opec+ efforts to support prices.

09:00 AM GMT

Labour to overturn onshore wind ban if it wins election

Shadow energy secretary Ed Miliband has said that a Labour government will overturn the onshore wind ban “at the stroke of a pen”.

The Labour frontbencher told the International Energy Week annual conference:

With a Labour government, you will know as businesses and investors that capricious decision-making will not rule out your technology.

Take the onshore wind ban in England in place since 2015, which is costing families £180 every year in higher bills.

The current government could overturn this ban very easily. But there is a culture of inertia and stasis.

Difficult decisions are ducked. Consultations are used to avoid decision making.

This institutional inertia is just not good enough – it blocks business investment and drives up bills for the British people.

If there is a Labour government, this will change from day one. That is why one of my first acts, if I am the Energy Secretary, will be to overturn the onshore wind ban, which can be done at the stroke of a pen.

Former Labour leader and shadow energy secretary Ed Miliband has pledged that his party would overturn the ban on onshore wind development – Andrew Milligan/PA Wire

08:58 AM GMT

Croda slumps as Covid vaccine boom ends

Croda shares have slumped by 2.7pc after a sharp downturn following the pandemic boom years.

Sales at the Yorkshire-based chemicals business fell 18.9pc to £1.7bn while pre-tax profits plunged by 69.7pc to £236.3m.

It comes after two record years following the pandemic, when it supplied key elements for the Pfizer-BioNTech Covid vaccine.

However, adjusted profit before tax was down 33pc to £308.8m last year and the company admitted the “recovery trajectory for each of our business units remains difficult to predict”.

Neil Shah of investment research company Edison said:

Chemicals company Croda International have posted a troubling set of results today, with adjusted profits dropping by a third.

2023 was one of the most difficult years in living memory for the chemicals industry.

The general macroeconomic situation has been difficult; disruptions to supply chains have raised costs; and – most significantly – buying trends after the pandemic have reduced demand: consumers stocked up on chemical products just after the end of the pandemic and have not yet exhausted this stock – leading to a steep drop in purchases.

08:39 AM GMT

FTSE 100 rises as gold and copper prices boost miners

UK shares rose in early trading amid gains in mining stocks and some upbeat annual results.

The resource-heavy FTSE 100 index has risen 0.2pc after precious and base metal miners lifted 0.9pc and 1.3pc, respectively.

The sectors tracked gold and copper prices moving higher on a weakening dollar.

While it is a light week for UK economic data, consumer prices figures in the US and the Europe will be widely watched, which could influence the monetary policy path globally.

Investors are now awaiting comments from the Bank of England Deputy Governor Dave Ramsden at a speech later today.

Smith+Nephew advanced 3.9pc to the top of the FTSE 100 as the medical equipment maker forecast an improvement in profit margin this year after beating market estimates for 2023 profits.

However, Croda International slid 1.6pc, after the chemicals supplier forecast lower 2024 profits, hit by persistently weak volumes at its Crop Protection and Industrial Specialities units.

The mid-cap FTSE 250 added 0.1pc, led by a 7.2pc jump in Abrdn, after the asset manager announced job cuts and plans to reduce costs.

08:28 AM GMT

Food price inflation falls to two-year low

Grocery price inflation has fallen to a two-year low as fierce competition among supermarkets offset the cost of disruption to Red Sea shipping routes, figures show.

Supermarket prices were 5.3pc higher than a year ago in February, the lowest rate since March 2022 and a decrease marking the lowest rate since March 2022 and a significant drop from January’s 6.8pc, according to analysts Kantar.

In an indication of the intensifying competition between retailers, Morrison’s became the latest retailer to launch a price match scheme with Aldi and Lidl, after Asda made the move in January.

Promotions increased again over the month after a post-Christmas slowdown, and consumers spent £586m more on them than in February last year.

However, Britons still found room within their budgets to celebrate Valentine’s Day, with spending on steak and boxed chocolate up by 12pc and 16pc compared with last year.

The end of ‘Dry January’ saw total alcohol sales jumping by 18pc in volume terms on the previous month, with consumers buying 28pc more wine and 16pc more beer and lager.

Red wine was particularly popular, with eight million more bottles bought this month than in January.

Grocery price inflation has fallen to its lowest level in two years – REUTERS/Henry Nicholls

08:21 AM GMT

Rouble rises amid stable oil prices

The Russian rouble opened higher as it was helped by stable oil prices and low demand for foreign currencies by exporters ahead of tax payments.

