Could my mortgage cost me more than I make from house price rises?

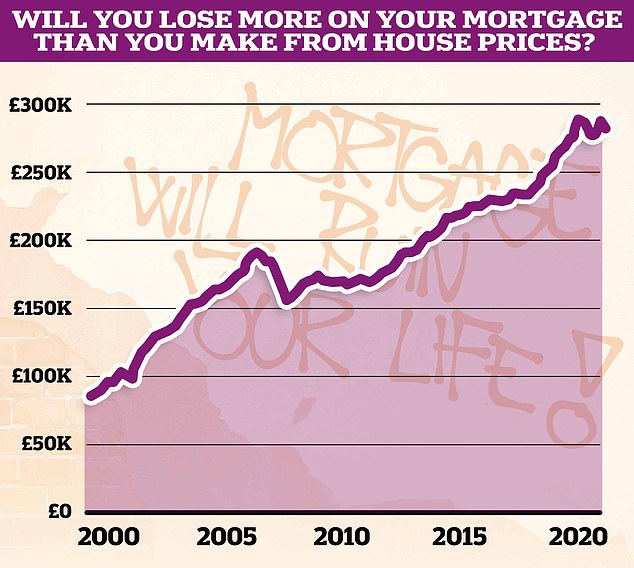

When people buy a home they tend to think they are making a sound investment, as prices tend to rise in the long run.

But unless they are a cash buyer, they require a mortgage from a lender in order to purchase a property.

They will then spend decades repaying that mortgage, with a large portion of their monthly payments going on interest.

While it’s easy to know how much they’ve made from house price growth when they come to sell, homeowners usually pay less attention to how much the mortgage has cost them in the meantime.

With mortgage rates having risen over the past two years, it means the total amount paid back is more likely to have superseded any gains made by house price growth during that time.

New research from the comparison site, Finder, has revealed how much someone currently buying the average UK home would need it to rise in value in order to offset mortgage costs

That doesn’t mean buying a home is necessarily a bad idea, especially if the alternative is paying ever-higher rents – but owners may be interested to know how much they would need their property to rise by to fully offset their mortgage costs.

Thanks to some new research shared exclusively with This is Money by the personal finance comparison site Finder, we are able to reveal just that.

The analysis is based on someone buying the average UK home with a 25 per cent deposit on a 30-year mortgage term, whilst paying the average mortgage rate over the last 30 years, which is 4.25 per cent when also factoring in typical fees associated with remortgaging.

The average UK home currently costs £281,913, and someone buying this with a 30-year mortgage would end up spending £445,000 on the house and mortgage, according to Finder.

For the property to reach this valuation, the asking price would therefore need to rise by 58 per cent, equating to over £163,000 in monetary terms over 30 years.

The good news for potential homebuyers, though, is that over the last 30 years, the UK’s average house price has risen by a huge 416 per cent.

Were this to happen again, a house worth £281,913 today would be worth £1,454,981 in 2054, according to Finder.

What if mortgage rates remain where they are?

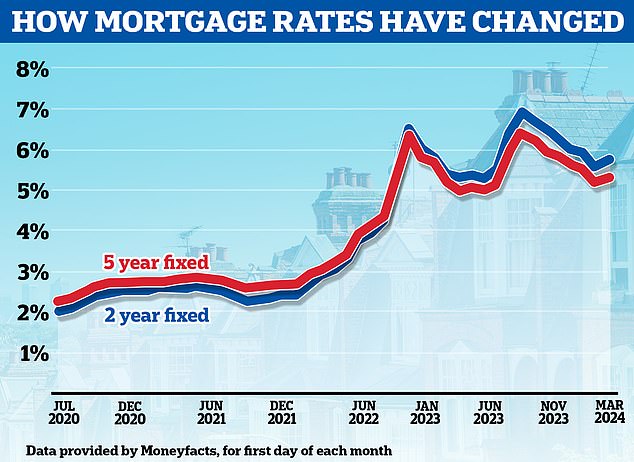

Mortgage rates are currently slightly above the 30-year average.

At present, the most popular mortgage product among borrowers are two-year fixed rates, according to broker L&C Mortgages.

The current average two-year fixed mortgage rate for someone buying with a 25 per cent deposit is 4.97 per cent, according to Finder.

If this rate were to stay the same for the next 30 years, the total amount someone would need to pay would rise to £477,900. This works out as an extra £90.65 per month, and over £32,600 overall.

> What next for mortgage rates and how long should you fix for?

According to Moneyfacts, the average two-year fixed rate mortgage is 5.81%

According to Moneyfacts, the average two-year fixed rate mortgage across all deposit sizes is currently higher at 5.81 per cent.

If this were the average rate over the next 30 years, the total amount someone would need to pay, when buying the average home, would rise to £517,705, which equates to an extra £72,705 over the mortgage term, albeit not taking into account additional fees.

For house prices to match the cost of the mortgage, they would need to rise by roughly 84 per cent over the next 30 years.

Will house prices continue to rise like in the past?

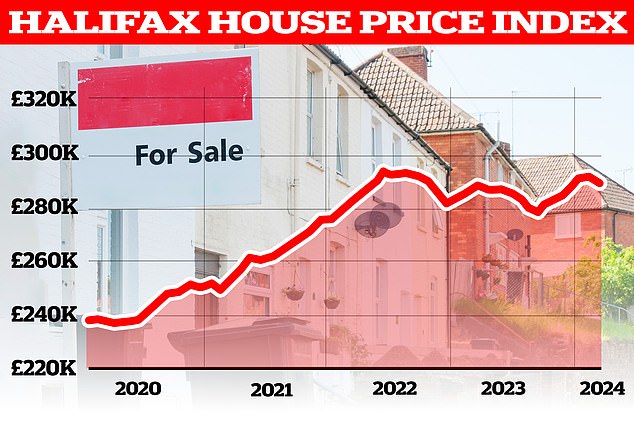

For house prices to rise over the next 30 years as fast as they have over the past 30 years, they would on average need to rise around 5.63 per cent every year, taking into account the effect of annual compounding.

This might seem entirely possible. However, many of the major house price forecasts paint a more downbeat picture, over the next five years at least.

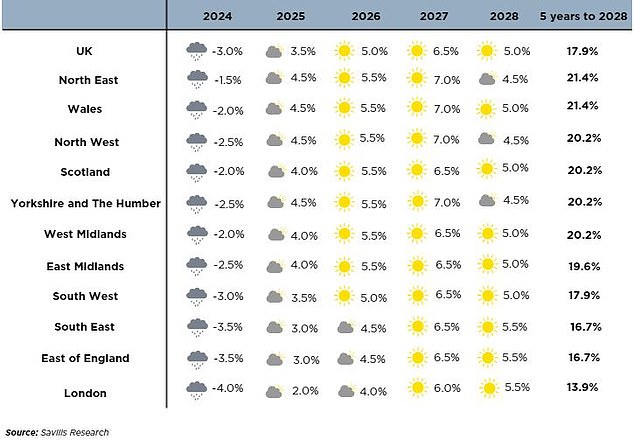

For example, the estate agent, Savills, is predicting that average UK house prices will rise by 17.9 per cent in the five years to 2028.

Savills is forecasting that UK house prices will rise by less than 18% over the next five years

Meanwhile, Knight Frank is forecasting average UK house prices to rise by 20.5 per cent over the same period.

The property firm, JLL, is predicting an even flatter picture with average house prices rising 14 per cent by 2028, representing an average rise of 2.7 per cent each year.

Ultimately, house price forecasts are to be taken with a pinch of salt. Forecasting the next five years is hard enough, but forecasting the next 30 years accurately is almost impossible.

Is buying a home a sound investment?

Owning one’s own home is often viewed as more than just an investment, it’s a British obsession, and many view ‘getting on the ladder’ as one of life’s great milestones.

Buying a property is often considered to be a mark of independence, security and success.

Owning is often also deemed as a preferred alternative to renting, which often means paying ever-increasing rents to a landlord who could ask tenants to leave at any time, with just two months’ notice.

What next? While house prices have tended to rise in the long run, they have been drifting sideways and even dipping over the past two years thanks to higher mortgage rates

But in purely financial terms, buying and owning a home carries more than just the cost of a mortgage.

Buying also comes with some additional costs such as legal and surveyor fees and for those that move it will also involve estate agent fees and in most cases stamp duty costs on future purchases.

Then there is the cost of ownership, which includes repairs and maintenance or more often service charges and ground rents if a leasehold property.

Ultimately, while buying a property can be seen as an investment, it should not be done for that reason alone.

Liz Edwards, personal finance expert at Finder said: ‘Getting on the housing ladder has typically been a sound investment for Britons but there are some key things to bear in mind before you buy.

‘Firstly, don’t assume that previous house price rises will continue.

‘It’s even possible that prices could go through a prolonged dip – for example, prices slumped and didn’t recover for almost eight years between July 1989 and April 1997.

‘Secondly, it’s worth remembering that the price of a house isn’t the only cost involved. There are additional fees like stamp duty, solicitors’ fees and a mortgage fee.

‘And as this research has shown, mortgage costs add a significant amount to the overall cost of a house – especially if interest rates rise in the future.’