Few stocks are able to sustain 9% dividends, yet that’s exactly what Energy Transfer (NYSE: ET) did on February 6 when it increased its payout even though its dividend yield was already above 9%. And this isn’t the first time Energy Transfer has boosted its already-high dividend. The company has raised the payout every quarter for more than two years.

Is this your chance to secure a truly reliable 9% dividend yield?

This stock is built for income

Some businesses are built for growth, while others are designed to produce free cash flow. Energy Transfer is the latter type of business. It owns assets that, while expensive to initially construct, eventually generate high levels of extra cash, the reason for the stock’s high dividend over the years.

What exactly does Energy Transfer do? As its name suggests, it helps energy companies transfer their output from extraction sites to refineries, storage, and eventually the market. It deals mainly with crude oil and natural gas, owning pipeline and terminal assets throughout the U.S., with a particular focus on Texas and its neighboring states, which all have high levels of new fossil fuel production.

Assets like pipelines are capital intensive to construct. That means Energy Transfer must access the debt markets to get new projects up and running. Once built, however, the company often has a monopoly over its customer base. After all, pipelines are the most cost-effective way to transport most fossil fuel production. If there’s only one pipeline that services a particular area, then potential customers have little choice but to use it.

This market power typically allows Energy Transfer to set the rules. The company therefore generates around 90% of its cash flow on a fee basis, meaning its earnings are not tied to commodity prices, which can fluctuate a lot over the short term. Customers just pay for what they use in accordance with a preset fee schedule.

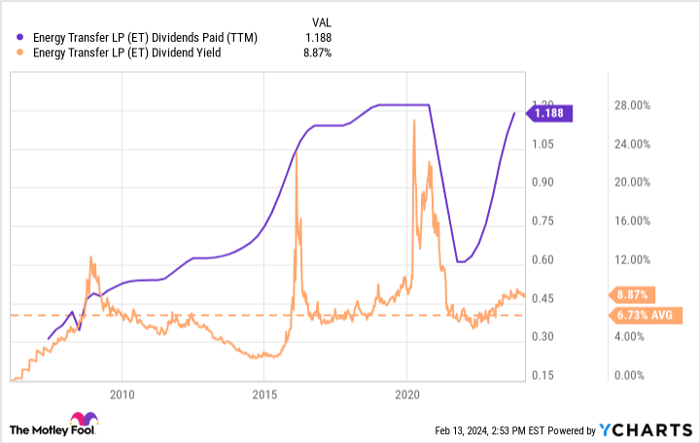

Stable cash flows have allowed the company to pay a steady dividend for more than a decade, the only exception being a temporary drop during the early days of the pandemic when it wasn’t clear how liquid capital markets would be. The dividend was suspended out of caution, not because the business was falling apart. . This year the company expects to generate at least $7 billion in distributable cash flow, around $1 billion more than it needs to support the dividend and near-term growth initiatives.

ET Return on Equity

ET Dividends Paid (TTM) data by YCharts.

Why is the dividend yield so high?

If Energy Transfer can sustain its 9% dividend, why isn’t the market bidding up the stock price to push the yield down to a more normal range? The issue is that companies that rely on fossil fuel production have been trading at a discount for years. Just look at Enbridge, a close competitor. Enbridge owns one of the largest pipeline networks in the world. It has a terrific track record of success, with high pricing power over its customer base. Yet its dividend yield is around 8%, even though the payout has grown by 10% annually for nearly 30 years.

The market’s wavering confidence isn’t due to unreliable dividends, nor is it caused by deteriorating business results. Both Energy Transfer and Enbridge have generated respectable returns on equity over the past decade or two, with recent results slightly above multi-year averages.

The market knows that these businesses are performing well, and that the current dividends are a bargain.

The issue is that these businesses may end up with stranded assets. That is, if regulations or market dynamics force a sudden shift away from oil and gas, pipeline operators will suddenly be left without any customers, with little else to do with their multi-billion dollar asset base.

This sudden shift in energy demand may eventually come to pass, but not for quite some time. Over the next few years, the EIA expects oil and gas consumption to steadily grow, though other groups like the IEA believe oil demand may begin to plateau in the 2030s.

Should you jump into Energy Transfer stock for the 9% dividend? With the exception of a global recession, the payout should remain stable, and likely for years to come. Just know that this is not a stock worth owning forever. At some point over the next century, the widespread replacement of fossil fuels with renewable sources of energy will present a growing headwind, one that will eventually pressure the dividend.

SPONSORED:

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.

News Related

-

, Nov. 28 — One of the most anticipated Android releases for 2023 has been the Google Pixel 8 lineup. The Pixel series is often considered the best of what Android has to offer since it brings the true stock Android experience. The Pixel 8 Pro was globally released on ...

See Details:

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

A blank space or an (NR) indicates no readings received. An (e) indicates that the water level has been estimated. An (w) indicates that the conditions were very windy, resulting in an inaccurate reading. Omatjenne Dam does not have abstraction facilities. The dam contents are according to the latest dam ...

See Details:

Namwater Dam Bulletin on Monday 27 November 2023

-

Dhaka, Nov. 27 — Nobel laureate Dr Muhammad Yunus has been appointed chair of the international advisory board of Moscow’s Financial University (under the government of the Russian Federation). On November 23, he joined a high-level strategic meeting with Prof Stanislav Prokofiev, Rector of the Financial University, and his colleagues. ...

See Details:

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

In a pivotal encounter at the International Cricket Council (ICC) Twenty20 World Cup Africa Final Monday, the Cricket Cranes faced Nigeria, knowing that a win could significantly boost their chances of securing one of the coveted tickets to the 2024 T20 World Cup in West Indies and the USA.Nigeria won ...

See Details:

Victory over Nigeria puts Uganda on the brink

-

Capture 1 The Bank Ghana (BoG) Monetary Policy Committee (MPC) has maintained the key policy rate at 30 percent, while introducing additional liquidity management measures to address excess liquidity and reinforce the disinflation process. Announcing the committee’s decision on Monday following its 115th meeting, BoG Governor Dr. Ernest Addison said ...

See Details:

BoG holds policy rate at 30%, tightens liquidity measures

-

Renita Holmes has been displaced four times in the past three years by rising rents With sea levels rising around the globe, Miami, in the US state of Florida, is facing an urgent need to adapt. As property investors turn their gaze inland, away from the exclusive low-lying beach area, ...

See Details:

When sea levels rise, so does your rent

-

Picture2 In a groundbreaking moment, Mrs. Adelaide Siaw Agyepong, CEO-American International School, has achieved yet another milestone by being crowned ‘Icon of Inspiration and Impact for the Year 2023’. The crowning achievement took place in Accra, where Mrs. Siaw Agyepong surpassed contemporaries to clinch this prestigious title at the 5th ...

See Details:

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Sierra Leone prison breaks co-ordinated - minister

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Address the rise of single parenthood

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Unmarried People Under 35 Outnumber Married Ones

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

European interior ministers in Hungary to discuss migration

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

Freetown’s streets were almost empty on Sunday after a curfew was imposed Gunmen in Sierra Leone attacked a military barracks and freed hundreds of prisoners in a “co-ordinated and properly planned” attack, the country’s information minister has said. Sierra Leoneans spent Sunday under a nationwide curfew amid disarray in capital ...

See Details:

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone

OTHER NEWS

Despite doing education at the university, Mellon Kenyangi, also known as Mama Bear, did not think of going to class, and teaching students was her dream job.“Since it was not ...

Read more »

213 Sri Lanka Cricket’s Chairman of Selectors, Pramodya Wickramasinghe reported to the Sports Ministry’s Special Investigation Unit( SMSIU) for the Prevention of Sports Offences yesterday for the second day. He ...

Read more »

137 Malindu Dairy (Pvt) Ltd., a leading food production company in Sri Lanka, won the Silver Award in the medium-scale dairy and associated products category at the Industrial Excellence Awards ...

Read more »

Africans Urged to Invest Among themselves, Explore Investment Opportunities in Continent Addis Ababa, November 27/2023(ENA)-The Embassy of Angola in Ethiopia has organized lecture on the “Foreign Investment Opportunities in Angola ...

Read more »

144 The dynamic front row player Mohan Wimalaratne will lead the Police Sports Club Rugby team at the upcoming Nippon Paint Sri Lanka Rugby Major League XV-a-side Rugby Tournament scheduled ...

Read more »

Dozens of people living with disabilities from New Hope Inclusive in Entumbane, Bulawayo on Saturday last week received an early Christmas gift in the form of groceries. The groceries were ...

Read more »

The East African Community (EAC) Summit of Heads of State has admitted the Federal Republic of Somalia to the regional bloc, making it its 8th member country. The decision was ...

Read more »