The rouble was 0.2pc stronger against the dollar at 92.16 and was up 0.2pc against the pound to 116.8. It had lost 0.1pc to trade at 100 versus the euro.

The Russian currency on Monday hit a one-week high, as markets opened for the first time since the latest round of Western sanctions were imposed on Moscow.

Bogdan Zvarich, chief analyst at the banki.ru online marketplace, said that stable oil prices and seasonal demand for roubles by exporters to make tax payments was keeping the rouble strong.

He said: “As a result, the American currency may retreat below 92 roubles during trading.”

The rouble should be at least temporarily buttressed by month-end tax payments that usually see exporters convert foreign exchange revenues to meet local obligations.

Brent crude oil, a global benchmark for Russia’s main export, was up 0.4pc at $82.87 a barrel. Russia today banned gasoline exports for six months from March 1, due to shortages and high domestic prices.

08:08 AM GMT

UK markets edge higher at the open

Stock markets in London have risen at the open despite higher-than-expected Japanese inflation putting investors on guard.

The FTSE 100 rose 0.1pc to 7,688.51 while the midcap FTSE 250 gained 0.1pc to 19,143.96.

07:52 AM GMT

Ryanair signs deal with On The Beach after ‘pirate’ row

Ryanair has authorised online travel agent On The Beach to offer its flights on its website weeks after dubbing the company a “pirate” for scraping data from the Irish carrier’s website.

On The Beach said it would only display the Irish carrier’s real prices, without any mark ups.

Earlier this month, the low-cost airline accused the travel agent of ripping off passengers by charging £125 for a flight change fee, which dwarfs the £45 fee levied by Ryanair.

Ryanair was forced to fly planes with more than one in ten seats empty in January after Michael O’Leary’s budget airline was banned by a host of online travel agent websites last year.

Ryanair has signed an agreement to display its flights on the website of On The Beach – Nicholas.T.Ansell/PA Wire

07:29 AM GMT

Abrdn to cut 500 jobs as it tries to save £150m

Investment manager Abrdn has said it plans to cut around 500 jobs as part of a cost-saving overhaul.

The asset manager announced the job cuts as it revealed a £6m loss for 2023, down from a loss of £612m the previous year as it continues with a long-term turnaround.

The company aims to save £150m by the end of 2025, with net operating revenue falling by 4pc last year to £1.4bn.

Stephen Bird, chief executive officer of Abrdn, said:

Over the past three years we have reshaped the business to fit the modern investment landscape.

We now have content and distribution aligned to the products and services clients need, and we are better positioned for future growth.

We are taking action to rebuild and grow profit in our investments business.

We have sharpened our focus on improving investment performance, streamlined our fund range, reduced costs by £102m in 2023, exceeding our £75m target and we announced a new cost-saving programme of at least £150m on January 24.

Our balance sheet remains strong which enables us to fund our cost transformation while continuing to strategically invest in growth areas and maintain our dividend.

Investment manager Abrdn plans to cut 500 jobs – John Keeble/Getty Images

07:21 AM GMT

China fashion giant Shein switches listing plans from New York to London

A Chinese fashion retailer Shein is reportedly considering switching its plans for a New York listing to London as it grapples with regulatory hurdles in the US.

The online “fast fashion” retailer, which is now based in Singapore, is exploring a London initial public offering (IPO) – the process of floating shares on a stock exchange – according to Bloomberg.

It is thought that the company, which has become hugely popular with Gen Z, thinks it is unlikely the US Securities and Exchange Commission will approve itsUS listing.

The Chinese e-commerce business, which has grown to become the world’s biggest fashion retailer, would reportedly need to file a new overseas listing application with Chinese regulators if it decided to switch to London or elsewhere.

Singapore headquartered Shein could list in London – REUTERS/Chen Lin

06:54 AM GMT

Good morning

Thanks for joining me. Russia has announced a six month ban on exports of petrol as Vladimir Putin’s regime races to meet domestic demand from drivers and farmers.

The ban, which comes into force on March 1, was confirmed by a spokesman for Deputy Prime Minister Alexander Novak and will also allow for planned maintenance of refineries.

Russia previously imposed a similar ban between September and November last year in order to tackle high domestic prices and shortages. Then only four ex-Soviet states – Belarus, Kazakhstan, Armenia and Kyrgyzstan – were exempt.

