Don’t underestimate the risks of being an executor – they’re about to get worse

Acting as executor comes with legal and financial risks – SolStock/E+

Email your tax questions to Mike via email: [email protected]

When a friend asks you to be named as an executor in their will, it seems an honour. It shows how much they trust and appreciate you, a bit like being asked to be best man at their wedding. But that is where the similarity ends.

Your duty as best man is to make sure the groom arrives at the church on time and to look after the ring. In return, you are allowed to make an amusing speech and (with consent) kiss the bridesmaids.

Becoming an executor to someone’s will, however, brings with it very real responsibilities and financial risks. You can even finish up with a personal liability if things go wrong. In financial terms, you step into the shoes of the deceased, take control of their assets and settle any liabilities. You have legal obligations both when applying for probate and when dealing with any questions from HM Revenue and Customs (HMRC).

Investigations can run on for several years and become both time consuming and distressing, and the very person you would most like to help you has inconveniently just died.

Last month, I wrote about a reader who planned to take his family on a series of very expensive holidays and was concerned that he might be caught for inheritance tax (IHT). Several readers suggested that it was not a problem, partly because HMRC would never find out about it. While such responses are understandable, this is not the way the law works.

Put simply, the onus is placed on the executors to declare any payments that are potentially caught for IHT, not on HMRC to discover them.

This point was well made in a comment on my article by John, who said: “There are many comments here which display a complete lack of awareness of the responsibility heaped on the shoulders of the executor. The executor is required to apply suitable diligence to verifying the tax declaration, and can be fined if gifts are not declared correctly, whether or not they benefited.

“The risk inherent in this can mean, for example, the (usually unpaid) executor being compelled to check through 12,000 payment transactions, spread over 16 accounts and seven years, and having to ask questions of ungrateful and grumpy beneficiaries who consequently make his or her life miserable. Please, spare a thought for the unpaid executor. In matters like this, do things in a way which is simple and honest, well informed by IHT law, and well documented.”

However, here are some of the other posts from readers:

“Spending money in this way would be impossible for HMRC to police, even if it does technically fall foul of the rules. Just spend the money on holidays and don’t worry about it.”

“Interesting article as always, but your answer that the holiday probably does have the status of a gift implies that anyone who buys a private yacht and takes friends on a cruise has a similar dilemma, which is plainly wrong?”

“Not sure I am with you here Mike. Thousands of grandparents take the family away but I have never seen an estate attacked by HMRC for IHT on such things. They could change policy in [their] ever more aggressive stance, but it would be a very poor reinterpretation of the law as practised and as you say create huge problems for executors.”

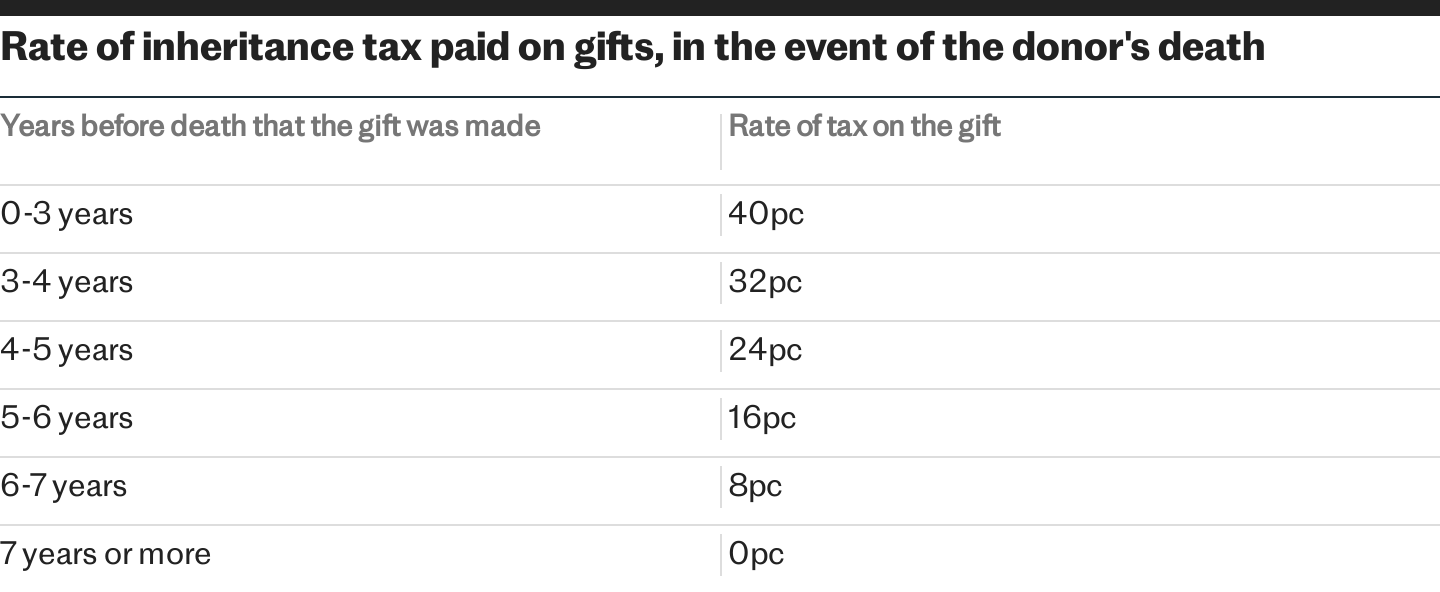

Rate of inheritance tax paid on gifts

In case I was being too cautious I decided to ask HMRC for its views. A spokesman responded:

“Any gift that reduces the value of the person’s estate may be chargeable to IHT, although exemptions may apply.

“For example, the normal expenditure out of income exemption may be relevant for the kind of scenario set out in the article (though we can’t comment on specific cases).

“Each case would be considered on the individual facts. For example, if part of the reason an individual may pay for the family to go on holiday is that, in order to go on holiday themselves, they require family members to provide care whilst there, it may be that there was no intent to confer any gratuitous intent.

“But in a case where a person pays a £100,000 bill for family members to go on an expensive holiday, it is reasonable to assume it is a lifetime transfer which would be chargeable to IHT if the donor dies within seven years (subject to exemptions).

“If such gifts were not viewed in this way, it would be easy for individuals to get around the rules as, for example, a gift of £100,000 could be made, but instead of being in cash, the gift giver could attempt to avoid an IHT charge by giving the value through a car or a holiday.

“Our published guidance provides an outline of the section on gratuitous intent, including that the burden of proof is on the person who contends that the section applies.”

If the opinion polls are correct, we will soon have a new government with a large majority and a mandate to collect more tax, including from the old and the wealthy. If you have any doubt about it you should read Brian Monteith’s article on Labour’s tax advisers spelling disaster for the wealthy and pensioners.

Brian is right to be concerned.

Labour will need to raise more tax, and will probably go for those taxpayers who will yield the most. It may be that historically many deceased estates have been cleared without a detailed review by HMRC – but I suspect that is about to change with many more investigations taking place. It would be wise to prepare accordingly.

In his comments above, John provided sound advice. For both the protection of your estate and assistance to your executors, please keep detailed records and let your executors know where to find them. This will serve two purposes; it will allow your executors to submit a full return to HMRC and respond to questions. It will also help substantiate any claims for relief under the normal expenditure out of income rules.

Mike Warburton was previously a tax director with accountants Grant Thornton and is now retired. His columns should not be taken as advice, or as a personal recommendation, but as a starting point for readers to undertake their own further research.

Recommended

What is probate? How it works and how to execute a loved one’s will

Read more

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.