For nearly six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been putting on an investment clinic for all to see. Since taking over as the CEO of Berkshire in the mid-1960s, the “Oracle of Omaha,” as Buffett has come to be known, has overseen an aggregate return in his company’s Class A shares (BRK.A) of almost 4,500,000%, as of the closing bell on Jan. 19, 2024.

Lengthy books have been written highlighting the investing traits Buffett exhibits when picking out winning stocks. However, his penchant for portfolio concentration has been one of the defining factors in Berkshire Hathaway’s sustained outperformance. Despite holding stakes in around 50 stocks, just seven core holdings account for 83% ($301.7 billion) of Berkshire Hathaway’s $365 billion of invested assets.

Berkshire Hathaway CEO Warren Buffett.

1. Apple: $175,384,746,776 (48.1% of invested assets)

Based on the more than $175 billion currently being put to work in tech stock Apple (NASDAQ: AAPL), it’s crystal clear that Buffett and his team value having an outsized percentage of their company’s investment portfolio in top ideas. Apple has been a continuous holding for Buffett’s company for eight years.

What makes Apple such a special company is its innovation. Its physical products have endeared users to the brand for a long time. This includes its market-leading iPhone, as well as iPad, Mac, and other wearables, such as the Apple Watch.

However, Apple’s innovation goes beyond physical products. CEO Tim Cook has been emphasizing a shift to subscription services in recent years. A services-driven operating model should further boost the company’s operating margin, improve customer loyalty, and reduce the revenue swings observed during major iPhone replacement cycles.

I’d be remiss if I didn’t also mention that Apple’s capital-return program is unmatched among public companies. It has repurchased more than $600 billion worth of its common stock since instituting a buyback program in 2013.

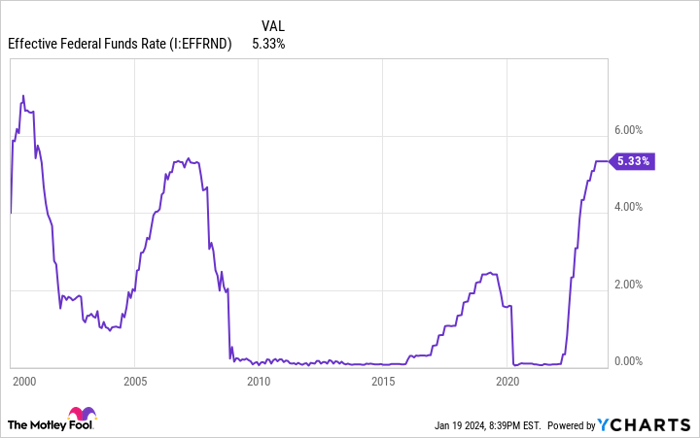

An aggressive rate-hiking cycle has been beneficial to Bank of America’s bottom line. Effective Federal Funds Rate

2. Bank of America: $33,278,491,633 (9.1% of invested assets)

There’s no sector of the market Warren Buffett has more knowledge of than financials. So it’s not a surprise to see money-center giant Bank of America (NYSE: BAC) as Berkshire’s second-largest holding.

One of the primary reasons Buffett and his team love bank stocks is because they’re cyclical. Berkshire Hathaway’s investment dream team is well aware that recessions are a natural part of the economic cycle. They also understand that downturns are short-lived and handily outpaced in length by periods of expansion.

These disproportionate periods of growth for the U.S. economy allow companies like Bank of America to expand their loan portfolios and steadily increase their net interest income over time. A heavy emphasis on cyclical stocks has helped Berkshire Hathaway and its shareholders.

Something else noteworthy about BofA is its interest-rate sensitivity. Changes to monetary policy will impact Bank of America’s net interest income more than any other big bank. The most aggressive rate-hiking cycle in four decades over the past two years has helped pump up its profits.

3. American Express: $27,770,51,919 (7.6% of invested assets)

Credit-services provider American Express (NYSE: AXP) has been a continuous holding of Berkshire Hathaway since 1991. It’s currently the third-largest holding in the $365 billion portfolio that Warren Buffett and his aides oversee.

In addition to benefiting from extended periods of economic growth, American Express is a “double dipper” that’s generating revenue from both sides of a transaction. It’s the No. 3 payment processor in the U.S. (the largest market for consumption globally) by credit card network purchase volume and also a lender to businesses and consumers. This allows AmEx to generate interest income and fee revenue to go along with merchant fees for processing transactions.

Furthermore, American Express has a knack for attracting a more affluent clientele. Cardholders with higher incomes are less likely to alter their purchasing habits if the economy weakens. This means AmEx may be able to navigate recessions better than most lending institutions.

Two people clanking their Coca-Cola bottles together while seated outside and chatting.

4. Coca-Cola: $23,932,000,000 (6.6% of invested assets)

Beverage stock Coca-Cola (NYSE: KO) is the longest-tenured company in Berkshire Hathaway’s investment portfolio (since 1988) and currently its fourth-largest holding. Thanks to a minuscule cost basis of $3.2475 per share, Berkshire is netting a nearly 57% annual yield, relative to cost, on its Coca-Cola stake.