However, the ban will this time not extend to member states of the Eurasian Economic Union, Mongolia, Uzbekistan and two Russian-backed breakaway regions of Georgia – South Ossetia and Abkhazia.

The top petrol producers in Russia last year were Gazprom Neft’s Omsk refinery, Lukoil’s NORSI oil refinery in Nizhny Novgorod and Rosneft’s Ryazan refinery.

Russia produced 43.9m tons of petrol in 2023 and exported about 5.8m tons, or around 13pc of its production.

The biggest importers of Russian gasoline are mainly African counties, including Nigeria, Libya, Tunisia and also United Arab Emirates.

5 things to start your day

1) Post Office boss accused of misleading MPs over £15k-a-month PR advice | Nick Read previously denied hiring advisers to handle fallout from ITV drama about Horizon scandal

2) Vodafone and Three’s £15bn merger will harm competition, says Virgin Media O2 boss | Lutz Schüler warns tie-up risks leaving rivals with patchier connections

3) Short-sellers bet Hargreaves Lansdown shares have further to fall despite slump | The investment firm faces pressure to cut fees amid rising competition

4) Lords seek powers to block Telegraph takeover | Laws proposed to give Parliament veto on foreign state ownership of British news media

5) How planning chaos built a failing housing market | Britain’s complicated and costly rules come under fire as the housing crisis deepens

What happened overnight

Asian shares were mixed on Tuesday after US and European stocks edged back from their record heights.

Traders are growing cautious after the New Year’s rally that has swept much of the world’s markets.

Stephen Innes of SPI Asset Management said: “All in all, investors are taking a well-deserved breather to start the week.

“This subdued tone suggests a moderation in investor sentiment following the recent tech-driven buying spree.”

Tokyo’s Nikkei 225, which has twice breached records in recent days, closed flat at 39,239.52, while the broader Topix index closed up 0.2pc, or 4.84 points, to 2,678.46.

Japan’s government reported that consumer prices rose 2.2pc in January from the year before, less than the 2.6pc rate in December, but above forecasts.

Higher inflation supports expectations that the Bank of Japan may soon make a shift in its longstanding ultra-lax monetary policy, which is underpinned by a minus 0.1pc benchmark interest rate.

Chinese markets were mixed, with Hong Kong’s Hang Seng falling 0.2pc to 16,595.29 and the Shanghai Composite up 0.7pc at 2,996.87.

South Korea’s Kospi declined 0.9pc to 2,623.40, while India’s Sensex rose 0.2pc. In Bangkok, the SET was down 0.5pc.

In Wall Street, the S&P 500 slipped 0.4pc, to 5,069.53, after closing last week at an all-time high. The Dow Jones Industrial Average of 30 leading US companies fell 0.2pc, to 39,069.23, and the Nasdaq Composite dipped 0.1pc, to 15,976.25.

Treasury yields ticked higher in the bond market. The yield on 10-year Treasury bonds rose to 4.27pc from 4.25pc late on Friday.

%n

Discover Telegraph Wine Cellar’s new wine club. Enjoy expertly chosen bottles at exclusive member prices. Plus, free delivery on every order.

News Related-

Pedestrian in his 70s dies after being struck by a lorry in Co Laois

-

Vermont shooting updates: Burlington police reveal suspect’s eerie reaction to arrest

-

Grace Dent says her ‘heart is broken’ as she exits I’m A Celebrity early

-

Stromer’s ST3 Urban E-Bike Goes Fancy With Minimalist Design, Modern Tech

-

Under-pressure Justice Minister announces review of the use of force for gardaí

-

My appearance has changed because of ageing, says Jennifer Lawrence

-

Man allegedly stabbed in the head during row in Co Wexford direct provision centre

-

Children escape without injury after petrol bomb allegedly thrown at house in Cork City

-

Wexford gardai investigating assault as man is bitten in the face during Main Street altercation

-

Child minder’s husband handed eight year sentence for abusing two children

-

The full list of the best London restaurants, cafes and takeaways revealed at the Good Food Awards

-

Mazda CEO Says EVs 'Not Taking Off' In The U.S.—Except Teslas

-

Leitrim locals set up checkpoint to deter asylum seekers

-

Ask A Doctor: Can You Get Shingles More Than Once?