Could the Bank of England leapfrog the Fed and cut interest rates first?

At the end of 2023, the US Federal Reserve was in prime position to start cutting interest rates. In the space of four months that narrative has been turned on its head.

Chair Jerome Powell has been forced to rule out rate cuts in the coming months as successive economic data disappointed.

At the same time, economic indicators in the Eurozone and the UK suggest there is space to start cutting rates in the summer.

It has pushed markets to consider whether we might start to see significant divergence between the Federal Reserve and other central banks.

Could the Bank of England break with tradition and ease monetary policy ahead of the Federal Reserve? Or will UK households have to wait a little while longer until the base rate is cut?

Decision time: Governor Andrew Bailey has increasingly distanced UK and US monetary policy

When will the Federal Reserve cut rates?

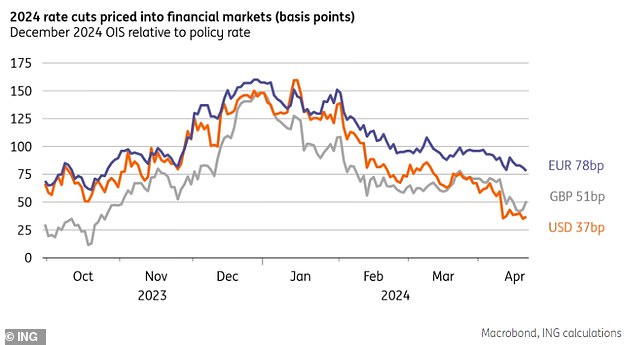

At the end of last year, markets assumed that there would be around seven rate cuts in the US in 2024.

But successive data on inflation, payroll and retail sales put a spanner in the works, with Powell now saying it would ‘take longer than expected’.

Inflation is running too hot for the central bank’s liking, and stubbornly stayed above 3 per cent in the last reading. The Fed’s target rate is 2 per cent.

The headline rate hit 3 per cent last June, its lowest rate since early 2021, but has fluctuated between 2 and 4 per cent ever since.

The surprise upside in inflation in February and March dashed investors’ hopes of any potential interest rate cuts by the summer.

Markets are not pricing in a rate cut in June’s meeting, although they remain on the cards for later this year, likely in the autumn.

‘We have shifted our expectation (since October) for the Fed to start easing in June, now seeing September,’ says David Page, head of macro research at AXA IM. ‘We now expect only two cuts this year and term rates have risen significantly.’

ING economists are also forecasting the first move in September, before further cuts in November and December.

Does the Bank of England have to follow the Fed?

With sticky inflation in the US ruling out imminent rate cuts, attention has turned to what the UK’s central bank might do.

The most recent UK inflation reading fell from 3.4 per cent to 3.2 per cent between February and March. Core inflation also fell, albeit not as much as the headline rate, to 4.2 per cent.

However, expectations of rate cuts have been pared back in recent months as US inflation ticks higher.

There is a risk that, while CPI has fallen, the UK could well mirror the US with inflation staying at the 3 per cent mark.

While headline inflation is expected to fall, the Bank needs to see service sector inflation and core inflation ease too.

Economists at ING say: ‘Pricing for the Bank of England has seen expectations rise more in line with the US narrative. Certainly, the stickier-than-anticipated inflation data and still hotter wage growth have contributed to that sentiment.’

While Capital Economics say: ‘We think that the legacy of the weaker UK economy will mean that inflation in the UK falls further than in the US and that this may be one of those rare occasions where the Bank of England cuts interest rates sooner and further than the Fed.’

Generally the Bank of England has followed the US on rate cuts, largely because of sensitivity to currency weakness.

The Federal Reserve has ruled out imminent rate cuts as inflation continues to run hot

Out of the eight cutting cycles since 1980, rates have been cut first in the UK only once, says Capital Economics.

But it isn’t a hard and fast rule. ING economists say the link between the Fed and BoE policy is often overstated.

‘There are plenty of examples where the BoE has diverged from the Fed in a meaningful way, and the US rate hiking cycle in 2016-18 is the most recent,’ they say.

‘Those concerns about the impact of a weaker currency have probably taken a back seat.

” Whatever happens, it looks like the Bank of England may well cut rates ahead of the Fed” ING

‘Not only is inflation much lower and there’s greater confidence about the disinflation in the pipeline, sterling has been one of the more resilient G10 currencies in the face of renewed dollar strength. In a sense, that offers a bit of a cushion against any fresh weakness and feedthrough to inflation.

‘We don’t think the BoE would have many qualms about cutting rates before the Federal Reserve, nor moving a little more quickly in subsequent meetings.’

Ruth Gregory, deputy UK chief economist at Capital Economics, thinks the central bank could have concerns about ‘the potential inflationary effect of a weaker pound if it cuts interest rates first and further,’ especially if second-round effects on inflation raise expectations and wages.

However, she predicts that the chances of second-round effects are likely to be lower.

‘We think UK inflation will be lower than in the US and that domestic prices will have less momentum. That may mean the Bank cuts interest rates earlier and further than the Fed… the big and obvious risk is that UK inflation trends follow US trends.’

When will the Bank of England cut rates?

The inflation picture in the UK is currently very different to the US. It looks likely that the headline rate will dip below 2 per cent in the coming months as food and energy, which had previously been significant drivers, are falling.

The 12 per cent fall in household energy bills in April will drag this month’s reading lower, which will likely be followed by a further decline in costs in July.

This will add to market expectation that the BoE could start to cut rates as early as June.

ING economists note that Andrew Bailey has tried to put distance ‘between domestic monetary policy and the Fed’s, stating that European inflation dynamics were different from those in the US where they were more demand led.’

They add: ‘We don’t hear from BoE officials nearly as often as we do from their colleagues at the ECB or Federal Reserve… the current chorus of optimism on the inflation outlook among key BoE figures, therefore, feels both intentional and significant.’

So if the central bank moves ahead of the Fed, when could we start to see base rate cuts?

Page says ‘a June interest rate cut still looks most likely with two further cuts in September and November.

‘Nevertheless, risks would be for a delay to August if inflation and wage growth continue to come in above expectations.’

ING economists predict service inflation could be stickier which would tilt the balance in favour of a cut in August rather than June.

‘Whatever happens, it looks like the Bank of England may well cut rates ahead of the Fed, where we expect the first move in September. We think the totality of BoE cuts this year will be greater too.’

It might also rest on when the European Central Bank (ECB) starts to cut rates. The mood music has been largely positive as economic activity starts to improve, mostly driven by services, although manufacturing remains weak.

The ECB continues to signal a cut in June and markets generally agree there will be three cuts by the end of the year.

Economists at ING say: ‘Clearly, the BoE should be lodged between the ECB and Fed in terms of timing, and we think should likely correct more towards August as the most likely rate-cut date according to our economist’s current forecast.’