Young black colleagues high-fiving each other at work

It’s never too late to try and build a retirement fund by buying FTSE 100 and FTSE 250 stocks.

Combined, these London indices have provided an average annual return of 9.3% in recent decades. If this record continues, stuffing my portfolio with blue-chip shares could prove to be a brilliant plan.

Targeting a million… with £520

The number of Stocks and Shares ISA millionaires has rocketed since the 2008 financial crisis. But investors don’t necessarily need to invest a vast lump sum to reach this enviable position. Nor do they have to ‘get lucky’ by buying the next Apple, Amazon or any other world-changing growth star before it takes off.

Sometimes it just takes a patient approach and a regular monthly investment. Even those with zero savings or investments can get a space on Millionaire’s Row if they give their portfolio time to grow.

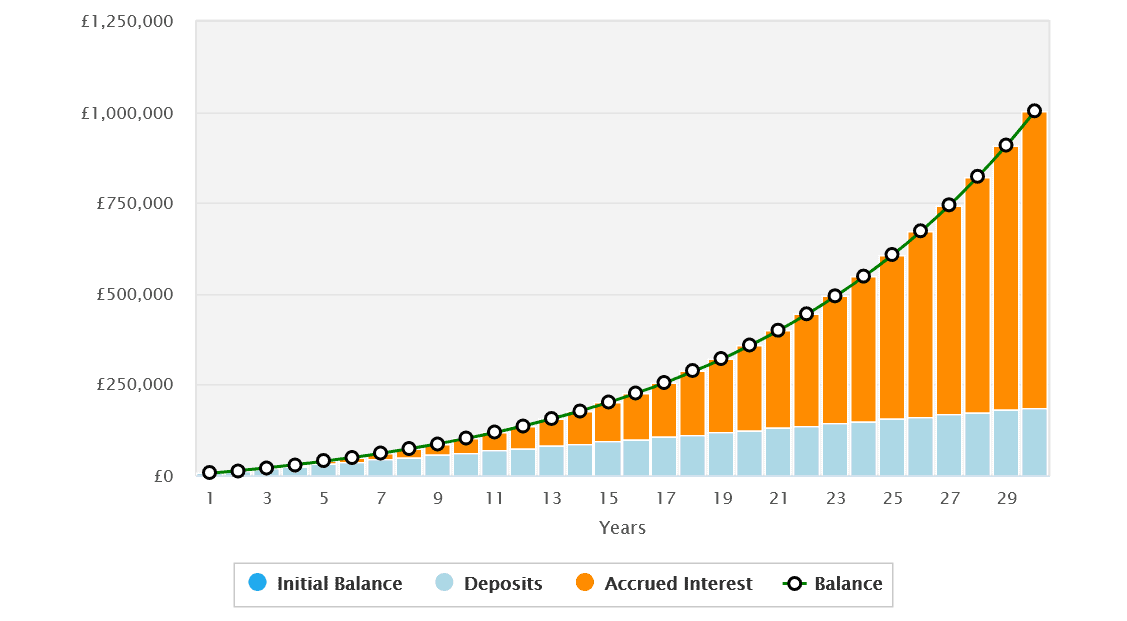

Let’s say I have nothing in the bank today, but can invest £520 a month in FTSE 100 and FTSE 250 shares. Thanks to the miracle of compound interest I could — after 30 years — have built a fund of a million pounds (or £1,013,620.51, to be exact).

Past performance is no guarantee of future returns. But that long-term return of 9.3% I mentioned shows what’s possible with a sensible and consistent investing strategy.

How a £520 monthly investment could grow to £1m+. Source: thecalculatorsite.com

An undervalued FTSE 100 star

I think now is an excellent time to start investing in UK blue-chip shares too. After years of underperformance, the London Stock Exchange is currently packed with undervalued stars.

Fears over Britain’s economy and political landscape mean Footsie shares now trade on an average forward price-to-earnings (P/E) ratio of 10.5 times. This is far below the historical average of around 16 times.

One dirt cheap share I’m considering buying today is JD Sports Fashion (LSE:JD.). At 115p per share, it trades on a P/E ratio of just 9 times for 2024. This is well below the company’s 10-year average of 16.9 times.

This could potentially lead to the stock delivering market-beating share price gains over the long term. I believe its lowly valuation will recover over time as trading conditions rebound.

Why I’d buy JD Sports shares

The sportswear business has had issues of late as consumers scale back on spending. The company slashed its full-year profits guidance by 10% in January following recent sales disappointment.

While trading troubles may remain an issue in 2024, the profits outlook for JD Sports remains extremely bright for the rest of the decade. And this makes the company a top buy, in my opinion.

I especially like the FTSE firm’s decision to focus on the premium end of the athleisure market. This segment is tipped by market experts to expand especially rapidly over the next 10 years, at least.

JD’s strong relationships with the most prestigious sports manufacturers gives it added ammunition to exploit this opportunity. The exclusivity agreements it regularly seals on stacks of products boosts its brand, and makes it the go-to place for the hottest products.

By continuing to expand its global footprint, JD is putting itself in the box seat to capitalise on its growing market too. I’ll be looking to buy this stock when I next have cash to invest.

5 stocks for trying to build wealth after 50

Inflation recently hit 40-year highs… the ‘cost of living crisis’ rumbles on… the prospect of a new Cold War with Russia and China looms large, while the global economy could be teetering on the brink of recession.

Whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times. Yet despite the stock market’s recent gains, we think many shares still trade at a discount to their true value.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. We believe these stocks could be a great fit for any well-diversified portfolio with the goal of building wealth in your 50’s.

Claim your free copy now

More reading

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Amazon and Apple. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report