What makes Coca-Cola great is the predictability of its operating cash flow. Food and beverages are basic-need goods that are going to be purchased in any economic climate.

To boot, the company’s products can be found in all but three countries (North Korea, Cuba, and Russia — the latter being due to its invasion of Ukraine). This virtually unparalleled geographic diversity ensures steady operating cash flow from developed markets, as well as an organic growth boost from emerging markets.

Coca-Cola’s marketing team has also been incredibly successful in engaging consumers for decades. The company is leaning on digital media and artificial intelligence (AI) to tailor ads to younger consumers while relying on well-known brand ambassadors to reach more mature audiences.

5. Chevron: $15,681,716,627 (4.3% of invested assets)

The fifth-largest holding in Warren Buffett’s portfolio at Berkshire Hathaway is energy company Chevron (NYSE: CVX). Oil stocks are known for their robust capital-return programs, which makes Chevron one of Berkshire’s top dividend stocks.

Energy stocks have historically not played a big role in Buffett’s portfolio — until recently. A greater than $15 billion position in Chevron indicates that the Oracle of Omaha and his team expect the spot price of crude oil to remain elevated.

Supporting this take is Russia’s aforementioned invasion of Ukraine, as well as multiple years of capital underinvestment by energy majors, caused by the COVID-19 pandemic. With oil supply constrained, a strong case can be made that the spot price for crude can head higher.

Additionally, Chevron has what might be the best balance sheet of all integrated oil and gas companies. Elevated energy commodity prices allowed Chevron to meaningfully reduce its net debt throughout 2022. It has exceptional financial flexibility, which could help when making acquisitions.

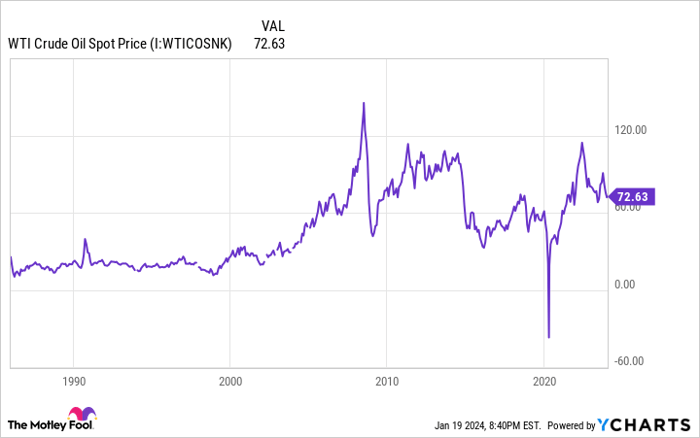

An elevated spot price for crude oil will be needed by Occidental Petroleum to further reduce its long-term debt. WTI Crude Oil Spot Price

6. Occidental Petroleum: $13,750,445,662 (3.8% of invested assets)

The other big oil stock in Berkshire Hathaway’s investment portfolio is Occidental Petroleum (NYSE: OXY). The roughly 243.7 million shares of Occidental common stock held by Buffett’s company have all been picked up since the beginning of 2022.

Occidental is an integrated oil and gas operator like Chevron but with a meaningful twist. Whereas Chevron generates most of its revenue from its downstream operations (e.g., refineries and chemical plants), Occidental brings in the bulk of its revenue from its upstream drilling segment.

If the spot price of crude oil rises, Occidental’s operating cash flow will disproportionately benefit, relative to its peers. Just understand that the opposite will happen if the spot price of crude oil declines.

It’s also worth noting that Occidental Petroleum is lugging around quite a lot of debt. Although it’s effectively halved its net debt since acquiring Anadarko in 2019, the $18.6 billion in net debt it was still carrying on its balance sheet as of Sept. 30 is nothing to sneeze at. Occidental very much needs the spot price of crude to remain elevated to further improve its financial flexibility.

7. Kraft Heinz: $12,074,539,051 (3.3% of invested assets)

The seventh stock that, collectively with Apple, BofA, AmEx, Coca-Cola, Chevron, and Occidental, accounts for 83% of Berkshire Hathaway’s $365 billion of invested assets is consumer packaged-foods and condiments company Kraft Heinz (NASDAQ: KHC).

The beauty of consumer staples stocks is the predictability of their operating cash flow. Since people need food in any economic climate, the company’s cash flow doesn’t change much from one year to the next.

Further, the company enjoyed a shot in the arm of organic growth during the pandemic. Kraft Heinz’s well-known brands and easy-to-make meals made it a popular choice when fewer people were dining out.

However, a case can also be made that Kraft Heinz is one of Buffett’s worst investments. Kraft Heinz has reported multiple quarters of declining volume/mix, which suggests consumers are trading down to less-costly store-branded goods. With a lot of debt on its balance sheet and the company’s pricing power waning, its high-yield dividend looks like its only redeeming quality for investors.

SPONSORED:

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 16, 2024

Bank of America and American Express are advertising partners of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Chevron, Kraft Heinz, and Occidental Petroleum and recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB