Artificial intelligence (AI) is a multi-trillion-dollar megatrend. According to an estimate by PwC, AI has the potential to provide a $15.7 trillion boost to the global economy by the end of this decade. That’s more than the current economic output of India and China combined.

To reach its full potential, AI requires two crucial components: computing power and electricity. While most investors are currently focusing on the first aspect (e.g., semiconductors), many don’t yet realize the importance of power. According to one estimate, data centers will grow from consuming 2% of the world’s electricity to 10% by 2030. That’s the equivalent of adding the electric generation capacity of the current U.S. power grid. While renewable energy will be crucial in powering AI, it can’t carry that load alone. That drives the view that cleaner-burning natural gas will be vital in helping power AI’s growth. Two under-the-radar ways to cash in on that trend are gas pipeline giants Kinder Morgan (NYSE: KMI) and Williams (NYSE: WMB).

Powerful demand growth ahead

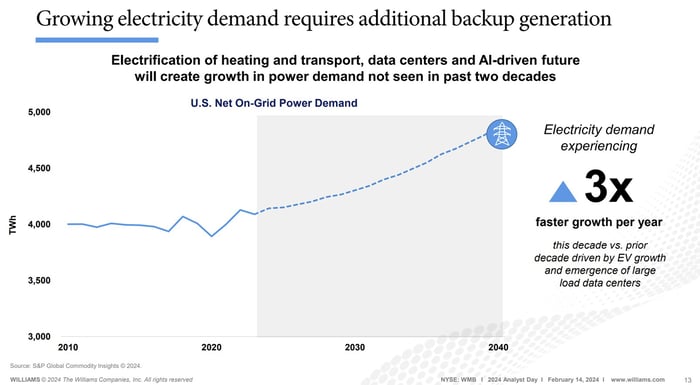

Electricity demand in the U.S. has grown slowly over the last decade. However, a reacceleration is coming:

A slide showing the expected reacceleration of U.S. electricity demand.

As that slide shows, U.S. electricity demand will grow three times faster over the next two decades, powered by the electrification of the heating and transport sectors and growth from the power-hungry data center space (which are crucial to supporting AI applications).

Data centers are already heavy power consumers. According to the U.S. Department of Energy, they typically use 10 to 50 times more energy per floor space than a typical office building. Meanwhile, AI applications are even more power-intensive. For example, an AI-powered search query can use 10 times more power than a typical internet search.

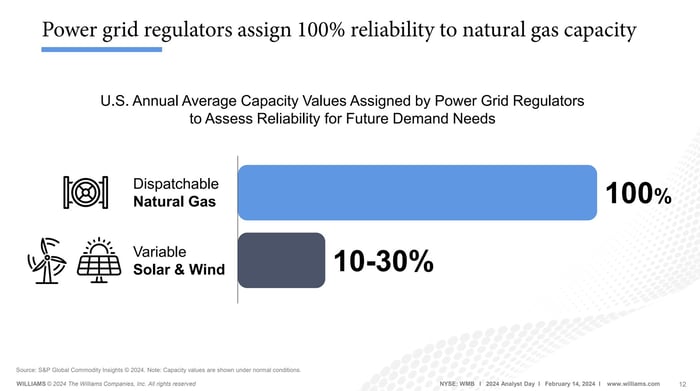

While most data center operators have pledged to use renewable energy to power their facilities, the power grid can’t rely on renewable energy alone because of its intermittency issues. That’s not a problem with natural gas:

A slide showing the reliability of gas versus renewables.

As that slide shows, utilities can count on natural gas to supply steady power. That’s not something renewables can guarantee since the sun doesn’t shine at night (or on cloudy days) while the wind isn’t blowing consistently. While there are solutions to the intermittency problem (energy storage), they add to the cost. Thus, cheap, abundant, lower-carbon natural gas will play a vital role in supporting the growing electricity demand. Further, while natural gas does produce carbon emissions, the industry can utilize carbon capture and storage technology to reduce its carbon footprint. The energy industry can also use natural gas to produce lower-carbon fuels like blue hydrogen, which could power data centers.

Leaders in natural gas infrastructure

Growing power demand should fuel the need for more natural gas power plants and related infrastructure to produce, process, and transport gas from production basins to end users. Current estimates suggest natural gas demand will grow by 19% in the U.S. through 2030, while global gas demand will increase by 15% by 2040.

That bodes well for natural gas pipeline companies. They should see rising volumes across their existing infrastructure and new expansion opportunities. Kinder Morgan is the undisputed leader in gas infrastructure. The company operates the largest gas transmission network in the country. It has 70,000 miles of pipelines that transport 40% of the country’s gas demand. It also operates 15% of the country’s natural gas storage capacity.

Kinder Morgan is in an excellent position to capitalize on future gas demand growth. It operates a nationwide pipeline network, with a stronghold in Texas and Louisiana, where gas production and demand are growing fastest (fueled by the Permian Basin on the production side and demand-driven exports). The company expects growing gas demand will increase its cash flow, giving it more fuel to raise its 6.8%-yielding dividend.

Williams also has extensive natural gas infrastructure. It has leading gathering and processing positions across top production basins. In addition, it owns the Transco pipeline, which transports gas to key market centers along the East Coast. It also controls 8% of the U.S. natural gas storage capacity.

Williams is investing $2.7 billion to expand its Transco pipeline to capitalize on growing gas demand from utilities. It’s also growing its gathering and processing positions to support rising gas production volumes across several basins. These expansion investments should give Williams the fuel to continue growing its 5.8%-yielding dividend.

AI-powered demand growth

AI requires a lot of energy. That will add to the world’s already growing demand for electricity as it pivots away from dirtier energy sources like coal and oil. While renewable energy will help supply a lot of this demand, it won’t be able to do it all on its own, which should open the door for cleaner-burning natural gas to pick up the slack. Growing gas demand means more infrastructure like pipelines, which will benefit Kidner Morgan and Willaims. That makes them under-the-radar ways to cash in on the expected AI power surge.

SPONSORED:

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Matt DiLallo has positions in Kinder Morgan. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool has a disclosure policy.

News Related-

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

Namwater Dam Bulletin on Monday 27 November 2023

-

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

Victory over Nigeria puts Uganda on the brink

-

BoG holds policy rate at 30%, tightens liquidity measures

-

When sea levels rise, so does your rent

-

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Sierra Leone prison breaks co-ordinated - minister

-

Address the rise of single parenthood

-

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Unmarried People Under 35 Outnumber Married Ones

-

European interior ministers in Hungary to discuss migration

-

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone