Cover Story: Who pays for anytime EPF withdrawals?

This article first appeared in The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

MEMBERS’ ability to decide not to transfer existing Employees Provident Fund (EPF) savings into the newly created Flexible Account 3 for anytime withdrawals is seen as the saving grace to what critics deem as a short-sighted compromise that will prove to have longer-term consequences.

In terms of retirement savings, the second positive is the further lifting of the ratio to EPF’s Retirement Account 1 from 70% to 75% from May 11, provided it remains off-limits until members hit retirement age. This, too, may have an unintended shorter-term impact, given that higher forced savings and the creation of an anytime pool potentially leaves less money in Wellbeing Account 2 for housing and education-related withdrawals, observers say (see “Managing the impact of a smaller ratio for EPF Wellbeing Account 2”).

With the increase in the ratio for Retirement Account 1 to 75%, EPF estimates that it is possible to see as many as 65% of its members achieve Basic Savings by 2035 compared with only 33.1% in 2023.

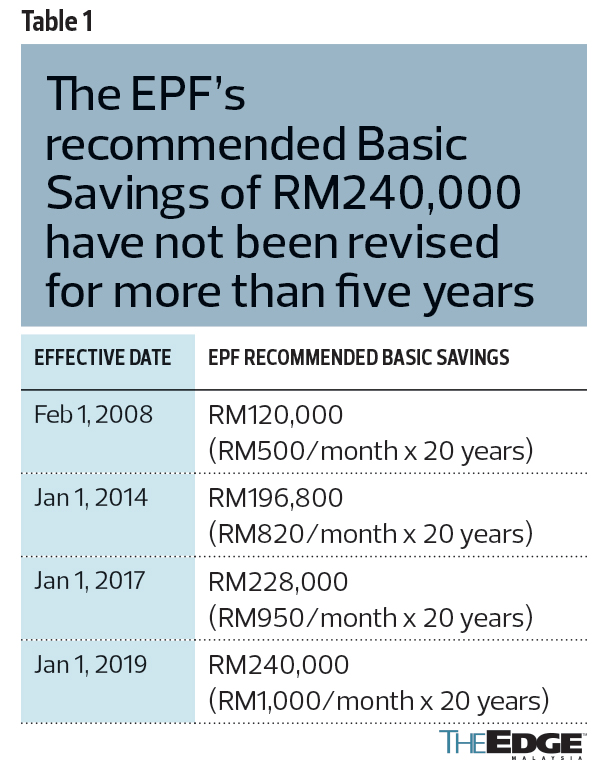

Critics note, however, that the 33.1% figure itself is an understatement, given that EPF has not revised its Basic Savings of RM240,000 (RM1,000 a month for 20 years) for more than five years (see Table 1).

EPF also hopes the flexibility to tap Account 3 would encourage more sign-ups and deposits from the self-employed as well as professionals such as doctors and lawyers to raise its coverage of the labour force from 50% now to 80% by 2035.

Hawati Abdul Hamid, deputy director of research at Khazanah Research Institute (KRI), says: “The more important aspect of this restructuring, I reckon, is the greater goal of promoting participation among workers who are yet a contributor of EPF in securing their financial futures and fostering a culture of proactive long-term savings.

“Malaysians still face a wide gap in terms of social security coverage, especially among self-employed and informal sector workers. The availability of Account 3 would be particularly beneficial to those who intend to save for retirement yet need flexibility in dealing with cash-flow issues due to the variability and irregularity of their income.

“EPF seems convinced from the feedback received from its public consultation indicating that 83% prefer empowerment through a flexible withdrawal and 63% are willing to trade off increasing allocation to Account 1 for flexibility.”

In the longer term, a wider pool of contributors should help delay the timing at which EPF is expected to start seeing annual net outflows instead of the current norm of sizeable annual net inflows, broken only twice in the past two decades, owing to pandemic-related withdrawals amounting to some RM145 billion. As it is, it is understood that net outflows are expected in 15 to 20 years, in line with demographic changes. A reading of the tea leaves shows that this is a first of a series of changes that will come (see “Managing the impact of a smaller ratio for EPF Wellbeing Account 2”).

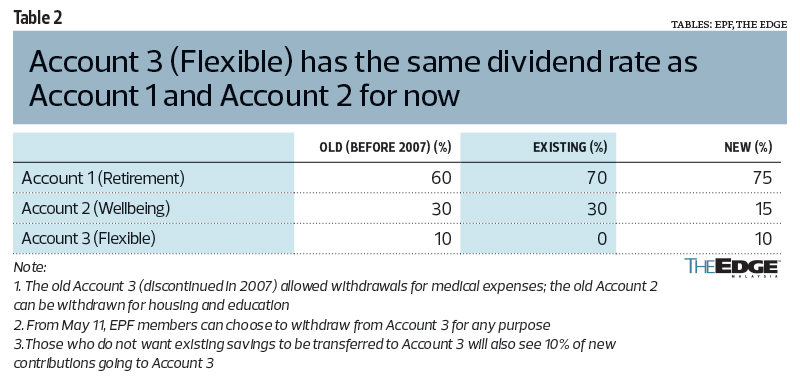

The last EPF contribution ratio change was effective from Jan 1, 2007, when contributions to Account 1 was raised from 60% to 70%. Back then, the balance in EPF Account 3 (10%) for medical expenses was consolidated into Account 2 (30%), which allowed withdrawals for housing and education (see Table 2).

It is not immediately certain how much of the benefit of a higher ratio was eroded when members were allowed to prematurely tap Account 1 during the pandemic. Members who withdrew money then are likely to have to work four to six years to rebuild savings, EPF had previously said.

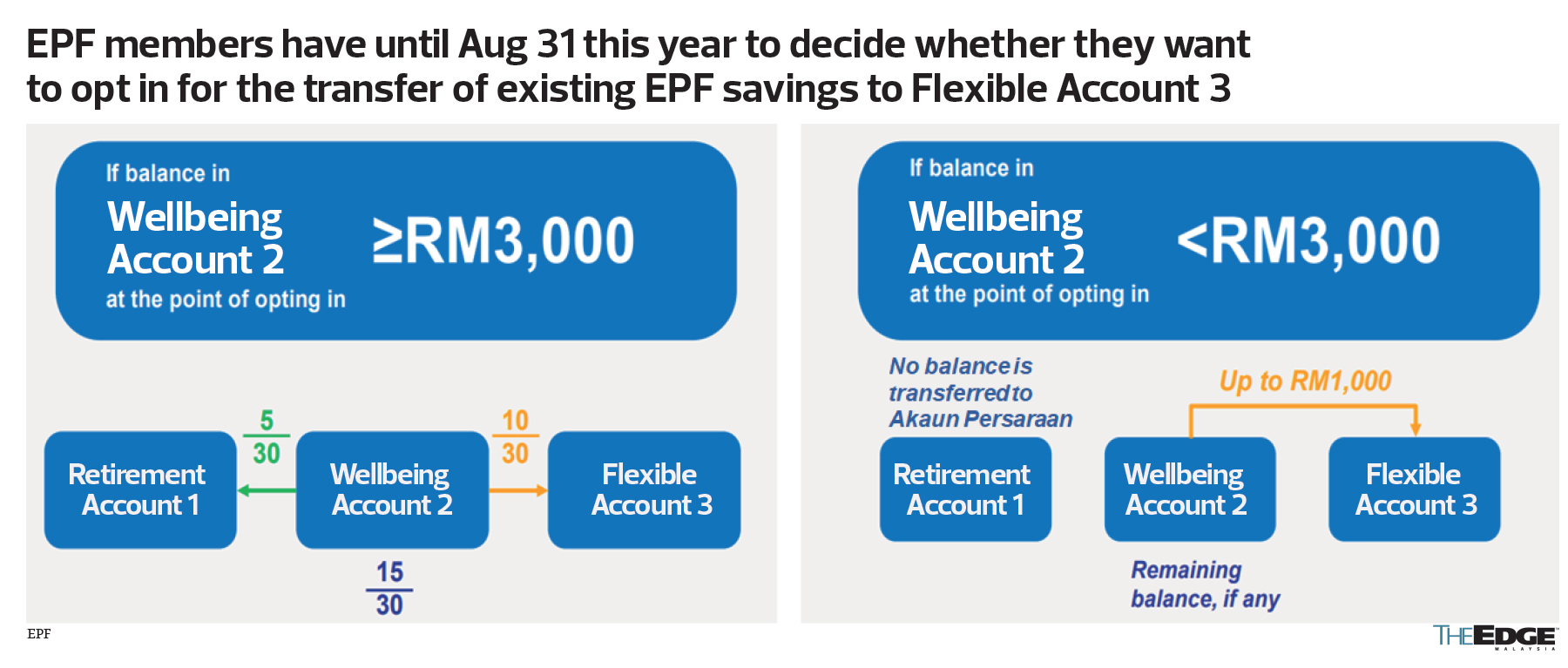

With the setting-up of Flexible Account 3 for anytime withdrawals this month, EPF members clamouring for more premature withdrawals of retirement savings would be able to take out up to a third of the balance in their existing Wellbeing Account 2, if they choose to transfer eligible balances from May 11 this year. Those eager to withdraw but only have between RM1,000 and RM3,000 left in Account 2 will be allowed to take out RM1,000; those with less than RM1,000 in Account 2 can empty it if they opt in for Flexible Account 3 transfers by Aug 31 (see diagram).

Even if members choose not to transfer existing savings to the new Flexible Account 3, new contributions to EPF from May 11 will automatically see 10% going into that account, with a 75:15:10 ratio for Retirement Account 1, Wellbeing Account 2 and Flexible Account 3 replacing the old 70:30 ratio for Account 1 and Account 2.

Downside to consumption boost

EPF expects only RM25 billion to be withdrawn from Flexible Account 3 this year, about 44% of the RM57 billion that could be taken out if every member below 55 opts in by Aug 31 and empties their accounts.

The RM25 billion to RM57 billion translates into 1.2% to 2.9% of gross domestic product (GDP), which could aid consumption in the near term, back-of-the-envelope calculations show.

The trade-off would, however, be “fewer funds available for investment, affecting economic growth potential”, CGS International economist Nazmi Idrus wrote in an April 25 note, observing that EPF had guided withdrawals to be between RM20 billion and RM30 billion this year.

Withdrawals from Account 3 are expected to be RM4 billion to RM5 billion annually from next year, EPF CEO Ahmad Zulqarnain Onn told editors at a briefing on the mandated change in savings ratio come May 11 this year.

Ahmad Zulqarnain says these estimates are based on past withdrawal patterns of EPF members aged below 55 when special withdrawal schemes were introduced.

Declining to comment on dividend in relation to flexible withdrawals, he says that even if the entire RM57 billion were to be taken out this year, there would be “no change” in EPF’s strategic asset allocation (SAA), apart from having to “maintain some extra liquidity [which] has been modelled in”.

External fund managers that receive allocations from EPF to invest new statutory savings coming in every month would probably be among those heaving a sigh of relief.

Indeed, the RM25 billion expected outflows from Account 3 pales in comparison to the rare net withdrawals that EPF had to deal with in 2021 and 2022, owing to pandemic-related special withdrawals.

In 2022, total withdrawals of RM91.04 billion exceeded contributions of RM84.78 billion, resulting in a net withdrawal of RM6.26 billion. In 2021, three pandemic-related withdrawal schemes pushed total withdrawals to RM131.08 billion, compared with only RM72.89 billion in contributions, resulting in the largest-ever net withdrawal of RM58.19 billion that year.

The expected outflows from Account 3 would indeed be manageable if EPF contributions remain strong, just like they did last year. Total contributions rose 15% year on year to RM97.56 billion in 2023, with net inflows guided around RM50 billion.

For now, there is no difference in the dividend rate for savings in Account 3 versus that in Account 2 or Account 1. Ahmad Zulqarnain says that could change, as liquid assets usually net a lower yield, but he does not say what could trigger the change.

Any change in dividend policy for Account 3 could affect members with savings above RM1 million, given that there is currently flexibility to withdraw everything above RM1 million on short notice.

EPF had 16.07 million members as at end-2023, of which 8.52 million were active members, defined as those who contributed at least once on a rolling 12-month basis.

About 1.52 million, or 18.1%, of 8.39 million active members as at end-2022 had less than RM3,000 in savings with EPF; 2.33 million, or 27.8%, had less than RM5,000 in savings; and 3.17 million, or 37.7%, had less than RM10,000 in savings.

A total of 75,802, or 0.9%, active EPF members have at least RM1 million savings totalling RM131.189 billion, or 16.92% of RM775.01 billion savings with active members as at end-2022.

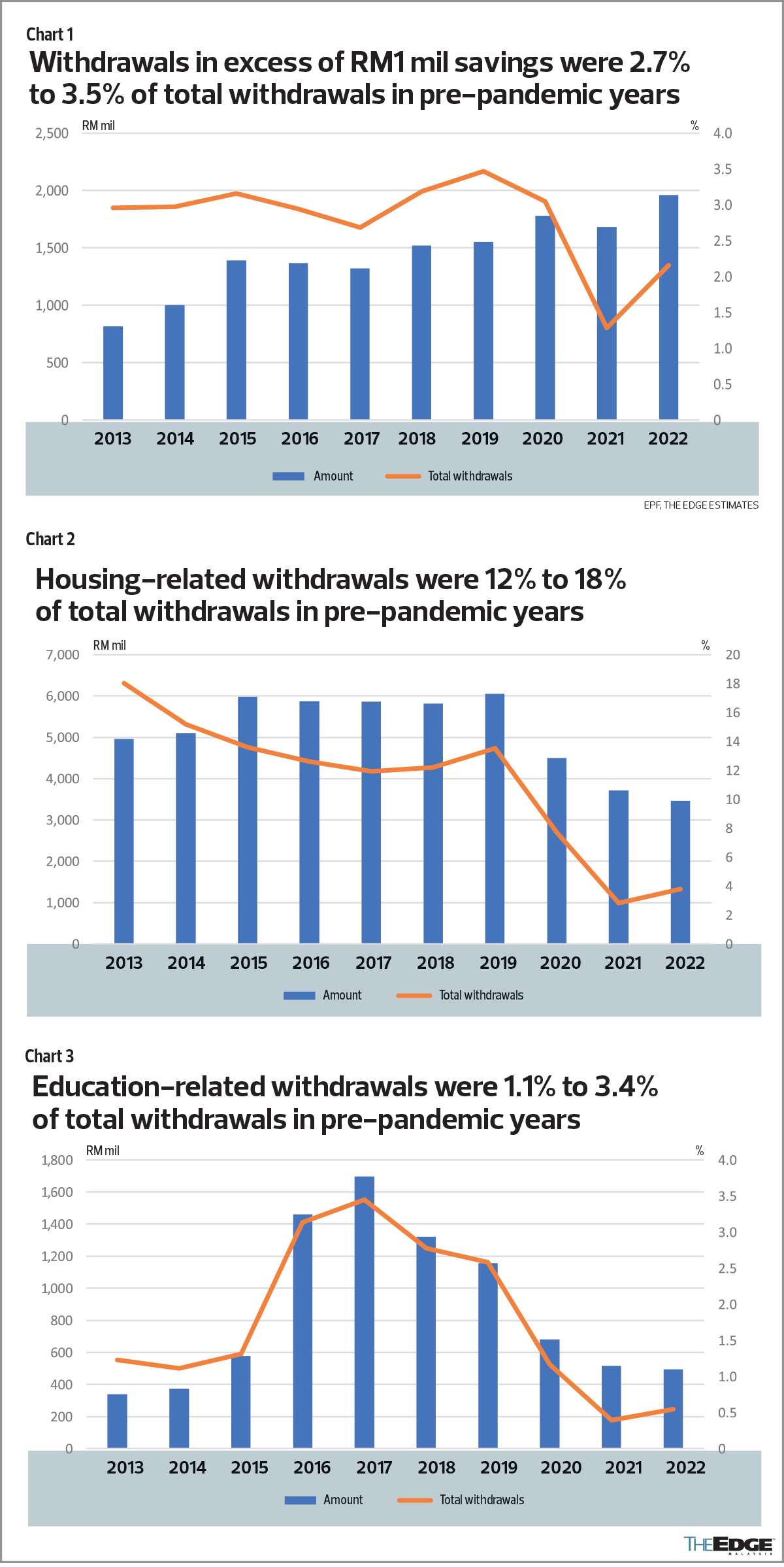

According to EPF data from the past decade (between 2013 and 2022), withdrawals of savings in excess of RM1 million accounted for between 1.3% and 3.5% of total withdrawals from EPF, with absolute amounts ranging from RM814.5 million in 2013 to RM1.96 billion in 2022 (see Chart 1).

In 2022, the RM44.57 billion taken out of EPF under the special withdrawal scheme was 49% of total withdrawals, exceeding the RM17.6 billion taken out by members aged 55 and RM4.3 billion withdrawn by members at aged 50.

In the pre-pandemic years, withdrawals by those aged 55 comprised between one-third and half of total withdrawals in the past decade.

Housing-related withdrawals comprised RM5 billion to RM6 billion, or 12% to 18%, of total withdrawals between 2013 and 2019 but fell to between RM3.5 billion and RM4.5 billion between 2020 and 2022, EPF data shows (see Chart 2).

Meanwhile, education-related withdrawals made up 1.1% to 3.4% of total withdrawals between 2013 and 2019, reaching as high as RM1.7 billion in 2017, but fell to about half a billion in 2021 and 2022 (see Chart 3).

Banking on … self-control?

According to EPF, members who are uncomfortable about having new contributions going into Account 3 can always choose to move their savings into Account 2, something that will be allowed using the EPF mobile application.

It is those with the tendency of emptying their savings that need to be made aware of the potential consequences if policymakers remove the guardrails, observers say.

KRI’s Hawati says: “There is a high likelihood of EPF members making full or continuous withdrawals, resulting in zero balance in Account 3. Adequate educational initiatives should accompany these changes to ensure that contributors make informed decisions that support their overall financial well-being. For example, members should be made aware of the consequences on their long-term savings and how they may miss out on the compounding effect.

“As the implementation details could be quite technical, it is equally important to ensure that the information is explained in an easy-to-understand way. Overall, the coming months will be crucial in evaluating the impact of the recent restructuring efforts in attracting new members and reallocation of savings to Account 3 and withdrawal by existing members.”

CGSI’s Nazmi believes “generous retirement fund withdrawals should never be permanent”, noting that those who are in dire need of cash are likely to be those who have limited balances or are not an EPF member.

“The key is to have in place mechanisms that disincentivise recipients from being overly dependent on the EPF Flexible Account. This could include requiring a higher percentage of EPF contribution or a minimum threshold of total balances before the Flexi Account can be created,” he says.

“With no limit for withdrawals, members are likely to empty their account even if there are no emergencies. Also, members could rely on the Flexible Account withdrawals to supplement their monthly income, leading to an unhealthy culture of dependency and living above their means,” he adds, referring to the tendency of consumers, if given the chance, “to spend their wealth now, regardless of the impact it might have in later years”.

Apart from educating EPF members on the consequences of premature withdrawals, Hawati says there is a need to raise the age limit for full EPF withdrawals above the current 55 years that was “determined quite some time ago”, when the average Malaysian’s life expectancy was much shorter at 56.6 years in 1960 compared with 75 years in 2022. After all, the retirement age in Malaysia has been raised to 60 for more than a decade.

Hawati also calls for the setting up of a contributory pension, which is a hybrid of EPF-type defined contribution (DC) and tax-funded defined benefit (DB), to supplement shortfalls.

What is certain is that every Malaysian who does not have adequate savings for retirement will need to have an avenue to earn income well through their old age, while they are still able to work. Otherwise, the burden will land on public funds.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.