Here's how to avoid getting 'hammered' on inherited individual retirement account taxes, experts say

- Inherited individual retirement accounts can be a financial boost for heirs, but the windfall can trigger tax issues, experts say.

- Since 2020, certain heirs, including most adult children, must deplete inherited IRAs within 10 years, known as the “10-year rule.”

- You can minimize the tax hit by spreading out withdrawals or taking the money during lower-income years.

Here’s how to avoid getting ‘hammered’ on inherited individual retirement account taxes, experts say

Inherited individual retirement accounts can be a financial boost for heirs, but the windfall can trigger tax issues, experts say.

Withdrawals from pretax inherited IRAs incur regular income taxes. Since 2020, certain heirs can no longer “stretch” retirement account distributions over their lifetime to reduce yearly taxes.

Now, certain heirs, including most adult children, must deplete inherited accounts within 10 years, known as the “10-year rule.” The rule applies to heirs who aren’t a spouse, minor child, disabled or chronically ill. It may also apply to certain trusts.

Ideally, you should smooth out your yearly tax liability “so you don’t get hammered by the end of the 10th year,” said individual retirement account expert and certified public accountant Ed Slott.

More from Personal Finance:

IRS waives mandatory withdrawals from certain inherited individual retirement accounts

Your Roth 401(k) after-tax matching contribution could trigger unexpected taxes

Here’s what to know before withdrawing funds from inherited IRAs

The IRS in 2022 proposed mandatory yearly withdrawals from inherited IRAs if the original account owner had already started distributions. However, the IRS has waived the penalty for missed required minimum distributions amid confusion — and extended that relief for 2024 in April.

Slott said there’s widespread confusion about the rules, but the relief only condenses the 10-year window for taxable IRA withdrawals.

“They’re just pushing off the inevitable,” said JoAnn May, a Berwyn, Illinois-based certified financial planner at Forest Asset Management. She is also a certified public accountant.

While only about 20% of May’s clients have inherited IRAs, she expects more heirs to face the tax-planning issue as baby boomers age.

Bigger inherited IRA withdrawals can significantly boost adjusted gross income, which can have “unintended consequences,” such as higher Medicare Part B and Part D premiums for retirees, May explained.

Younger heirs could be affected by higher income too. For example, they could face college-funding issues when submitting the Free Application for Federal Student Aid, or FAFSA.

Plus, there are income phaseouts for Roth IRA contributions, as well as for tax breaks like the child tax credit, student loan interest deduction and more.

How to plan for inherited IRA withdrawals

Typically, May runs multiple-year projections to help clients decide the best years to take withdrawals from inherited IRAs.

“Tax planning is very important,” she said.

Advisors may leverage a lower-income year — say, after a job layoff, retirement or other life changes affecting income — to take more income and reduce future withdrawals.

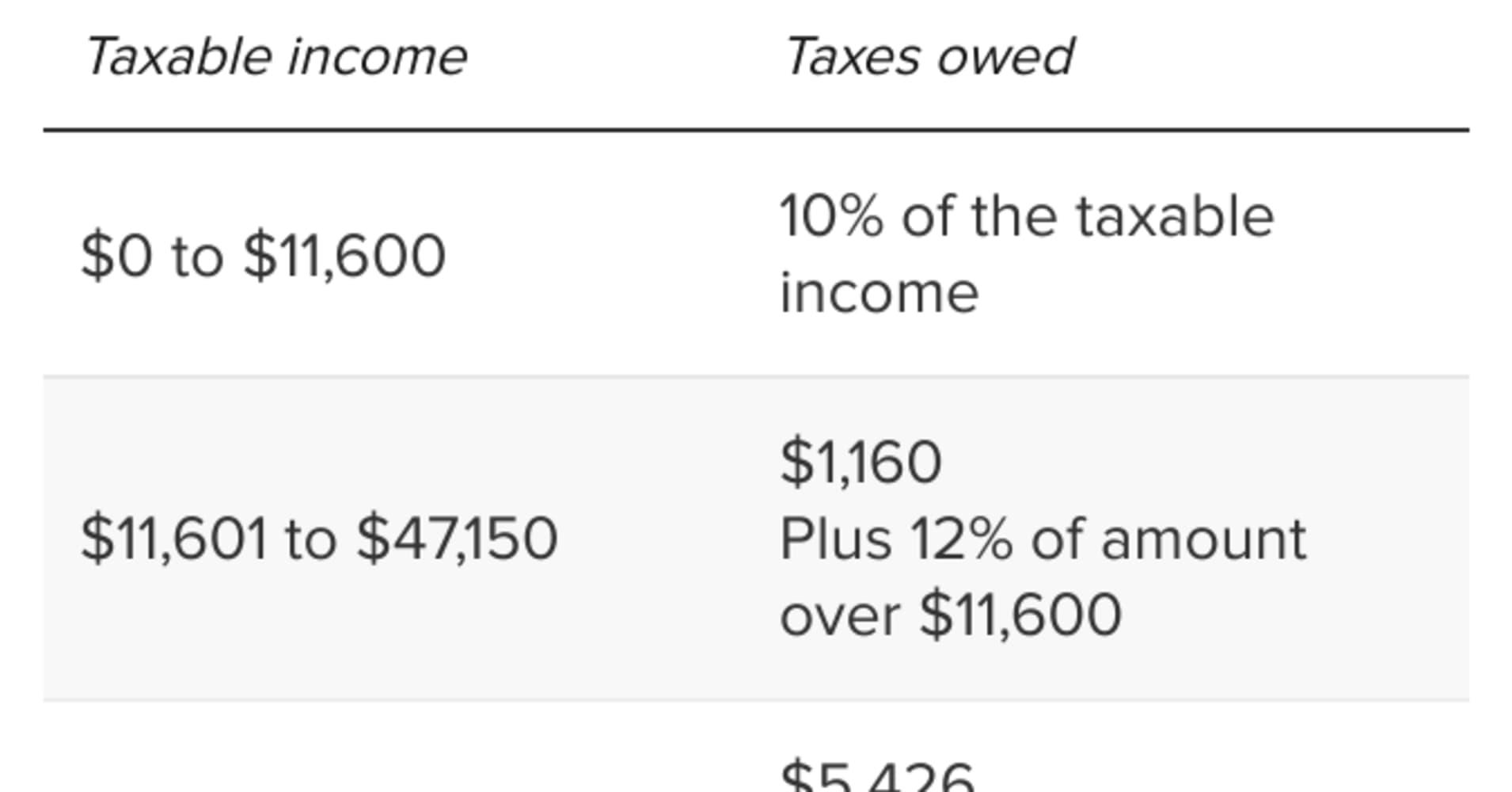

Typically, they try to take enough income to fill a tax bracket without spilling into the next one with a higher rate.

There are also tax-planning opportunities for the original IRA owner, CFP Karl Schwartz, principal and senior financial advisor at Team Hewins in Boca Raton, Florida, previously told CNBC.

For example, the original owner may consider so-called Roth IRA conversions. The move triggers upfront tax and after the conversion, the balance grows tax-free. Heirs would still face the 10-year rule, but withdrawals wouldn’t incur levies.

“It would probably make sense if they’re in a tax bracket that’s lower than their beneficiaries,” Schwartz said.