Einhorn Says Markets Are ‘Broken.’ Here’s What Data Shows

(Bloomberg) — David Einhorn put it bluntly: The valuation-be-damned boom in passive investing has “fundamentally broken” markets as it proceeds to crush the time-honored hunt for cheap-looking stocks across Wall Street — year after year.

In the telling of the renowned hedge-fund manager, the explosion in index-tracking flows is putting so many active investors out of business that the halcyon era of Warren Buffett and Benjamin Graham championing undervalued companies is no more. And that undermines everything from price discovery to corporate governance. “Passive investors have no opinion about value,” Einhorn said on Barry Ritholtz’s Masters in Business podcast back in February.

The Greenlight Capital founder’s views come in an era when cheap stocks have lagged their tech-heavy growth companies like never before, just as passive assets overtake active counterparts. After two banner years for his fund, Einhorn’s views constitute a critique rather than a lament, given his bullish takeaway that there’s still a way to make deep-value investing work.

Yet it’s reviving the broader debate on the market disruption wrought by Big Passive, a frenzy once dubbed “worse than Marxism.” But has the backlash gone too far? Perhaps. Here’s why a slew of pros argue the indexing boom — far from breaking things — is exerting a still-modest impact on the stock-picking backdrop, citing broadly business-as-usual data on valuations and equity returns.

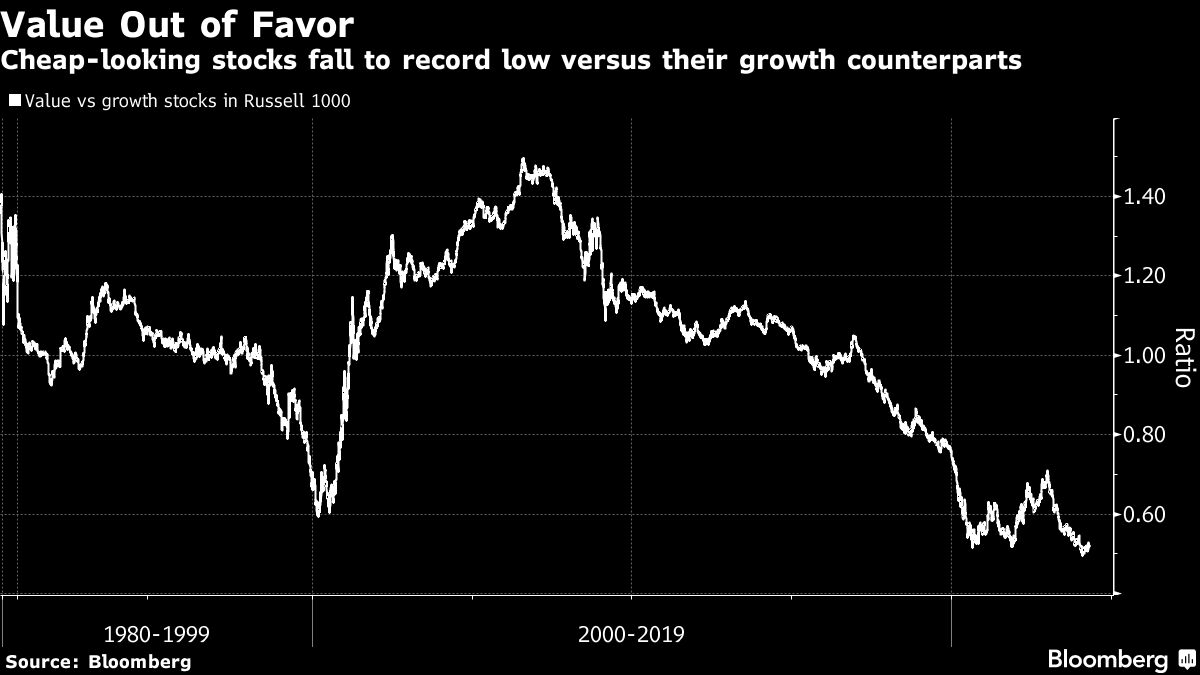

Value Out of Favor | Cheap-looking stocks fall to record low versus their growth counterparts

Vanishing Value

First off, the central contention by the 55-year old value manager — that it’s a tough time for old-school adherents of the investing style — rings true. Back in the day investors could score big wins by scooping up bargains across the board. Yet for more than a decade, the strategy has misfired again and again for the overwhelming number of managers.

An index of value stocks, those ranked low in metrics such as price to earnings or book value, has trailed the Russell 1000 benchmark in all but two years since 2012. Against shares boasting faster growth, value earlier this year sank to a record, thanks to the profit boom unleashed by the artificial-intelligence fervor.

To the likes of Einhorn, the hidden hand of passive money is behind a large part of this. Since new money is going to index-tracking vehicles, cash automatically goes after winning stocks. Laggards, often cheap as a result, get shunned. That, the thinking goes, creates a vicious cycle where value managers fail to deliver, cash is withdrawn and those stocks go down even more.

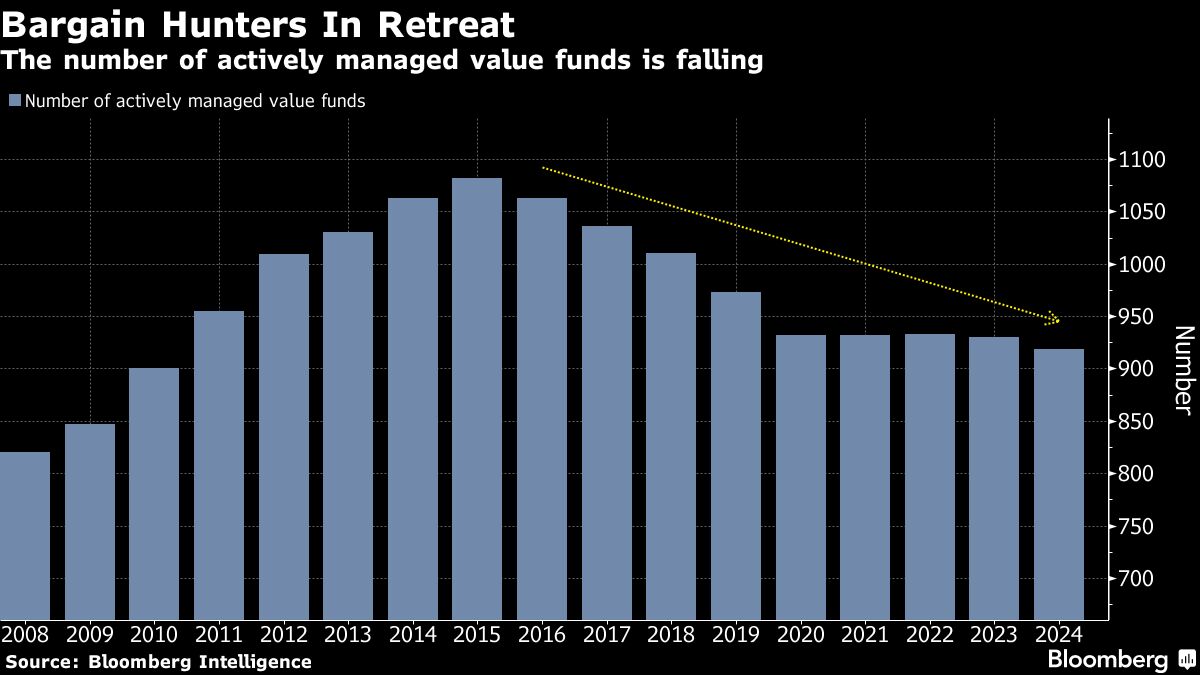

Bargain Hunters In Retreat | The number of actively managed value funds is falling

Indeed, the population of actively managed funds dedicated to value investing is shrinking. The number of mutual funds and ETFs focused on that style peaked at 1,082 in 2015 and has since fallen 15%, according to data compiled by Bloomberg Intelligence mutual fund analyst David Cohne.

Even stock-picking pros with a broader mandate have bought into the idea that bargain hunting these days is a largely futile endeavor. The average active fund’s value exposure sits 56% below that of momentum stocks, a level not seen in 15 years, according to a March study by Bank of America Corp. strategists including Savita Subramanian.

Active in Control

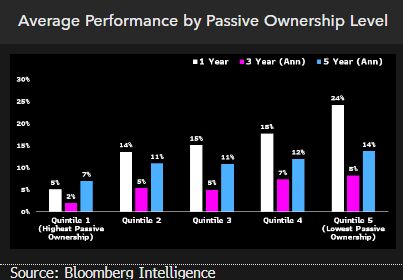

Yet Bloomberg Intelligence analysts found evidence that suggests there’s no cause for panic. After tallying up S&P 500 stocks by their passive ownership and comparing their performance, the analysts found that the least-owned bucket of stocks has actually beaten the others over one, three and five years.

“Despite the strong and steady growth of passive funds, their impact on market moves remains small,” Athanasios Psarofagis and James Seyffart wrote in a recent note.

Another argument that pushes back on the index disruption: That these funds typically follow the price trends set by their active counterparts. Tesla Inc.’s 2020 entry in the S&P 500, for example, was driven by a stock surge fueled by highly engaged day traders and growth-driven institutional investors. Meanwhile, a 2021 academic study showed the US equity market is just as active as it was two decades ago, with a slew of discretionary investors weaponizing passive ETFs to build out their portfolios.

Blaming value’s underperformance solely on indexing is therefore flawed, according to Rich Weiss, chief investment officer for multi-asset strategies at American Century Investment Management.

“The growth of passive investing has been going on since I joined the business,” said the market veteran with 40 years of investing experience. “It’s not new. So why all of a sudden it’s now achieved some level where value doesn’t work?”

Regardless of what’s behind the challenges for the broad value trade, Einhorn, whose New York-based fund soared almost 37% in 2022 and 22% last year, has a bullish takeaway. With price-insensitive investors taking over markets — from ETFs to algorithmic money — otherwise viable businesses now trade with ridiculously low valuations, known as deep value. That means even modest corporate payouts, in the form of dividends and buybacks, can mint returns for their last remaining value-tilted shareholders.

Einhorn wrote in an investor letter last month that the historic shift of capital as a result of the passive proliferation creates “a beautiful opportunity set.”

“Our return can come from the company itself, rather than from other investors,” he wrote.

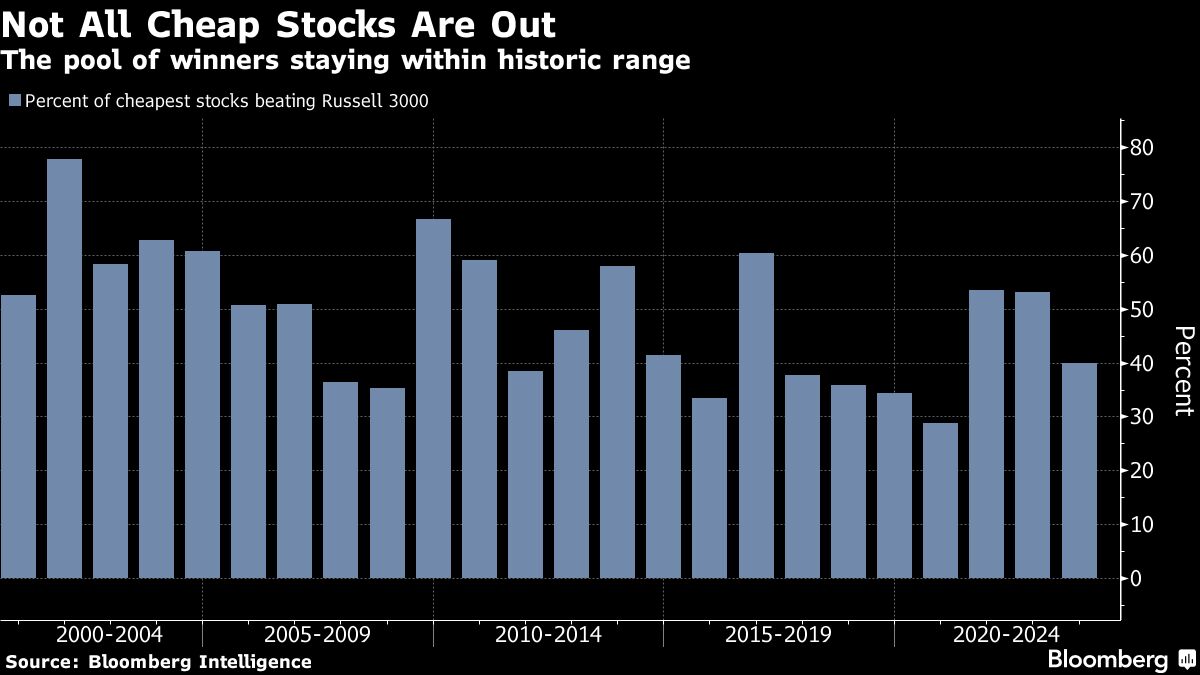

Pool of Bargains

When it comes to stock winners and losers, for now at least, nothing is breaking from the historic norm. While definitions of cheap equities vary and are often subjective, for the purpose of illustration let’s use price-to-sales to determine what’s cheap. Tracking the performance of the cheapest cohort, or quintile, in the Russell 3000, the last three years haven’t been the value-investing desert many have portrayed them as.

In that group, the proportion of stocks beating the benchmark increased to a five-year high of 54% in 2021 and stayed there the following year, according to data compiled by Bloomberg Intelligence.

Last year, when the so-called Magnificent Seven dominated gains, that percentage slipped to 40%. Yet this ratio of winning stocks still sits broadly within the two-decade trend — hardly something that signals a new investing regime.

Not All Cheap Stocks Are Out | The pool of winners staying within historic range

“If Einhorn was right that value is broken and basically fundamentals (valuations) don’t matter any more, you would see a persistent decrease in the number of value stocks beating the index,” said BI equity strategist Chris Cain. “But you don’t really see that. It’s back and forth with no real pattern.”

(Einhorn, in his most recent investor letter, pushed back on using conventional metrics to define value, writing: “A high-multiple stock can be undervalued, and a low-multiple stock can be overvalued.”)

Mind the Gap

Meanwhile the valuation gap between the cheap and the expensive is truly historic — but only when it comes to how long it’s lasted. The cheapest quintile in the Russell 1000 has seen its multiple stay depressed versus the most expensive for five straight years in a stretch not seen in Bloomberg data going back to 2001.

Yet for all, nothing out of the ordinary appears to be happening. The spread is wide, but it was similarly bad during the bursting of the dot-com bubble when passive funds were smaller.

Valuation Spread | Cheap stocks stay depressed but the gap to expensive shares shows nothing unusual

Perhaps value’s woes have less to do with passive and more to do with the winner-takes-all era of tech innovation. That’s fueled the ascent of large growth stocks with stable earnings such as software or internet companies — an even-more attractive investment when the economic outlook has proved murky like the pandemic.

The upshot? The relentless ascent of growth stocks may have been exacerbated by index money — but cheap-looking equities will eventually find their moment, according to Lamar Villere, a portfolio manager at Villere & Co.

“Whoever owns what’s out of fashion at that moment is going to argue the market is broken,” he said. “I don’t think the market is broken. I think maybe it’s not as fast to reward value investors as it was because there is this inherent growth bias to passive investment.”

(Updates with fund’s location in 15th paragraph. An earlier version was corrected to fix BofA strategist’s name.)

Most Read from Bloomberg

©2024 Bloomberg L.P.